By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy:

Housing Market Shift—

It is hardly news that the housing market is local at its heart. At any given time, there will be hot markets and cold ones. The overall pace of housing has been slower of late, but there are still many places experiencing high demand. This may become a more common development as mortgage rates fall, but for now the prime motivators have been factors such as home price and where people are choosing to work and live. The mid-size city is on the rise for three reasons—the cost of living is lower, there is job expansion and there is a housing shortage that has been encouraging a lot of building. Some of the communities that have seen growth have been Grand Rapids, South Bend, Boise and Spokane.

Oil Prices Continue to Drop

It wasn't been long ago that oil price volatility was the dominant economic factor. Every geopolitical disturbance, every weather threat, every nuance of production would be enough to send prices soaring. Now, the turmoil in the Middle East has been intense, hurricane season has started and there are focused efforts by big oil producers to reduce output. Any one of these would be expected to cause price hikes, but these have been few and minor. The factor that seems to be holding prices down is global growth worries. The U.S.-China trade war has been the trigger for a general collapse in the world economy and with that collapse has come a reduced demand for oil. That means generally lower prices for oil and ultimately gas at the pump.

Is a College Education Still Valuable?

The short answer is yes—college graduates will still earn more than those without a college degree, but the value proposition has changed and weakened. The problem is college has become much more expensive and the prospects for college grads have narrowed unless they choose their course of study carefully. The college grad of today is paying almost 10 times what a grad paid 20 years ago and many are now taking the jobs that once went to people with high school diplomas. It basically comes down to what skills have been learned. The student who majored in accounting or engineering and the like will still come out ahead, but those with humanities degrees or generic business degrees have a far steeper income hill to climb.

Short Items of Interest—Global Economy:

U.K. Economy Is Shrinking

It has been assumed that the Brexit mess would catch up with the U.K. sooner than later; that time seems to have arrived. For the first time since 2012, the British economy is in recession. This has occurred sooner than had been expected. The sharp decline has been attributed to loss of business confidence, which developed since the elevation of Prime Minister Boris Johnson. The previous expectation was that somehow the EU and the U.K. would work out a deal. Now the assumption is the British will come crashing out of the EU in late October and the business and investment community have started to panic.

Is China Winning the Trade War?

In truth, the two nations are both winning some and losing some, but the numbers suggest China is doing a lot better than expected and is experiencing little of the pressure the Trump team asserts. Since the tariffs were imposed in 2018, the U.S. exports to China fell by over $33 billion (mostly farm output). Meanwhile, the Chinese exports to the U.S. have grown by $4 billion. The U.S. trade deficit with China is now worse than when Trump started imposing tariffs.

Concerns Regarding Norway's Economy

The value of the Norwegian krone has been falling again and is now at lows not seen in decades. The reason for this fall is the turmoil in the oil markets and the subsequent fall in the per barrel price. The Norwegian economy remains heavily dependent on oil. North Sea production is expensive—requiring per barrel prices at $75 or above to be profitable. This is not where these prices have been.

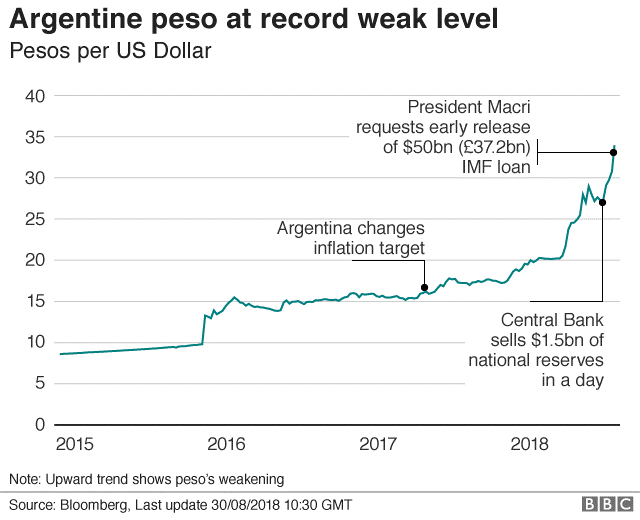

Argentina Lurches Back into Crisis

The latest election in Argentina shocked the sitting president and much of the region as Mauricio Macri was able to poll only 33% of the primary votes as compared to his populist challenger, Alberto Fernandez, who gathered 47%. At this point, it is clear that the populist would win the presidency in October's election. It was only a few years ago that Macri was hailed as the man who would rescue the nation from the disastrous economic policies put in place by his predecessor—Cristina Fernandez de Kirchner. Now, she is the running mate of the man who could win a first-round victory at the end of October (only 45% support is required). The population is not happy with the economic realities in Argentina and are blaming Macri for them. The voter now seems to believe that returning to the previous set of policies would be an improvement—all evidence to the contrary.

Analysis: The disaster that was the Argentine economy under Fernandez has apparently been forgotten as the new incarnation of that party is suggesting nothing new. The damage to the economy was extensive as exports plummeted, unemployment soared, debt levels rose dramatically and the country became an international financial pariah. Farmers grew so frustrated by the export restrictions that they destroyed their output rather than accept the prices set by the government. Wages fell, businesses went into bankruptcy and the value of the peso collapsed. The people around Cristina Fernandez were as corrupt as any seen in the country for decades and the entire nation was teetering on the edge of utter economic collapse. Macri had been the mayor of Buenos Aires and had been seen as clean and a reformer. Initially, his market reforms had the desired impact and the economy improved as international investment came back. The problem is global economics turned sour for the Argentine economy along with everybody else's.

Trade with Brazil fell off when Jair Bolsonaro won the election and as the Brazilian economy started to falter right away. The European market dried up as the eurozone nations saw growth fall to less than 1% and the U.S. has not picked up any of that slack. Then came the real death blow. The Argentine economy depends heavily on its agricultural exports. Over the years, the focus of that business has been China. The Chinese still buy from Argentina, but their slowdown has meant less demand for goods from all the nations that once supplied the rapidly growing Chinese market. The lack of an active export market has gutted the Argentine economy and there is very little that can be done about it.

The nostrums offered by the populists are the same as offered before. Taxes on the "rich" will be hiked. What that really means is the middle class, as the rich will either shelter their incomes or flee as they have in the past. The government will borrow heavily through the sale of bonds that will carry very high yields as they are considered very risky. The previous Fernandez government defaulted on bonds and only the most risk-tolerant will invest now, but not without forcing the government to offer very high interest rates that it can ill-afford to pay back—setting up another default. There will be export restrictions on farm output to ensure domestic food prices stay low, but it will not work out that way as the farmers will simply refuse to produce if they can't get paid. The last time this was tried, the farmers were expected to produce even though it cost them twice what they would be paid.

Global investors are already pulling back and the stampede will truly begin later in the year if Macri's numbers do not improve. There is one faint hope—that these primary numbers are really just protest numbers. The voter could be sending a signal of distress now, but will not want to return to the bad old days and will support Macri in the end. If one adds the 8.5% of the primary vote earned by the former Economy Minister Roberto Lavagna to the 32.7% for Macri one gets 41.2, just short of what the populists are getting. It all depends on how willing voters are to be fooled into thinking that failed policies from the past will work this time.

Guatemalan Leader Rejects Trump Plan

In the end, the vote was not even close as the center-right candidate won over 59% of the vote in Guatemala. The new leader will be Alejandro Giammattei—a 63-year-old doctor who has tried four times to win this post. He defeated the center-left candidate easily and in all parts of the country. Sandra Torres is the former first lady and was not really able to separate herself from her husband who was not popular when his term ended. Giammattei also had the full support of the military. The message was that he would be able to deal with the violent drug gangs—a promise that has been made many times in the past.

Analysis: He has already rejected the Trump plan that Guatemala become a holding area for those trying to seek asylum in the U.S. and is demanding a resumption of the aid the U.S. once sent to help fight the drug gangs.

Data to Watch for This Week

There will be several items of interest this week—data that will provide some insight into what is going on in the economy apart from all the recent drama over trade tirades and the uneasy markets. Of particular interest will be all the information on the behavior and attitude of the consumer. It bears repeating that the future of the economy is in the hands of the American consumer. This is true for the U.S. economy as well as the global. We are the undisputed champions of consumption—for better or worse. Everything in the typical American household is geared to buying more stuff—even though there have been some subtle shifts in the kind of things we wish to buy. If the consumer is in a good mood, the business community as a whole will soon be in a good mood as well. A shift towards caution and frugality, however, will result in an economic downturn of some kind.

Analysis: On Tuesday there will be the release of the latest Consumer Price Index. It is expected to signal low levels of inflation, but there is also an expectation that some prices will have started to rise. Last month, the index rose by 0.1%, but there was a major jump in the core rate (that which excludes food and fuel). It rose by 0.3%, the most significant rise since January of 2018. The core rate is still under the 2% level the Fed has set as a goal, so nobody will be alarmed by another slight hike in the inflation rate. But if this is the start of a trend, the assumption will be that there may be some return to normal inflation motivators. Thus far, there has been very little inflationary pressure from wages despite the very low rate of unemployment and there has not been all that much commodity-driven inflation either. Gas prices are still falling and will likely come down some more as the end of the summer driving season arrives. Tomorrow, we will get some idea as to what has been driving the little bit of inflation we are seeing now. The sense is it will be seen in services more than in goods. Down the road, there will be intense interest in the impact of tariffs. Up to this point, the tariffs have not affected consumer goods as much as they will in the future. There has been evidence that Chinese producers are swallowing the price hikes rather than risk losing market share. This is a tactic they can't maintain forever and there is a strong possibility that price hikes will start to show up soon.

Later in the week, there will be an even more telling piece of data available. This will be the retail sales numbers. For the last four months, there has been an increase in activity and across the spectrum of consumer purchases. This was somewhat expected given the high levels of consumer confidence, but there has also been a lot of angst about the impact of trade wars and other economic challenges. Each month, there has been an expectation of decline, but thus far the consumer has maintained their pace. This is the time of year retail activity gets critical as it is the start of the holiday season. The back-to-school sales have started up (earlier than ever now since school starts for most kids in mid-August). Thus far, they have been solid enough. The next big indication will be Halloween sales and Christmas stuff which has already appeared. The sense is retailers will be approaching this year with the same strategy used the last few. There will be somewhat limited inventory and the focus will be on early season sales. The emphasis will be on October and November and capturing the early shoppers. December will be left in the hands of the last-minute shoppers.

Two other releases on Thursday will provide more clues. The Labor Department will have information on productivity. The hope is the good news from the last report will continue. In June, there was a 2.4% jump in productivity year-over-year. This was the best number since 2010. If there is a repeat of that pace, there will be more confidence in the economy going forward. Much of the productivity gain seems to be coming from increased use of technology and robotics. That is a trend that will continue. There will also be data released regarding industrial production from the Federal Reserve. The improved industrial numbers last month were due mostly to the utility sector and to activity in the oil production area. Manufacturing has been down since the trade wars started as much of the U.S. manufacturing sector is pointed towards exports. It has suffered from both the tariffs and from the global economic slowdown. The data on Thursday will show whether the manufacturing sector is still slowing or has started to steady out. The betting is that there will have been further decline.

Has Minimum Wage Debate Become Irrelevant?

The issue of raising the minimum wage rate on a federal level from the current $7.25 to $15 has become a major political issue for both the Democrats (who favor the rise) and Republicans (who mostly oppose the rise). It has become part of all the stump speeches, but if one looks at the facts, this emphasis is puzzling. Of the 156 million civilian workers in the U.S., the percentage making minimum wage is .028%—roughly 450,000 people. Of that number almost 60% are under the age of 25 and almost 70% are part-time workers. In other words, the majority of employers are already at $15 an hour or above. This is due in part to state and local efforts to raise the minimum wage, but mostly due to competitive pressure at a time when the jobless rate is at a 30-year low.

Analysis: There is a much bigger labor issue and it is hardly new. The focus should no longer be on raising the minimum wage for a tiny handful of people, but should be on addressing the chronic shortage of labor. Nearly every sector is complaining of the same problem—too few people with the skills needed to take the many jobs on offer. The emphasis should be on training and creating the workforce needed. Thus far, the effort has been utterly haphazard and piecemeal. To put the issue in the starkest of terms—in 1945, there were 41 workers supporting every retiree. By 2030, there will be two. That is unsustainable, utterly unsustainable. It either means that workers will be taxed twice what they are now or benefits will be slashed to a bare minimum.

George F. Will Is a Smart and Funny Man

Most of the time, I am not able to stick around and hear the other speakers at a given conference as I am usually headed for the airport. This time, the schedule allowed for some lingering and I was able to hear the comments made by George Will. I have enjoyed his writing for years and find myself in agreement with him the vast majority of the time. He is really the kind of conservative I believe I qualify as. His fiscal concerns are ones I share and many of his social positions are also those I hold. Perhaps most important of all—he is an ardent baseball fan and has historical knowledge second to none. In his address to this group of people who work with the Federal Home Loan Bank, he made some very cogent points about the situation facing the country.

Beyond the idiocy that passes for economic policy, he commented on social challenges. There has been a real breakdown of the norms that once governed behavior and we are the poorer for it. I have commented and complained about this before, but rarely as eloquently as Will. The relationship is in peril in the U.S.—the relationship between man and wife, between parents and children, between friends, colleagues, neighbors and strangers. The patterns of the past were built on obligations, loyalty and patience. Today, they seem to be based on convenience and selfishness. Everyone seems to be thinking "what is in this for me," and all the time. The fact is that it isn't always about you or me. Much of what we do should never be about us but should be about what others need—our spouses, kids, friends, co-workers and even strangers. We really should put our needs last. For many years we seemed to do that. It seems that such sacrifice is now exceedingly rare.

Argentine Peso at Record Weak Level

The currency is already in trouble and the latest election results are not going to help. The peso fall should help the nation's exports, but that has not been the case before as the nations Argentina sells to are not buying in the volumes they once did. That is not changing anytime soon regardless of what happens to the peso value.