Strategic Global Intelligence Brief for April 1, 2019

Short Items of Interest—U.S. Economy

It Is Not Time—Even Doves Agree

Neel Kashkari has been one of the most vocal of the regional Fed presidents on the subject of rates. He has been consistently dovish and has opposed all of the rate cuts that have taken place thus far despite eventually going along with some of the decisions. He is not a voting member of the Open Market Committee this year, but he continues to make his opinions known. His path to the position as head of the Minneapolis Fed has been a little unusual and has included a period as the head of the TARP program, a run at the Governor's position in California and time in the private finance sector. He now argues strongly against the idea that rates should be cut although he remains very insistent that they do not rise further at this point.

Buyer's Market Emerging This Year?

Last year was pretty rough for the housing market as prices were high, mortgage rates were high and there were many housing markets with severe shortages of available stock. This year, things appear to be quite different—for the buyer anyway. The mortgage rates have come down a little and so have prices in some areas. Perhaps most importantly, there are few areas that suffer the same level of shortage as was the case last year. There are even some major markets sporting higher levels of availability. That will give prospective buyers some variety and options. At the same time, there is an expectation that more Millennials will be trying to enter the housing market, which may tighten availability.

Lots of Data to Peruse This Week

This will be a loaded week as far as data releases are concerned. The Commerce Department will release retail numbers today. They are expected to be a bit better than they were last month. The Purchasing Managers' Index (manufacturing) will be out today as well. It is likely to be sluggish due to some of the bad weather conditions last month, but better than it was in February. On Tuesday, there will be durable goods numbers. They have risen for the last three months in a row. This trend will likely continue. On Friday, there will be another jobs report. It will attract the usual attention—especially given the weak creation noted last month when only 20,000 jobs were added. A rebound is expected this month.

Short Items of Interest—Global Economy

Rebound in Chinese Manufacturing

The latest edition of the Purchasing Managers' Index for China showed a nice little rebound from last month—going from 49.2 to 50.5. This is the best performance seen in six months, but the numbers are still just barely over the 50 line. The economy continues to react to the threat of more tariffs and restrictions. There has also not been a major recovery in terms of the export sector as many of China's target markets are not doing that well.

Erdogan Loses Part of Iron Grip

The advance of Reccip Tayyip Erdogan's power in Turkey has been relentless or so it seemed. His AKP group has been a juggernaut in most of the elections and his continuous grabs for more and more power have been rubber stamped by a legislature that has been under his sway. The local elections that have just taken place have shaken the leaders of the AKP as it has lost control of two of the largest cities in Turkey—places that had once been strongholds for Erdogan. Both Istanbul and Ankara are now in the hands of opposition parties.

Resurrecting the French Center Right

The election that brought Emmanuel Macron to power seemed to spell the end of the traditional French right and shook the center right throughout Europe. The contest now seemed to be between the populist right and the Europeanists or center left. The new head of the French Republicans is trying to work with Germany's Christian Democrats under Annegret Kramp-Karrenbauer (AKK) to rebuild the center right reputation.

Anger and Frustration Fuel Elections

The assumption is that when the voters finally go to the polls, the thing that matters most is their economic well-being. They will vote for whomever has the best economic plan. That supposedly favors the technocrats who had answers to those economic questions, but often that technocrat is unable to compete with the demagogue who could make endless promises. Slowly, the pattern has morphed and now people are voting out of anger and frustration. Often, that anger is motivated by the economic issues that matter most to people—jobs, income, inflation and recession, but just as often, the anger is more diffuse. Anger at immigrants who might "steal" their jobs or change their culture, anger at the corruption of their government, anger at those whose lifestyles frighten or offend, anger at violence and despair.

Analysis: Populism has surged throughout the world. It has taken root in the U.S., U.K., Sweden, Italy, Greece, Spain, Poland, Brazil, Philippines, India and elsewhere. Elections have already brought populists to power in many of the East European states. It is likely that there will soon be more. The leading candidate in the Ukraine election is a comedian who has made a living lampooning the leaders over the last few years. There, the populism is of the right with Volodymyr Zelensky winning enough votes to face the incumbent in a runoff. Right now, he has support from over 30% of the voters. Meanwhile, Slovakia just elected an anti-corruption lawyer to be their president. Zuzana Caputova is a populist of the left who promises a broad attack on the powers that be.

That both can be seen as "populists" illustrates the challenge of defining this movement. Caputova is pro-European and liberal, while Zelensky is more typical of the populist leaders that already hold office in the region—Viktor Orban in Hungary or Andrzey Duda in Poland. Both left and right reject the status quo and seek more radical alternatives. That frequently draws severe critiques from the technocrats and experts who try to point out the fatal flaws. The U.S. elections of 2020 are shaping up the same way with Trump's brand of populism competing with the more leftist version as personified by Bernie Sanders, Elizabeth Warren and others who have thrown their hats in the ring.

At the heart of the populist message (left or right) is rejection of change. There are many millions of people who have been left behind by the rapid changes that have taken place in the last few decades. People have lost jobs they thought they would have for a lifetime as they watched their employers replace them with robots or move to other nations. Cultural standards have changed to be more inclusive, but many do not want to include other races or other cultures. Whether the populism is from the left or right, there are powerful waves of nostalgia—references to the old ways when they had secure jobs, kids behaved and everyone knew their place in the order of things.

Much has been made of the personalities that have been driving populism in a variety of nations—Trump in the U.S., Bolsonaro in Brazil, Duterte in the Philippines, Le Pen in France, Johnson in the U.K., Grillo in Italy and so on. In nearly every case, these have been outsiders with little traditional political backing or experience. They have been propelled by these populist movements and desperately try to stay ahead of them rather than control them. Anger is palpable and is driving a wedge in the very heart of a democratic principle—the ability to work with and respect one's opponent in search of common goals.

Why Isn't Maduro Gone?

The end of the Maduro regime in Venezuela has been predicted for several years now. Over the last few months, it seemed that his political demise was imminent as the diffuse opposition in Venezuela seemed to have coalesced around Juan Guaido. The elected head of the national legislature has won the support of nearly every nation in the world and has been backed aggressively by the U.S. and Colombia as well as Brazil and many in Europe. Still Nicolas Maduro remains in power with only some defections from his military. Why?

Analysis: The short answer is that Maduro is being propped up by Russia, China and Cuba—a classic triumvirate from the Cold War. All three have their ostensible reasons, but mostly they are motivated by being able to thwart U.S. intent. Meanwhile, the Venezuelan people are trapped in a nightmare that has already prompted over a million to flee. It is expected another two million will leave this year.

Are Consumers Signaling a Weaker Economy?

Maybe they are just taking a breath after a somewhat frenetic 2018? It is a little difficult to say at this stage; there is some ammunition for both interpretations. The most immediate concern was a somewhat unexpected reading for the personal consumption expenditures numbers. The expectation had been growth of 0.3%, but instead, the gain was just 0.1%. That came on top of the drop in December of 0.6%. The consumer confidence numbers have also been eroding although they remain higher than they had been in much of the last decade. These are always very volatile numbers that react to a wide variety of issues—some of them related to the economy and others not so much. It is this set of somewhat noneconomic issues that worry analysts as it is not easy to figure out how long the consumer will be bothered by these factors. If it continues to affect their enthusiasm to spend, the economic downturn that has been feared comes that much closer, but if these are temporary issues, the consumer may resume their more traditional pace and the economy rebounds. There are many issues that seem to have confounded the consumer thus far. It has been hard to determine which of these are the most important. Concerns have included the impact of the government shutdown, the general sense that Congress is too divided and hostile to accomplish anything, worries about the impact of tariffs and trade wars, fears that tax reform efforts last year are hurting some people this year and so on. It really is quite a long list.

Analysis: Roughly two-thirds of economic activity in the U.S. is tied to the activity of consumers. Should this two-month-long slump extend well into the spring, it will affect growth. Many analysts are already lowering their growth forecasts on the assumption that this consumer retreat is both real and likely to extend. The fourth quarter numbers for 2018 have already been downgraded a bit and there are several forecasters now taking their estimates of Q1 growth down. There remains a pretty significant variation between the various assessments with some as low as 1.1% and some as high as 2%, but the overall consensus has been somewhere around 1.5% with several downgrades in the last few days.

Part of the confusion stems from the fact that not all the recent data releases have been signaling a downturn. The University of Michigan consumer confidence numbers improved, but that was after a dramatic drop over the last few months that had taken its poll far lower than the one put together by the Conference Board. There was also an improved report coming from the housing sector. These pieces of good news are competing with other signals—such as the dreaded inverted yield curve. This has spooked many investors, but it is useful to point out that correlation is not causation. The inversion does not cause recession. It is simply that when the 10-year bond yield weakens like this as compared to the three-month bond, there is reason to think that a recessionary period is coming, but its arrival can be (and often is) years away. The presumption is that the Fed will react to the threat of recession and will thus cut interest rates, which in turn affects the value of these bonds. If the Fed doesn't elect to cut rates, the ingredients for a recession have not been deemed as significant enough. The Fed has done little to suggest that it has rate reduction on its agenda. As a matter of fact, there has been far more interest in raising rates as inflation on the horizon still poses a major concern—especially to voting members of the Open Market Committee such as Esther George and James Bullard.

The economic trends can still go either way depending on what the consumer will react to in the coming weeks and months. It has been pointed out this has been a very rugged and long winter. That often results in an explosion of consumer activity once the warm weather actually arrives. People are reluctant to head out to the malls and restaurants when the weather is bad. They don't start buying for the spring and summer until they see some evidence the warmer weather is here—that includes everything from lawn gear to spring clothing. As the grip of winter recedes, there is some expectation that better spending days will be ahead.

Is Worrying About Deficit Foolish?

This rather controversial position is the one taken by those who subscribe to the Modern Monetarist Theory (MMT). The assertion is basically that governments can borrow endlessly as they can always print money if they need it. The argument against this kind of deficit spending has long been that this activity creates a major threat from inflation and creates dislocation within the economy. The MMT advocates point to the very low rates of inflation and the very low costs of borrowing and assert that far larger deficits can be run. The only real question is whether that borrowed money will be used effectively on programs that grow the economy or solve big issues.

Analysis: The latter is a big "if." Past behavior is not encouraging when it comes to the wise use of borrowed money. The U.S. has already racked up an enormous deficit with both the reduction of taxes and additional spending and has little to show for the investment. There is still a trillion dollar need for infrastructure repair and development and gaping holes in terms of research and development. It can be argued that little has been done to address social issues such as mental illness and virtually nothing has been invested in training and developing the future workforce. Much of the deficit has been created by giving generous tax cuts to a select few, investing 62 cents of every tax dollar in the military and spending on a wide variety of vanity projects.

One other issue that is passed over by the MMT advocates is the costs of debt service. This has become the fourth- or fifth-largest segment of the Federal budget (behind Social Security, Medicare, Medicaid and the military). That means that around $300 billion comes off the top of the federal budget every year—money that can't be spent on anything else

Democracy in Peril?

Times seem to have changed. I am not sure whether this has been for the better. Perhaps this is what happens when there is a rainy, cold weekend and my desires to get out in the yard and enjoy spring are thwarted once again.

Are we the democracy we once were? I worry about the fragility of this system. It seems to me that democracy requires a level of compromise and cooperation. We will not always get precisely what we want or think we want. We have to be willing to lose and try again. We have to see the other side of people's issues whose viewpoints are different than ours. We have to find those things that unite as well as acknowledge those things that divide. I have passionate opinions on lots of things and am convinced that my beliefs are correct and noble and right. I often see decisions made that make me grind my teeth in frustration and I don't shy away from expressing my opinions. However, I will always strive to stop far short of disliking those with whom I disagree. There must be something we can agree on.

This is the only way we avoid deteriorating into some kind of dictatorial crisis with one side trying to crush and eliminate the other. In past years, I have found common ground with my ardent critics through mutual admiration of cats, Dr. Who and the Green Bay Packers. When the tensions start to reach that fever pitch, we retreat into funny cat videos, a discussion of whether Daleks or Weeping Angels are scarier or whether Clay Matthews should have been kept. We cool down so we can disagree again—with some modicum of civility and respect.

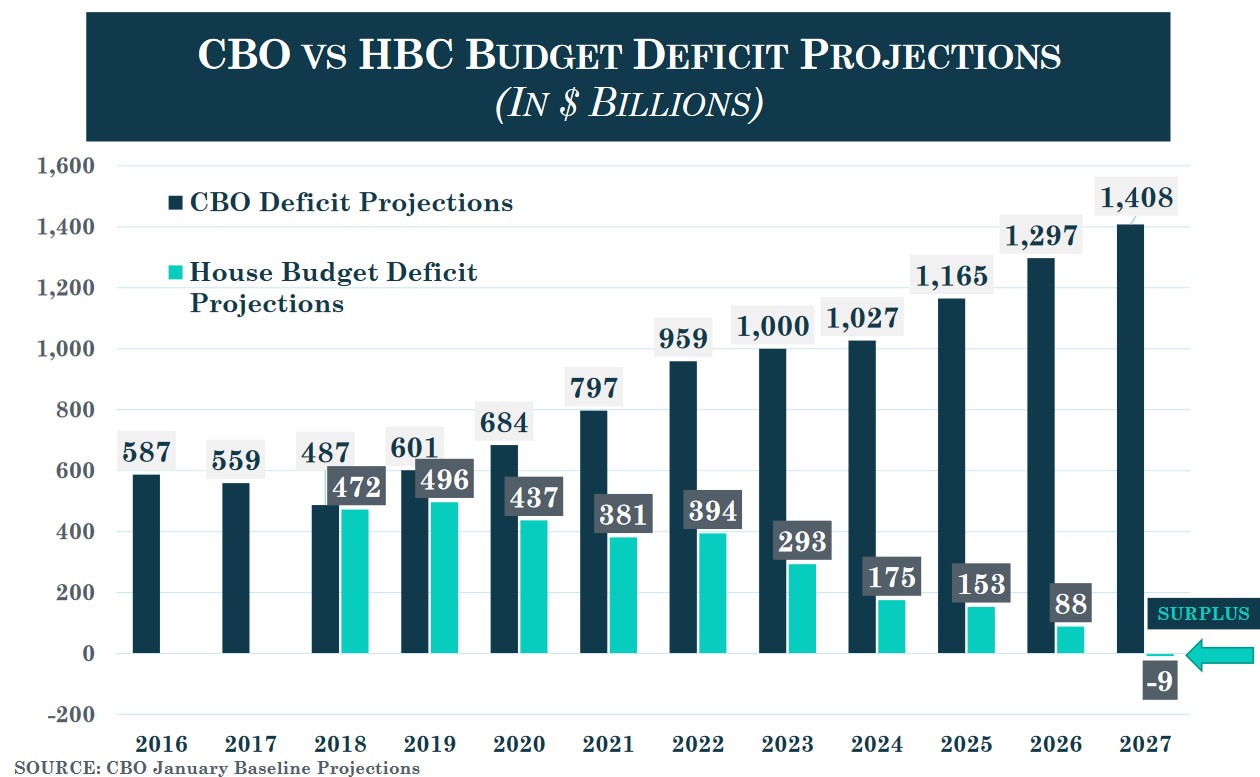

Budget Deficit Projections

There is not a lot of unity when it comes to predicting the size of a deficit as it all comes down to the assumptions made. One version is from the White House and the other from the Congressional Budget Office (CBO). The White House version assumes far faster rates of annual growth as compared to the CBO (between 3.5% and 4.5% as compared to rates between 1.7% and 2.5%). The White House assumes far higher revenues from taxation due to that growth and the CBO asserts that growth is unlikely and points to the tax cuts as reasons for the ballooning deficit.