What We're Reading:

Russia and the West are vying for influence in Africa and Ukraine is a big reason why. Russian, French and American leaders are crisscrossing Africa to win support for their positions on the war in Ukraine, waging what some say is the most intense competition for influence on the continent since the Cold War. (NPR)

US economy shrinks again ringing recession alarms. The U.S. economy has shrunk for the second quarter in a row, a milestone that in many countries would be considered an economic recession. That is not the case in the U.S., which uses additional data to make that call. (BBC)

EU agrees to cut natural gas use amid Russian supply fears. European Union governments agreed Tuesday to reduce consumption of natural gas this winter to protect themselves against any further supply cuts by Russia amid its invasion of Ukraine, although the measure contains exemptions for some countries. (AP)

IMF: UK set for slowest growth of G7 countries in 2023. The UK is set for the slowest growth of the G7 richest economies next year, the International Monetary Fund has warned. It is predicting UK growth will fall to just 0.5% in 2023, much lower than its forecast in April of 1.2%. (BBC)

Developing nations seek to overcome energy, currency crises. Business leaders and officials from eight developing nations said more cooperation was needed among them to overcome dwindling foreign currency reserves, a growing energy crisis and supply chain disruptions. (AP)

Survey: 70% of companies planning reshoring or nearshoring projects. Seven out of 10 U.S.-based manufacturing companies are planning to invest in new production capacity closer to their home bases as a result of the global upheavals of recent years, a new survey has found. (IndustryWeek)

Yale study shows sanctions are crippling Russia's economy. Sanctions on Russia are taking a heavy toll on the economy, despite Moscow's assertion that the country is not feeling the pinch, according to a new study from Yale University. (DW)

Biden speaks with China's Xi as tension grows over Taiwan. President Joe Biden and his Chinese counterpart Xi Jinping held a lengthy and candid discussion about Taiwan on Thursday as tensions mount between Washington and Beijing, despite Biden's onetime hope of stabilizing the world's most important country-to-country relationship. (CNN)

As the planet heats up, it’s now or never for manufacturers to act. As we collectively work toward a low-carbon economy—which is at once an enormous challenge and opportunity—an increasing number of companies have a keen eye to furthering their sustainability efforts and reducing their greenhouse gas emissions and associated carbon footprint. (IndustryWeek)

Germany on the hunt for labor. From heavy industry to healthcare to household maintenance, the German economy is facing a shortage of workers. Immigration reform may be on the table to attract more foreign labor. (DW)

Impeach President Buhari over Nigeria's mounting security issues, opposition senators urge. Nigerian opposition Senators pushed for President Muhammadu Buhari to face impeachment, 10-months before the end of his second term in office, over the country's spreading security problems. (CNN)

If Brazil legalizes more Amazon mining, it would drive deforestation, study says. Legalizing mining on indigenous land and other protected areas in Brazil's Amazon rainforest would lead to thousands of square kilometers in new deforestation, according to a study. (Reuters)

Energy on the table, Macron hosts Saudi prince for dinner. French President Emmanuel Macron is welcoming Saudi Crown Prince Mohammed bin Salman to his presidential palace and offering him dinner in controversial talks that mark another step in the Saudi leader’s diplomatic rehabilitation. (AP)

Ukraine: Agreement to Export Ukrainian Grain from Black Sea Ports Unlikely to Significantly Reduce High Food Prices

Pascaline della Faille, analyst, Credendo

On 22 July, Russia signed an agreement to resume Ukrainian grain exports from the Black Sea ports. Under the agreement, a coordination center staffed by belligerents, Turkey and the UN would monitor cargo ships transiting Ukrainian ports and inspect them for weapons. The agreement is to be renewed every 120 days. The grain deal brokered by Turkey and the UN was directly jeopardized by an attack on the port city of Odesa on 23 July. Despite the recent strike, the implementation of the deal is moving forward as shown by efforts to demine arears for maritime traffic.

IMPACT

The resumption of grain exports would support the Ukrainian economy by providing badly needed hard currency. Indeed, food exports accounted for almost 30% of current account receipts in 2020.

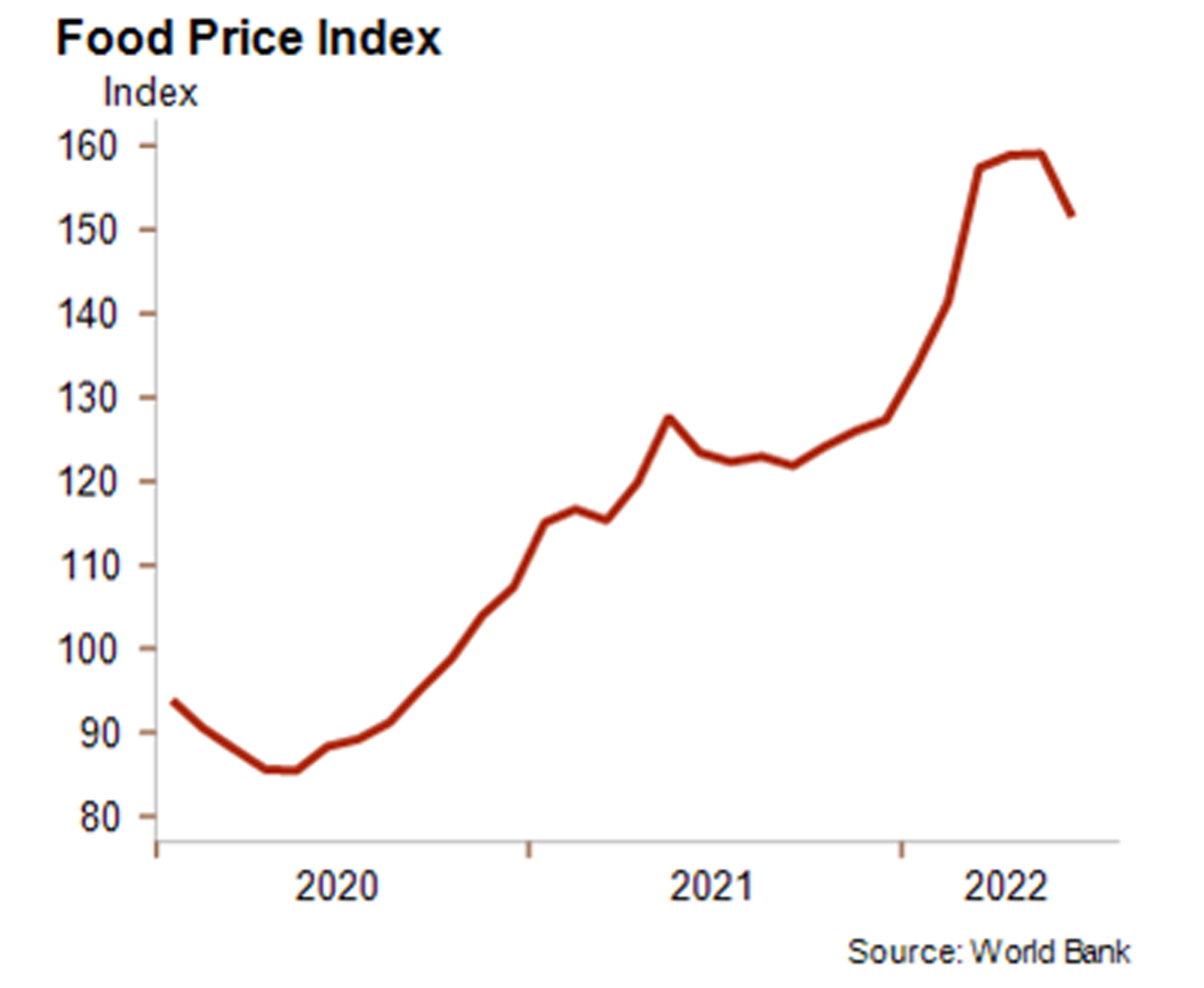

On a larger plan, an effective implementation of the grain deal would alleviate the risk of a global food crisis. Indeed, despite the recent ease (cf. graph), food prices have soared following Russia’s invasion of Ukraine seeing that both countries are major grain exporters.

Apart from its devastating humanitarian impact, the sharp increase in food prices is a source of concern for two main reasons. First, it is adding to already high inflation pressure worldwide, along with other factors such as the supply chain disruptions and the very high price of other commodities (notably energy prices). High inflation is weighing on consumer confidence and hence on economic activity. To stem inflation pressure, many central banks worldwide are rising their policy rate. Along with the tighter monetary conditions—notably in major economies such as the U.S. and the euro area—global financial conditions are deteriorating rapidly. This is putting pressure on the exchange rate and foreign exchange reserves of many economies amid notably capital outflows from emerging markets. Moreover, it implies that some emerging markets—such as Kenya and Ghana—with very weak fundamentals (e.g., high public debt and large twin deficit (= current account deficit and fiscal deficit)) no longer have access to international markets to issue new debt or refinance existing debt. Moreover, borrowing costs are increasing rapidly for the public and private sector alike as access to credit is becoming more restrictive. This happens as in some countries public debt is still very high despite some fiscal consolidation measures implemented last year. Last but not least, the high food prices weigh on public finances if the authorities decide to put in place fiscal measures aiming at alleviating the impact on high prices.

The second source of concern is related to the heightening risk of social unrest. Across the world, protests are erupting to complain about the high cost of living (e.g., Kazakhstan, Peru, Pakistan, Sri Lanka). This trend is likely to continue in the coming months, raising the political risk in an environment where uncertainty is already very high. In this uncertain context and amid a fast deterioration of the economic environment, Credendo is likely to downgrade the business environment risk and political risk of additional countries in the coming months.

Reprinted with permission by Credendo.

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

-

MAY

17

10am ET -

Economic Outlook for China and the Rest of Asia-Pacific

Speaker: Louis Kuijs, Chief Economist, Asia Pacific at S&P Global Ratings

Duration: 60 minutes

-

Revolutionizing Invoice-to-Cash with AI

Speaker: Ali Rezaei Yazdi and Danny Wheeler

Duration: 60 minutes | Complimentary -

MAY

22

11am ET

Central Banks Continue to Raise Rates in Effort to Curb Inflation

Diana Mota, editor in chief

Worldwide about four dozen countries have raised interest rates since December “in a bid to contain the most rapid inflation in decades,” the New York Times reported in June. Last week the European Central Bank joined those ranks as its governing council voted to increase three key ECB interest rates by 50 basis points, the first increase in 11 years.

Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility was increased to 0.50%, 0.75% and 0.00% respectively, effective July 27. The ECB also “introduced a forthcoming Transmission Protection Instrument, a debt-purchasing device meant to guard against ‘unwarranted, disorderly market dynamics,’” Bloomberg reported.

So far efforts to reign in inflation have not taken hold. “Europe’s prices went up by nearly 9% in the year to June, about as fast as inflation in the U.S.—but the causes differ in ways that make the ECB’s task a lot harder,” Bloomberg reported. “Too much demand, something monetary policy can address, has played a leading role in the U.S. In the euro zone, not so much: The supply shock due to Russia’s war on Ukraine and interruptions to energy supplies is far stronger, narrowing the central bank’s scope for action.”

The ECB governing council is expected to meet again on Sept. 8. The majority of analysts included in a Capital.com story “forecast ECB rate hikes of 50bp each in September and October, followed by a 25bp in December amid expected rising inflation.”

The rate increases by several banks have exceeded expectations, potentially raising concerns of mistrust. “When central banks’ target rates were zero, their guidance about future policy was everything,” Bloomberg reported. “Now that we’ve moved on from record-low rates, policy makers need to rethink forward guidance—or risk losing even more of their credibility.” The Fed’s Jerome Powell and ECB’s Christine Legarde recently have “added caveats to their pre-meeting guidance” that decisions would ultimately be driven by economic developments.

The Bank of England is considering its next move and could see a 50bp increase when it meets on Aug. 4. “In simple terms, this means that a 50-basis point increase will be among the choices on the table when we next meet,” said Michael Saunders, member of the monetary policy committee, in a speech. “50 basis points is not locked in, and anyone who predicts that is doing so based on their own view. We do not pre-announce bank rate decisions for the very simple reason that MPC decisions are based on deliberation at the time among nine people focused on returning inflation to the 2% target sustainably.”

The bank has raised interest rates five times since December, starting with a 15bp increase followed by 25 basis points each. It was the first major bank to raise rates since the pandemic. On Wednesday, the U.S. Federal Reserve once again voted for a 0.75 percentage point interest rate increase—its fourth-rate hike in five months.

Shifting Global Winds Pose Challenges to Latin America

Gustavo Adler, Ilan Goldfajn and Anna Ivanova, IMF

The economies of Latin America and the Caribbean have continued their strong post-pandemic rebound, but the winds are shifting as global financial conditions are tightening and commodity prices are reversing their upward trend, while inflationary pressures persist.

The reopening of contact-intensive sectors, especially hospitality and travel, the unwinding of pandemic pent-up demand, and still favorable external financial conditions supported a solid expansion in the first half of the year, allowing services to catch up with manufacturing, and employment to reach pre-pandemic levels. Year-on-year growth reached 2.8% in the first quarter, compared to an average of 1.7% in the years preceding the pandemic, and high-frequency indicators point to continued momentum in the second quarter.

On the back of this solid first half of the year, and despite an expected slowdown in the second half, we forecast the region to grow by 3.0% this year, an upgrade from our April forecast of 2.5%.

However, the region faces significant challenges, including tightening global financial conditions, lower global growth, persistent inflation, and increasing social tensions amid growing food and energy insecurity. These factors contribute to our downgrade in growth to 2.0% in 2023, 0.5 percentage point lower than anticipated in April.

Uneven recoveries, common inflationary pressures

The strength of the post-pandemic recoveries has varied across the region. The global rebound of commodity prices from the pandemic lows, further boosted by the war in Ukraine, has generally supported the recovery of commodity exporters (some South American economies), while constraining those that depend more on commodity imports (Central America and tourism-dependent Caribbean economies). The upward trend of commodity prices seems to be reversing, as the global financial conditions tighten.

Among the largest economies, Chile and Colombia have seen a particularly dynamic rebound, propelled by strong growth in services, in part due to the fiscal stimulus in late 2021, while Mexico’s economic output is yet to regain its pre-pandemic level as services and construction continue lagging.

Caribbean economies are also behind in their recovery as tourism is yet to return to pre-pandemic levels, despite the recent rebound. Meanwhile, Central America, Panama and the Dominican Republic have already surpassed their pre-pandemic output levels, driven by the rapid recovery in the United States, through strong exports and remittances inflows as well as supportive policies.

Inflation, on the other hand, has accelerated throughout the region, amid rebounding domestic demand, lingering supply chain disruptions, and rising commodity prices. Central banks have appropriately tightened monetary policy to contain second-round effects and anchor longer-term inflation expectations. But inflation could prove persistent in the wake of compounding shocks and broadening price pressures.

Meanwhile, after last year’s withdrawal of pandemic stimulus, fiscal policy in most countries has largely shifted into a neutral stance in 2022. This should help put fiscal balances on a more sustainable footing and support monetary policy in containing inflationary pressures.

Challenging global conditions

With inflation on the rise around the world and central banks in advanced economies tightening financial conditions, global demand is weakening. Growth forecasts for 2023 have been revised down considerably from 2.3% to 1.0% in the U.S. and 2.8% to 1.8% in Canada. Even before the full impact of financial tightening, growth in these economies was decelerating, leading to a downward revision of our 2022 growth forecasts from 3.7% to 2.3% for the United States, and from 3.9% to 3.4% for Canada.

Amid global monetary tightening and greater economic uncertainty, external financial conditions for Latin America and the Caribbean are worsening, leading to rising borrowing costs and currency pressures. Adding to this, and partly reflecting the global slowdown, some commodity prices have fallen and are expected to soften further. This could bring some welcome relief to global inflationary pressures with time, but at a cost of further challenges to the region.

Inflation outlook

As elsewhere, price pressures in the region are likely to remain high for some time, as indicated by our inflation forecasts of 12.1% and 8.7% for 2022 and 2023, respectively, the highest rates in the past 25 years. This means we expect inflation to exceed the upper bound of central banks’ target ranges by about 400 basis points, on average, in the five largest Latin American economies (Brazil, Chile, Colombia, Mexico, and Peru) by the end of this year, and to remain outside the target range for part of next year.

Further currency weakening—especially if global financial conditions tighten further—and growing wage pressures, together with existing indexation mechanisms in some countries, could lead to additional inflationary pressures.

Navigating shifting winds

Persistent inflation amid decelerating economic activity in the context of falling commodity prices will make policymaking more challenging.

Policymakers should remain focused on preserving macro-economic stability and social cohesion. Amid high post-pandemic public debt levels and rising real interest rates, fiscal policy will need to focus on strengthening fiscal balances and ensuring debt sustainability while continuing to support the most vulnerable people with targeted and if needed temporary measures through a period of slower growth and high inflation.

Meanwhile, monetary policy must continue focusing on taming inflation and anchoring inflation expectations. This, together with clear communication, will remain key to preserve the hard-won credibility of central banks.

Reprinted with permission IMF Blog.

Week in Review Editorial Team:

Diana Mota, Editor in Chief

Annacaroline Caruso, Editorial Associate