April 18, 2024

Unleash your leadership superpowers

Kendall Payton, editorial associate

Every iconic superhero knows their strengths and weaknesses—and the best leaders are no different. Unleash your leadership potential and discover your own powers, whether you have the agility of Spider-Man, the wisdom of Yoda or the intellect of Batman.

Why it matters: Every leader possesses a unique set of strengths that, when understood and harnessed effectively, can propel them to greatness.

A team is only as good as the leader they follow. It is important to reflect on your role as a leader because you can either be a catalyst for team growth or a barrier.

Assessing your strengths is the first step to becoming an effective leader. You must evaluate who you are as a collaborator and communicator.

Transparency also plays a significant role in trust. When you are open with your team about the organization’s challenges and triumphs, it becomes easier for each team member to recognize their role and contribute accordingly. Leaders must learn how to balance transparency and privacy.

Does your team feel empowered enough to make day-to-day decisions that impact their job? Do they take accountability for their work product? Both play into the idea of being invested in what the vision is.

Encourage opportunities for your team to take risks and be innovative. The natural ebbs and flows of work can present opportunities for everyone to try new things. Whether it is taking on a new task, or even juggling multiple at once, giving your team a chance to push themselves helps build more trust in your relationship.

“When I put my team together, I chose individuals who are strong and can handle things under stress,” said Cindy Fredericksen, senior credit and collection manager at Regal Rexnord Corporation (Wausau, WI). “Being in the credit and collections world is one of the most difficult functions in a company. To succeed, you must sell products, but customers also must pay for it, so it’s fine to keep that balance between sales and cash flow. It can be very difficult when you’re dealing with sales, customer service and everyone trying to get orders out.”

Credit managers must partner with other business functions and avoid being viewed as the anti-sales department. “Showing that restraint as a leader is important to make sure you are teaching your team that you are partnering with the business and not trying to be the negative department not allowing them to sell,” Fredericksen added. “As a leader, it’s very important to have a strong character.”

Yes, but: As all superheroes have their strengths, they also have their kryptonite.

Leaders must know how to both cope with change and the best way to communicate that change with their team. Any time you deal with new challenges or workflow disruptions, you must guide your team to overcome the obstacles.

Sharpening your skills as a leader is a great way to challenge yourself. For example, education through webinars, certification programs or workshops are all ways to do so. NACM’s Executive Leadership Workshop at Credit Congress will equip both teams and leaders with the essential tools and strategies to navigate change successfully. It will empower participants to embrace change, build a change-oriented mindset, and foster a collaborative environment to lead their teams through transitions effectively.

Jen Martin, director of credit at Carter-Jones Companies (Kent, OH), is looking forward to learning new effective ways to lead at the Executive Leadership Workshop. “I’m looking for new ideas on how to share a vision and engage the stakeholders of that,” she said. “I’m eager to learn how to speak to a variety of audiences and get everybody on that same ship going the same direction. On a personal level, I look forward to connecting with other leaders and having casual discussions about the challenges they face, how to approach them and what ideas they have as well as a level of camaraderie!”

The bottom line: Effective leadership requires understanding and harnessing one's unique strengths, fostering transparency and accountability within the team, adapting to change, and continually seeking opportunities for self-improvement and innovation.

ChatGPT: Revolutionizing credit industry operations

Jamilex Gotay, editorial associate

AI and automation tools, like generative AI chatbots, have transformed business operations. ChatGPT, the AI-driven chatbot developed by OpenAI, is revolutionizing the industry with its user-friendly interface and unprecedented human-like responses.

Why it matters: Understanding the impact of ChatGPT in the credit profession is essential as it can reshape business operations and risk management.

ChatGPT has helped companies streamline processes and enhance workflow, saving time from mundane tasks to focus on crucial company tasks. With its instant information generation, ChatGPT is a valuable tool in business for customer service, workflow automation, optimization and marketing.

By the numbers: Despite ChatGPT's growing use in business, its integration into the B2B credit industry is notably slower. According to a recent eNews poll, 53% of credit professionals do not leverage ChatGPT at work. Of those who do, most use it to generate responses to customer inquiries (35%).

- While 23% use it to research customer information

- 13% use it to analyze financial data

- Only 10% use it to help with writing and reviewing legal documents

Generating Responses

ChatGPT can assist credit professionals by improving responses to common customer queries and issues, reducing response times and increasing overall customer satisfaction.

For some credit professionals, ChatGPT has significantly improved their efficiency by streamlining communication processes and ensuring consistency in their correspondence.

“ChatGPT assists us in crafting prompts and accurate responses to customer inquiries, enhancing our customer service,” said Joshua Nolan, CCE, senior director of financial operations at PrePass (Phoenix, AZ). “The AI's ability to understand and generate relevant responses has helped us handle a higher volume of inquiries and tasks effectively.”

Research Customers

ChatGPT can speed up research by summarizing articles, responding to questions and extracting insights from large text data. It's useful for extracting key information from academic papers and reports.

Credit professionals have leveraged ChatGPT to research customer information in their credit investigation. A process that once took weeks or even months can be shortened to less than a week.

Chantal Rousseau, CCP, corporate credit director at MPG Canada (Brossard, QC), says that her department uses ChatGPT to research customer information such as finding the relation between two entities or the owner of a corporation. “ChatGPT quickly provides the information I need, saving me from sifting through repetitive content on multiple websites,” she said. “Not that I trust 100% of what it gives me, but usually if the information is available somewhere, it's going to pull it up and then it's easier to confirm that part than just to find the exact information.”

For Nolan, ChatGPT helps him gather relevant information about customers, enabling better decision-making. “It has a quick response time and the ability to provide accurate information makes it a valuable tool for our team,” he said. “Although we have tested it for solving equations, we do not use it on a regular basis.”

Writing Letters

One of the most efficient aspects of ChatGPT is that it can assist in generating high-quality content. It can provide ideas, drafts and suggestions for improvement when it comes to writing.

Elliott Jenneman, CCE, regional credit manager at McNeilus Steel Inc. (Dodge Center, MN), uses ChatGPT to help write emails, contracts and dunning letters for customers. “I would type up what I want to say and have AI give me some ideas or rewrite it for me,” he said. “I'll give instructions such as, write more professionally or write in a friendlier tone or proofread this for spell checks. I usually pick and choose from a variety of styles, but I never just copy and paste. I may just pull a line or two or write similarly in my own words because I like what I wrote better.”

Rousseau's new ERP system includes a functioning credit and collection module, enabling automatic customer reminder letters. “I would type, I need one letter for this timeline with this information, and it would write five letters I needed,” she said. “I adjusted a few aspects to fit our industry better. It's beneficial for writing professional content without spending too much time.”

Although he isn’t using ChatGPT on an official basis in his department, Martin Smith, CCE, CICP, credit manager at Ash Grove Cement Company (Sumterville, FL), uses it strictly to write letters to his customers. “I input very specific information into ChatGPT, and it'll take those sentiments and generate a collection letter with a greater impact than what I would typically do.”

Financial Analysis

ChatGPT can simplify data analysis and report generation, making it more accessible across an organization. It's useful in identifying trends in internal company data.

Jenneman says he’s used ChatGPT to solve equations and financial analysis to detect fictitious data a few times before. “As a trial, I multiplied customer data by some factor to see if I could get the answers I'm looking for,” he said. “But I’ve never used it to research customer information and I'm very hesitant about uploading any kind of customer-related stuff into it at all.”

While ChatGPT is a valuable tool, it may not be suitable for tasks requiring complex analysis or decision-making, Nolan said. “It is important to use human judgment and expertise in conjunction with AI tools to ensure accurate and reliable results.”

Creating an AI Policy

As you can see, ChatGPT, while innovative, has room for improvement. It quickly delivers confident answers but doesn't disclose its information sources. It also uses web-scraped data to generate its responses and prompts. It could increase the risk of spreading misinformation and promote bias, experts say.

Credit departments that regularly use ChatGPT should consider implementing an AI policy to safeguard against potential risk—or at least add a set of AI regulations to their existing credit policy.

“I think it would be important for businesses to have a policy around AI,” said Eleanor Hartman, CCE, credit manager at Autodesk, Inc. (Portland, OR), who does not use ChatGPT at the workplace. “Chatbots create a self-referential loop, sourcing themselves for more data and answers that can quickly become a cesspool of information. Everyone must exercise caution when navigating AI and ChatGPT, as it has its limitations and may appear capable of certain actions when it is not.”

Having a policy around AI and ChatGPT usage is essential to ensure responsible and ethical use of technology. “This policy should outline guidelines for the appropriate use of ChatGPT, including data privacy and security measures, as well as protocols for verifying information generated by the AI,” Nolan said.

ChatGPT may not suit everyone. “ChatGPT, from an efficiency standpoint, slows things down in my department,” Jenneman said. “If I’m having trouble writing a letter to a customer, it would take more time to write it and work with ChatGPT to find a way to say it better than writing it myself.”

The bottom line: Despite the increasing use of ChatGPT in various industries, the integration into the B2B credit industry is notably slower.

Understanding personal guarantees in construction credit

Jamilex Gotay, editorial associate

A personal guarantee, a legal commitment where an individual pledges to cover the business's debts if the loan defaults, has become a significant tool in the credit industry.

- By facilitating lending and financial transactions, it provides additional assurance to creditors.

- Most notably in construction credit, personal guarantees have become part of the credit application.

Why it matters: Grasping the significance of a personal guarantee is vital as it boosts creditworthiness and trust in finance and is now essential in sectors like construction for credit applications.

Typically, a personal guarantee (PG) is required for Small Business Administration (SBA) loans and many online and traditional loans. But even if a business is creditworthy and meets all business loan requirements, a lender (or creditor) will often want extra assurance that they will fulfill their financial obligations.

If a business fails to keep up with loan payments and the creditor starts to enforce the personal guarantee clause, it could trigger financial repercussions and potentially lead to a court case. If the business can't cover expenses, the creditor can initiate legal action to seize personal assets for debt repayment.

Cross-corporate guarantee

A PG is not to be confused with a cross-corporate guarantee—an arrangement between two or more related companies to provide a guarantee to each other's obligations. This guarantee is mostly made between companies trading under the same group or between a parent company and its subsidiaries.

What they’re saying: “Credit professionals are able to go after the principal owners of the company or whoever signs that personal guarantee, personally for the money,” said Chris Ring of NACM’s Secured Transaction Services (STS). “That’s why when the customer signs a credit application, there's a separate part for a personal guarantee.”

Isaac Kotila, credit support manager at Insulation Distributors Inc. (Chanhassen, MN), says that his department uniquely uses a stand-alone personal guarantee within a stand-alone credit application. “After the customer agrees to our terms and conditions, our warranty information and signs on our credit application, they need to look at the PG section and sign that too,” he said. “Depending on the organization, there will be some pushback on the PG because they don't want to risk losing their personal assets. But if we aren’t confident in their ability to pay, we’re most likely not going to do business with them.”

For larger organizations, whether that’s a corporation with multiple entities involved or a board that oversees the whole business, Kotila can work around the PG as it isn't applicable to how the customer’s business is structured. “But for the most part, we look at a personal guarantee as a guarantee for payment,” he said.

The bottom line: Personal guarantees provide extra assurance to creditors—boosting trust in finance, particularly within sectors like construction; however, they carry potential financial risks if loan payments are not met.

Checking all the boxes.

“This has been my goal for a while as the CCE is a very prestigious designation to have behind your name,” Lorielle Champagne, CCE, regional credit manager at H&E Equipment Services, Inc. (Arlington, TX).

Read more...

Achieving credit success.

“The CBA gave me more knowledge and confidence that I needed to jump into the credit world,” said Heather Will, CBA, credit manager at Anchor Industries, Inc. (Evansville, IN).

Read more...

Bridging the Gap: Automation Solutions for Staff Shortages.

On the latest episode of NACM's Extra Credit podcast ... Automation not only helps with staffing shortages, but it can attract the new generation of credit managers.

Read more...

Beyond the invoice: The changing landscape of B2B payments

Jamilex Gotay, editorial associate

Gone are the days of cash and checks, as payment methods have taken a leap into the future. Last year, we surveyed credit professionals on customer payment methods from most to least common. Checks topped the list, closely followed by Automated Clearing House (ACH) payments.

Why it matters: As technology progresses, B2B payments will evolve, replacing traditional methods.

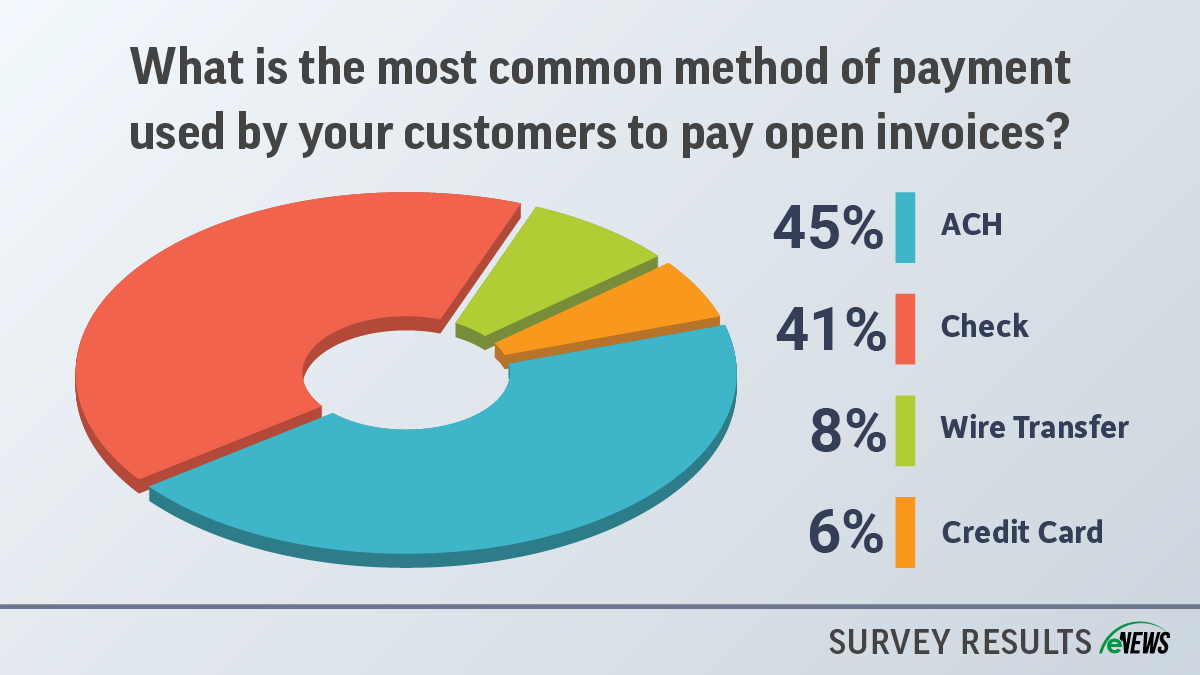

By the numbers: A recent eNews poll revealed that most B2B customers use ACH to pay open invoices as compared to last year when the majority used paper checks.

ACH transactions, also known as electronic checks or direct deposit payments, allow businesses to pull funds from the buyer’s account and deposit them into the seller’s account.

ACH payments are safe, reliable and efficient for recurring payments. They are cost-effective and allow customers to initiate payments.

Mark Sciortino, credit manager at Kodiak BP, LLC dba Carpenter Contractors of America, Inc. (Belvidere, IL), notes an increasing number of customers adopting ACH payments to reduce their transaction costs. “For them, it eliminates the need for processing and tracking paper checks,” he said. “As far as our benefits, we get the check on the same date for each payout, which greatly helps us with doing our cash projections and eliminates concerns about snail mail and lost checks.”

The drawback of businesses accepting ACH payments is the need to validate customers’ bank details for correct fund transfer.

- Convincing customers to provide sensitive banking information for ACH setup can be difficult.

- If a customer disputes a transaction or experiences unauthorized activity, they may request a reversal, which can impact a business’s cash flow and require additional resolution efforts.

Checks are the second most popular customer payment method due to their familiarity and comfort for customers and employees.

“For many customers, it could be that they've always sent by check, so they want to continue to do that until they're absolutely forced to do something different,” said Jeff Cozad, business manager at Patz Corporation (Pound, WI), whose majority customer base pays via check.

The largest complaint is that paper checks carry a higher risk of fraud, including issues such as counterfeit checks or altered payment amounts. Cozad reminds customers to use alternative methods such as ACH payments as a faster, safer alternative to mailed business checks due to fraud risks.

Credit cards have become increasingly common in B2B trade. “Over the last few years, I’ve seen the use of credit cards increase, in many cases, eclipsing ACH and printed checks,” said Chris Bergstrom, credit manager at Traco Manufacturing, Inc. (Orem, UT). “The biggest advantage is instant cash flow, which helps us meet our obligations to vendors.”

Jaxx Sinn, credit specialist at Northwest Cascade, Inc. (Puyallup, WA), accepts various methods of payment, including ACH, checks and cash. However, credit cards are the preferred method for her customers. “That is because payment or refunds are instant and cards can be arranged for automatic transactions streamlining payments or saved to quickly process payments,” she said.

Credit card payments, while handy, often incur high fees for businesses. According to an Invoiced article, interchange fees typically comprise around 80% of the processing costs for each transaction. Assessment fees make up roughly 10% of all processing costs while credit card processor fees make up roughly 7% of processing costs.

Customers can request chargebacks if they claim goods were never received, were different than described, damaged or purchased without their authorization. This complicates the collection process further for creditors.

Wire transfers, direct payments between two banks, remain one of the lowest-ranking payment methods in B2B trade. One of the main reasons is that wire transfers often incur transaction fees that vary based on the banks and currency used. These fees can be higher compared to other payment methods, potentially reducing the transaction's profitability.

Also, wire transfers rely on the stability and availability of banking systems and infrastructure. Technical issues, system downtime or holidays can affect the ability to send or receive wire transfers, potentially causing delays in payment processing.

Despite the disadvantages, wire transfers are useful for high-value transactions because they allow you to transfer large amounts of money at a time. “My customers are mostly from the Caribbean, Central and South America, who mostly pay by wire transfer,” said Denise Bonnet, CICP, regional credit manager at Daikin Applied Latin America, LLC (Miami, FL). “Very few pay by ACH and the ones that do are because their corporate offices are located in the U.S., Puerto Rico or the Virgin Islands.”

Bonnet has had customers switch from wire transfers to credit cards during the last days of the month. “This usually happens when they are short of funds and need the equipment order to be processed or sent for production,” she said.

What’s next: “Many financial institutions are making it easier for companies to use one-time payment cards,” Bergstrom said. “I see the use of such cards as only increasing in the future.”

Single-use credit cards, also known as virtual or disposable credit cards, provide multiple alias numbers for your existing account, concealing your real account number from merchants. Your bank's website or apps generate these numbers for online and occasionally phone purchases.

Bergstrom also predicts that many companies will be using merchant cards, or a card issued to the company that can only be used for specified amounts. “This is especially true for companies that pay us through a third-party accounts payable service, like bill.com,” he said. “It seems more common now that many of our customers are relying on new technology for their payables.”

Some companies are transitioning to integrated payables, a secure online payment solution that streamlines payment processing and management, enhancing cost savings, visibility, control and business growth. How it works:

- Integrated payables solutions integrate with your accounting system.

- Once invoices have been approved for payment, IP solutions will retrieve the payments information from your ERP system, collect money from you to facilitate payments, and disburse payments on your behalf.

- This enables customers to manage payables through a unified workflow, ensuring timely, accurate payments and consistent data reconciliation across all payment types.

The bottom line: The shift from traditional payment methods such as checks to more advanced ones like ACH and credit cards is inevitable in the B2B sector due to technological advancements, despite their respective advantages and drawbacks.

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

-

MAY

13

3pm ET -

A Grizzled Attorney Presents the Construction Law Battlefield Webinar

Speaker: Randall Lindley, Esq., Partner, Bell Nunnally

Duration: 60 minutes

-

The Economic Outlook for China and the Rest of Asia-Pacific

Speaker: Louis Kuijs, Chief Economist, Asia Pacific at S&P Global Ratings

Duration: 60 minutes -

MAY

17

10am ET