Global Strategic Intelligence Brief for May 3, 2019

Short Items of Interest—U.S. Economy

Better than Expected

The latest jobs report was certainly healthy—a little better than even the optimists had thought likely. The estimate had been that 196,000 jobs would be created, but the final tally was 263,000. The rate of unemployment also fell to yet another half century low of 3.6%. The details will be poured over in the coming days but a few factors stand out already. The first is that many of these jobs have once again been in the service sector and that generally means they are lower paid and more likely to be lost when there is a slowdown. The lower rate of joblessness is due to the number of people coming back into the workforce as jobs are easier to get. There are far fewer people staying in school or staying home to care for kids or relatives.

ISM Service Index Down

There may be more hiring taking place in the service sector but that has not meant that service activity in general has been robust. The latest ISM reading for services was down to 5.5, and the expectation had been that there would be a reading of 57. The majority of that decline seems to have been in retail and construction. The retail slide is of greater concern as that had been boosting Q1 GDP growth, and construction was slowed by weather and should bounce back in the months to come. This is the second ISM reading to come in lower than expected as the manufacturing index was also weaker due to issue of export decline and general trade issues.

Fed Stands Pat

The calls from President Trump (and now Vice President Pence) continue as they assert that interest rates need to be slashed by at least a point. The Fed is ignoring this "advice" and with ample reason. Growth is over 3%, and now the unemployment rate is as low as it has been in five decades. How much faster can the economy grow when it is already at this pace? The only real concern now is triggering inflation in everything from wages to commodities. The fact that Senate pressure has forced Trump's two designates to the Fed to withdraw suggests that there is no stomach for creating a politicized central bank that engages in truly reckless behavior.

Short Items of Interest—Global Economy

European Army Debate Splits European Candidates

One of the key issues between the candidates to become the next President of the European Commission is whether there should be an independent European military and one that could engage in both defensive and offensive action. Germany is a strong supporter of the idea but the Socialist governments in the region have been opposed. Germany asserts that the U.S. has walked away from Europe and can no longer be relied on. They argue that the U.S. under President Trump will likely pull out of NATO and that means that Europe needs to take care of itself. The opposition doesn't want to spend that kind of money.

Iranian Women Blame the U.S.

As discussed later in this issue, there has been a concentrated effort by the U.S. to break the economy of Iran in hopes that this triggers a revolt that overthrows the regime. One group that has been counted upon to lead that revolt are women as it is perceived that they are taking the brunt of the economic challenge and that they are generally oppressed. Thus far, the polls suggest that women are far more supportive of the current regime than men and the majority blame the U.S. squarely for their economic hardship. It remains a question as to how much these polls can be relied upon.

Academic Scandal: Chinese Style

While the U.S. has been preoccupied with stars like Lori Loughlin and various members of the elite there was engagement from overseas as well. A Chinese family sent $6.3 million to Stanford university to ensure that their progeny attended there. They claim that the money was simply a donation but it seems that "gift" had some very clear strings attached.

The End Game in Iran

For much of the Trump Presidency the conduct of foreign policy has been haphazard and reactive. There have been some themes as far as trade has been concerned with a basic assumption that the trade system has been stacked against the U.S. for years and that steps have to be taken now to "level the playing field." There certainly have been relationships that have not favored the U.S. economically but the assertion is that these deals were made for political reasons more than to boost trade. It has also been asserted that more trade deals have favored the U.S. than haven't. Other than trade, it has been hard to determine a theme—longtime allies have been spurned at the same time that overtures have been made to arch enemies such as North Korea and Russia. Trump inherited the usual quagmires in Afghanistan, Iraq, Syria and elsewhere in the Middle East and has seen new issue arise in places like Libya and Iran. Most of the foreign policy activity has been described as transactional as opposed to thematic. One exception to this general rule seems to be Iran and that is likely to have far-reaching implications for the U.S. and global economy.

Analysis: The conduct of policy toward Iran is orchestrated by National Security Advisor John Bolton. His approach has not wavered in over three decades, going all the way back to his time in the Bush administration as the U.S. Ambassador to the UN. He has always seen Iran as the single greatest threat the U.S. faces in the Middle East and arguably the world. He points out four areas where Iranian policy clashes directly with U.S. aims and commitments. The first is that Iran is an implacable enemy of Israel and seeks to destroy the Jewish state one way or the other. It is Bolton's view that development of nuclear weapons by Iran is for the sole purpose of launching a devastating strike against Israel. The second issue is the Iranian support of terrorist groups such as Hezbollah, Hamas and others. Granted the Iranians do not back Sunni-connected terror group such as ISIS but they have been very supportive of Shiite organizations that threaten regional stability. The third area of concern is the conflict between Iran and Saudi Arabia. The U.S. considers Saudi Arabia an awkward but important ally and the enmity between the Iranians and the Saudis continues to be intense—rooted in everything from religious differences to simple power politics in the region. The fourth area is Iran's role in the oil world. It remains one of the largest oil producers or at least it could be if there was a reduction of pressure from sanctions. Iran has the ability to push oil prices up or down depending on their production decisions. This power is not as pronounced as it was when the U.S. was a major oil importer and not the world's biggest oil exporter.

The strategy that has been developed by Bolton and others in the current foreign policy infrastructure is rooted in regime change through the collapse of the Iranian economy. It is asserted that the U.S. can bring Iran to the brink of total economic collapse with the further tightening of sanctions and policies that further isolate the country from the global financial community. Analysts assert that such a strategy is imminently doable although it will not be easy as the U.S. will get overt opposition from Russia, China and even from Europe. They will do what they can to maneuver around the sanctions and in the case of both Russia and China these maneuvers will be overt. The assumption is that a collapsed economy will provoke the population in Iran to revolt and throw their existing leadership out so that the nation can find its way back into the global economy. All that would be required by the U.S. of a new Iranian leadership would be acceptance of Israel, abandoning support of Shiite insurgent groups, a peaceful relationship with Saudi Arabia and an oil policy that favors the U.S., and the end of nuclear weapons development. It is assumed that the population will seek to overthrow the current regime in order to replace them with pro-American leaders willing to do what the U.S. demands.

Very few analysts assert that this would be the outcome of a revolt. The most likely scenario is that a government under pressure becomes more disruptive and aggressive than ever. That might mean an overt attack on Israel or Saudi Arabia in an attempt to drag the U.S. into another ground war. Iran calculates that there is very little support for this in the U.S. and that the U.S. will offer relatively little support for either Israel or Saudi Arabia. It is also assumed that Iran will turn to its terrorist connections and order them to launch attacks in Europe and the U.S. The upshot is a very bloody confrontation unlikely to end with a group of pro-U.S. leaders in place.

Good News Expected in Jobs Report

The jobs report that comes out today is expected to show a gain of around 200,000 jobs. If that is the case the expected trends will have been established after the drastic reduction in job gains last February. As usual, there will be some important points to consider—perhaps the most important is the rate of working age adults in the workforce. That number slumped a little last month, and overall that reading has been lower than it has been in years. These are people between the ages of 25 and 54. Their rate of employment has improved dramatically since the recession but there are more drop outs than has been the case before.

Analysis: The major reason for the decline in workforce participation has been the retirement of the Boomer generation; they are still reaching retirement age at a rate of 10,000 a day. This factor is not playing a role with that prime working age population. The issue here would be people that are opting out of the workforce for other reasons. The fastest growing of these rationales are people who have had to leave the workforce to take care of elderly and sick relatives. Even more distressing is the fact that taking care of the opioid addicted has become the dominant rationale. There are also still many who are delaying entry into the workforce due to school and there are the people who have decided to stay home to take care of their children. The last two factors are seen as temporary while the care of the elderly could stretch into many years.

Implications of an Aging Population

The world of aging is changing and far faster than many had expected. The shrinking and aging of populations may be emerging as the biggest challenge to economic growth in the next 10 to 30 years. It means that workplaces will feature four generations interacting at the same time with vastly different experiences and expectations (Boomers, Gen X, Millennials and Gen Z). The expectations regarding the lifespan of work have changed and that affects the assumptions made regarding retirement. Setting the age of retirement at 65 was a construct of the 1930s when it was assumed that most people would live perhaps five or six years past that retirement point. If one used the demographic guides used then to establish retirement now the age of retirement would be 83 rather than 65. In the developed world there is a massive cohort that will be available for work 20 and 30 years past the traditional retirement age. Accommodating this group has significant implications. If they do indeed retire, they will need to be able to support themselves for that two-or-more-decade period. If they stay in the workforce, they will be blocking the advancement of the following generations.

Analysis: There is a new category of elderly referred to as the Young-Old. These are people between the ages of 60 and 80. They no longer fit the traditional definition of elderly in terms of health, employment, ambition or lifestyle. They are best seen as being in extended middle age. They are likely to be in as good health as they were in their 40s and 50s. Almost a third remain employed full time and in the same professions they were in earlier. Fully two-thirds are employed at least part time. The expectation has been that this group would end up spending far less than when they were younger but that has not been the case. The Boomer attitude has been more along the lines of, "I'm spending my children's inheritance."

The economic implications are interesting. There will be many states that will be struggling with that aging population. China may have the most pressure as they are still trying to grow their economy out of underdevelopment at the same time they deal with an aging population. There is a labor shortage already and the country is not prepared for a population that is nearly 40% over the age of 60. Japan is in the midst of a demographic crisis already and Europe is not far behind. The U.S. once avoided this problem with increased immigration but that may not be the solution it once was due to the current climate of immigrant hostility. On the other hand, the U.S. has often been hostile to newcomers until it is determined they are needed to grow the economy.

Graft Allegations Split Italian Coalition

Part of the appeal of the two populist parties that emerged as the biggest vote getters in the last election was that they were both anti-corruption and had plans to clean up the mess that had ravaged the Italian political system for generations. Now one of the leading members of the League has been accused of graft for taking bribes in connection with his position as Minister for Transport. Armando Siri has denied the allegations but the evidence has continued to build. Now the leaders of the Five Star Movement are demanding that he step down as they had built their reputation on clean government.

Analysis: From the start there was tension between these two coalition partners—they are not the most well matched of groups. The League is the inheritor of the policies and traditions of the Northern League. Its priorities have been halting immigration and opposing the money and support that southern Italy has received over the years. To many in Italy they appear to be the embodiment of northern Italian attitude and bigotry. The Five Star Movement was founded as a protest party that focused on issues of corruption and general mismanagement. They have struggled to actually govern and their leader – Giuseppe Conte—is a former academic that has not been all that comfortable as a practical leader.

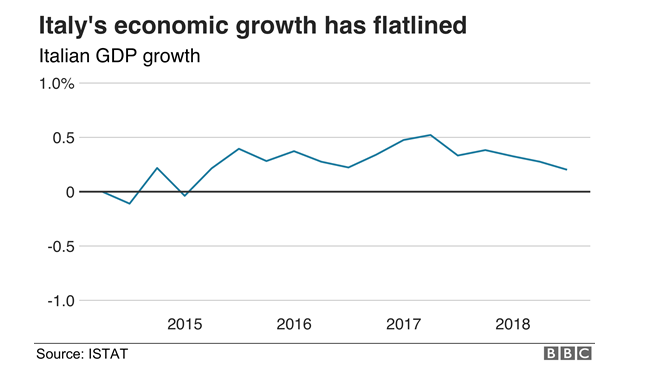

Italy's economy continues to stagnate—higher levels of unemployment, marked rise in inflation and the public has all but lost faith in the ability of the coalition to do much. The problem is that voters do not trust the other parties either. The challenge for the Italian economy is that it needs structural reform and nobody is in a position to offer it. The pension system is a major burden and so are ossified work rules that make it hard for business to adapt and make it hard for new entrants to get into the workforce. Italy's productivity is at the bottom in Europe and that has affected the business community's competitiveness. The government now is more preoccupied with trying to hold itself together than on addressing any of these issues. The immigration crisis just adds another layer of complexity.

Being Part of that Young Old Designation

The more I learn about this concept of the "young-old" the better I like it. I have reached that traditional age of retirement but that is really the furthest thing from my mind. To start with, my business partner is 12 years younger than me, and he has indicated that I am not allowed to consider this option until he turns 65 (so the soonest that I could contemplate my leisure would be when I am 77. My wife "retired" a few years ago but is clearly busier now than she ever was. Frankly, I have no other interests other than what I do so I have no reason to quit.

A number of years ago I was participating in a seminar where the leader asked everyone to sum up their life in five words. At first, I found this exercise to be silly and listened as people struggled with coming up with comments other than "Family, Health, Wealth, Happiness" and so on. Suddenly it occurred to me that really could do this – my response was "Learn Stuff and Tell People". That is really all that I have ever wanted to do—as a professor and now as a public speaker and consultant. I will always need fresh ears that have not heard my jokes before so I will be doing this for a while.