Week in Review

Week in Review

What We're Reading:

October 12, 2020

Turkey’s currency drops to record low on Russian missile defense tensions with US. In addition to the pandemic, Turkey is facing double-digit inflation and mounting unemployment, and a ballooning current-account deficit. (CNBC)

EU governments, parliament edge closer to deal on recovery plan. The European Union edged closer to a deal over the bloc’s budget and recovery package of 1.8 trillion euros after national governments offered concessions, but key differences remained. (HSN)

US hits Iran's financial sector with fresh round of sanctions. The United States on Thursday slapped fresh sanctions on Iran’s financial sector, targeting 18 Iranian banks in an effort to further shut Iran out of the global banking system as Washington ramps up pressure on Tehran weeks ahead of the US election. (Reuters)

Israel's second lockdown carries a hefty economic price. Israel’s decision last month to impose a second nationwide lockdown after a resurgence in coronavirus infections has dealt a hammer blow to the economy and the livelihoods of small business owners. (Reuters)

How banks and insurers in Saudi Arabia are faring during Covid. While Covid-19 has understandably had a significant impact on Saudi Arabia’s financial services industry, the banking and insurance sectors have proven resilient this year. This is according to new analysis by KPMG. (Consultancy-me)

Iran’s declining regional influence. Tehran capitalised on US mistakes in the Middle East, but its proxy wars and consistently aggressive façade have a cost.(Interpreter)

Indian textile companies to benefit from US-China trade war. The simmering trade war between the US and China is expected to throw open fresh opportunity for the Indian textile industry. The US recently issued a Withhold Release Order on cotton and apparel imports from specific producers in the Xinjiang Uygur Autonomous Region which may escalate global trade tensions. (HSN)

Haiti's currency is suddenly strong against the dollar. For many, that's disastrous. A sudden and spectacular appreciation in Haiti's national currency, the gourde, is creating havoc across the country as economists try to figure out what's fueling it and skeptical Haitian consumers wonder how long it will last. (Miami Herald)

Russia’s Strategy in Africa. Rumors of Russian involvement in Mali have gained momentum since 2018. Even if this link has yet to be proven, the growing connection between Russia and sub-Saharan countries is threatening the balance of power in the region. (Global Risk Insights)

Global trade policy at a lull, but for how long? With economies and trade meetings cut down by Covid 19, and political uncertainty in the air, we’re at a standstill. (Interpreter)

What you need to know about the “Quad,” in charts. This week in Tokyo, Australian Foreign Minister Marise Payne, Indian External Affairs Minister S. Jaishankar, Japanese Foreign Minister Toshimitsu Motegi, and US Secretary of State Michael Pompeo will meet for the second ministerial of the “Quadrilateral,” or “the Quad.” (Brookings)

Exporting to Canada: What You Need to Know. This week, we look at the history of US trade with Canada; how NAFTA and now the USMCA has altered trade with Canada; the process of exporting to Canada, including documentation and compliance requirements; and the benefits and considerations for US companies looking to break into the Canadian market. (Shipping Solutions)

Who pays for the toilet paper? The big questions of the work-from-home era. As the world convulses in crisis, and tens of millions of us dig in for the long haul of working from home, one question looms large: who pays for the tea and toilet paper? (HSN)

Central Banks Laying It on the Line

Chris Kuehl, Ph.D.

Statements made by various central bankers around the world are surprising in a couple of ways. It is somewhat unusual to see so much unity among them. Their attitudes toward inflation and economic growth are generally more varied. The mission of a central bank is always national. The overall performance of the global economy is secondary. What is good for their own economy is paramount.

The bankers are unified when it comes to their position on inflation and interest rates, but that is not the only thing they are agreeing on these days. Many harsh words are being directed at the fiscal powers in their country, and these remarks are getting sharper. Recently, Fed Chair Jerome Powell essentially blamed Congress and the US president for stifling economic recovery. His assertion is that failure to continue supporting the economy will invite “tragedy.” This is a sentiment that has been echoed by Cristine Lagarde of the European Central Bank, Andrew Bailey of the Bank of England and others.

The response to a recession is nearly always the same. The government does all it can to stimulate production and consumption so that the economy has a chance to recover and start to grow again. The basic strategy is simple enough: Get money into the hands of the consumer as quickly as possible and count on the producers to keep pace with that demand. This will mean that fewer people will be laid off and fewer businesses will be forced out. The two means by which to stimulate this activity are spending and lowering taxes. The idea is to get money into people’s hands one way or the other.

As the pandemic-inspired lockdown was implemented, the number of people thrown out of work was staggering. Some 40 to 50 million workers lost their jobs in the United States alone. The rate of unemployment was at 3.7% in September of 2019 (U-rate was 6.9%). As the lockdown recession occurred, the rate increased to 13.6% at the U-3 level, total unemployed, as a percent of the civilian labor force; this is the definition used for the official unemployment rate. It was at 21.6% at the U-6 level, total unemployed, plus all marginally attached workers, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all marginally attached workers.

Today, these numbers have fallen a bit but remain far higher than they were a year ago. The U-3 rate is now at 7.9% and U-6 stands at 12.8%. This is the crux of the problem. These unemployed people are consumers that are not consuming, and that hampers the ability of the economy to rebound. To get a recovery, this group of people need money to spend, and that is the rationale for government engagement.

The direct allocation of funds to people is by far the quickest way to boost economic growth. Reducing taxes is a far slower process and doesn’t do much good for people who don’t have jobs in the first place. The assistance that was provided at the start of the recession was generous enough and was instrumental in blunting the impact of the lockdown. However, it was not intended or designed to last very long. The assumption was that control over the virus would occur in April, and by May the economy would be getting back to normal. Quite obviously this assumption proved not to be accurate. The aid expired at the end of July, and the economy started to falter almost immediately. The conclusion reached by Jerome Powell and the majority of the Fed members was that financial help was still needed, and this assistance needed to be substantial and sustained.

Their recommendations have been falling on deaf ears as far as the majority of Congress has been concerned. Quite frankly, the politics of the moment have superseded economic strategy, and there has been no effort whatsoever to craft a compromise that would allow additional support. The GOP has objected to benefits deemed too generous as there has been reluctance on the part of some recipients to take jobs that are offered. There are ongoing concerns regarding the size of the debt and deficit as well. The Democrats have favored an extension of the original plan and care far less about the impact on the debt or the fact that generous support can push people away from seeking a new job.

The point that Powell and others have made is that there is room to compromise. It is entirely feasible to craft a plan that provides a level of assistance that is not a disincentive to work. As for the debt issue, Powell points out there was ample time and opportunity to contend with that growing debt when the economy was doing well but there was no willingness on the part of Congress to either reduce spending or add revenue. The time to get control of the debt was then not when the country is staring at high rates of unemployment, thousands of shuttered businesses and a GDP collapse of over 30%.

-

APRIL

24

11am ET -

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

-

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute -

APRIL

29

3pm ET

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

Insolvencies Forecast to Jump in 2020

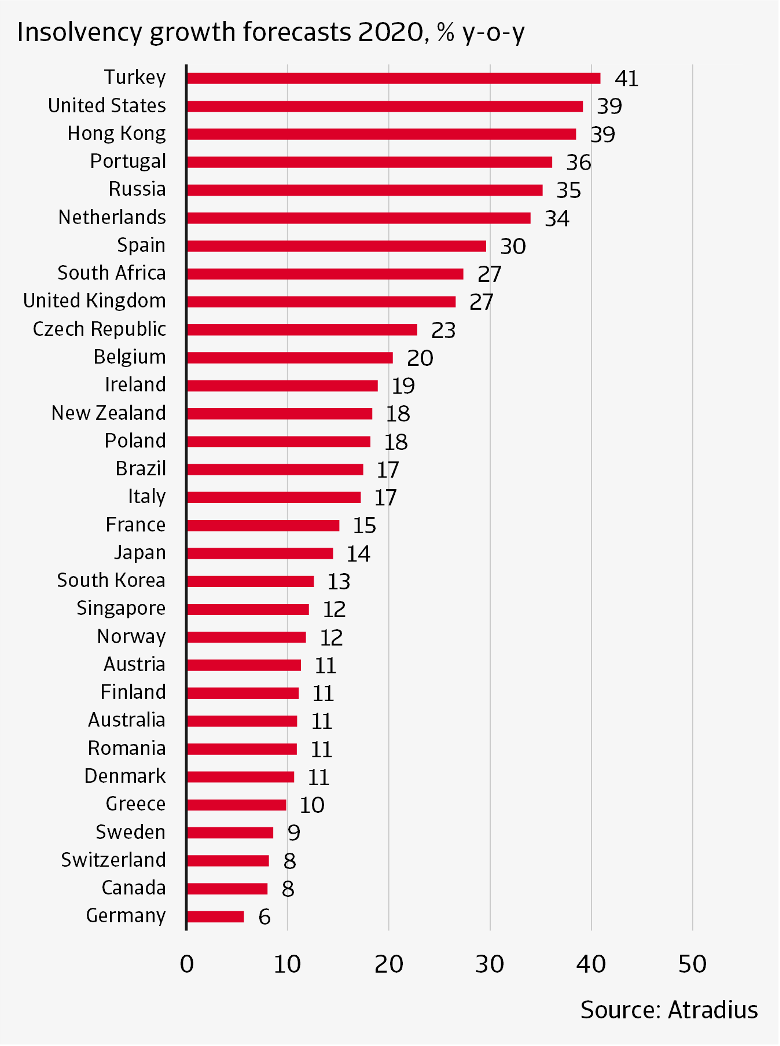

A 26% increase in global corporate insolvencies is on the horizon, largely in the second half of 2020, according to trade credit insurer, Atradius.

The increase is mainly driven by the impact the Covid-19 pandemic is having on global economies. Every major economy, except for China, is expected to enter recession this year. The depth and length of which will be determined by the ability of economies to manage health regulations and either exit lockdowns or thrive in social distancing.

Atradius pointed out the ways governmental measures have reduced the anticipated increase in insolvencies:

- Threshold shifts for filing

- Reduction in debtor’s ability to force bankruptcy

- Financial support to delay filings

However, as the support programs expire, the number of filings should climb rapidly, Atradius noted.

Southern Europe economies are experiencing a bigger coronavirus impact than Northern Europe. Southern European economies such as Spain, Italy, France, Portugal and Greece typically rely more heavily on tourism. Germany, Denmark, Austria and the Netherlands are less dependent on tourism and have fared better in containing new infections, with their economies seeming to adapt better to social distancing restrictions. In Germany, the forecast of a particularly small rise in insolvencies reflects the low correlation between GDP and insolvencies as well as (along with Switzerland) less stringent lockdown measures. The U.K. is expected to experience the largest GDP contraction in Europe following a more stringent lockdown and Brexit uncertainty.

The US, Japan and Australia have more positive GDP outlooks than most European countries. However, the US, along with Hong Kong and Turkey, is expected to experience one of the largest insolvency increases. Japan’s early lifting of restrictions put pressure on economic growth which may raise insolvency risks. And while Australia has been a model example for containment, its tourism industry may experience a latent impact causing a bigger increase in 2021 insolvencies.

FCIB has a number of upcoming webinars on country-specific insolvency laws. The next one is on Insolvency Law in Italy. To learn about others, check out the Event Calendar or the on-demand library.

Pandemic Spurs Historic Technology Surge

The COVID-19 pandemic has spurred one of the biggest surges in technology investment. Companies spent the equivalent of about $15 billion extra a week on technology to enable safe and secure home working environments during COVID-19, according to the 2020 Harvey Nash/KPMG CIO Survey.

IT leaders worldwide have spent more than their annual budget rise in just three months, as the global crisis hit, and lockdowns began to be enforced, the survey finds.

Challenges, however, accompany the spending surge, which placed security and privacy as the top investment. Four out of 10 IT leaders reported that their companies experienced more cyberattacks. More than three-quarters of the attacks were from phishing and nearly two-thirds were from malware, which suggests that the massive move to home working has increased exposure for employees, the survey finds. And for the first time in more than a decade, a security-related skill has topped the list of global technology skills shortages.

In sync with the unexpected and unplanned surge in technology investments, organizations have undergone massive changes in how they operate, finds the Harvey Nash Group, noting that more organization changes have occurred in the past six months than noted in the last 10 years. The firm believes that organizational culture and engagement with others will be key for success in the future.

The 2020 Harvey Nash/KPMG CIO Survey of more than 4,200 CIOs and technology leaders took place in two pulses: one prior to COVID-19 (commencing on 17th December 2019) and one during the pandemic (5th June – 10 August 2020), across 83 countries.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations