Strategic Global Intelligence Brief for January 14, 2019

Short Items of Interest—U.S. Economy

Visa Reversal?

At this stage nobody quite knows what this means, but on the surface, it sounds promising. The statement by President Trump in a tweet was cryptic and nobody knows if this is part of some well-developed effort or something that just occurred to him. The statement suggests there will be some major changes to the current H1B visa program that would make it easier to recruit skilled people from around the world to come to the U.S. It hints that more will be issued and there will be some path to citizenship involved. Outside of this, there is nothing to assess. If this is true, it will be a dramatic departure from the current stance on the issue of immigration as up to this point there has been hostility to both legal and illegal immigration and the quota on H1B visas had been getting steadily smaller.

Markets Pulled in Opposite Directions

Last week, the markets started a nice little rally and the S&P performed better than it has since August. This enthusiasm was attributed to the fact that trade talks were starting to settle down between the U.S. and China and because the Fed had started to sound a more cautionary note on the issue of interest rates. These are both somewhat ephemeral as there is nothing concrete about the U.S.-China progress and the Fed has certainly not ruled out the possibility of higher rates. This week the atmospherics seem to have changed as many are expecting some disappointing earnings statements—especially from banks. The stress of the year has started to manifest already. That may result in a dramatic sell-off.

No Compromise in Sight

Reports indicate that various elements of the administration and Congress are working towards some kind of compromise, but nothing has emerged that seems capable of breaking the deadlock at this point. This challenge is not about Trump's commitment to a policy (he has changed gears on this many times before) nor is it about a sudden shift towards frugality on the part of Democrats. This is about power. The first one that gives ground will lose that first power struggle. That sets up the next two years of interaction between the House Democrats and the White House.

Short Items of Interest—Global Economy

Calls for Tax Cuts in Germany

The new head of the Christian Democratic Union, Annegret Kramp-Karrenbauer, was the candidate that Chancellor Angela Merkel favored to replace her. She is wasting little time in establishing a reputation for decisive action as she is now calling for substantial tax cuts as a way to keep the German economy from sinking further. This puts her at odds with some in her own party as well as her supposed coalition partners—the Social Democrats. Her position is that waiting for the economy to tank further is not helpful and preemptive action is needed. Those who oppose the effort believe that tax cuts will lead to spending cuts.

China's Exports Down

The level of Chinese exports are down more than they have been in two years. The reasons are related to both the impact of the trade war with the U.S. and domestic decisions that have been designed to push the Chinese economy towards a more internal approach. The plan has been to build a bigger consumer base, but that has meant higher salaries, which limits the ability of those manufacturers that are geared towards the export market. The latest data shows that export-oriented business is struggling, but the domestic business has been unable to make up the difference at this point.

No Give in Europe

Prime Minister Theresa May has hinted that perhaps the U.K. would opt not to leave the EU at all if the powers that be can't support her plan. This has not been supported in any way by the EU and they are not leaving that option open. It is either agree to the May plan as stated or experience a hard and total exit. That is not a good option for the British at all.

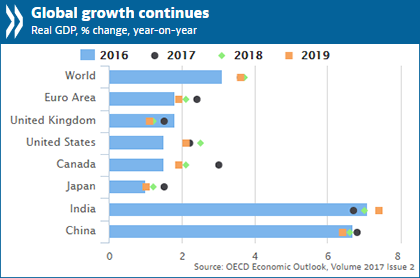

OECD Anticipates Slower Global Growth

There is no expectation of another worldwide recession, but the Organization for Economic Cooperation and Development (OECD) is not expecting the run of good economic news to continue in 2019—at least not at the pace that many had become accustomed to. The news from the major economies has been mixed so not everything has been gloom and doom, but some of the positive factors that made last year successful are losing their impact. The U.S. is expected to see a decline, but a slow one and not one that will take the U.S. economy back to the recession of 2008-2009. The Chinese have been seeing a steady decline, but that has slowed dramatically. It appears that they are starting to stabilize. The greatest concerns revolve around Europe and specifically with the U.K. It looks more and more likely there will be a hard exit from the EU. That has long been seen as the worst-case scenario for the British as well as for the Europeans.

Analysis: The OECD report contrasts the activity that marked 2018 with what is expected in 2019. One of the primary differences is there is unlikely to be the same level of stimulation in the coming year as was the case last year. The U.S. is not planning another tax cut and there is no appetite for increased spending. If the drama over the border wall and the shutdown are any indication, this will be the most fractious government the U.S. has experienced in years; nothing will happen that boosts the economy in any way. The Chinese have continued to push stimulus measures to bolster their growth, but these have been less and less effective as the real issue for their economy has been a drop in the level of exports. Some of that decline has been due to the U.S. trade and tariff policy, but much of the problem stems from the fact that many of China's consumer nations have been struggling with their own growth these past months. Then, there is the fact that China is facing a lot more competition from states like Vietnam, India and many others.

The European situation concerns the OECD most of all. German economic growth has flattened. That always ricochets through the entirety of Europe. The German consumer has been pretty confident throughout the last year, but the business and investment community has been nervous about the political struggles that have weakened Angela Merkel. The Brexit issue will also affect Germany as the British were once solid trade partners. The OECD worry goes beyond slowdown in Germany as it seems that growth is also stalling in France where the Macron reform efforts trigger reactions all over the labor and corporate community. Italy is a solid mess and it seems like Spain is regressing. Britain is now facing the worst of the Brexit scenarios. This promises actual recession in the U.K. and slowdown in the rest of Europe.

Japan has not weakened much, but neither has it been able to escape the doldrums that have plagued it for years. Part of what has been affecting Japan has been the slowdown in China, but more importantly, there has been less activity in their entire export sector as the U.S. has erected barriers and the Europeans are just having money struggles of their own.

Trump Threatens Turkey Over Kurds

The decision by Trump to pull out of Syria was not a sudden one as he had been promising to do this since the campaign in 2016. Each time it appeared that a withdrawal would be imminent he was talked out of it by advisors who are aware of the delicate and complex relationships in the Middle East. He now seems determined to go ahead with the plan despite the fact this decision caused his Secretary of Defense to resign. National Security Advisor John Bolton is now arguing that this plan will not be executed quickly, but nobody seems to have informed Trump.

Analysis: The key issue for many in the U.S. has been the Kurds. This ethnic minority has no nation of its own but desperately wants one. The Kurds are spread across Iraq, Syria and Turkey with the largest population in Turkey. To Reccip Tayyip Erdogan and the Turkish military, the Kurds are terrorists and insurgents, but to the U.S. they are the only group in the region that has remained a close ally. They prop up the Iraqi government, while their Peshmerga army has been fighting with the U.S. as an ally for nearly two decades. The decision to pull out of Syria leaves the Kurds in that nation vulnerable to attacks from the Syrians. It also weakens the Kurdish position in Turkey. The threat to inflict economic devastation on Turkey should the Kurds come under attack was apparently designed to protect these U.S. allies, but is very likely to backfire as Turkey's president has predictably reacted with a furious retort. There have even been reports of stepped up attacks on the Kurds already. The sense is that Erdogan is calling Trump's bluff or may simply believe that President Trump meant none of what he tweeted. It is up to the Turks to do what they want as far as the Kurds are concerned.

We Will Know More at the End of the Week than We Do Now

But perhaps a little less than would ordinarily be the case. It is certainly making life a bit more difficult for economists and analysts. Among those who have been deemed non-essential are the legions of statisticians and researchers who collect and assess all the information that comes in to the government every hour of every day. If this shutdown drags on for much longer, there will be some substantial gaps developing in terms of what we know about the performance of the economy. Given that these are critical days of transition, this is bad timing to say the least. This week there will still be some reports issued and they will be gone over with a fine-toothed comb to glean some clues as to where the economy is right now and where it may be heading.

Analysis: Tomorrow, the Labor Department releases the latest data on producer prices. The expectation is that they will not shift much from where they were last month. In November, they went up very slightly —a sharp contrast to the rise that occurred in October. Many of the economists polled believe the prices actually went down as oil prices dropped sharply during this period. Even the metal prices that had been driving costs tended to calm down—they remain higher than they were before the imposition of tariffs on imported steel. However, that price jump has largely been absorbed and there have been no further gains of significance. This data would tend to indicate that inflation has been tame, which will have some impact on Fed decision-making. The Fed remains more interested in the changes that take place in the personal consumption expenditure numbers than in producer prices. But that hardly means this data is ignored.

Another piece of information that will be available comes from an institution that has not been affected by the shutdown—the Federal Reserve. This is the week that the first 2019 Beige Book will be released. This is the periodic "report from the trenches" that provides a snapshot of the economy through the eyes of the 12 regional banks. The report is not meant to be exhaustive and loaded with statistical detail, the Fed has plenty of these reports emanating every week. This one is taken primarily from the banks and businesses that interact with the Fed. It is their estimation of how things are going in their corner of the world. It is a report that captures the mood of the country quite effectively.

If one goes back to the last couple of editions of the Beige Book issued in 2018, there were three or four major concerns that popped up throughout the country as well as many issues that were more unique to a given region. The four universal issues included the impact of the tariffs and the impending threat of a trade war. This was an issue that mattered most to the states that do a lot of import and export, but nearly every business had concerns. The second issue was the Fed's interest rate policy as there are concerns that rates might climb high enough to affect the growth of the overall economy. For the most part, there was just interest in understanding the motivation for Fed moves. The third issue was the chronic one of labor shortage. The majority of respondents are still reporting they can't find qualified people and have been driven to hiring people on the basis of attitude as opposed to aptitude. They will do their own training and hope for the best. The fourth issue was based on an expectation of government paralysis. The last Beige Book report was released before the shutdown over the wall, but this impasse seems to have reinforced the concerns expressed last year. The next two years will be nothing but a full-on fight between the White House and Democrats in the House of Representatives. Nothing whatsoever will be done to address any problem.

The week may end on a fairly positive note as the Fed will release the latest industrial production numbers and the University of Michigan will release the preliminary consumer confidence numbers. The cold weather at the end of last year boosted the activity among utilities. That pushed industrial production numbers up despite the fact that oil output was a little less robust than it had been. There was also some activity as far as the manufacturing sector was concerned. That trend is expected to continue with this month's data. The consumer numbers should look decent as there was a surge in confidence at the end of the year based on good employment data and a strong finish to the retail season. This is the time of year that consumer sentiment begins to erode as this is when the holiday bills start coming due and the minds of the populace start to turn towards tax time.

Economic Impact of the Shutdown

The economic impact of the government shutdown will be both subtle and dramatic. Those that are getting hit hardest are the workers who are not receiving paychecks. They have now missed their first. It is estimated that roughly two-thirds of the 800,000 people not being paid are in immediate distress with no ability to pay their bills. The other impacts will be more subtle. The functions of government have ceased. That has left thousands of businesses without the ability to continue functioning—either because they counted on money from the federal government or because they can't get the permissions and licenses they need.

Analysis: The estimate is that growth in the first quarter will be around 2.2%, a far cry from the 3.1% that had been predicted only a few months ago. Not all of this decline can be attributed to the impact of the shutdown, but it is definitely a factor. It is hard to estimate the daily monetary impact as it varies from one community to the next according to how big a role the government plays in that community. Sectors that have been hit the hardest include rural communities that depend on help from the Agriculture Department and areas where government employees make up the bulk of the job market. The cost nationally is already in the billions of dollars and climbing.

Kitten in the House

It has been a while since we had a kitten. The last one to arrive was Spike and he is already going on seven years. He was certainly a kitten, but not a real young one when he was relinquished by the neighbor that no longer wanted him. Now we have a bona fide itty-bitty. His name is Seamus. That brings us back to the feline five (Snip passed last year at 16). He is about thirteen weeks old and was part of a feral litter. That meant he was fostered for a few weeks to get him socialized and used to people. We were warned he would be very shy and could take months to adjust. It took him less than 12 hours.

He won over the other cats immediately as Smoky (the dominant male) treated him like is baby from the very start. Even the aloof Scoot plays with him and she barely acknowledges that she is a cat. He has a purr that rattles the windows and has been eager to climb into laps for his naps. He races through the house like he is possessed and then flops into some comfy place and sacks out. Nothing scares him and he explores everything. I am amazed as we were prepared to wait months for him to get comfortable with us and the rest of the gang. Night two he found his spot on the bed with the rest of us and has figured out all the other routines. He is a long hair with some Maine Coon in him somewhere. He certainly has made life more than a little lively around here.

Global Growth

The OECD chart below shows that there is still some expectation of growth this year, but it is likely to be fueled by some new actors on the global scene. The one nation that looks to be progressing faster is India. They may be the country that benefits the most from the tension between the U.S. and China. The U.S. is not going to start producing the consumer goods and other inexpensive manufactured items it once bought from China. They will have to come from somewhere else. That will often mean from India. There will likely be contributions from other states that once competed with China, but lost market share as China expanded. Look for gains by the likes of Vietnam, Sri Lanka, Thailand, Brazil and many others.