Week in Review

Global Roundup

January 27, 2020

Week in Review

Global Roundup

January 27, 2020

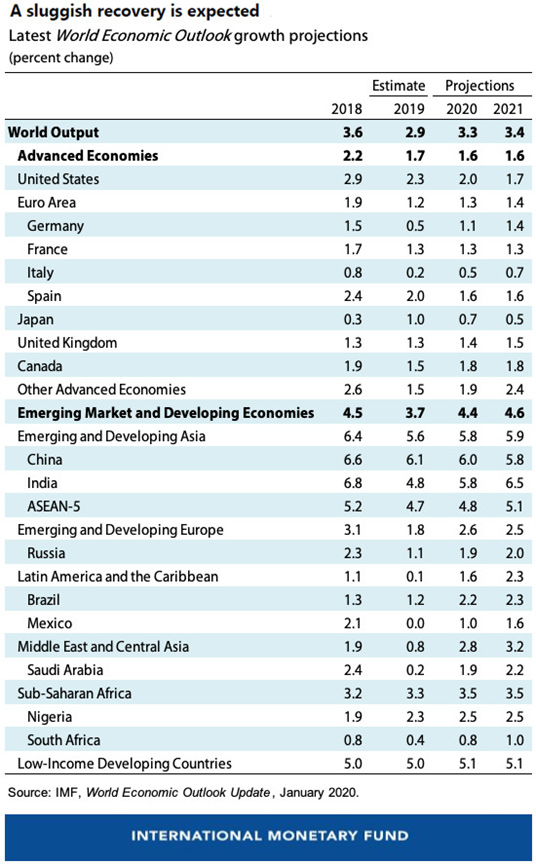

No turning point in sight as IMF predicts sluggish global growth. Global growth appears to have bottomed out, but there is no rebound in sight and risks ranging from trade tensions to climate shocks makes the outlook uncertain, according to a top International Monetary Fund official. (New York Times)

Leaders at Davos face $12 trillion imminent economic disruption. Questions continue to be asked whether this disruption is happening swiftly enough, given the rise in global risks particularly environmental risks. (HSN)

Coronavirus spreads from China, increasing risks. Originating in the Chinese city of Wuhan, a coronavirus known as 2019-nCoV has spread quickly this month, migrating to multiple countries as international health officials rush to contain its spread and calm fears. (Risk Management Monitor)

China virus outbreak may damage economy and financial markets. News that a new virus that has afflicted hundreds of people in central China can spread between humans has rattled financial markets and raised concern it might wallop the economy just as it might be regaining momentum. (Business Mirror)

Trump at Davos sends warning shot to Europe on trade. President Trump is leaning on the strong U.S. economy to project strength among the global elite as he gears up for a bruising reelection battle and a new round of tense trade negotiations with the European Union. (The Hill)

Iran will pull out of NPT if nuclear issue is referred to U.N., top diplomat says. If Iran’s nuclear file is sent to the United Nations Security Council, then Iran will withdraw from the Non-Proliferation Treaty (NPT), Iran’s Foreign Minister Mohammad Javad Zarif said Monday, according to the official IRNA news agency. (Japan Times)

Trump hails trade deal for U.S. farms, China has other plans. Donald Trump’s trade truce with Beijing included a pledge to buy billions of dollars of U.S. foodstuffs over the next two years, reopening one of the most important export markets for America’s farm belt. (Bloomberg)

Peruvians vote for new Congress as country seeks to turn page on crisis. Peruvians headed to the polls on Sunday to choose a new Congress that will be in place for just over a year, as the copper-rich South American nation seeks to overcome a political crisis that led to the closure of parliament. (Reuters)

Germany’s Merkel in Turkey for talks on Libya, Syria. German Chancellor Angela Merkel and Turkish President Recep Tayyip Erdogan held joint talks in Istanbul today on topics ranging from the conflicts in Syria and Libya to the refugee crisis. (Middle East Monitor)

Political and policy risks weigh on EM sovereign creditworthiness in 2020. Heightened tensions in the Middle East following the killing of Iranian general Qassem Soleimani as well as a wave of protests reflecting public discontent centered on economic issues has underlined the vulnerability of emerging markets (EM) to political risk. (Fitch)

UK to outpace Europe in trade growth this year, US seen as top market for SMEs. UK exports will grow more than trade from any other European country this year, according to research from Euler Hermes. (Global Trade Review)

Expect more hype, little progress on North Korea this year. Donald Trump and Moon Jae-in are eager for a deal, but the current stalemate is likely to continue. (Interpreter)

Incoterms 2020 CIF: Cost, Insurance and Freight. Incoterms 2020 rules outline whether the seller or the buyer is responsible for, and must assume the cost of, specific standard tasks that are part of the international transport of goods. This week the International Trade Blog discusses the Incoterm CIF, also known as Cost, Insurance and Freight. (Shipping Solutions)

Blockchain: Why awareness among finance professionals must increase. While blockchain has been around for more than a decade, research by order-to-cash specialist Onguard shows almost half (48%) of 1,000 finance professionals surveyed as part of the 2019 Fintech Barometer lack awareness of the technology and the benefits it offers. (TMI)

Trade Targets Shift

Chris Kuehl, Ph.D., NACM Economist

If anyone was laboring under the impression that U.S. President Donald Trump had softened his position on global trade after making a deal with the Chinese and presiding over the passage of the USMCA, his speech at the World Economic Forum should disabuse one of that impression. At the moment, it is hard to tell an enemy from an ally when it comes to trade relations.

The Chinese have won a tariff reprieve on the basis of another round of pious promises to buy from the U.S., despite the fact China has broken these same promises multiple times in the last few decades. Thus far, there has been little for the U.S. to show for this “phase one” deal, but it is early days. China may come through later in the year.

Meanwhile, Trump arrived in Davos full of threats and attacks aimed at ostensible allies such as France, Germany, Great Britain and others in Europe. These threats range from additional tariffs on vehicles and parts; tariffs on French wine and other foodstuffs; tariffs on machinery, cultural exports, consumer goods and so on.

The issued prompting this latest round of threats and attacks vary. The car market has been a target for the last couple of years, but the focus on France is more recent and tied to the proposed “digital tax” that France and the U.K. want to impose on the likes of Google and its parent company Alphabet. The French president just announced this tax will be delayed for a year, while there are negotiations over how it might be implemented. Neither the British nor Italians have indicated if they plan to follow suit as yet.

The U.S. wants a comprehensive trade deal but so far, the demands are far more favorable to the U.S. than to the Europeans. There is little enthusiasm for what is now on the table. The U.S. wants the deficit with Europe reduced—the same motivation that has driven the talks with China. The issue this time is that there is far more interaction between U.S. and European businesses. The trade with China is simple in comparison because it generally involves U.S. imports of consumer goods. The trade with Europe is often inter-company trade with many corporations maintaining significant facilities in both the U.S. and Europe. Trade relations go back many decades and separation will likely do as much damage to the U.S. company as to the Europeans.

Then, there are the noneconomic ties. The U.S. relies on China for nothing when it comes to global politics; the relationship is hostile in almost every respect. The U.S. has relied on Europe extensively in every conflict the U.S. has engaged in. This has often been through NATO, but there have been many other engagements involving troops from all over the EU. The relationship between the U.S. and Europe has been severely strained since Trump took office, and it is now doubtful that any European nation would assist the U.S. in any substantial geopolitical strategy.

-

APRIL

24

11am ET -

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

-

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute -

APRIL

29

3pm ET

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

Turkey Payment Survey 2019: Companies Remain

Cautious Regarding Economic Prospects

The deterioration of cash flow has slowed down, and fewer Turkish companies expressed tougher conditions while making payments, according to trade credit insurer Coface. Nowadays, the average payment term offered by Turkish companies to their clients stood at nearly 85 days in the domestic market and at 69 days in export markets compared with 108 days in 2017.

Still, the average payment period remains long on an international scale, according to Coface’s Turkey Payment Survey 2019. It notes that companies are gradually changing their terms of payment to their customers’. In Turkey, only 40% of companies request that payments be made within 60 days to their export clients, the survey finds. This falls even lower at 33% in domestic markets.

The liquidity squeeze of domestic clients and competition on the export markets were the key factors noted for pushing companies to sell on such terms. Credit continues to remain an issue for the Turkish corporate sector despite recent improvement.

Regarding the future payment experience, companies seem to have a more cautious view. Indeed, 46% of surveyed companies expect payment terms to lengthen in the domestic market in 2020, while 45% of companies expect longer terms in export markets. However, these ratios were close for those who expect payment terms to remain flat on the domestic (45%) and export market (44%), Coface said.

In the past two years, payment delays declined for Turkish companies: 41 days in the domestic market and 58 days in export sales. If receivables cannot be collected in the domestic market, 40% of the surveyed companies cover the loss from the own resources, while 28% take banking loans. More than a third of companies (37%) request a down payment from their customers. For Turkish companies, the use of credit insurance is not an automatic process. Only 26% use it against potential nonpayment by their customers.

Despite recent economic recovery, many companies (44%) still expect economic conditions will deteriorate in Turkey in 2020. Paper, pharmaceutical, metals and construction are among the most pessimistic sectors. Tougher conditions to access financing and narrower domestic demand are considered among the factors that would weigh on the payment capacity of the companies. Despite these challenges, willingness to do new investments in 2020 remains high for some sectors such as pharmaceutical and agri-food. On the export side, automotive companies look comparatively more cautious with nearly 20% reporting lower export revenues expectations for 2020, above the survey average of 9%.

Of the credit professionals who participated in FCIB’s International Credit & Collections Survey on Turkey in June 2019, 47% noted terms of 30 days or less, 33% 60-31 days and 20% 61 days or more. The average days beyond terms was 12.5 days, which was a 50% drop from November 2018. Close to a quarter were experiencing an increase in payment delays in June 2019, while none of them experienced a decrease in delays, 64% no change in payment behavior and 14% no payment delays. FCIB members can access the full results of the survey as well as the survey archives in the Knowledge Center.

Of the credit professionals who participated in FCIB’s International Credit & Collections Survey on Turkey in June 2019, 47% noted terms of 30 days or less, 33% 60-31 days and 20% 61 days or more. The average days beyond terms was 12.5 days, which was a 50% drop from November 2018. Close to a quarter were experiencing an increase in payment delays in June 2019, while none of them experienced a decrease in delays, 64% no change in payment behavior and 14% no payment delays. FCIB members can access the full results of the survey as well as the survey archives in the Knowledge Center.

The current International Credit & Collections Survey looks at payment behavior in Argentina, Brazil, Colombia and Peru. The survey closes on Feb. 6. The monthly survey is open to all credit and risk management professionals. Nonmembers who participate in the survey will receive the results via an email. Participation in the survey furthers the collective knowledge of global credit professionals by sharing real-time credit and collection experiences.

Tentative Stabilization, Sluggish Recovery?

Gita Gopinath, IMF Chief Economist

In the October World Economic Outlook, we described the global economy as in a synchronized slowdown, with escalating downside risks that could further derail growth. Since then, some risks have partially receded with the announcement of a U.S.-China Phase I trade deal and lower likelihood of a no-deal Brexit. Monetary policy has continued to support growth and buoyant financial conditions. With these developments, there are now tentative signs that global growth may be stabilizing, though at subdued levels.

In this update to the World Economic Outlook, we project global growth to increase modestly from 2.9% in 2019 to 3.3% in 2020 and 3.4% in 2021. The slight downward revision of 0.1% for 2019 and 2020, and 0.2% for 2021, is owed largely to downward revisions for India. The projected recovery for global growth remains uncertain. It continues to rely on recoveries in stressed and underperforming emerging market economies, as growth in advanced economies stabilizes at close to current levels.

There are preliminary signs that the decline in manufacturing and trade may be bottoming out. This is partly from an improvement in the auto sector as disruptions from new emission standards start to fade. A U.S.-China Phase I deal, if durable, is expected to reduce the cumulative negative impact of trade tensions on global GDP by end 2020—from 0.8% to 0.5%.

The service sector remains in expansionary territory, with resilient consumer spending supported by sustained wage growth. The almost synchronized monetary easing across major economies has supported demand and contributed an estimated 0.5%age point to global growth in both 2019 and 2020.

In advanced economies, growth is projected to slow slightly from 1.7% in 2019 to 1.6% in 2020 and 2021. Export dependent economies like Germany should benefit from improvements in external demand, while U.S. growth is forecast to slow as fiscal stimulus fades.

For emerging market and developing economies, we forecast a pickup in growth from 3.7% in 2019 to 4.4% in 2020 and 4.6% in 2021, a downward revision of 0.2% for all years. The biggest contributor to the revision is India, where growth slowed sharply owing to stress in the nonbank financial sector and weak rural income growth. China’s growth has been revised upward by 0.2% to 6% for 2020, reflecting the trade deal with the United States.

The pickup in global growth for 2020 remains highly uncertain as it relies on improved growth outcomes for stressed economies like Argentina, Iran, and Turkey and for underperforming emerging and developing economies such as Brazil, India, and Mexico.

Risks retreating but still prominent

Overall, the risks to the global economy remain on the downside, despite positive news on trade and diminishing concerns of a no-deal Brexit. New trade tensions could emerge between the United States and the European Union, and U.S.-China trade tensions could return. Such events alongside rising geopolitical risks and intensifying social unrest could reverse easy financing conditions, expose financial vulnerabilities, and severely disrupt growth.

Importantly, even if downside risks appear to be somewhat less salient than in 2019, policy space to respond to them is also more limited. It is therefore essential that policymakers do no harm and further reduce policy uncertainty, both domestic and international. This will help to revive investment, which remains weak.

Policy priorities

Monetary policy should remain accommodative where inflation is still muted. With interest rates expected to stay low for long, macroprudential tools should be proactively used to prevent the build-up of financial risks.

Given historically low interest rates alongside weak productivity growth, countries with fiscal space should invest in human capital and climate-friendly infrastructure to raise potential output. Economies with unsustainable debt levels will need to consolidate, including through effective revenue mobilization. To ensure a timely fiscal response if growth were to slow sharply, countries should prepare contingent measures in advance and enhance automatic stabilizers. A coordinated fiscal response may be needed to improve the effectiveness of individual measures. Across all economies, a key imperative is to undertake structural reforms, enhance inclusiveness, and ensure that safety nets protect the vulnerable.

Countries need to cooperate on multiple fronts to lift growth and spread prosperity. They need to reverse protectionist trade barriers and resolve the impasse over the World Trade Organization’s appellate court. They must adopt strategies to limit the rise in global temperatures and the severe consequences of weather-related natural disasters. A new international taxation regime is needed to adapt to the growing digital economy and to curtail tax avoidance and evasion, while ensuring that all countries receive their fair share of tax revenues.

To conclude, while there are signs of stabilization, the global outlook remains sluggish and there are no clear signs of a turning point. There is simply no room for complacency, and the world needs stronger multilateral cooperation and national-level policies to support a sustained recovery that benefits all.

Reprinted with permission from the IMF Blog.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations