Strategic Global Intelligence Brief for September 30, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Global Slowdown Catching Up

For the last several months, there has been an expectation of global impact on the U.S. economy, but it seemed the consumer and the business community was managing to avoid the pitfalls. Those days may be coming to an end. The latest data has been showing some real strain as consumers are slowing down at the point in the year when they would be expected to be picking up the pace. The investment from the business community has also slowed. There has been a dip in capacity utilization as well as overall durable goods. The declines have not been precipitous and there is no reason to assume this is setting up a real recession. The slowdown is definitely underway, but at this point it appears to be a return to mediocre growth as opposed to a crash.

Shale Production Levels Off

The oil world has changed drastically as the U.S. has been developing its oil shale breakthroughs. The shale revolution has made the U.S. the world's-largest oil producer, but that development has been based on getting access to the easiest oil and these deposits are starting to play out. The U.S. now supplies about 10% of global oil, but in the last year, that percentage has started to fall as the deposits have been exploited. The reality is the cheap and easy oil has been developed. What now has to happen is additional investment and that means more costly oil. The events in Saudi Arabia had an impact on prices, but requiring more costly shale oil will have a much bigger impact.

Does Inversion Curve Really Signal a Recession?

It has been pointed out that every time the U.S. has experienced an inversion there has been a recession. This is true, but there are important caveats. The first is that inversion is an indicator and not a cause. It simply means investors are anticipating Fed reactions to the impending slowdown and the lowering of the Fed Funds rate will be among those expected reactions. The other caveat is there is no way to anticipate the timing as the recession may show up in months or years. One other thing that matters is not every nation has had the same experience. The inversion in the U.K. has only predicted about half the recessions there. It bears remembering that economists have predicted 17 of the last three recessions.

Short Items of Interest—Global Economy

Austrian Moderates Return to Power

In many respects, the Austrians have been playing the role of indicator. The country was one of the first nations in Europe to host the development of radical right-wing populism. For a time, the Freedom Party looked set to rule for years. In the last election, the Freedom Party lost considerable ground and so did the left-leaning Social Democrats. The winner was Sebastian Kurz of the Austrian People's Party. It seems that the population is no longer enamored of the populist nostrums and doesn't trust the left's message. That has led them back to the traditionalists. There has been a similar drift in Germany in the latest regional election.

Changes in Iran's Patterns

Years and years of sanctions have forced many in Iran to flee the cities. This is now the only nation in the world where urban areas are shrinking and rural areas are growing. The population simply can't afford to live in the city and are seeking cheaper lifestyles in the country. This will have long-term implications for the economy and the politics of the country as the stronghold for the clerics has long been the rural sectors.

Trade War Expands

The markets keep expecting the Trump position to change when it comes to China. The expectation is he will strike a deal at the last minute so as to provide a nice economic boost at the start of next year. That may yet be the plan, but in the meantime, the war gets more and more involved and serious with the latest salvo aimed at Wall Street and the ability of Chinese companies to list on U.S. exchanges. Unwinding from this war is not going to be easy.

How Worried Are the Markets Regarding Trade and Why?

This has been a volatile month in the markets. Every day features another change in mood. At the start of the month, it appeared the U.S. and China had started to get serious about a deal. By the end of the month, the pessimism had set in again. The crux of the issue is that nobody really knows what the trade war between the U.S. and China is really about. Option one is that this is all a political ploy for both Presidents Trump and Xi—both needing to look tough and both prepared to make a big splash of solving the issue at the appropriate moment. Option two is that this is really a lasting confrontation and both Trump and Xi are prepared to suffer short-term pains in order to force a new order.

Analysis: Those who favor option one are assuming that at some point both sides declare victory and the trade war essentially ends. The U.S. and China would both see a big boost in their economy (in the short term anyway) and that is good politically for both men. The betting is that it is towards the start of next year when the elections heat up. Those who favor option two see this as an issue that only gets more tense and confrontational; one that could possibly lead to other than economic conflict.

The fact is the trade war has already taken its toll on countries other than the U.S. and China. Germany is now in recession and Japan is backsliding again. Both cite the trade war as the problem. The markets are focusing on how secure the leaders of both China and the U.S. appear. This week, there was a renewed fear that Trump's position will be compromised. This means he will need to rely on his base more than ever, which makes negotiating with China that much trickier.

Saudi Warning Against Iran

The attack on the Saudi oil facilities caused a stir in the oil markets, but nothing like what was initially expected. The price per barrel rose by around $20 at first, but even that hike only brought the price per barrel to the 60s. Imagine what would have happened a decade or so ago when even a hint of conflict in the Middle East would have driven prices into the $100 barrel and above range. The impact was relatively minor and didn't last all that long. The impact has been felt almost entirely on the Saudi oil sector as they lost almost half of their productive capacity and have even had to start importing crude from the U.S.

Analysis: The warning from Saudi Crown Prince Mohammed Bin Salman seems a little self-serving and may be part of the ongoing effort by the Saudi government to change the narrative on the country after the scandal that gripped the nation due to the assassination of Washington Post columnist Jamal Khashoggi. The assertion is Iran will stir things up to the point oil prices will indeed start climbing to radical levels. The reality is that sanctions on Iranian oil have had more impact on global oil prices than this attack has. The assumption by the Saudi government is that Iran will step up attacks on their oil, but the evidence is that Iran is not all that interested in expanding this conflict. The effort by the Saudi government to start talks with the Houthi and the decision by Iran to release the two British oil tankers that had been seized would seem to point to efforts to reduce the tensions. This is not to say that further attacks are not possible as the war in Yemen is ongoing, but the moves of late suggest that all sides are trying to defuse the situation and thus reduce the impact of higher oil pricing on the global economy.

What Does the Business Community Really Want?

In truth, this is an impossible question to answer and perhaps even to ask. There is nothing approaching unanimity as far as the business community is concerned. What one sector desires is often anathema to another. The steel producers are happy with tariffs aimed at steel imports, but the manufacturers that use steel would like to see those tariffs lifted. Is there anything that business in general wants from its political leadership or from anyone else. I would argue that there is. I draw this conclusion from my opportunity to visit with dozens of business groups in the last few weeks. It seems there are three areas of agreement—development of the labor force, reasonable and logical regulations and a tax system that doesn't punish growth. The order of importance will vary from one sector to another and expectations vary, but all three come top of mind.

Analysis: We have been harping on the labor situation for years and will doubtless continue to do so as very little ever seems to be done about it—at least on a national scale. The shortage of qualified people affects almost every sector now—especially manufacturing, transportation and construction, but increasingly in health care, finance and the professions as well. Part of the problem is there are just too many people leaving the workforce as Boomers retire at a faster pace than Millennials can enter it. There is also the fact that schools are not training people for those jobs in manufacturing, construction and transportation. It is also harder for people to enter these job markets than it used to be as these jobs are more demanding than was once the case. The old pattern involved hiring people to do low-skilled jobs and providing an opportunity for them to gain skills and move up. Today, the low-skilled jobs are being handled by machine and on-the-job training is rarer. There is no simple solution. It will require changes in the education system, changes in the attitudes of parents and students, changes in immigration policy and changes in how people work. The problem is made worse by the lack of attention focused on this chronic problem.

Next up is the regulatory environment. No responsible business wants to live in an unregulated environment. Everyone wants safe products and decent working conditions, but too often, the regulatory environment seems to skid off into extremes. Setting regulations will always require a balance, but the pendulum had swung too far to the restrictive in the past decade. It made growth and even survival for small- and medium-sized business difficult. The last two years have seen reduced regulatory activity. For the most part, these have been accepted as positive although in some situations the pendulum has swung too far in the other direction. There continues to be intense conversation over what the mission of a business should be. Is it enough they are focused on the investor and owner or should responsibility to the consumer, employee, community and world in general be considered?

Then there are taxes. Every business understands the need for taxation and few would argue they have no responsibility to pay them. The issue is how much and on what. There are fatal flaws in the corporate tax system employed by the U.S. There is not time to go into excruciating detail, but two issues stand out. The first is that most of the corporate tax will simply be passed on to those who buy the goods and services offered—the tax is a cost of doing business. That means the tax falls on the consumer in the end. The other issue is that taxes like these are disincentives to grow as the tax burden grows right along with the added revenue. The real desire is for business to grow and therefore hire people and otherwise contribute to the economic health of the community. Taxes that are too high will interfere with that growth and expansion.

It is not that business is unaffected by issues such as trade and tariff wars or immigration as a whole or even the many social issues that people struggle over. These can be of paramount importance to many businesses and business leaders. The point is that the three issues discussed here cause the most ongoing concern.

Some Data to Watch for This Week

This is the week that the Purchasing Managers' Index (PMI) will come to dominate the economic headlines. The reports will be coming from at least 34 nations and will be prepared by a variety of organizations. In the U.S., the originator of the index will have its opportunity. The Institute for Supply Management invented the PMI and has been releasing this data for over 30 years. In addition, there will be the version from Markit—a British-based marketing firm that has taken their PMI to countries all over the world. The Chinese government does their own and so do several big banks around the world. What makes this kind of information so valuable and interesting?

Analysis: The PMI is a very simple index when it comes down to it. That is part of what makes it so effective. It is simply asking the people who do purchasing in businesses all over the world whether they are doing more, less or about the same as they did the month before. A company is going to be growing if it is purchasing more commodities, raw materials, intermediate parts or even just more toilet paper and snacks for the break room. The latter two categories can be expected to increase as the company elects to hire more people. Simply noting whether there is more or less activity will say a lot about the performance of the overall economy.

The purchasing manager also provides clean data as they are simply doing what they are asked to do. I sometimes joke that purchasing managers do not even know what their company makes or does—they just buy what they are told to buy. That is certainly an overstatement, but the reality is that they are carrying out the orders and demands of others; the decisions are not theirs to make. Another factor that makes the index valuable is its simplicity as far as interpretation is concerned. The diffusion index is easy to grasp—anything over 50 signals expansion and growth and anything under 50 signals contraction. At a glance, one can see whether the economy is growing or shrinking. As an added bonus and perhaps the most interesting is that the PMI system is the same across the world so that a PMI for China is the same as one for the U.S., Germany or Mexico. One final important note on the PMI is that the surveys separate into a manufacturing measure and one for the service economy.

The data of late has been sending some distress signals. The U.S. PMI for manufacturing last month dipped into contraction territory for the first time in years—sitting at 49.1. It is anticipated that this month's numbers will be slightly higher than last and back into expansion territory, but only by a narrow margin. Most of the other data for manufacturing looked better this past month (durable goods orders, capacity utilization, industrial production, etc.). The expectation is that the PMI will also show some improvement. This is not the case for many other nations. China is expected to show some improvement but remain in contraction territory with a reading of 49.6. It has been pointed out the U.S. has been seeing a dramatic slowdown in its export activity. There have been many who assert this is all due to the strong dollar caused by the Fed and its "high" interest rates. The more salient issue is that of the top 15 U.S. trade partners, all but three are facing PMI numbers that are under 50. Some of the most important of these nations are in the mid to low 40s.

Observations

As I sit in this coffee shop working on today's newsletter, I am surrounded by many others who are here to conduct business. It can be quite edifying. There is the breathless young woman in the real estate business who has been haranguing the poor client nonstop for the past 40 minutes. I don't think she has even stopped to breathe. The poor guy she is talking to has not uttered a word and looks like he would rather be hitting himself with a ball peen hammer. First rule of selling is "shut up every now and then."

Next to her is a guy who exudes utter desperation as he is apparently being interviewed for a job. His interviewer has adopted the Japanese style of questioning—long periods of silence. He has simply listened and the other guy gets so uncomfortable that he starts to negotiate against himself. He has already lowered his salary request and given up benefits—none of which the guy asked for.

Next to him is a group of guys who obviously know each other well and are discussing whether to invest in a project. They are basically at the point of deciding what they want in return for their money. The focus has been on who to keep in the start-up and who has to go. The awkward part is that the founder is solid gold and that's the only reason they are interested, but the guy's brother is an idiot and untrustworthy. How to get rid of big brother now becomes the question. The option seems to be to buy him out.

Life in a coffee shop. Never a dull moment for somebody who is essentially a voyeur.

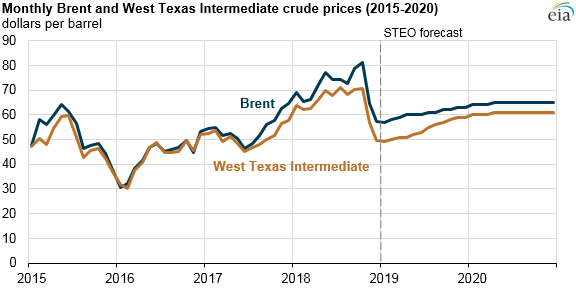

Oil Prices

The forecasts for oil are always somewhat suspect. It is like trying to forecast a rainy day three years into the future. The charts always look like an EKG until the predictions are made. Suddenly, the range looks nice and flat. The point of this chart is that nobody is looking at higher oil prices in the immediate future—even with the new tensions in the Middle East.