Week in Review

Week in Review

What We're Reading:

September 7, 2020

No-trade deal Brexit fears rise as talks stumble on state aid. The chances of Britain leaving the European Union without a trade deal have risen sharply as negotiations have been threatened by London’s insistence that it have full autonomy over its state aid plans, negotiators and diplomats said. (Reuters)

Australia's economy takes sharpest dive since the 1930s. The latest national accounts showed the economy shrank 7% in the June, the biggest contraction since records began in 1959. (Economic Times)

Debt-laden Angola gets relief from creditor nations of the Paris Club under G20 plan. The southern African nation is also seeking debt service suspension from its single largest lender, China. (SCMP)

France unleashes 100-billion-euro stimulus to revive economy. France plans to spend 100 billion euros ($118 billion) to pull its economy out of a deep coronavirus-induced slump, signaling renewed efforts by President Emmanuel Macron to push through a pro-business reform agenda. (HSN)

South Sudan’s forex shortage highlights broader economic crisis. The South Sudan central bank announced last month that the country had nearly run out of foreign cash reserves. (Mail & Guardian)

Israel sees $6.5 billion in trade as UAE peace talks kick off. Talks to normalize relations between Israel and the United Arab Emirates launch last week with a focus on economic issues, with thornier defense matters pushed off as controversy churns around the Gulf Nation’s bid to buy the U.S.’s top warplane. (Business Mirror)

Captainless WTO in troubled water with no land in sight. As Roberto Azevedo left the World Trade Organization last month, the institution faces multiple crises without a captain—a situation experts warn could drag on for months. (EurActiv)

Release of World Bank 'Doing Business' report halted over fudging of data. A statement said that the World Bank will act based on the findings of the probe and retrospectively correct the data of countries that were most affected by the irregularities. India was among the countries which witnessed the "most notable improvement" as per the 'Doing Business' 2020 report released in October 2019. (Economic Times)

Australia faces down China in high-stakes strategy. The government of Scott Morrison has reached a stark new view of China: It's not just a top trading partner, but also a threat to the nation's sovereignty. The dramatic shift shows how countries are struggling to cope with China's growing might.(Reuters)

Why one of the world's richest petro-states is running out of cash. Kuwait's budget deficit is expected to reach the equivalent of almost $46 billion this year. (Arabian Business)

‘Abenomics’ fell short—Japan’s new prime minister will have to pick up the slack. Outgoing Japanese Prime Minister Shinzo Abe is stepping down with much unfinished business in reviving the world’s third-largest economy—leaving his successor to pick up the slack. (HSN)

How’s the coronavirus economy? Great or awful, depending on whom you ask. The coronavirus recession has been financially devastating for many. It has been a boon for others. (HSN)

What’s going on with the US Postal Service? In recent months, many Americans have expressed fear about the U.S. Postal Service. Reports of crippling backlogs of mail, medicine deliveries gone missing or long delayed, and viral social media posts showing USPS’s iconic blue boxes being carted off have all contributed to the uncertainty. (Lawfare)

Creating a ‘Zombie’ Economy

in Europe and the World

Chris Kuehl, Ph.D.

The Germans are in the midst of an intense debate over the state of support for businesses during the crisis— a debate that is going to be visited in every other nation in the months to come. The assertion is that all the attention to state support for ailing companies will create what has been referred to as “zombie companies.”

These are companies that are surviving solely due to the state support they are receiving. They have no realistic exit strategy as far as this aid and will continue to rely on that largesse for years. The drain on the state budget never ends, and the distortion of the market extends well into the future.

This has always been a concern when there is a recession, but this time, the situation is different and far more vexing. In a “normal” recession, some support is offered for a while, but there is faith in “creative destruction.” It is assumed that weaker companies will fall by the wayside and stronger companies will expand by absorbing that market share. The circumstances of this recession have been very different.

The argument for propping up business is compelling, especially this time. The governments of the world essentially visited the recession on the business community. This was not a recession brought on by failure in the business community as was the case with the 2008 recession. The hubris of the financial community brought the system down in 2008. This recession has been due to the hubris of global governments due to the assertion that a massive lockdown of the economy would defeat the pandemic.

Given that it was government edict that plunged the world economy into crisis, it would follow that governments would need to do whatever they could to ameliorate the damage. That has been the logic behind every effort to stimulate and thus far, there have been mixed results. The primary challenge is the lockdown itself has interfered with the recovery effort. It is equivalent to having one’s foot on the brake and the accelerator at the same time. Money is funneled to the consumer and business community, but their ability to spend it is restricted.

How does a system avoid creating “zombie” companies? In a “natural” recession, it is a matter of allowing the market to make the call: Does the consumer support the business or not? There is always some kind of transition taking place. Throughout the world, there has been a shift from traditional retail to the online option and that is driving malls, department stores and Big Box stores to the brink.

This process may have been accelerated by the pandemic response, but it was happening before the lockdown. This is “natural” attrition and it makes little sense to prop these companies up. On the other hand, there is the hospitality industry. Hotels are in dire straits with occupancies at less than 20%. They require immediate help. When the crisis is past, they can be expected to recover quickly along with air travel and event-based activity. Bailing these sectors out makes sense because they were doing fine before the pandemic and will do fine again assuming the viral crisis ends.

It is estimated that one-sixth of the companies in Germany are headed towards zombie status. Cutting them loose from government support will be a very hard decision. It means people losing their jobs on a permanent basis, and it means cutting into the revenue of those companies that worked with the zombies. Take the closure of a mall as an example. There are hundreds of service workers involved, and many are low paid and vulnerable. The suppliers of these stores suffer and so do the manufacturers that suppliers worked with. The construction sector loses business, local governments lose revenue and so on. There is a massive ripple effect. This confronts the governments with a choice between a rock and a hard place. Support the zombie and have a dependent for years, fail to support the zombie and deal with lost jobs, lost opportunities and lost revenue.

-Date & Time Title Speakers

SEP 15 9am ET

Credit & Risk Management Today: Policies and Procedures

FCIB’s Autumn Online Virtual Workshop |

Countries Face Significant

Fiscal Challenges Ahead

Governments have taken unprecedented fiscal action in response to the COVID-19 crisis, but countries will need to support economic recovery in the face of significantly increasing fiscal challenges, according a new OECD report.

Tax Policy Reforms 2020 describes the latest tax reforms across OECD countries, as well as in Argentina, China, Indonesia and South Africa. The report identifies major tax policy trends adopted before the COVID-19 crisis and takes stock of the tax and broader fiscal measures introduced by countries in response to the pandemic, from its outbreak to June 2020.

It notes that while the size of fiscal packages in response to the COVID-19 crisis has varied across countries, most have been significant, and many countries have taken unprecedented action. It also points out that most countries have adopted a phased approach to COVID-19, gradually adapting their fiscal packages as the crisis has unfolded.

Initial government responses focused on providing income support to households and liquidity to businesses to help them stay afloat. As the crisis has continued, many countries expanded their initial response packages. The most recent measures and discussions suggest that the recovery phase will be supported by expansionary fiscal policy in a number of countries.

With countries facing such high levels of uncertainty, policy agility will be key and targeted support measures should be maintained as long as needed to avoid scarring effects, according to the report. Once recovery is well underway, governments should shift from crisis management to more structural tax reforms, but they must be careful not to act prematurely as this could jeopardize recovery.

“Right now, the focus should be on the economic recovery,” said Pascal Saint-Amans, director of the OECD Centre for Tax Policy and Administration. “Once the recovery is firmly in place, rather than simply returning to business as usual, governments should seize the opportunity to build a greener, more inclusive and more resilient economy. One path that should be urgently prioritized is environmental tax reform and tax policies to tackle inequalities.”

Rising pressure on public finances as well as increased demands for fairer burden-sharing should also provide new impetus to reach an agreement on digital taxation. “Tax co-operation will be even more important to prevent tax disputes from turning into trade wars, which would harm recovery at a time when the global economy can least afford it,” Saint-Amans said.

The report also provides an overview of the reforms introduced before the COVID-19 crisis. It highlights continuation of a number of trends identified in previous years, including personal income tax reductions for low and middle-income households and the stabilization of standard value-added tax (VAT) rates observed across many countries. Corporate tax rates have continued to decline, but at a faster pace than in 2019.

Areas where clear progress has been made include reforms to ensure the effective collection of VAT on online sales of goods, services and intangibles, and the adoption of measures in line with the OECD/G20 Base Erosion and Profit Shifting Project to protect corporate tax bases against international tax avoidance, it says. On the other hand, progress on environmentally related taxes has been slow, with reforms being concentrated in a small number of countries and limited in scope.

The report also notes that there has been a marked change in property taxation compared to previous years, with an increase in the number of reforms in that area, generally aimed at raising taxes.

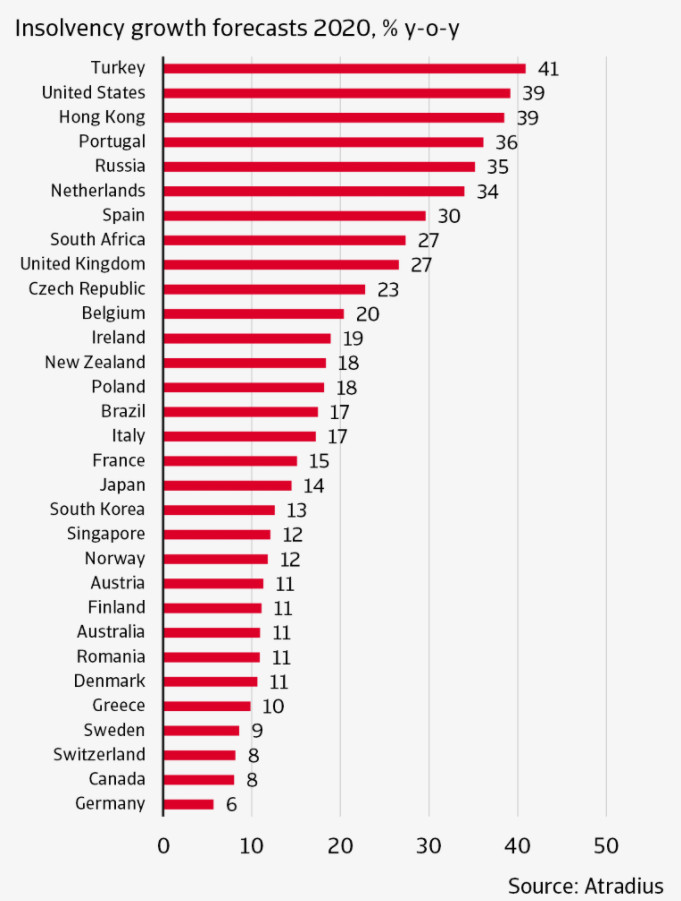

2020 Insolvencies Forecast to Jump

Atradius anticipates a 26% increase in global corporate insolvencies, largely in the second half of 2020. The increase is mainly driven by the impact the COVID-19 pandemic is having on global economies.

Every major economy, except for China, is expected to enter a recession this year, the trade credit insurer said. The depth and length of which will be determined by the ability of economies to manage health regulations and either exit lockdowns or thrive in social distancing.

“Government measures have reduced the anticipated increase in bankruptcy filings in a range of ways,” said Atradius Chief Economist John Lorié. “They have either shifted the threshold for filing, reduced debtor’s ability to force bankruptcy, or provided sufficient financial support to delay filings. However, as the support programs begin to expire, the number of filings should climb rapidly.”

Southern European economies are experiencing a bigger coronavirus impact than Northern Europe, the firm noted. Southern European economies such as Spain, Italy, France, Portugal and Greece typically rely more heavily on tourism. Germany, Denmark, Austria and the Netherlands are less dependent on tourism and have fared better in containing new infections, with their economies seeming to adapt better to social distancing restrictions.

In Germany, the forecast of a particularly small rise in insolvencies reflects the low correlation between GDP and insolvencies as well as (along with Switzerland) less stringent lockdown measures. The U.K. is expected to experience the largest GDP contraction in Europe following a more stringent lockdown and Brexit uncertainty.

The U.S., Japan and Australia have more positive GDP outlooks than most European countries. However, the U.S., along with Hong Kong and Turkey, is expected to experience one of the largest insolvency increases. Japan’s early lifting of restrictions put pressure on economic growth which may raise insolvency risks. And while Australia has been a model example for containment, its tourism industry may experience a latent impact causing a bigger increase in 2021 insolvencies.

FCIB is offering a series of webinars on country-specific insolvency laws: Turkey, China, Hong Kong, India, Italy and Germany. For countries previously covered including Australia, France and the U.K., visit the on-demand library. If there is a specific country that you would like covered, email This email address is being protected from spambots. You need JavaScript enabled to view it..

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations