Strategic Global Intelligence Brief for February 25, 2019

Short Items of Interest—U.S. Economy

Unemployment Is Low but So Are Wages

This is not supposed to happen—at least not according to the rules of economics. The Phillips Curve states that when the rate of joblessness is low, the average wage will rise, which makes a certain amount of sense. The assumption is that business will get into a bidding war of sorts over the available pool of workers, and wages will then rise. It has not happened this time, and that is somewhat puzzling. The best explanation thus far is that business is finding it hard to obtain the people they need with the right skills and are hiring people who are less than qualified. This means they will have to be trained before they can really be productive. While they are getting to that point, the business is unwilling to pay what they would if these workers already had the needed skills.

What Happens When Wages Rise?

If the above theory is correct, there will come a point when the employee will be fully trained and able to demand a higher wage. If the company they work for now is not willing to pony up, there are others more than happy to do some poaching by offering more money. There is evidence of this happening already. The Fed is being cautioned to watch this development closely as it may mean that the Phillips Curve impact has not vanished—it has just been delayed. In the next year or so, the impact of that low jobless rate on inflation will manifest. The tight labor market remains a prime motivator for rising inflation.

GDP Numbers Released This Week

The fourth quarter numbers will be released this week—a little later than they usually are due to the government shutdown. The expectation is that growth slowed quite a bit towards the end of last year—maybe to around 2.3%. This is certainly not bad growth. It is consistent with the pace over the last two decades, but it is a far cry from the 3% and above that marked 2018 earlier in the year. The retail community started off pretty strong, but slumped towards the end as the major shopping took place earlier in the season. Bad weather has also had an impact. That will show up in Q1 data for 2019 as well.

Short Items of Interest—Global Economy

Expectations Low for North Korea

A second summit is now taking place between Trump and North Korea's Kim Jong-un. Few really have any real idea why. The first summit that took place in Singapore gave Kim a great deal of attention and allowed the state to escape its pariah status in the world, but this was supposed to prompt the North Koreans to give up their nuclear weapons. Nothing has happened since then. Now, Trump is suggesting that he is not expecting anything. He has stated he is satisfied that no more tests are being conducted. However, analysts point out that every preparation is in place and that new tests could be carried out tomorrow. There has been no progress at all. It begs the question—why give Kim more global attention now?

EU Pushing for a Brexit Extension

The head of the European Union is pushing Prime Minister Teresa May to formally request a delay in the process so that the U.K. is not hurled out of the EU in a "hard exit." Given the fractious nature of her own political party, this kind of move would likely mean the end of her as Prime Minister, but few think she will survive much longer in any case. The EU is not making any major concessions, but they are agreeing to keep talking.

OPEC Urged to Keep Oil Prices Low

President Trump has called on the OPEC leaders to stop restricting the supply of oil as a means to get the price per barrel up. His requests are being patently ignored as they see the U.S. trying to force prices lower as a national strategy. In truth, the U.S. oil producers would like to see those prices come up a little as well.

No Need to Ever Worry About Deficit Spending Again?

It was only a few years ago that such an assertion would spark near hysterical outrage from a significant segment of the Republican party as well as some Democrats. There were few economists or analysts who would have made this kind of assertion, but now there is a school of thought emerging that holds that deficit spending and mounting government debt is no big deal. This is certainly not a universally shared notion among economists (and certainly not this one), but it has become a popular position among politicians from both the liberal and conservative sides of the aisle.

Analysis: There have long been several issues as far as deficits are concerned. The first is that governments that run persistent deficits must borrow money year after year to finance the deficit they create. This is done through the issuance of Treasury bonds authorized by the Federal Reserve and sold through select banks. The government is then competing with all the other entities that seek to raise money through issuing bonds—corporate bonds, municipal bonds and so on. If there is too much debt issued by the government, it crowds these other bonds out as the Treasury bill is the most secure of all the options for an investor. The investment in equities is for the adventurous to some extent as it promises the higher return, but equity investing also risks losses. Bond investing is the more secure approach, but that means focusing on the most secure bonds and avoiding those that carry more risk. To compete with the treasuries, the corporate bonds and others will have to offer more return. That makes them a little less effective as a money-raising instrument.

The second objection to the use of deficit spending is that it encourages inflation. The need to continue borrowing to finance spending efforts means more and more money is added to the pool of global cash. Sooner or later, this becomes overwhelming and the money starts to lose its value—too much money in circulation. This is the very definition of inflation. Unfortunately, this tactic is popular with those that hold these debt obligations. If the money loses its value over time, these old debts will be paid with money that is worth less than when it was borrowed. This development is the reason banks do not like lending into an inflationary environment. They will be getting paid back with money that has less value than the money they originally loaned. The response is either to severely limit the lending that takes place or hiking the rate of interest so the lender has some protection from the ravages of inflation. Either approach means less lending and therefore less economic expansion.

There is a third issue. It is one that gets more problematic the longer there is an excessive deficit. The U.S. is obligated to pay on these bonds before it pays for anything else: before the entitlements, before the military, before anything. The debt obligations mean an even larger share of the federal budget goes to that debt service. Right now, that is 8.3% of the total federal budget or $364 billion. Within five years this becomes 12.5% of the budget and over $688 billion. This is a massive slice of the annual budget—often the fourth- or fifth-largest share. The issue is an age-old one in economics—opportunity cost. Think of what $688 billion would buy in the U.S.?

As with everything, there are complex issues involved in this kind of debate. Spending more than one takes in is often justified. It is common during recessions when there is a need to offer assistance to the population while the recovery takes hold. There are times of national emergency such as a war or natural disaster. It is even justified to spend on some major infrastructure improvement that will later grow the economy, although there will be lots of debates over what is and what is not useful. What has never before been seen as justified is spending during a period of growth, and on the general run of government activity. The day-to-day activity of government is supposed to be handled by available revenue. If that is not sufficient, the solution is supposed to either be reducing the activity of government or raising more revenue. The GOP once argued for reducing what the government does and the Democrats argued to raise more revenue (generally speaking). Now the GOP has switched and wants more and more spending for its favored projects (and still wants no tax hike). The Democrats are adding more and more spending projects without reducing any of those that are already in place. Both are arguing that deficits and debts no longer matter. They say the U.S. can run them higher and higher and suffer no consequences.

Tariff Decision Delayed

As had been expected since Trump's statement last week, the next round of tariffs on goods made in China has been delayed. The official commentary indicated that "substantial progress" had been made by the negotiators, but most analysts have indicated that nothing much changed as far as the Chinese position. It is not clear how long this delay would last or when the summit between Trump and Xi Jinping would take place, but most anticipate the meeting will take place within the next month or so.

Analysis: The comments from the White House suggest that U.S. negotiators reverted to topics that were part of the talks some months ago and avoided the more controversial demands that had led to the current impasse. When the discussions began, the big concerns for the U.S. were protection of intellectual property and issues of technology transfer. The Chinese had seemed willing to move in the direction the U.S. favored and an agreement seemed possible last October. That was when the U.S. began to demand "structural reforms" which amount to radical changes in how the country handles is business community and exports. This would involve everything from ending subsidies to changing bank lending practices and altering the value of the Chinese currency. This was clearly too much for China and the whole process stalled. Now it looks like these larger demands have been shelved and the focus has been on the more practical issues.

Ghost Newspapers

The term has been widely used of late—along with zombie newspapers and other references to the demise of the daily newspaper. Over the last decade, there has been a shift in the fortunes of the newspaper business that has all but destroyed it. The vast majority of papers in the U.S. have seen subscription rates plummet by half or more. The majority of these daily papers have become a shell of what they once were. Staff cuts have eliminated as much as 80% of the writers and reporters. The majority of these papers are now little more than a few pages of wire copy and an occasional local story. Most of the papers in the U.S. are now owned by venture funds that have been busy stripping assets and shutting down operations. The question that hangs over all this is why.

Analysis: The local paper is certainly not the only business that has been radically altered by the changes in consumer taste and the rise of technology, but it is also not the only business that has reacted to the pressure with steps that made survival even less likely. The first instinct of a business facing reduced revenue and profit is to find ways to reduce costs. This has been a strategy that has worked to some degree in manufacturing as machines can be brought in to replace the workforce or there can be production in other parts of the world where costs are lower. These are not options for a local newspaper so the cost cutting simply lowered the value of the product. As there was concern over the loss of subscribers, the papers were providing less and less to those subscribers so it should not have been a big shock to see these defections rise.

Some of the larger nationally oriented papers were able to use the online option to compete. There have been more subscribers coming to papers like the New York Times, Financial Times and Washington Post. The online approach has been tried by the smaller papers, but has been far less appealing to the people that had been subscribers. It has also been less than popular with local advertisers. The spiral has accelerated quickly. The result has been the closure of over 500 local papers since 2006. In 2001 there were 412,000 people working in journalism. Today, that number is less than 175,000. There have been more losses in this profession than among coal miners in the U.S.

The impact on the local community has been significant as the local voice has been largely stilled. The papers that have survived are owned by conglomerates and venture funds and chains. They have substituted local news with whatever national message they favor. Very often, these messages are highly ideological. The task ahead is daunting. Winning readers back assumes the papers will have something for them to read. It also assumes the readers have not abandoned the paper altogether. The data shows that more people now get their "news" from social media platforms such as Facebook, Twitter and Instagram than from newspapers, radio and TV.

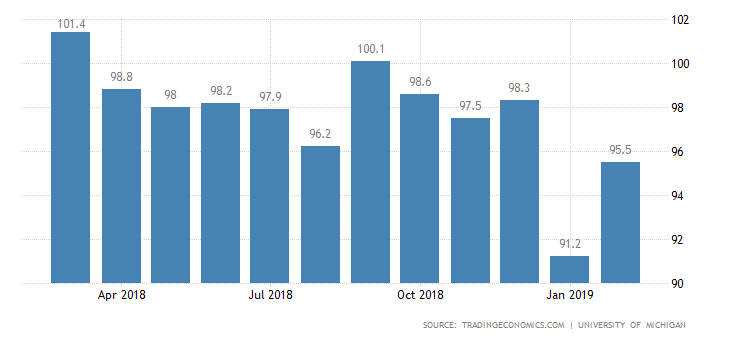

Consumer Confidence Numbers

For three months, the level of consumer confidence had been falling as the various threats to the status quo continued to mount. There was worry about everything from the stock market failing to the impact of the government shutdown to the trade war. Now that it seems some of these threats have passed, the general level of optimism has returned—at least to a degree. These are still concerns, but the big motivator for consumer mood is still the job market. As long as that data keeps coming in strong, the consumer feels relaxed about the immediate future. The shutdown was not as big a deal as expected as it turns out that consumer expectations for government are so low that nothing much surprises any longer.

Analysis: We have cautioned about taking too much from the consumer confidence surveys that are prepared by either the University of Michigan or the Conference Board (or any of the dozens of others that appear whenever somebody decides to poll consumers). The target is fickle and easily distracted. For years, the movement of gasoline prices affected the consumer confidence numbers profoundly. A small hike in the price of gas made people very positive and the shift downward made them depressed. Today, it is hard to pinpoint what will make the consumer happy or anxious. The big issue is always employment. As long as people think their job is secure, they are confident. When they see people getting laid off, they worry they might be next. Beyond that, it can be anybody's guess what makes their mood shift from one week or month to another. It can be the stock market or it can be the tension over a government shutdown. It is rarely anything that really has much to do with their role as consumers. If that was a motivation, the specter of higher import prices due to tariff and trade wars would have had a bigger impact.

Hoping for Good Fortune to Continue

I live at the mercy of the elements and the actions of others. Of course, we all do to a significant extent, but when travel is part of the deal, that becomes ever more obvious. This has been a truly miserable winter in much of the country with storms wreaking havoc from coast to coast, but somehow I have managed to dodge these. My trips have not been cancelled or even delayed, but most of that has been the luck of timing—leaving just before the snow hits or getting back right after. This week, I am out for four days and will be testing that luck once again. Granted, I am heading south to Florida (twice) and Texas, but this year that has not been the protection it might have been in the past.

All one can do is prepare. I have the luxury of being able to do what I do anywhere—just as long as I can find an outlet to plug into. The part that causes heart palpitations is the prospect of being unable to get someplace in time for the scheduled talk. I have not had to resort to renting a car and driving 600 miles, but I have come close. Others on the speaking circuit have these tales of woe to tell. I will keep all manner of digits crossed this week and hope for the best. I once did a program for a group in Kansas City while standing in the airport in Ft. Lauderdale as I was trapped—the cell phone was my only option. That meant the attendees could hear the airport announcements as well as the screaming child at the gate. I don't want to repeat that experience any time soon.

Consumer Confidence

There has been a lot of variability when it comes to consumer confidence. Just recently there was a dip that has been attributed to issues like the government shutdown and worries about the next few months as far economic progress is concerned. This chart shows there was a pretty swift bounce-back after that down month. The No. 1 issue for the consumer is always jobs—as long as people feel secure about their position, they remain confident about their immediate future.