What We're Reading:

China manufacturing PMI in contraction again after a short-lived expansion. Manufacturing PMI was lower at 49.0 in July from 50.2 in June. According to the official press release, industries in contraction include textiles, oil, coal processing, ferrous metal smelting and rolling processing. (HSN)

Ayman al-Zawahiri: Shock in Kabul as US kills al-Qaeda leader. The first signs of an operation that was months in the making erupted when an attack rocked the center of Kabul in the early hours of Sunday morning: we heard two thunderous blasts on our street nearby. (BBC)

Bank of England launches biggest interest rate hike in 27 years, predicts lengthy recession. The Bank of England hiked interest rates by 50 basis points, its largest single increase since 1995, and projected the U.K.'s longest recession since the global financial crisis. (CNBC)

The first Ukrainian grain ship leaves Odesa after months of Russian blockade. A cargo ship loaded with 26,000 tons of Ukrainian corn left the country's largest port Monday for the first time since Russia's invasion on Feb. 24. (NPR)

Ukraine's Zaporizhzhia nuclear plant is out of control, says IAEA. The head of the United Nations' nuclear agency has said the Zaporizhzhia nuclear plant in Ukraine is "completely out of control.” (BBC)

Pelosi tells Taiwan US commitment to democracy is ‘ironclad.’ After a trip that drew China’s wrath, a defiant Nancy Pelosi concluded her visit to Taiwan on Wednesday with a pledge that the American commitment to democracy on the self-governing island and elsewhere “remains ironclad.” (AP)

Cold showers, no lights: Europe saves as Russian gas wanes. Fanning out like urban guerrillas through Paris’ darkened streets well after midnight, the anti-waste activists shinny up walls and drain pipes, reaching for switches to turn off the lights. (AP)

What's behind Iraq's explosive political crisis? Iraq is in the midst of its worst and longest political crisis in years. At the center of this overheating conflict stands Iraqi political kingmaker Moqtada al-Sadr and a rival bloc of parties with strong ties to neighboring Iran. (CNN)

The role of regional economic communities in implementing the African Continental Free Trade Area. Andrew Mold, chief of regional integration for Eastern Africa at the United Nations Economic Commission for Africa, explores aspects of the continent’s economic integration agenda under the African Continental Free Trade Area (AfCFTA), arguing that low estimates of intra-African trade can be misleading and exploring how the region’s individual regional economic communities will be central to the agreement’s implementation. (Brookings)

Swiss adopt new EU sanctions on Russia, allow oil payments. The Swiss government imposed further sanctions against Russia over the war in Ukraine on Wednesday, in line with the European Union's latest measures on gold and gold products, the cabinet said. (Reuters)

China conducts ‘precision missile strikes’ in Taiwan Strait. China conducted “precision missile strikes” in waters off Taiwan’s coasts as part of military exercises that have raised tensions in the region to their highest level in decades following a visit by U.S. House Speaker Nancy Pelosi. (AP)

High number of 'zombie' businesses need specialist advice, says insolvency firm. The U.K.’s hordes of “zombie” businesses need access to specialist help rather than being left to fail, an insolvency professional has said. (Daily Echo)

Shipping firm Maersk, a barometer for global trade, warns of weak demand and warehouses filling up. AP Moller-Maersk on Wednesday predicted a slowdown in global shipping container demand this year amid weakening consumer confidence and supply chain congestion. (CNBC)

Are We on the Brink of a Global Recession?

Annacaroline Caruso, editorial associate

Most experts agree the world is teetering on the edge of a recession, yet many questions remain about when the tipping point will come and what a recession would look like. “The global economy, still reeling from the pandemic and Russia's invasion of Ukraine, is facing an increasingly gloomy and uncertain outlook,” Pierre-Olivier Gourinchas, economic counsellor and director of research for the International Monetary Fund (IMF), wrote in a blog post. “Many of the downside risks flagged in our April World Economic Outlook have begun to materialize”

The Bank of England raised interest rates by 50 basis points last week, the largest hike since 1995, per CNBC. This it the sixth consecutive time the Bank has increased interest rates, as it braces for the possibility of a recession.

“The Bank is simultaneously forecasting a long recession starting later this year and an even higher peak in inflation,” Luke Bartholomew, senior economist at Abrdn, told the news outlet. “This is a toxic economic combination, which would be difficult for the central bank to navigate at the best of times, let alone when it is increasingly being dragged into the political spotlight.”

Rising gas prices led the Bank of England to issue “significant deterioration” in their economic outlook for all of Europe. The MPC now projects that the U.K. will enter a recession in the fourth quarter of 2022 and last roughly five quarters.

“Growth thereafter is very weak by historic standards. The contraction in output and weak growth outlook beyond that predominantly reflect the significant adverse impact of the sharp rises in global energy and tradable goods prices on U.K. household real incomes,” the MPC said in its monetary policy report.

And in the U.S., experts share those same recession fears. “Almost certainly there will be a full-blown recession. If we’re not in one yet, I think we will be in the next 12 months,” Dudley, the former president of the New York Federal Reserve, told CNN.

U.S. GDP contracted for two consecutive months, which is a historical recession indicator. However, NACM Economist Amy Crews Cutts, Ph.D., CBE, says to take note of the labor market as well. “The Recession Dating Committee does not rely much on GDP readings,” she said during a recent episode of Extra Credit. “They are also looking at the labor market statistics, which is showing very low unemployment and solid jobs numbers. So, for right now we are not in a recession, however there is weakness and things are deteriorating. I am firmly in the belief that we will see a recession in the next twelve months, but it has not yet arrived.”

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

-

MAY

17

10am ET -

Economic Outlook for China and the Rest of Asia-Pacific

Speaker: Louis Kuijs, Chief Economist, Asia Pacific at S&P Global Ratings

Duration: 60 minutes

-

Revolutionizing Invoice-to-Cash with AI

Speaker: Ali Rezaei Yazdi and Danny Wheeler

Duration: 60 minutes | Complimentary -

MAY

22

11am ET

How Will a Slowing Economy Impact Credit Defaults?

Martin Zorn, managing director, Kamakura Corporation a SAS company

U.S. GDP contracted 0.9% in the second quarter, following a contraction of 1.6% in the first quarter. It’s a strong contrast to the fourth quarter of 2021, in which GDP expanded 6.9%. Inventory contraction was the largest driver, reducing GDP by 2 percentage points. Consumer spending increased by just 1%–the lowest rate since the pandemic, and far below the 1.8% growth rate in the previous quarter. Inflation continues to be high and push higher on a global basis. Last month we asked whether central banks could reduce demand without causing a recession. This month we examine how central bank policies and the business cycle will impact the credit cycle.

The Kamakura Troubled Company Index® shows that short-term default risk improved over the month as credit conditions jumped to the 95th percentile of the period from 1990 to the present. The 100th percentile indicates the best credit conditions during that period. The Kamakura Troubled Company Index closed in July at 5.56%, compared to 6.94% the month before. The index measures the percentage of 41,500 public firms worldwide with an annualized one-month default probability over 1%. An increase in the index reflects declining credit quality, while a decrease reflects improving credit quality.

At the close of July, the percentage of companies with a default probability between 1% and 5% was 4.70%, a decrease of 1.10% from the previous month. The percentage with a default probability between 5% and 10% was 0.61%, a decrease of 0.15%. Those with a default probability between 10% and 20% amounted to 0.19% of the total, a decrease of 0.11%; and those with a default probability of over 20% amounted to 0.06%, a decrease of 0.02% over the prior month. Short-term default probabilities ranged from a low of 5.56% on July 29 to a high of 6.67% on July 1.

Figure 1: Troubled Company Index — July 29, 2022

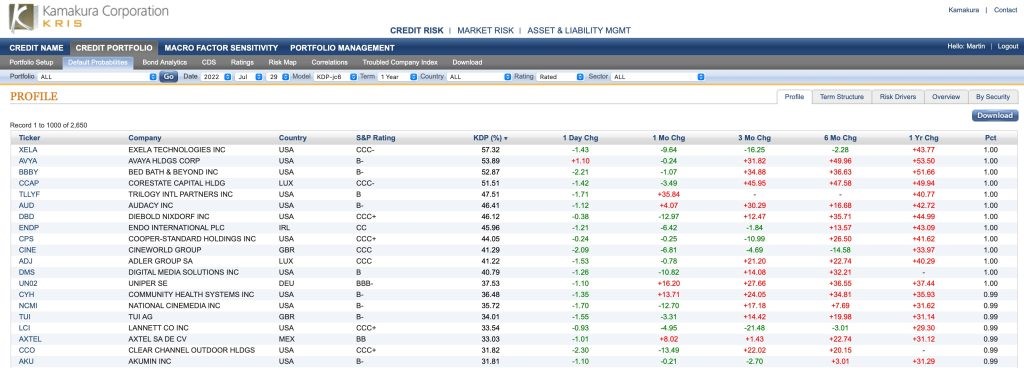

Given that we are in the early stages of the tightening cycle, we will shift the analysis to the 20 riskiest-rated firms based on their one-year probability of default. In July, 13 of these companies were in the United States, with two each in Luxemburg and the UK and one each in Germany, Ireland and Mexico. The riskiest-rated firm was Exela Technologies (XELA:NASDAQ), with a one-year KDP of 57.32%, up 9.64% from the previous month. By comparison the one-month KDP was 28.77% up 0.23%.

Table 1: Riskiest-Rated Companies Based on One-Year KDP – July 29, 2022

The Kamakura Expected Cumulative Default Rate, the only daily index of credit quality of rated firms worldwide, shows the one-year rate down 0.40% at 1.98%, and the 10-year rate down 0.26% at 16.06%.

Figure 2: Expected Cumulative Default Rate — July 29, 2022

Corporate Bankruptcies at Highest Level in 13 Years

Annacaroline Caruso, editorial associate

The number of businesses filing for insolvency in England and Wales is at the highest level since 2009, according to the Evening Standard. More than 5,000 companies filed for insolvency between April and June 2022, per The Insolvency Service, “an increase of over 80% on the previous year and up 13% on the last quarter. The increase was led by a 74% jump in creditors’ voluntary liquidations, which is often used when companies sell off their remaining assets before shutting down altogether.”

Samantha Keen, a restructuring strategy partner at EY-Parthenon, told Business Matters magazine that the second-quarter was just “the first tranche of insolvencies. We expect insolvencies among larger businesses that are struggling to adapt to challenging trading conditions, tighter capital, and increased market volatility.”

Construction firms made up one-fifth of all insolvencies, followed by wholesale retailers, accommodation and food services as the worst-affected sectors. “It’s essential to spot the tell-tale signs of insolvency risk early—those include low productivity, difficulty securing labor or materials, and failure to pay suppliers,” Martin Sudweeks, T&T’s managing director for cost management in the U.K., told Building Co.

Inflation, supply disruptions and labor issues are some of the biggest threats facing businesses today. “Many businesses are being hampered by supply and staff shortages, which are limiting revenues at a critical time, just as demand levels are recovering or back to pre-pandemic levels,” John Cullen, business recovery partner at accountancy firm Menzies LLP, told the Financial Times. He described the sharp rise in bankruptcies as “an indication of the severe cash flow pressures that many businesses are facing, which are exacerbated by soaring energy and fuel costs.”

This rise in corporate insolvency filings is a total reversal from the record lows we saw during the height of the pandemic. “The changing economic climate has created a widespread situation in which many supply chain-reliant firms have been unable to service their outstanding debts,” wrote Dana Bodnar, economist at Atradius, in an article for Supply Chain Brain. “In both the U.S. and most countries in Europe, instances of insolvency have been considerably increasing. The sudden rise in the risk of insolvency has proven to be a truly global phenomenon, with New Zealand, Portugal, South Korea, and the Netherlands identified as four of the countries anticipating the greatest increases. Switzerland, Turkey, and Russia are also anticipating steep increases to be on the horizon.”

Week in Review Editorial Team:

Diana Mota, Editor in Chief

Annacaroline Caruso, Editorial Associate