Strategic Global Intelligence Brief for April 1, 2020

By Chris Kuehl, NACM Economist—

Short Items of Interest—US Economy—

Tempting but Now Is Not the Time

It crossed my mind only briefly but today is, after all, April Fools' Day. I had considered starting today's issue with a piece that announced the COVID-19 thing was all over or was just a ruse. That level of humor is inappropriate in the extreme, but we would all be well advised to try to keep seeing the lighter side of life if we have the opportunity. There is a great deal to be depressed and scared of, but it is also springtime and the world is coming alive. There is still plenty of beauty in the world and our friends are still there—even if they have to stand six feet away. For the vast majority of us, the issue of the next few months will not be fighting the virus, it will be coping with a world that has been stopped in its tracks. That is going to require patience and fortitude beyond what most of us have ever experienced.

Infrastructure as Next Stimulus Effort?

There is a frantic effort underway in the U.S. and every other nation in the world as the economic impact of the virus moves faster than the virus itself. The U.S. is just now trying to get the $2 trillion package executed. There is already talk of what the next step might be. The consensus view is that infrastructure development will anchor the next wave if a decision is made to spend more money. There is no doubt that infrastructure in the U.S. needs the help desperately and has for years. The bigger question is whether this would do much to impact the current crisis. These projects would not be launched quickly and the employment impact would be minimal. There is already a shortage of people with the appropriate skills; there will be no mass hiring of unemployed restaurant workers to become road builders.

Most Powerful Person in Washington

It is certainly not Trump, Pelosi, McConnell or any other politician at this stage. The real power now lies in the hands of the bureaucracy, especially that of the Treasury Department. The $2 trillion plan will be administered by Treasury. That makes Steve Mnuchin the point man. This is nearly always the case with any crisis that involves the economy. It was Timothy Geithner under Obama that reacted to the recession of 2008 and Hank Paulson under Bush. Now it is Mnuchin's turn.

Short Items of Interest—Global Economy

Testing Is the Test

From the start of the COVID-19 outbreak, the mantra has been testing. It has become painfully obvious the world was not ready. The nations that have emphasized testing have made far more progress on containment than those that have been slow to respond. The U.S. and U.K. have been extreme laggards while Germany and South Korea have generally been ahead of the game. There are two main types of test—an antigen test that detects the presence of the virus and an antibody test that determines if the person has ever been infected.

Tariff Suspension

As the COVID-19 crisis has come to dominate the economic discussions, there are still restrictions in place as a result of the trade war. Trump has elected to suspend some of the tariffs imposed on China for 90 days, but others have remained in place. The fact is that global economic recovery will depend on the resumption of normal trade patterns. It is likely that pressure will mount for a reversal of all of these rules—at least in the short term.

Outbreaks in Highly Stressed Areas

There is mounting evidence that COVID-19 is present and expanding fast in areas with substantial populations of refugees and migrants. These areas have seen no testing and the virus has been hidden to some degree by other maladies. As the virus spreads to these already vulnerable populations, the impact will be especially severe.

Recession Markers Appear—Question Is How Bad

Since it is the first of the month, we will be getting a new round of data that will have chronicled the impact of the COVID-19 virus on the economy thus far. The collapse has been dramatic to say the least. Every new set of numbers will be that much more depressing. The more important consideration at this stage is how this compares to past crisis events and what might that tell us about the long-term impact of this crisis. The "standard" against which all these downturns will be compared will be the recession of 2008. This COVID-19 recession has not reached that level as yet. The latest set of Purchasing Managers' Index (PMI) numbers from around the world is telling a pretty grim story at this stage, but they have been worse.

Analysis: Given that Asia has been the hardest hit region, and given that there seems to have been a peak reached in terms of infections, it has become the best indicator as far as predictive impact. China actually notched a significant improvement in their PMI reading as the new reading is 50.3 after a near total collapse last month with a 40.3 reading. The majority of those who had been assessing the Chinese situation assumed the reading would still be in the 40s with the most optimistic analysts holding out hope for a 45. The Chinese data shows numbers now in expansion territory (over 50), a result of business recovery in the Hubei region. The other Asian nations have not seen the rebound, but the experience in China seems to indicate that once the lockdown has eased, there is a fairly quick rebound.

The readings are not as dire as they were in the 2008 crisis when many of these states were seeing reports in the 30s. The South Korean index fell from 48.7 to 44.2, the worst point reached since that downturn. The Philippines set a new record of 39.7, Thailand hit an all-time low of 46.7 and even Vietnam was slammed with a 41.9 despite their gains as a result of the shifting of supply chains away from China.

There have been two drivers as far as these declines are concerned. The first and most obvious has been the lockdown itself. Many companies have been forced to close operations as a means to slow the progression of the virus. The second factor has been the general lack of demand as the rest of the world engages in its own shutdowns. Many Chinese businesses are now back to near full capacity, but they have not seen a recovery in demand and therefore remain subdued.

Politics of COVID-19

There has long been something of a silver lining when there is a natural disaster. Not that anyone is willing to interpret the arrival of a hurricane or a tornado or tsunami as a good thing in any respect, but we are all familiar with the notion that disasters bring people together in ways that were not possible before. The storms wreak havoc on everybody. For the most part, people rally to deal with the aftermath. The virus outbreak has indeed brought out some of that same willingness to help one another, but it has also brought out strong political conflict and has exacerbated existing tensions.

Analysis: In every nation that has ordered some form of a shutdown, there has been a deep conflict between those who think the action is absolutely vital to the survival of the population and those who assert the whole effort has been overblown. The extremes on both sides have created intense conflict. The pro-shutdown group has gone so far as to attack people and businesses they accuse of being uncooperative, while those who oppose the efforts engage in deliberate activity designed to hasten exposure. Both sides attack the media, the politicians and the medical community. Both spread waves of disinformation that serves to utterly confuse the majority of people who are only focused on trying to bring an end to the threat. This issue has been additional fodder for the populist groups on both the right and left.

A bigger issue has emerged most dramatically in Europe, but exists in the U.S. and other nations as well. There has been a great deal of attention focused on the health care community as they are the first responders in this situation. That attention is deserved and so is the concern expressed for others in law enforcement and emergency services. That same level of concern and support is not seen for those who pick up the trash, work behind the counter at grocery stores, drive the trains and buses or deliver all that material we are now ordering online. The overwhelming majority of these people are low-paid workers. They are running the same risks (or greater) as are the medical professionals and with only a fraction of the protection. This has erupted in Europe as almost a class issue.

There is a sense that the workforce is now separating into categories that create stark differences between people based on how they make a living. There is the urging by authorities to work at home. That may be possible if one's job is essentially tied to technology already—a job that was done on one's computer. Can the factory worker take their job home? Can the maintenance worker? What about the people who perform personal services such as hair dressing, house cleaning, yard work? There are establishments that remain open as they are deemed essential and they are staffed by clerks. Even the circumstances at home differ. Being told to remain home in a place with plenty of space and distractions is a far different experience than for someone lacking those amenities.

V, U or L?

There are many ways a recession can be categorized. In the next several weeks, they will all be trotted out as analysts attempt to get a handle on the threat facing the global economy at this stage. There will be discussion around every new measure of slowdown as these are unprecedented events. The most basic of the assessments revolves around the shape of the recession. Will this be a V? That is the traditional short and sharp recession that most economies have been through many times. The damage is done quickly and the recovery is just as quick. The average length of a V is two quarters. Then, there is the U which starts out similarly to the V, but the recovery is slower. These often last three to four quarters. Finally, there is the dreaded L. This is the downturn that falls quickly like the others, but takes its sweet time rebounding. This is what the 2008 recession turned out to be as the recovery dragged on for several years after the fall in 2008. It still felt recessionary in 2013 and 2014, even after the recession came to a formal end in 2009.

Analysis: What are we looking at this time? As usual, there are a variety of opinions on offer. There are the pessimists declaring we are facing a lengthy period of downturn and those who assert this will be short and intense. If we look at some of the past recessionary events, there may be some lessons. The 2008 recession was a collapse of the financial sector brought on by massive miscalculation and poor strategy regarding mortgage-backed securities and the subsequent loss of credit. The entire underpinning of the financial system was exposed as flawed. In 2001, there was a recession provoked by a single event—the 9-11 attack. This attack was unprecedented and stunned the global economy. It took a couple of quarters for the world to recover and rebound. Thus far, the COVID-19 economic crisis looks more like the 2001 situation than it does 2008.

Grim Calculations

The U.S. and every other nation that has been affected by the COVID-19 outbreak now faces a very grim task. At some point, a calculation will have to be made as regards the death toll. Trump has now reversed course completely from his position two weeks ago as he asserts that between 100,000 and 240,000 people will likely die from the virus in the near future. The number of infections will be in the vicinity of a million. That is a large number, but there are 330 million people in the U.S.

Analysis: The calculations are going to be very unpleasant as they will essentially be an exercise in triage. The report from the St. Louis Federal Reserve suggests that the lockdown will cost in the vicinity of 47 million jobs. Is this a tradeoff that can be sustained for very long? At some point, there will be a death toll to attribute to an unemployment level of between 20% and 30%. There are already sharp hikes in the number of economically motivated suicides.

The Great Mask Debate

At the start of the virus outbreak, there were a lot of people suddenly sporting face masks to protect themselves from infection. This resulted in a severe and immediate shortage of the devices that has led to many in the health care field facing shortages. There was repeated advice that wearing masks would not provide much in the way of protection. People were urged to stop hoarding them so that those who really needed them would be able to obtain them. Now the issue of mask wearing is being reviewed by health authorities around the world.

Analysis: The basic issue has not changed. There is very little the mask can do to protect the wearer. The transmission of the virus is by touch and not through the air. If one is coughed upon or sneezed upon by someone with the disease, the mask would provide a modicum of protection, but the person affected would be well advised to wash their entire body and change their clothes as the virus would be all over them. The mask would be effective in keeping somebody from infecting others—that is what it is designed to do.

The challenge of the virus is that it has a slow incubation period and it is not always a serious illness. The flu manifests in a matter of a day or two at the most. One knows they have a cold or flu almost as soon as they get it. The COVID-19 virus may take several days before it appears. During that time, the person can spread it to others. The new recommendations will likely urge people to wear the mask if they think they might have been exposed and might have been infected. This will mean the vast majority of people will have no reason to wear the mask. The worry on the part of the health authorities is that people will start hoarding the masks again and deprive those who actually need them. There is already a shortage. That is why there have been suggestions that people use scarves or something else in the event they think they might have been exposed.

What We SHOULD Be Hoarding?

The urge to hoard is natural and strong—it is a reaction to insecurity. We are all facing an unknown period of isolation and restriction with new rules and threats revealed every day. We react by trying to ensure we have enough of what we need. Unfortunately, we often seem to hoard weird stuff and forget about what we really need. We are all aware that there are people who apparently go through several dozen rolls of toilet paper every day and have stripped the aisles. Is there a proper list of things to hoard?

Top of that list is likely to be soap. That is the first line of defense and one should be using a lot of it these days. We also need to eat. That would bias us towards food that can be stored for a while. Number three is my favorite—hoard books. I have been doing this my whole life and now feel vindicated. The next thing is subscriptions to streaming services. If you have been thinking about Netflix, Hulu or Disney, etc. now seems to be the time for binge watching. Let us not forget medicine, but remember that pharmacies and medical offices are not shutting down under any circumstances. Your decision to stock up on meds would be in the event you can't get out.

There is one other thing that ought to be on our list—empathy. Now would be a very good time to check on people. Do your family members have what they need? Do your neighbors? Do your pets have what they need? As we consider those food and medicine stocks, we need to remember the requirements of the other members of the household.

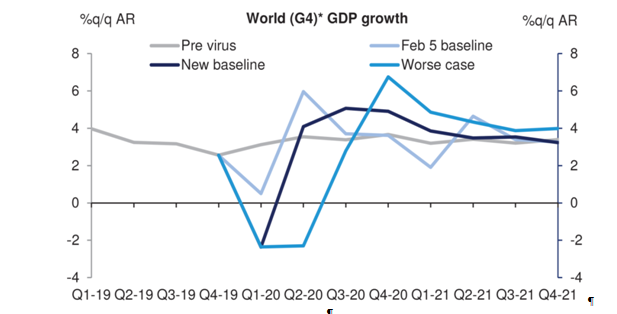

World GDP Growth

There is always a lot of conjecture and risk involved with trying to predict and forecast—but we do it anyway. This chart is essentially a composite of several economic assessments. It seems to have a somewhat happy ending, but only after a good deal of pain. The best-case scenario is a sharp recession with a swift recovery by the second quarter. The worst case is a slower recovery by third quarter. The two scenarios converge by 2021 and global growth is back to normal.