Week in Review

What We're Reading:

Turkey's inflation hits 36% amid financial turmoil. Turkey's annual inflation rate has soared to a 19-year high, underlining the country's financial turmoil and alarm over its president's policies. (BBC)

China’s economy: the fallout from the Evergrande crisis. The crackdown on real estate ordered by Xi Jinping is putting growing pressure on local governments and many companies. (Financial Times)

‘There is no money left’: Covid crisis leaves Sri Lanka on brink of bankruptcy. Half a million people have sunk into poverty since the pandemic struck, with rising costs forcing many to cut back on food. (The Guardian)

China’s central bank set to step up cash injection before Lunar New Year holiday. China’s central bank is set to replenish liquidity shortfalls before the Lunar New Year holiday, the China Securities Journal reported, even as markets were split on whether more monetary easing was imminent in the world’s second-largest economy. (HSN)

US cuts off Ethiopia, Mali, Guinea from Africa duty-free trade program. The United States on Saturday cut Ethiopia, Mali and Guinea from access to a duty-free trade program, following through on President Joe Biden's threat to do so over alleged human rights violations and recent coups. (US News & World Report)

Using uncertainty modeling to better predict demand. In the effort to reduce waste and eliminate redundancy, many companies have exposed themselves to greater risks of supply chain disruption, despite heavy investment in data analytics around demand prediction that should, in principle, drive out uncertainty. (Harvard Business Review)

What’s next for China-US after phase-one trade deal? Nearly two years ago on January 15, 2020, China signed what is termed “phase-one” agreement with the US in the hope of ending the 22-month-old US-initiated trade deadlock, defusing a costly trade war, giving relief to businesses and reassuring the global economy. (HSN)

Russian troops arrive in Kazakhstan, as dozens of protesters killed, thousands arrested. Russian paratrooper units have begun arriving in Kazakhstan to help its president end mass protests in the Central Asian country, as security forces there said they have killed dozens of protesters amid violent clashes. (ABC News)

EU’s international procurement law one step closer to completion. Half a year after EU member state agreed their common position and nine years after the Commission first proposed it, the European Parliament voted its negotiating stance on an instrument aimed at ensuring access of European companies to public procurement markets outside the EU. (Euractiv)

London says COVID is masking Brexit hit to finance. Getting ahead in global finance after Brexit needs sustained British government impetus, the City of London’s policy chief said on Wednesday, adding that COVID-19 may be masking some of the impact of leaving the EU. (HSN)

Gas shortage hits Pakistan’s exports, adding to economic stress. About $250m of textiles exports were lost last month after mills in Punjab had to shut for 15 days on fuel shortages. (Al Jazeera)

Former McDonald's CEO warns that a surge in retiring baby boomers amid ongoing hiring struggles will lead to a 'catastrophe.' McDonald's former CEO is warning of an impending "catastrophe" for the labor market as Baby Boomers—and their children—begin to reach retirement age. (Business Insider)

Your BlackBerry dies on January 4: End of an era for iconic handset. BlackBerry devices running the original operating system and services will no longer be supported after January 4, marking the end of an era for the storied device that catapulted work into the mobile era. (Business Mirror)

Used clothes choke both markets and environment in Ghana. Each week, Ghana receives 15 million items of used clothing sent from the West. But 40% of the products get discarded due to poor quality. They end up at landfills and in bodies of water, polluting entire ecosystems. (DW)

Planning for Risks in the Year Ahead

Martin Zorn, president and COO, Kamakura Corporation

When we entered December with the new threat of the Omicron variant, the markets initially sold off, but then quickly recovered and continued their march upward. It was just another example of a year that proved to be financially resilient, no matter what uncertainties unfolded. One must wonder if the markets in 2022 will continue to overcome whatever gets thrown at them, or whether they will slow to adjust to an environment containing an increasing number of uncertainties. Another possibility is a correction. If we do have one, will it be mild or will the markets overreact to the downside?

There has been much debate about inflation. For many months central bankers insisted it was transitory. But the narrative began to shift as excess savings that were accumulated during the pandemic led to pent-up demand—amid significantly insufficient supply and bottlenecks. Policymakers then said they hoped this situation will correct itself. (Hope is not a strategy, but that’s a discussion for another time.)

Central banks have long insisted they have the tools to fight inflation, but do they have the backbone to use them? Have they already waited too long, and will these above-target inflation rates be with us longer than expected? These questions imply that we should model rate hikes both slower and faster than expected, as well as using lower and higher figures than the markets seem to indicate.

In addition, geopolitical risks are rising. Russia and Ukraine, China and Taiwan, a nuclear Iran and expanding and shifting alliances in the Middle East are a few examples of the risks we see in current headlines. While Afghanistan seems to have evaporated from the headlines, the risks there remain, as do the continual risks of escalating conflict between India and Pakistan. Global risk is always a “known unknown,” which for forecasting purposes means deterministic modeling is not enough, and one should include stochastic models in the tool kit.

Another perennial headline grabber is environmental risks, which are primarily being addressed through regulatory means rather than allowing market solutions to evolve. I am at an age to remember Ronald Reagan’s famous statement: “The nine most terrifying words in the English language are ‘I’m from the government, and I’m here to help.’”

Central planning simply does not work. Regulatory reforms often lead to unanticipated consequences, and environmental risks are no exception. When government policies pick winners and losers, what could possibly go wrong? We will undoubtedly find out.

During 2021, we also saw the rise of meme stocks, crypto assets and the use of SPACs as an easy way to go public without providing the transparency of a normal offering. Having been involved in filing many Form S-1s and Form S-3s, I appreciate the fact that launching a SPAC is easier. But I also am aware that the lack of transparency carries its own set of risks.

I cannot conclude a list of potential risks without asking about what is next for Covid. The virus has been the primary disruptor of business, the economy, and modeling and risk management for two years. While we can’t yet model this known unknown, it is a factor that risk managers will need to consider in 2022, and possibly beyond.

-

APRIL

24

11am ET -

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

-

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute -

APRIL

29

3pm ET

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

Structural Reforms Can Ease China’s Transition to High-Quality Growth: Report

To achieve quality growth over the medium-term, China must rebalance its economy across several dimensions, according to the World Bank, in its latest economic update, Rebalancing Act, from Recovery to High-Quality Growth.

Following a strong rebound in the first half of 2021, economic activity in China cooled rapidly in the latter half of the year. Real GDP growth is projected to reach 8.0% for 2021, before moderating to 5.1% this year.

The economic slowdown reflects less-favorable base effects, diminished support from exports and the government’s continued deleveraging efforts. Although full-year growth is projected to slow in 2022, momentum is expected to pick up, aided by a more supportive fiscal stance following the rapid withdrawal of fiscal policy support in 2021.

Risks to China’s economic outlook are tilted to the downside. Renewed domestic COVID-19 outbreaks, including the new Omicron variant, could require more broad-based and longer-lasting restrictions leading to larger disruptions in economic activity. A severe and prolonged downturn in the highly leveraged property sector poses another downside risk which could have significant economy-wide reverberations.

While the authorities should stand ready to ease fiscal policy to support domestic demand in 2022 and provide liquidity to stem risks of contagion from distressed developers, the report argues that the traditional playbook of boosting growth through infrastructure and real estate investment has run its course.

Three challenges stand out: first, rebalancing from external to domestic demand and from investment and industry-led growth to greater reliance on consumption and services; second, rebalancing from the significant weight placed on state leadership and regulation to a greater role for markets and the private sector; and third, transitioning from a high to a low-carbon economy.

To support the rebalancing toward domestic consumption, fiscal reforms could create a more progressive tax system while boosting social safety nets and spending on health and education, the report notes. The wider use of carbon pricing along with power sector reforms and the development of a wider set of green financing instruments would help accelerate China’s low carbon transition while encouraging green innovation, thereby boosting medium-term growth prospects.

Global Construction: Growth Slowing and Switching from Housing to Infrastructure Work

Global construction output is estimated to have rebounded 4.1% in 2021 to $13.2 trillion, from a minor downturn in 2020 (0.1%), according to Global Construction Perspectives. Its annual forecast covers construction volumes in 112 countries until 2030.

Key points in the latest report include:

- In 2022, global construction growth is expected to slow to around 3.0%, with infrastructure work replacing housing as the strongest sector. Growth rates are forecast to vary from +20% in Panama to -10% in Myanmar.

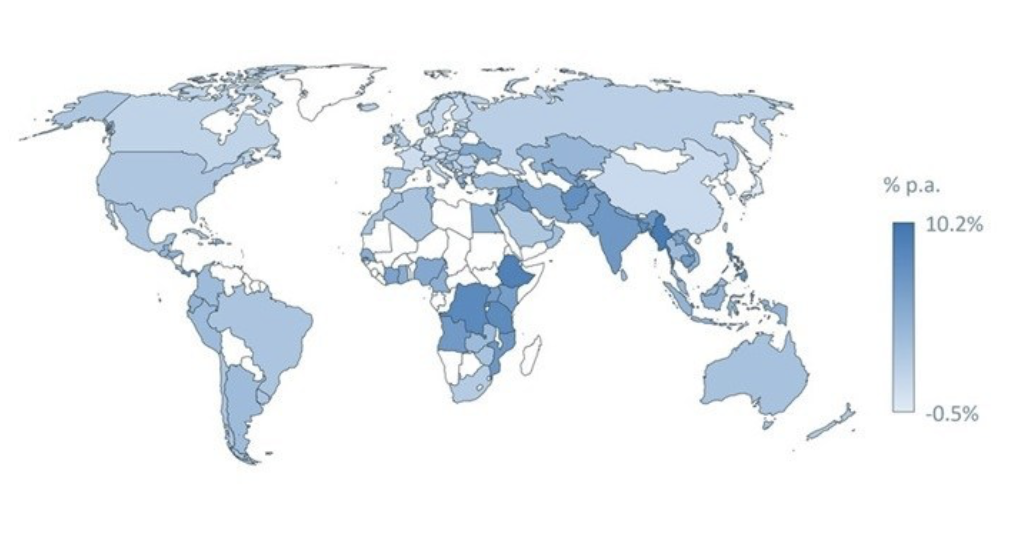

- Longer term (2023-30) growth in global construction volumes is forecast to average 2.3% per annum, ranging from 10.2% growth a year in Lebanon, following its collapse in recent years, to an average 0.5% per annum (p.a.) decline in Japan.

- Bangladesh (8.0% p.a.) and the Philippines (+7.5% p.a.) are amongst the most attractive construction markets longer term in our view, particularly if their currencies remain strong.

- A global need for an average of 54 million new homes a year: 12.2 million p.a. in China, 11.4 million p.a. in India and one to two million each a year in Nigeria, U.S., Brazil, Indonesia, Pakistan and Bangladesh.

Week in Review Editorial Team:

Diana Mota, Editor in Chief and David Anderson, Member Relations