Strategic Global Intelligence Brief for February 22, 2019

Short Items of Interest—U.S. Economy

Support for Higher Interest Rates

The consensus view at the moment holds there is no reason at all for the Fed to even consider hiking interest rates. That has been the admonition from Trump for several months. Now, the markets have joined in with all their doom and gloom assessments of growth in 2019. Lately, there has been pushback from economists who point out there is plenty to fear from inflation even as the current rates are staying low. They are backing the positions staked out by the likes of Federal Reserve Bank Heads Esther George and Loretta Mester. They urge the Fed to watch the tightening labor market and the rise of consumer prices due to the imposition of more tariffs and trade barriers. Inflation moves very slowly until a critical point is reached. Then it tends to explode. The Fed is urged to be proactive, which is what the hawks have been saying all along.

Housing Market Still Cooling

For the third month in a row, the sales of existing homes have declined. That further reinforces the notion that the housing market is stumbling a little. Much attention is focused on new home construction and permits and the like, but the bulk of the housing sector is caught up in the existing home market. This has especially been the case as the new home builders have moved away from the starter home to the more expensive end of the spectrum. Many things affect demand for these homes. There have been more on the market than in past years as Boomers retire and elect to relocate to some form of senior living. The decline in January was not precipitous, but a drop of 1.23% on top of the other reductions has started to add up.

New Claims for Unemployment Decline

Under normal circumstances, this data can be very volatile as there are many times that people are subject to short-term layoffs and furloughs. The data for the last few weeks has been skewed by the government shutdown as many of those who had been furloughed were eligible for unemployment. Now, they are back. The same thing happens every year when the auto sector refits plants and lays people off for a few weeks or months. The four-week running average is more reliable and has been holding at just over 235,000 a week—slightly higher than it has been in previous months.

Short Items of Interest—Global Economy

Brexit Build-Up

British retailers are on a buying spree, one that is likely to last a few more weeks or perhaps longer—depending on whether there is progress made with the Brexit talks. It seems there has been a wholesale loss of confidence as far as the talks are concerned. Many retailers now assume they will be cut off from European supply. They are loading up with as much inventory as they can afford, but that carries risk with it. The Brexit talks may yet work out. Then, there will be huge inventory surpluses to work off. There is also the fact that a Brexit fail may send the U.K. into recession. That will make it hard for consumers to buy anything.

Deep Split in Venezuela

Much conversation revolves around the upper 1% in the U.S. vs. the other 99%, but that gap is nothing as compared to other states. In the U.S., that 1% still numbers over 3.5 million people. In Venezuela, the upper half percent own over 96% of the assets of the country, only several hundred people. Today, almost 90% of the population is malnourished, but the expensive restaurants thrive. Two days ago, Maduro spent $5,000 (U.S.) on a meal for 10 members of his family and close friends.

Saudi Shift to Asia

Since Crown Prince Mohammed bin Salman has lost much support in Europe and the U.S., he has turned to Asia to burgeon his position using familiar tactics—loads and loads of cash to finance every project one can think of.

Breaking the China Impasse

At this point, it is not clear there is a path forward on this topic as it is really not clear what the real issues are as far as the U.S. and China trade talks. It may be helpful to try looking at this complex relationship with some degree of realism. The current conversation seems to revolve around trade, but on closer examination, it really isn't. In many ways, the economic relationship between the U.S. and China is an anomaly as far as relations between rivals are concerned. The U.S. and China have been overtly hostile towards one another for most of modern history—at least since the end of the Second World War. The Korean War was really a war between China and the U.S. It was one that ended unsatisfactorily for both nations. The U.S. and China started down a different path with the death of Mao Zedong and the rise of Deng Xiaoping. To some in the U.S. and the western states in general, this transition meant China was on its way to becoming just like the U.S., Europe, Japan and others. That was, it turned out, a very naïve assumption. China did indeed change and adopted more of a capitalist economic system under the rubric of Deng's exhortation of "to get rich is glorious," but the western assumption that moving to capitalism meant moving to democracy was wishful thinking at best. The Communist Party has as much or more control over China now as it has ever had.

Analysis: There are many things the U.S. would like changed in China today. Only some of them have to do with trade and economics. Just as a starting point, the U.S. would like China's support for the North Korean regime to end or at least be scaled back so that Kim is required to comply with global demands regarding his nuclear program. The U.S. wants China to stop threatening the Republic of China with threats to invade Taiwan. The U.S. wants China to stop expanding their influence into the South China Sea and they want China to stop persecuting Tibetans and Uighurs. The U.S. wants China to stop propping up governments such as Nicolas Maduro in Venezuela and the dictators in Africa. Then, there are the economic and trade issues.

China has a built-in advantage when it comes to production as the government squashes protests and any form of worker organization into unions. Pollution is ignored, worker safety is ignored and so is consumer safety. The government subsidizes export industries and discriminates against imports. The country allows overt theft of technology and widespread counterfeiting. To put it bluntly, there is a lot to dislike about Chinese policy and behavior. The part that adds complexity to all this is the fact that China is also a massive and lucrative market for hundreds of U.S. businesses. It is a manufacturer of consumer goods at such price levels as to enable U.S. consumers to have enviable lifestyles.

Is there a way to have a relationship with China? It has always demanded an ability to take the good and either ignore or tolerate the bad. The question is whether the Trump team really wants a trade pact of some kind or is really after something bigger. There are those on the team who want to see China as rival and enemy and not as a partial ally in some things. Others want to keep trying to maneuver the relationship to better favor the U.S., but without escalating tensions any further.

Syrian Reversal

The decision by President Trump to leave some troops in Syria has thrilled the Kurdish allies that had been lobbying hard to maintain some kind of presence, but it may complicate things for Trump given his strong statements regarding the withdrawal. The number of troops that will stay is small but significant as it means that attacks on Kurds and other U.S. allies risk killing U.S. personnel. That invites a bigger U.S. response. It also makes it far easier to beef up that involvement should it be deemed appropriate later.

Analysis: This reversal comes at the behest of most of Trump's military and intelligence advisors who pointed out that leaving meant Russia would have a free hand in the area and that Bashar al-Assad would be untethered as well. The U.S. will be there as advisors and trainers, but they will be there. That gives the U.S. a stake in what happens next. The Kurds had been feeling betrayed and still do not trust Trump, but they now assume that the U.S. military is truly behind them. That cements the relationship between the Kurds and the U.S. in Iraq. Neither Russia nor Syria is happy about the decision, however, and there has been opposition from Iran as well. The Saudi government had also been lobbying the U.S. to stay. This reassures them regarding U.S. commitment to other parts of the region.

Uncertainty: The Bane of Business Existence

There are many factors that have a negative impact on business to one degree or another. That is the nature of competition after all. The successful business is the one that by luck or skill manages to navigate these challenges. Among those issues that occupy the strategic time for management are taxes, regulation, labor resources, competitive pressure, consumer mood, natural disasters and various global economic trends. The fact is all of these factors can and do change frequently—most with some advance warning, but many will alter unexpectedly. When the changes are more predictable, they can be managed and prepared for, but those that are sudden or unexpected can leave a company vulnerable. By definition, a natural disaster is unpredictable. To a business, it can be either boom or bust—depending on the business. Actions by a competitor can be unexpected as well, but usually these moves can be anticipated. The same can be said for the actions and moods of the consumer. The factors that are not supposed to change on a whim are those connected to the government or the overall system in which a company operates. Changes in tax rules and the regulatory environment rarely take place without some advance warning as the changes are usually discussed and then move toward implementation. When these become unstable, or predictable factors become unpredictable, the business community is forced to be more cautious. That generally results in a slowdown.

Analysis: The latest numbers suggest that business is feeling a far greater sense of uncertainty than normally would be the case. It is affecting their willingness to expand, invest and grow. The durable goods numbers were released yesterday and the initial enthusiasm about the increase faded quickly as the data was explored. The only sector that grew was aerospace—the sales of aircraft jumped. This sector can be counted upon to skew the data either up or down given that sales of aircraft tend to come at certain times and in large jumps. Planes are not sold to consumers one at a time—they are purchased by fleets, usually in the dozens or even hundreds. When the world's airlines are expanding, it will be good times for the likes of Boeing and Airbus. When there is less expansion, these sales drop off quickly. This last month, aircraft sales jumped. It was good news for some of the smaller companies as well—Bombardier, Embraer, Fokker and some others. If one adds in all this additional aircraft activity, the durable goods numbers were up by 1.2%. But separate these numbers out and durable goods orders fell by 0.1%. This is a worry given that much of the other economic data would suggest that more investment would have been made at this point.

One of the factors pushing investment should still be serving that purpose, but it seems that business is slowing when it comes to capital investment and expansion. The labor shortage has been acute for manufacturing, transportation, construction, health care and many other sectors. This shortage has been manifesting for several years now. There have been several reactions to the shortage. Companies have tried to recruit the labor needed, but the pipeline is extremely limited, so they are turning to poaching workers from other companies. In past years, there would be more interest in bringing people from other countries, but immigration is now a dirty word. This leaves using machines and robots to replace people. That trend had been accelerating, but now there are signs it is stalling out as this kind of commitment is expensive. Putting in technology and robotics is far riskier than hiring people. If the expected business does not manifest or there is a downturn of some kind, the company can lay people off to save money, but what can they do if they spent millions on those machines?

This is the part where uncertainty comes in. If the business is unsure what comes next, they become cautious to the point of paralysis. They are unwilling to buy these new machines and they are even reluctant to staff up (assuming they can even find the people they need). What is making businesses feel so uneasy right now? In the majority of polls taken of business leaders in a variety of business sectors, one factor stands out as the main concern for companies of all sizes. Trade wars and tariff wars have introduced a level of uncertainty that has become crippling. It is not even that these tariffs and trade barriers are being erected, although this has been a huge issue for companies that engage in global business. The real problem is that nobody has a clue where all this ends up. The renegotiated NAFTA (the USMCA) is stuck in Congress and picking up new enemies every day. China is threatened with higher tariffs, but the deadline keeps moving. Europe is threatened with tariffs unless they buckle under to the U.S., but nobody knows when. Every U.S. trade partner is in the dark as to what comes next. That is slowing U.S. business significantly.

Speaking of Uncertainty

For the U.S. to take a tough position with China has always made a certain amount of sense given that China has been playing its own games with trade for decades. The positions taken by Trump when it comes to longtime allies like the Europeans, Canadians and Japanese are far harder to explain or justify.

Analysis: President Trump continues to threaten the Europeans with very high tariffs on imported cars and car parts if they do not make a deal that satisfies him. The issues that vex Trump are not even trade related. That is the crux of the issue. Trump doesn't like the European position on Iran's nuclear program or their stance on Brexit or their position as far as Israel and the Palestinians are concerned. These are the issues that have prompted the U.S. to threaten trade barriers and tariffs, even as it is pointed out that such moves would do significant damage to the U.S. economy in the process. The relationships between the U.S. and Europe are very complex and have been in place for decades. This threat to destroy these relationships will not end well.

The Workers

I have gotten to know many of the people who work at my local airport—the kind of thing that happens when one flies as much as I do. I am on a first-name basis with many of the TSA people as well as gate agents for Southwest and the ladies who run the various snack bars. The other day, I had a chance to talk to both Margaret from TSA and Judith from the snack bar. Both women are at the point where they could have retired some time ago. One might assume they were still working because they needed to. Neither has that as their main rationale—although both appreciate the extra pocket money.

All their lives they have worked and really don't want to stop now. Judith seems to be at that snack bar 24/7. She is always there when I am coming and going. I found out that she has a second job driving big vans and limos for groups and various teams. She works a seven-day week and seems to enjoy it. Margaret takes extra shifts and also has other part-time work. It seems that people who like to work just like to work and find little enjoyment in being idle. I think I can relate.

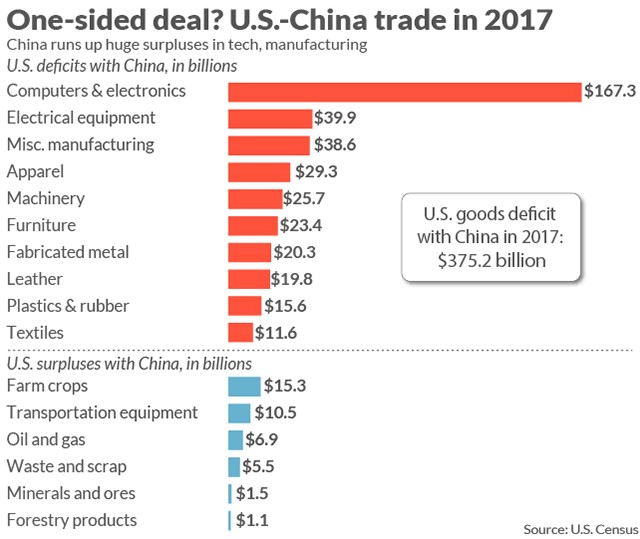

U.S.-China Trade in 2017

If there was any doubt as to the one-sided nature of the trading relationship between the U.S. and China—this chart should dispel it. The Chinese are supplying one of the most aggressive sets of consumers in the world. At the same time, they have erected substantial barriers against imports from the U.S. If there is a decision made to focus on just the trade aspects of the U.S.-China relationship, there is obviously a lot to work on.