Strategic Global Intelligence Brief for December 19, 2018

Short Items of Interest—U.S. Economy

More Backpedaling on the Wall

The latest twists and turns over the border wall are somewhat predictable given the number of times this situation has arisen already. Those lines in the sand are blurring again. It looks like it is time for another acrimonious compromise. Trump spokespeople have indicated the $5 billion demand is off the table. President Trump is now saying he doesn't want to shut the government down. The Senate is looking at passing a short-term package that would likely fund the government through February and leave the core issue until the next Congress. This would make the wall even tougher to get through as the House will be firmly in the hands of the Democrats. They will have no incentive at all to shift their position.

Multifamily Construction Drives New Home Data

The surge in new home construction in the last month is almost entirely due to expanded building in the multifamily sector. The growth of the single-family home, however, is slower than it has been since the recession started. There are several theories as to why. One holds that there are too few people left who can afford the single-family home as prices and mortgages have gone up. Then there is the preference that Millennials still maintain. They are not yet settling into a home and remain mobile and more interested in renting. There is also the assertion that people are generally shifting from single family to multifamily as they retire. The growth in assisted-living facilities continues to be explosive.

Expanding the Labor Pool

Given that the unemployment rate has been at a very low level for an extended period of time, there has been a demand for workers from anywhere they can be found. That has expanded the labor force in a variety of nontraditional directions. There have been more hires among very young workers, much older workers, stay-at-home parents, those who have been incarcerated, those with varying disabilities and immigrants (both legal and illegal). It has been good for the economy that these populations have been available, but the concern is that when the economy slows, these may end up being the first fired or replaced.

Short Items of Interest—Global Economy

Belgian Government Collapses

The Belgian government had been hanging on by a thread for months, but has now fallen apart as current Prime Minister Charles Michel tendered his resignation. He had lost support of the Flemish nationalists over his attempt to pass the UN migration plan through the parliament. That ultimately made it impossible to hold the government together. This makes yet another nation in Europe thrown into chaos over the issue of migration. It is safe to say that the issue has become radioactive and there are no easy solutions in sight.

Information War

Some remain naïve enough to think the Cold War somehow ended when the Soviet Union collapsed. Even a cursory examination of global politics would disabuse anyone of that notion. The Cold War now is an information war and is being aggressively waged by the likes of Russia, China and others. Thus far, the U.S. has been abysmal at protecting its democracy and has therefore allowed these disinformation attacks to continue. The fact is too many people are too gullible and easily fooled by manipulated media. The assertion about CNN and others being the problem ignores the fact the U.S. is under attack by the secret police of Russia, China and others. This is the real source of "fake news."

Is China Due to Slip

By 2040, the Chinese share of global output will start to shrink. It will fall from 19% of the global total to perhaps 17%. The developed nations will hold steady, but some emerging markets will grow.

Lots of Subtext in Latest Chinese Speeches

There are several aspects of the Chinese system that will strike the average American as peculiar, but perhaps none more than the way political speech is handled. We have grown accustomed to political rhetoric that is essentially meaningless—aimed at some group of supporters or opponents, but carrying no weight. For the most part, the commentary by President Trump is dismissed as some kind of stream of consciousness. There is no evidence it is vetted or even seen by members of his staff. In contrast, you have the excruciatingly scripted speeches by the likes of Xi Jinping. Every word and every phrase is considered from every angle. There is no opportunity for any kind of spontaneous opinion. Even the historical references are loaded with symbolism.

The latest speech was on the general subject of reform and the direction China is heading in the years ahead. It comes on the 40th anniversary if Deng Xiaoping's reform plan. This is an auspicious occasion and the comments are especially interesting given the fact that some prominent economists and analysts have been attacking some elements of the current economic reform plan.

Analysis: One of the more unexpected aspects of the speech was that it never once mentioned the trade war with the U.S. or the tariffs imposed by China on the U.S. and by the U.S. on China. It was a very deliberate attempt to put these trade issues in a much bigger context. Xi stated that "no master can dictate to the Chinese people." This was stated in a very defiant tone. It has multiple meanings. On the one hand, it is a warning shot to the Trump White House that China will not be bullied and dictated to by the U.S. or anybody else. But there was more to it than this when taken in the total context. It also means that nobody in China can dictate to the Chinese people either. That means that Xi and the other leaders have only limited and indirect powers over an economy that is at least partially a market-based entity. This may be a bit overstated given all the tools at the government's disposal and their penchant for manipulating and protecting select industries, but he makes a key point as far as China's future is concerned.

It was not that many years ago that every tiny aspect of the Chinese economy was tightly controlled by some aspect of the government and Communist Party. Today, the vast majority of small businesses are independent in nearly every sense of the word, while the larger ones remain under the tutelage of the powers that be. The critics have been suggesting more of that control be removed and that China become ever more market oriented and subject to the rules that govern competition.

One of the points made in Xi's speech was one that has been repeated quite a lot in the last few years. All of this government intervention and control is expensive. The bottom line is China really can't afford this as it has in the past. The subsidy culture runs deep in China as consumers are routinely protected from higher prices for everything from food to fuel to housing. The country is littered with inept and inefficient businesses that can only survive with extensive government help. The Chinese overproduce steel because every rural burg set up a steel operation so it could employ people. The expressed thoughts from Xi and others focus on allowing the market to do what it does best—creative destruction.

U.S. Continues to Put Pressure on EU and U.K.

The Brexit mess is not just an issue for the British and the Europeans, of course. The implications are serious for the U.S. as well as most other nations in the world, given that they trade with the Europeans and British and have long been connected with their financial and banking communities. The U.S. has been especially insistent that provisions be made to ensure that certain financial sector systems remain intact regardless of what happens with the whole process. Jay Clayton from the Securities and Exchange Commission has been especially vocal on the subject of non-centrally cleared derivatives contracts and the whole area of investment management.

Analysis: The British and EU have until March of 2019 to work out an organized withdrawal from the EU. The politics of that exit have become pure chaos with the British Prime Minister barely surviving a no-confidence vote from within her own party. The Europeans have not been willing to budge an inch from the position they stated when PM Teresa May concluded the last meeting. The two sides are being governed more by politics than economics as the current path will be deadly for both. The worst outcome for all concerned is a chaotic tumble out of the EU with no provisions for an orderly path. The U.S. has thus far been unable to do much to alter the situation as this administration has been unpopular with all concerned. At the same time, the pragmatists are trying to find a way to avoid the perils of disorganization.

Government Shutdown and the Economy

From the outset, these disputes have to be seen in context. This is a political battle and little else. It is also not unusual for legislatures and governments to fight over money and budgets. Every democratic nation in the world engages in some version of this kind of budget brinkmanship as there will always be disputes over what money to spend and on what. The people who have some control or influence over these decisions will use whatever leverage they may have to affect that decision. There are several aspects of the budget battle that are unique to the U.S., however. Few other nations have to go through the process of raising the debt ceiling—usually it is assumed that once a budget is approved, the government is obligated to fund the decision. The U.S. is a little less unique in its battle over funding government and threatening to shut it down. What does a decision like this actually mean for the economy as a whole?

Analysis: To begin with, the current threat is to impose a partial shutdown as 75% of the government activity has already been funded. There are parts of what the government does that are mandated regardless of what kind of budget theatrics are in play. Those affected by the shutdown will likely experience one of two reactions. There will be some workers who will be deemed essential. They will be required to work, but will not be paid until after the shutdown impasse is over. That could be days or weeks and could be longer, but that would be highly unlikely. Those workers that are not considered "essential" will be furloughed until the impasse ends. Then, they presumably receive back pay. That decision is not automatic, however, as it will take another decision by Congress. In the past, there have been those that balk at paying for work that wasn't done. The workers point out that this was not their decision, but that of Congress.

Essential workers are generally in areas such as public safety, health care and security, but in the past, there have been designations for those working in finance and certain areas of accounting and oversight as well as in the legal arena. The estimate is that some 800,000 people would be affected by the process—either being furloughed or asked to work for no pay. There has already been an impact on the economy from the threat as those that expect to be affected have been forced to reduce their spending in anticipation of being without an income for a period. Granted, the delay is likely to be short, but few people carry a substantial reserve fund these days. An interruption of income affects them immediately.

The bigger economic issues stem from the disruption of government activity. There is a tendency for people to assume that government work is somehow less important than the private sector. There is waste in government activity from time to time—just as there is with any large organization or corporation. The vast majority of what is done under the auspices of the government is done well and contributes significantly to the overall society. When these tasks are not carried out, the impact can be severe. There will be delays for important projects and some plans may have to be abandoned altogether. The uncertainty factor is important as well. Along with the employees, there are close to 200,000 businesses that work in some capacity for the government. Suddenly, they will not be paid either. In past episodes, there has been a strong reaction after the government reopens. Many of these companies choose to no longer work for the government as it has become an unreliable client that does not pay its bills.

All of this economic angst is due to political infighting. In past years, the issue was debt and deficit in broader terms. There were those in Congress that objected to the ever-increasing budgets and the inability of the legislators to create a balanced budget. The demand was that more cuts be made to bring the budget closer to that balance. This fight is not over anything quite that grandiose. It is about one program—the construction of a border wall. President Trump has decided this is an issue he will place ahead of all others. The Democrats are just as determined to make sure no more money is poured into this effort. This is the first real salvo between the two sides. If this impasse is any indication, the country is in for a very long and very contentious two years. A shutdown could also be a long one given the lack of interest in any sort of compromise.

Fed Continues to Ignore Pressure

There is obviously still time for the Federal Reserve to choose not to hike rates by another quarter point when they meet tomorrow, but such a reversal would be highly unusual and disruptive in the extreme. Since the days of Alan Greenspan, the Fed has positioned itself as predictable and reliable and suggests that it will telegraph moves far in advance. There has been no hint of a desire to leave rates alone at this stage, although there has been less certainty regarding next year.

Analysis: President Trump and others have been roundly attacking the Fed for its decision to keep pushing rates, but that is typical of politicians in general—nobody ever wants to stop the party. Leaving rates at these very low levels for the better part of a decade has already had an impact that is not altogether healthy. There is an inflation threat building now. There has also been far too much speculative borrowing and investing. There has not been an opportunity for the Fed to build up "ammunition" for the next recession. This latter issue is more important than many realize. If there was to be another downturn, and as soon as late 2019 or 2020, the Fed would be hard pressed to react as rates would already be low. During the last recession, there was no help coming from Congress until very late in the game—the stimulus was all coming from the Fed. In order to do this again, the rates have to be high enough that lowering them again matters. One more reason to raise rates is to provide some additional rationale for investing and saving. Rates have been so low and for so long that traditional saving is almost unheard of.

Much Needed Laughs

"Businessman enters the shop. He wears clothes that cost money. His hands are briefcases and he is Hallmark hot." If you have not yet seen the attempt by a bot to write a Hallmark Christmas movie you owe it to yourself to find this online. The premise is that somebody made a bot watch 1,000 hours of these Hallmark movies and then asked it to write its own. I cannot attest to the verity of this claim, but the dialogue is priceless—even if somebody made the whole thing up. I have to confess that I have consumed my share of these movies. The plot looks very familiar and likely.

It is worth a search so you can also thrill to this kind of dialogue. "Shut your sound. I am from Huge City. I bought your land and am now turning it into an oil resort." "Rude behavior. This is a family business. I sell families. I am widow. My husband is now bones." In the end this will likely turn out to be from "The Onion," but I have not laughed so hard in months.

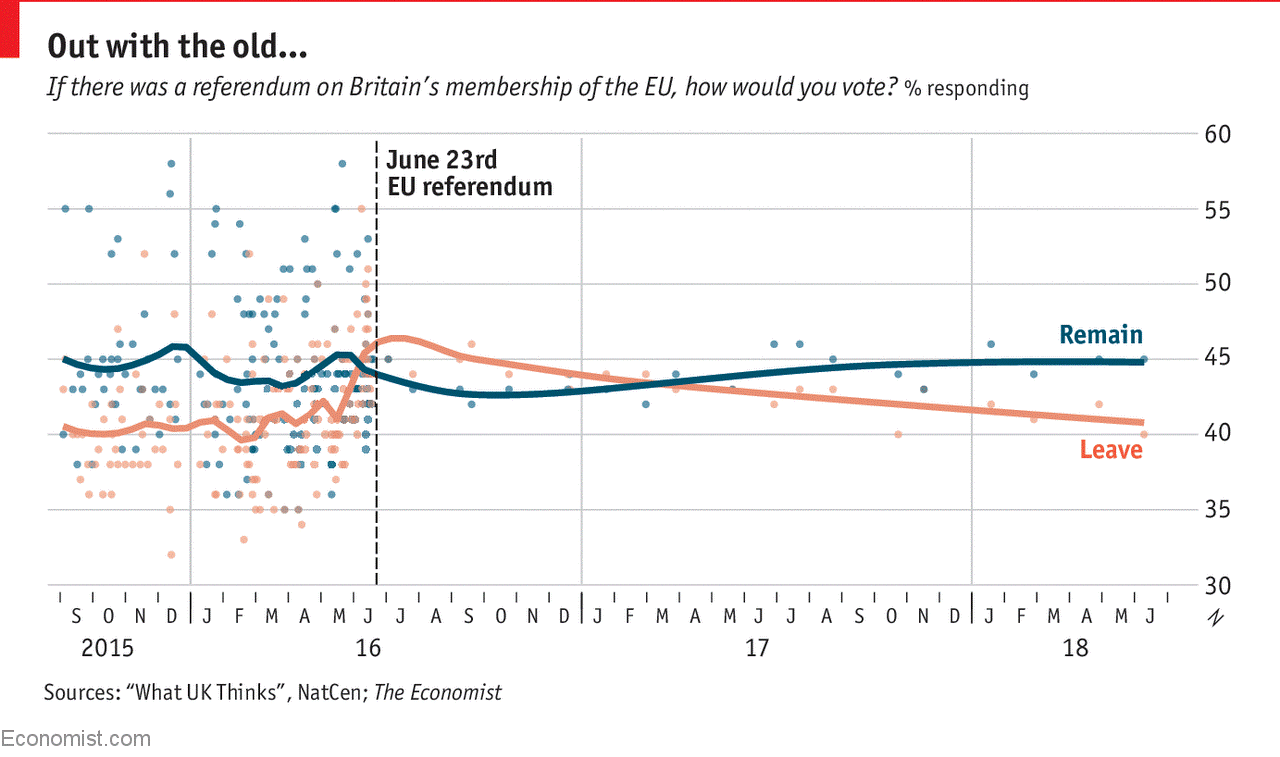

Brexit

It might as well be called "voter remorse." Now that many of the dire predictions made regarding the British exit from the EU have come to pass, the majority of the population in the U.K. wants a "do-over." That is not in the cards by any stretch of the imagination. The EU has not been the least interested in giving the U.K. another opportunity and there is not the will to hold another election in Britain. This reaction has been part of a larger pattern when it comes to various populist efforts in Europe and the U.S. The action sounds appealing and people find their nationalism fired up, but in the end, the decisions are unworkable and the expected damage really does come to pass. The U.K. has yet to really feel the recession that will be triggered by the mess. When that takes place, the number of people opposed to the idea will surely increase—for all the good that will do.