April 25, 2024

When a phisher drops their hook, don’t bite the bait

Kendall Payton, editorial associate

Cyber criminals send over three billion emails per day through phishing attacks disguised as trusted senders.

- The scammer may use the name of trusted companies, or even your CEO.

- Unfortunately, the weakest link in a cyberattack is the person behind the keyboard—all it takes is one click on the wrong link.

Why it matters: Most cyberthreats target individuals directly. An effective security awareness and training program for all employees is crucial because staff are on the front lines.

By the numbers:

- 81% of cyberattacks took the form of phishing scams, password hacks and malware attacks.

- 84% of U.S.-based organizations have stated that conducting regular security awareness training has helped reduce the rate at which employees fall prey to phishing scams.

- Cyberattacks that used stolen or compromised credentials increased 71% year-over-year in 2024, per IBM.

What they’re saying: “There is a vast community of cyber criminals—whether individual, teamed up or government-sponsored—that are out there to get you,” said Steve Winn, corporate credit manager at Marek Brothers Systems LLC (Houston, TX). “It's not a matter of if, but when you will get hit. Before, you could easily spot a phishing email by knowing the logo was fake—but now you have to dig deeper, see if the links match up or if you were expecting the email to begin with.”

Some credit professionals have experienced successful cyberattacks firsthand. Shelley Clark, CCE, director of credit national accounts at Ben E. Keith Company (Fort Worth, TX), said these kinds of attacks have a significant impact on credit.

“We primarily see fraud attempts when it comes to submitting new credit applications and processing or refunding payments,” Clark said. “Our company experienced a cyberattack during the spring of 2023. It impacted the entire business and for credit specifically, we were unable to view our daily receivables, process or post payments, or complete full credit evaluations for at least three weeks. Our entire company stepped up to keep our business moving as our IT team worked tirelessly to get us back to business as usual.”

Training your staff is the number one way to help prevent scammers from being successful. Whether monthly, quarterly or annually, a refresher on cyber etiquette is always helpful. For example, you can ask your IT provider to keep tabs on all current events related to cybersecurity. Being briefed on the latest scams can also keep your staff up to date between trainings.

Some companies will get their IT team to purposely send out phishing emails to see how employees handle it. “We get bi-weekly, three-minute videos and take a four-question quiz at the end, along with semiannual tests on cybersecurity training,” said Nate Yagle, vice president of credit at Premier Companies (Seymour, IN). “We have a dashboard that lets us monitor progress and compete with our teams to see who gets the better score.”

When recovering from a cyberattack, one of the best ways to move forward is through creating a business continuity plan. The plan should be specific to your department with attention to critical items along with an alternate plan to maintain access to data during a potential outage.

“There is AI technology out there that organizations can adopt to filter new data from customers and vendors that makes it so much easier to detect and identify fraud,” said Clark. “The IT teams should work with credit to train associates on phishing scams and what to look for when it comes to fraudulent activity. These criminals get very creative.”

The bottom line: With the increasing threat of cyberattacks, organizations must prioritize regular security awareness training for employees and develop robust business continuity plans to mitigate risks and ensure swift recovery from potential incidents.

To learn more about cybersecurity best practices, register now for Credit Congress 2024 and reserve your spot for session #33077. Something Smells Phishy: Cybersecurity Is a Credit Problem.

Overcome chronic credit task procrastination

Jamilex Gotay, editorial associate

Timeliness is essential in the credit management profession, as delayed actions can result in missed sales opportunities, financial losses and strained customer relationships.

Why it matters: Procrastination can lead to overlooked deadlines, delayed credit approvals and increased risk exposure.

When asked, credit managers said the tasks they find themselves procrastinating the most are credit reviews of good-paying customers, new customer onboarding and difficult collection calls.

By the numbers: A Jobera report revealed that 88% of the working population procrastinate for at least one hour per day, while 20% of adults are chronic procrastinators.

But what makes people procrastinate? Procrastination is driven by a variety of thoughts and habits. People procrastinate tasks they believe will be unenjoyable or fear they won't perform well, according to Psychology Today. “People may also procrastinate when they are confused by the complexity of a task (such as filing one’s taxes) or when they’re overly distracted or fatigued,” the article reads.

Heavy workloads force credit managers to prioritize some tasks over others. For example, prioritizing the management of existing customers may extend the turnaround time for onboarding new customers. “If I put anything off, it’s reviewing new credit applications,” Amy Cook, CCE, credit manager at McNaughton-McKay Electric Company (Madison Heights, MI), said during a Credit Leaders Thought Leadership Forum call. “I used to pride myself in a 48-hour turnaround time for onboarding new customers. But now, I’m at a two-week average.”

Tasks that aren’t as urgent make for increased procrastination at the workplace. Conducting account reviews, especially for customers with a good payment history, may not feel immediately urgent. For Kevin Stinner, CCE, CCRA, credit manager at J.R. Simplot Company (Loveland, CO), it takes time to review open accounts that aren’t past-due. “You need to request new trade references, National Trade Credit Reports (NTCR) and research financial information,” he said.

Preventing procrastination can be challenging but it is crucial for workplace efficiency and productivity. Here are some tips to help you stop procrastinating and start doing:

#1 Prioritize Tasks

Credit professionals can reduce stress and boost productivity by prioritizing urgent tasks, leaving simpler, enjoyable ones for the end of the day. For example, Deborah Davis, CCE, CICP, finance systems analyst at Tektronix, Inc. (Beaverton, OR), says that getting work done early has helped her procrastinate less. “Do it first thing in the morning so you can have the rest of the day to look forward to,” she said.

#2 Set Tighter Deadlines

Professionals often delay tasks due to distractions. Setting deadlines is key as it adds pressure to complete tasks promptly. “Projects with long-range due dates tend to be the ones that you put off because you get distracted by more urgent matters,” said George Demakis, credit manager at Scafco Corporation (Spokane, WA). “There is nothing like being put under pressure to deliver on a due date to overcome procrastination.”

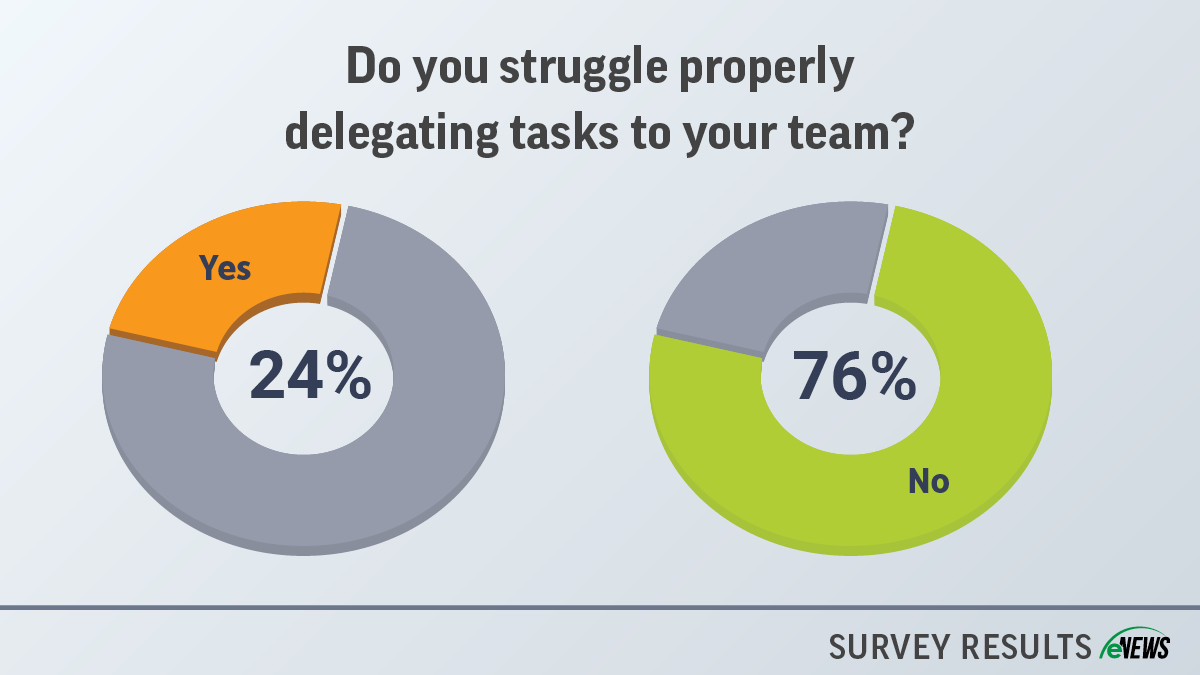

#3 Delegate Tasks Strategically

Delegating tasks to your team not only lessens your workload but promotes cooperation. “Focusing on someone else's strengths can help share responsibility, or at least, having them develop those strengths to do those tasks helps too,” said Sheryl Rasmusson, CCE, president at Kilgore TEC Products Inc. (Spokane, WA).

#4 Plan Ahead

Planning which tasks will be completed and when will help you accomplish them much faster. By preparing in advance, you can anticipate potential problems and develop solutions before they occur.

Set up routine meetings with clear objectives and tasks to be completed. Rasmusson conducts weekly staff meetings to run through and delegate tasks. “I work at developing my team so that anyone can take on tasks that maybe someone doesn’t have time to accomplish that week,” she said. “If there’s more to do the following week, we dive into getting it accomplished collectively, which helps develop the team further.”

#5 Take Breaks

Taking breaks not only prevents burnout, but it gives you the ability to regain the energy to complete any task. Short breaks can help people perform at their best. William Helton, Ph.D., professor of human factors and applied cognition at George Mason University (Fairfax, VA), and colleagues showed that short breaks can improve attention, according to the American Psychological Association (APA).

#6 Reward Yourself

Positive reinforcement, like rewarding yourself with early finishes or treats, can deter procrastination. This incentive encourages quicker, more enthusiastic task completion.

Yes, but: Studies show that in certain cases, negative stimuli are more powerful and effective than positive ones. “By pulling the two levers of positive and negative reinforcement, you may be able to tap into your brain’s reward system,” reads a Fast Company article. “If you’re only giving yourself positive incentives, then failure to perform a certain action merely means not getting the reward. But what a punishment does is introduce a consequence.”

To put it into practice, every time you fail, discipline yourself by reducing the time of your next break.

The bottom line: To overcome procrastination, you must first understand its root cause. As a credit manager, the stakes are high to complete responsibilities on time.

The power of job information sheets in infrastructure projects

Kendall Payton, editorial associate

Collecting important project information for payment documents, like preliminary notices or lien waivers, can pose a widespread challenge across the construction industry—and it can become frustrating when you realize essential project details are left behind when completing documentation.

Without sufficient and accurate job information, the company’s ability to secure payment through a mechanic’s lien or bond for their projects may be in jeopardy.

Why it matters: Infrastructure projects can be complicated for several reasons. Whether it is the absence of a physical address of where the job will take place or funds from public-private partnerships (P3), these projects can have an overall higher chance for something to go wrong.

Construction credit professionals can use a special document with essential project information allowing the ability to preserve their lien rights and get paid. This document is known as a job information sheet.

What is included in a job sheet? Most will include information such as:

- Company name and address

- Project type

- Important project dates

- Property owner, developer and bonding information

- Participants on the project

Credit professionals should not just obtain this data from the direct client, but for all parties to the job, including the subcontractor, the GC, the owner and lender for the project. This can help with both collections and due diligence efforts.

Isaac Kotila, credit support manager at Insulation Distributors Inc. (Chanhassen, MN), recently reworked forms on his job account process to remove additional data that was not necessary for what was required of their company.

“We removed some of the old language and carved it down to the specifics of what we need in order to appease on the sales side because they have to get all the information from our customer to make that process smoother and quicker for everybody,” Kotila said. “There is helpful information that you get from the job sheet by knowing the GCs and owner for the project. Payment must be exchanged in multiple peoples’ hands before it comes downstream to everybody else. So, knowing who those parties are and who you'd have to go after to make sure that those payments are being received is important.”

Job information sheets at their core are an underwriting process to figure out where the money is coming from and how to identify all involved parties. It is also important to identify the location of the property where you intend to assert your rights. Some credit professionals think job sheets resemble credit applications because they are doing an underwriting practice. However, the two have their differences.

“Job accounts justify the credit against a piece of property that is being improved rather than the credit limit of the customer based on their financial integrity,” said Chris Ring of NACM’s Secured Transaction Services. “You may receive a credit application from a subcontractor and after you do your due diligence, they may qualify for a $5,000 credit line. But that subcontractor may want to purchase $100,000 of your materials. To justify that amount of credit, you’d obtain job information and set up a job account to justify that $100,000 credit line against the value of the piece of property being improved. Or if it’s a public job, against the payment bond posted by the general contractor.”

Mitigating risk is an essential function in credit overall—but it is especially true when it comes to infrastructure projects. Whether it is a public or private project, you must know where your money and supplies are going. Exchanging job information also increases transparency on the project. For those who are closer to the top level, it can be hard to track all tabs on the project—and most do not want to deal with mechanic’s liens on the property.

“We need to know the value of that project, who the general contractor is, if there is one, who owns the property and whether our customer is the owner, the GC, sub or another material supplier,” said Alissa Brown, credit manager at Koch Air LLC (Evansville, IN). “We use the job sheet to get to know all the players so that we can track if we have lien rights or not. And we will find that out upfront because a lot of times that will help you decide on whether to extend that customer credit.”

Brown said if there is a newer customer with a project that has no lien rights, they may avoid that job. “It’s very helpful if they have a bond, but otherwise, it’s considered completely unsecured,” she explained. “That's why we do job sheets up front to see if we have lien rights for a private project, and if it's public, is there a bond to gather all information so that we can make a better risk decision.”

The bottom line: Job information sheets are critical to secure payment, mitigate risk and increase transparency.

Setting a strong foundation.

“The instructors were very approachable, and each class was more like a discussion than a lecture,” said Jackson Subbert, CBA, credit analyst II at Lennox Industries Inc. (Richardson, TX).

Read more...

For the love of credit.

“When an opportunity became available in the credit department, it interested me very much because my sister is a credit analyst and would share how much she enjoyed her career,” said Jay Coyle, Jr., CBA, CCRA, credit analyst at Carlisle Construction Materials, LLC (Carlisle, PA).

Read more...

Strive for more.

“I feel fulfilled and motivated now, in my career and in life,” said Lisa Cullen, CCE, CCRA, credit manager at Daikin TMI LLC (Chesterfield, MO).

Read more...

ChatGPT prompts for credit managers

Jamilex Gotay, editorial associate

Staying ahead often means embracing innovative tools and technologies. One such tool gaining traction is ChatGPT, an advanced language model that can assist credit managers in various aspects of their work.

Why it matters: To get the most out of ChatGPT, credit managers need to know exactly what to ask.

Carefully navigating your conversation with ChatGPT is vital for efficient workflow and accuracy. NACM has gathered insights from credit professionals on what they ask ChatGPT to get the information they need.

Customer research prompts

A recent eNews poll revealed that 23% of credit professionals use ChatGPT to research customer information. A process that once took weeks or even months can be shortened to less than a week.

Chantal Rousseau, CCP, corporate credit director at MPG Canada (Brossard, QC), uses ChatGPT to research customer information such as finding the relation between two entities or the owner of a corporation.

“Depending on the case, I will ask the following variations, such as, ‘Can you tell me what the relationship is between X and Y?’ or ‘How are X and Y related?’ or ‘Can you find any proof of a relationship between X and Y,’” Rousseau said.

Below, ChatGPT has outlined a handful of specific prompts credit professionals can use for various aspects of the credit investigation process:

- Financial analysis:

"Can you analyze the financial stability of Company XYZ based on its recent annual reports?" or "What are the key financial metrics I should consider when assessing the creditworthiness of Company ABC?" or "Compare the financial performance of Company DEF to its industry peers over the past three years."

- Industry insights:

"What are the current trends and challenges in the [industry/niche] that Company LMN operates in?" or "Provide an overview of the competitive landscape for Company PQR's industry," or "What regulatory changes or market shifts could impact the credit risk of businesses in the [specific sector]?"

- Company background and reputation:

"Can you provide a summary of any recent news or controversies surrounding Company UVW?" or "What is the reputation of Company EFG within its industry and among its customers?" or "Retrieve any information on significant management changes or legal issues for Company HIJ."

- Risk assessment:

"Identify any red flags or warning signs indicating potential credit risk for Company ZAB," or "Provide insights into the credit risk associated with extending a line of credit to Company CDE," or "Assess the likelihood of default for Company FGH based on its historical performance and market conditions."

- Customer behavior and payment history:

"Retrieve any information on late payments or defaults by Company IJK in its previous transactions," or "Analyze the payment behavior and credit history of Company OPQ with its suppliers," or "Compare the payment patterns of Company XYZ with industry benchmarks to identify any anomalies."

Writing prompts

ChatGPT generates high-quality content by providing ideas, drafts and improvement suggestions for writing.

To write emails, contracts or dunning letters, Elliott Jenneman, CCE, regional credit manager at McNeilus Steel Inc. (Dodge Center, MN), uses the following language: ‘Please assist in helping me sound more (insert adjective like professional, clear or concise) in this (type of document; email/letter/communication).’

Although not officially implemented in the workplace, Martin Smith, CCE, CICP, credit manager at Ash Grove Cement Company (Sumterville, FL), uses ChatGPT to generate collection letters. He’d type, ‘Write me a collection letter with a slightly aggressive or very low-key tone.’

“I also use a couple of keywords and then it'll generate the letter, leaving the customer's name out of it because I don't want to leave a trail of their information,” Smith said.

Credit managers should use plain, easy-to-understand language and limit corporate jargon for cleaner responses from ChatGPT. Jenneman asks for multiple drafts by saying, ‘Provide four drafts for me to choose from.’ After picking the one he likes best, he combines sentences and word choices to write his own letter.

Reviewing prompts

One of ChatGPT’s most desirable qualities is that it can offer suggestions, identify errors, provide alternative wording or give general critiques based on the content it analyzes.

You can ask it, ‘Rewrite this collection email to be more professional,’ or ‘Review this contract language for pay-when-paid clauses.’

Sometimes the return is not as clear as you would wish and you have to communicate changes, said Michelle Kelly, CCE, CCRA, CICP, senior credit manager at Mansfield Oil Company of Gainesville, Inc. (Gainesville, GA). She has prepared a list of prompts to review her work:

- Make this more concise

- Condense into two-three paragraphs

- Make into bullet points

- Use this to create a business plan

- Remove contractions

- Use a more professional tone

- Use a kinder tone

- Revise to be less formal

- Remove “esteemed” and replace with “respected”

- Add this specific data

- Remove this specific data

“The software occasionally struggles with context and may misinterpret or have difficulty grasping the subject matter,” Kelly said. “Therefore, it's crucial to review the responses for accuracy.”

Using keywords

Although keywords do not generate detailed ChatGPT responses, they can lead you in the right direction and save you time from crafting a specific prompt. Kelly has a set of standard keywords she uses in ChatGPT:

- Rewrite

- Create

- Review

- Develop

- Create an outline, step-by-step process

- Task with an example (mathematical, strategy, business plan etc.)

To research customers on ChatGPT, Smith uses keywords along with the company’s name to look for public filings such as news reports.

Although there are countless keywords used in the B2B credit profession, here are 10 keywords credit managers can use when interacting with ChatGPT:

- Trade credit

- Credit terms

- Credit application

- Credit risk assessment

- Credit analysis

- Payment terms

- Credit policy

- Credit limit determination

- Credit evaluation

- Credit scoring models

Asking questions

Rather than using keywords or short phrases to generate responses, try asking ChatGPT questions to get the answers you need. For example, Kelly frames her questions as such, ‘What are some best practices for managing…’ or ‘How does …’

Most of the time, ChatGPT prompts vary on a case-by-case basis. Credit professionals must ask more specific questions to generate relevant responses. Rousseau asks more complex, detailed questions like, ‘If you are being told XYZ, and you are a credit manager, how would you respond?’

Depending on the answer you get from ChatGPT, you can ask supplemental questions to get the right answer for you. “If something is not clear, I would ask to clarify what XYZ means,” Rousseau said. “Or if the answer did not address a portion of the complaint, I would want to revisit that part. It would really depend on how much I like the answer or not as well.”

The bottom line: To maximize the benefits of ChatGPT, credit professionals should continuously refine their questioning techniques and adapt to the responses received.

-

APRIL

29

3pm ET -

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minutes

-

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes -

MAY

7

11am ET

-

MAY

8

11am ET -

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary

-

A Grizzled Attorney Presents the Construction Law Battlefield Webinar

Speaker: Randall Lindley, Esq., Partner, Bell Nunnally

Duration: 60 minutes -

MAY

13

3pm ET