March 28, 2024

Audit season: A guide for credit managers

Kendall Payton, editorial associate

Audits are designed to ensure all financial reports are knowledge-based, factual and follow regulatory guidelines. The auditing process is important as it presents credibility to a set of financial statements—giving both shareholders and the company confidence in the fairness of all accounts. It can also help to improve a company’s internal controls and systems as a resource to better processes and find efficiencies in them.

Why it matters: Based on the auditing and internal control requirements imposed by the Sarbanes-Oxley (SOX) Act of 2002, executives must certify financial statements and companies must maintain internal controls to prevent fraud. SOX prohibits outside auditors from having financial relationships with the companies they audit.

It is nonnegotiable that credit managers complete their own due diligence. As someone who started her career in auditing for commercial credit, Brooke Wilson, ICCE, region credit manager at Volvo Penta of the Americas (Chesapeake, VA), said it is important for credit professionals to truly understand the process of auditing.

What they’re saying: “It not only opens doors to seeing things from a different perspective and then helps you with being a credit manager, but it also creates more awareness in what you need to look for and understand when evaluating someone or a customer in that respect,” Wilson said. “While we may not all enjoy being audited, in some ways we are auditors ourselves. Whether we’re reviewing documentation or noting process and procedures, it’s the same as looking at an internal control’s perspective or auditing for fraudulent activity.”

All auditors have the purpose of looking for proof that your report of revenue or records match what they find themselves. Some auditors may even ask customers directly to confirm. “Sometimes auditors may ask us to provide an invoice copy or proof of delivery to show that we provided the product and then proof of payment to show that the customer paid it,” said Kelly Simon, CCE, senior credit and collections manager at Outdoor Research (Seattle, WA). “Auditors will take a look at inventory and if it is represented accurately and everything is proofed then there would be audited financial statements.”

Yes, but: The overall purpose of auditing is an obligation—but here are a few dos and don’ts for credit professionals when it comes to the auditing process.

Do

Communicate clear expectations to the auditor. It is essential to communicate what you can without volunteering too much information. Though it may be a fine line balancing both sides, holding back key information can lead to serious legal repercussions in the future.

“There has to be some sort of rapport with the auditor to garner a sense of trust,” said Denise Moller, CCE, ICCE, credit manager at Agri-Fab, Inc. (Sullivan, IL). “You may experience different auditors with different experience levels, so communication skills are essential for no matter who shows up.”

Be transparent. Following clear communication, transparency within that communication is also essential. If you act evasively or try to be protective, it can create a trust issue. You want them to know you’re being upfront and honest with your information. In addition to looking at credit lines, policies and procedures and seeing if you do what you say you’re doing in assessing customers, auditors will also check to make sure you are following your process of delegation of authority (DOA). For example, if someone is signing off on credit terms outside of their DOA.

Don’t

Don’t answer questions that aren’t asked. When faced with questions from auditors, the instinct may be to provide as much information as possible to ensure transparency and cooperation. Volunteering extra information beyond what is explicitly requested can potentially open a Pandora’s box of inquiries and complications.

Don’t get too comfortable. When you’re too comfortable with an auditor or the auditor is too close it can create a blind trust—leaving the door open for someone or something to be taken advantage of. “Across the board, trust and respect should be given regardless, and leading with respect is important,” Wilson said. “However, if there is that rapport, then they know that they will get quality work or the information they need. It’s a good learning opportunity for my team to see what auditors ask for and why they ask for it. It’s important that even when auditors are not here, we continue to uphold these processes and abide by guidelines and rules. Ultimately, they are here to protect us and the company.”

The bottom line: Credit professionals must understand the auditing process to better oversee transactions and ensure due diligence.

US economic update: It’s a matter of perspective

Jamilex Gotay, editorial associate

The U.S. economy kicked off 2024 powerfully. Business activity, labor markets, sentiment and inflation indicators have been trending favorably. Yet, we must stay vigilant as rising consumer debt and high interest rates threaten to slow down economic growth.

Why it matters: Understanding these economic trends is crucial as they influence our strategic planning, business decisions and potential growth trajectories.

While headlines and statistics often present a seemingly clear picture, the reality is that interpretations can vary significantly depending on one's perspective.

Economists anticipate steady progress on inflation in the upcoming quarters, despite potential hurdles. As supply chains recover and housing and service-related price pressures gradually ease, they remain optimistic.

“Notably, services demand should cool as consumer spending wanes,” The Conference Board reports. “We expect headline personal consumption expenditures (PCE) inflation to hit the Fed’s 2% target in Q3 2024. This expectation will trigger rate cuts starting in June 2024. We anticipate four 25 bp cuts this year (100bps in total) and an additional four 25 bp cuts in 2025 (100bps in total).”

The Federal Reserve (Fed) announced at its March 2024 meeting that it would maintain the overnight federal funds rate at the current range of 5.25% to 5.5% in its continued attempt to curb inflation.

Persistent labor market tightness over the past year is expected to continue, despite a slowing economy. This is largely due to a shrinking labor force as Baby Boomers retire, making businesses less likely to lay off workers.

By the numbers: According to the Bureau of Labor Statistics (BLS), nonfarm payroll employment rose by 275,000 jobs in February and the unemployment rate increased to 3.9%.

- Revisions to December and January's employment gains reduced the cumulative job count by 167,000.

- “Average hourly earnings were up by 0.1% in February and 4.3% over the year,” the report reads.

Bankruptcy filings increased substantially in 2023, a trend which has continued into 2024. U.S. filings rose by nearly 17% and business filings by 40% in 2023. Last month saw a 22% surge in overall filings and a 48% jump in business filings from February 2023, according to Epiq Bankruptcy and the American Bankruptcy Institute.

Global bankruptcy filings have also increased, although at a more modest rate of 7% by the end of 2023, according to an Allianz Trade report.

Credit professionals should expect continued elevated business distress throughout the remainder of 2024 across several key industries. “Although healthcare and other consumer-facing industries will remain in the headlines, the restructuring industry continues to keep a close eye on commercial real estate,” said Justin Kesselman, partner at ArentFox Schiff LLP (Boston, MA). “Commercial tenants, landlords and lenders are stuck in a tripartite struggle. Tenants aim to cut costs, but landlords can't offer rent reductions due to stricter banking credit terms. Without significant economic shifts, this commercial real estate stalemate could create distress for all parties involved.”

Consumers remained cautious in February, with retail sales rebounding less than expected following their January plunge, according to EY Parthenon. “With employment and household income growth softening, costs remaining elevated and interest rates only gradually easing, consumer spending is expected to grow a more modest but still respectable 2.0% in 2024,” the report reads.

The Fed's rate hikes have a potent, delayed impact and we're nearing the peak effect of these increases, said NACM Economist Amy Crews Cutts, Ph.D., CBE. “Businesses are concerned about decelerating disinflation, which means prices are rising but at a slower pace, not deflation where prices fall,” she said. “This creates a disconnect between economists and consumers. People are upset because even though inflation is decreasing, prices aren't.”

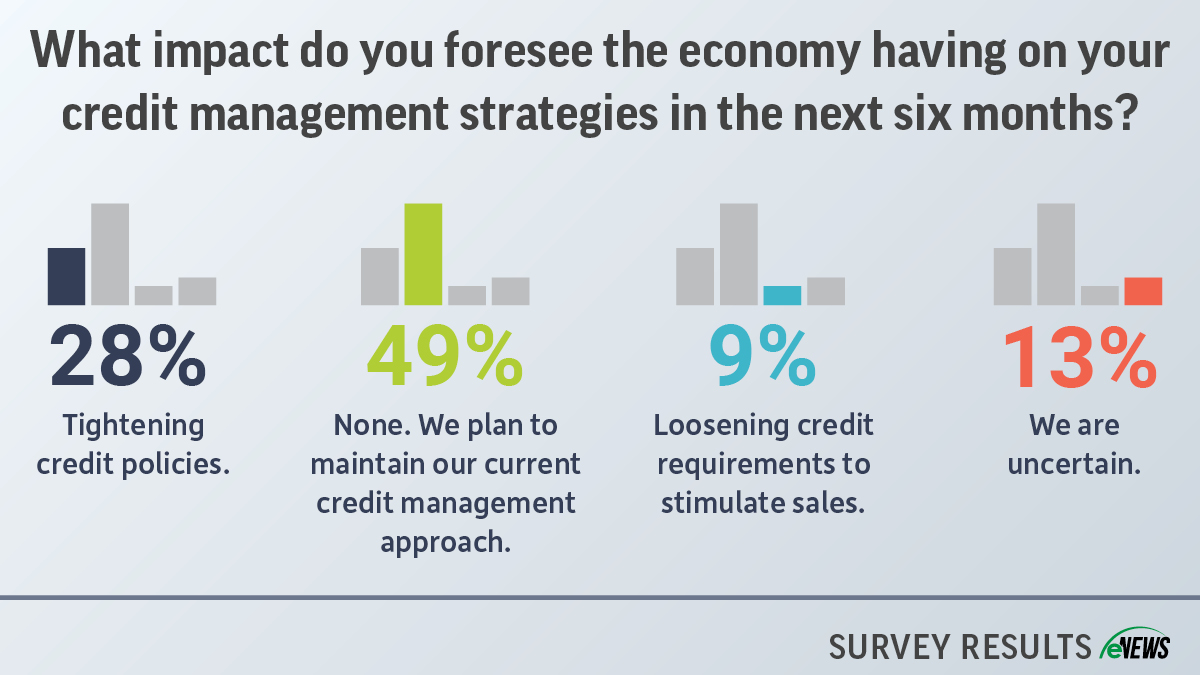

What credit professionals are saying: A recent eNews poll revealed that nearly half of credit professionals do not foresee the economy affecting their credit management strategies in the next six months.

- 28% plan to tighten their credit policies

- 9% plan to loosen credit requirements to stimulate sales

- While 13% say they are uncertain of the effects

Scott Dunlap, director of credit and collections at Coleman Oil Co. (Lewiston, ID), is optimistic about the direction of the economy and plans to loosen credit requirements to stimulate sales. “I recognize that inflation is rising, and the cost of living is outpacing wage growth,” he said. “This seems to be counteracted by a trend favoring smaller businesses over larger ones. These smaller enterprises often offer superior and more tailored services, which could help restore equilibrium in the long run.”

This optimistic attitude is echoed by Martin Zorn, managing director, risk research and quantitative solutions at SAS Institute Inc (Honolulu, HI), who says liquidity remains very high whether that's bank lending or access to capital markets. “Companies can continue to get the funding they need in a fairly stable economy over the next couple months,” he said. “An increase in commercial real estate defaults can cause an increase in bank failures, then you have the risk of your access to capital, especially for small to mid-sized businesses being negatively affected.”

What’s next: “While we no longer forecast a recession in 2024, we do expect consumer spending growth to cool and for overall GDP growth to slow to under 1% over Q2 and Q3 2024,” The Conference Board reports. “Thereafter, inflation and interest rates should normalize, and quarterly annualized GDP growth should converge toward its potential of near 2% in 2025.”

EY Parthenon sees two prominent downside risks heading into 2024:

- Potential inflation surges due to oil price hikes, tariffs or supply chain issues.

- Increased interest rates due to stricter monetary policy or fiscal sustainability worries, resulting in tighter financial conditions and reduced private sector activity.

The bottom line: Despite a strong start to 2024 for the U.S. economy with favorable trends in business activity, labor markets and inflation indicators, rising consumer debt and high interest rates pose a threat to economic growth. This, coupled with potential hurdles such as increased bankruptcy filings and cautious consumer spending, necessitate vigilance in strategic planning and decision-making.

The basics of lien waivers: four types and when to use them

Kendall Payton, editorial associate

A lien waiver is a legal document that relinquishes a party’s right to claim a lien on a property or asset. It is commonly used in construction projects, where subcontractors or suppliers may have a right to place a lien on the property to secure payment for their services or materials. By signing a lien waiver, these parties agree to waive their right to file a lien against the property in exchange for payment or other consideration.

Why it matters: The process of filing lien waivers is traditionally labor-intensive and riddled with manual tasks. Before signing a lien waiver request, credit managers should carefully consider several key factors to ensure efficiency and compliance.

Movement of money: Once the general contractor (GC) gets paid, they pay the subcontractor and the subcontractor pays the material supplier. For each party to ensure they receive their money, many will waive their lien rights due to two main factors: one being a time consideration.

The second factor is a money consideration. Many banks use waivers to ensure that once their funds are released, the property owner is paying downstream general contractors, subcontractors and material suppliers.

It's essential to understand the varying types of lien waivers and their implications:

- Conditional lien waiver on progress payment. This waiver is issued by the contractor or subcontractor when receiving a partial payment for work completed up to a progress point in the project. Lien rights are waived when payment is received—and are typically used when projects hit significant milestones, such as laid foundation.

- Unconditional lien waiver on progress payment. Given when a GC or subcontractor receives partial payment for the work completed. The lien rights are waived as soon as the document is signed and is typically used when the payment does not require further confirmation.

- Conditional lien waiver on final payment. Issued when a contractor or subcontractor receives the final payment for the completed project, however, it includes a condition that the waiver is valid only after the payment clears the bank.

- Unconditional lien waiver on final payment. Given when a contractor or subcontractor receives final payment and waives their rights immediately without any conditions.

Yes, but: Lien waiver documents are supposed to be easily interpreted, one to two-paged documents that are free of legalese difficult to digest. However, in some cases, the lien waiver sent by the owner, or the GC could have more legalese included than needed. So, when completing a lien waiver, special attention to detail is needed. “I’ve seen some waivers printed on both sides of legal-size paper in an 8-point font, filled with legalese,” said Chris Ring of NACM’s Secured Transaction Services. “The party who has received the waiver is more than likely to be confused and will hire a lawyer to tell them what’s being presented, and that’s not how the process should be. It’s best to double check for indemnify clause language as well. That’s where the art of dealing with these waivers comes in.”

What they’re saying: Not using lien waivers correctly or at all opens the door for potential fraud. Lien waiver forms help mitigate risk and exposure by ensuring controls are put in place to verify payments have been made. Period of performance, waived dollar amounts, and authorized signatures should be aligned with contractual agreements put in place. It’s especially important to pay attention to invoices of costs covering materials and supplies that may need waivers due to no on-site presence.

“Each monthly draw that isn’t accompanied by a lien waiver will increase the financial risk for the general contractor as the amount of funds issued increases,” said Isaac Kotila, credit support manager at Insulation Distributors Inc. (Chanhassen, MN). “When we don’t see lien waivers, I do run into instances where the subcontractor was paid for the project but never paid us for the material we supplied. When the deadline is reached to file the mechanics lien or bond claim if the subcontractor doesn’t have those funds available to pay the suppliers balance, the GC will either have a lien or a bond claim filed on their project, or they will need to pay the supplier directly for the material, essentially paying twice to avoid either filing on the project.”

Credit professionals in the construction industry apply lien waivers in the project development process differently—and some are changing how they use lien waivers. “Currently, we only use them on jobs where we are doing the work, however, I have been making a push here to use notices on all large projects where we are the supplier of material,” said Mary Beth Owens, CICP, credit manager at Keene Inc. (Cleveland, OH). “It is very important as a supplier of material to ensure that we have maintained our lien rights on a construction project. We use a job sheet that our customer completes which identifies who the GC and project owner is, the exact location of the job, the expected exposure we will have and the time we anticipate the job being completed.”

Being time-efficient is essential in construction projects, and there are a few ways to optimize your process. First, it’s important to update all your customers consistently about payment schedules, like waiver status and completed work. Secondly, having a centralized system will help all parties access any updates from their lien waiver information in real time—collaboration is key in optimization. Lastly, training your team on how to be involved in the lien waiver process is essential and falls under compliance.

“We use a third-party service to file our notices,” Owens said. “Since this is only a small segment of our business and I am a department of one, I want to make sure the waiver is being properly executed and filed in the appropriate places. There’s a higher risk when you don’t use waivers correctly. You may have the best customer in the world, but if they don’t get paid for a job, your chances of getting paid for the same job on a timely matter is in jeopardy.”

The bottom line: Lien waivers, essential in construction projects for financial risk management and ensuring payments, should be used efficiently with attention to detail to avoid risks and potential legal issues.

Checking all the boxes.

“This has been my goal for a while as the CCE is a very prestigious designation to have behind your name,” Lorielle Champagne, CCE, regional credit manager at H&E Equipment Services, Inc. (Arlington, TX).

Read more...

Achieving credit success.

“The CBA gave me more knowledge and confidence that I needed to jump into the credit world,” said Heather Will, CBA, credit manager at Anchor Industries, Inc. (Evansville, IN).

Read more...

Bridging the Gap: Automation Solutions for Staff Shortages.

On the latest episode of NACM's Extra Credit podcast ... Automation not only helps with staffing shortages, but it can attract the new generation of credit managers.

Read more...

Tailored study methods for NACM courses

Jamilex Gotay, editorial associate

In the pursuit of academic excellence, understanding how to effectively study is paramount. From late-night cram sessions to meticulously planned study schedules, each embarks on a unique quest to uncover the methods that yield the greatest results.

Why it matters: Grasping the nuances of one's study methods can significantly enhance learning efficiency and productivity, fostering a more conducive environment for personal growth and professional development.

Prepare

To accomplish anything, especially in education, you must actively prepare. According to Harvard University, students who are mentally prepared for class and know what to expect from the day’s schedule can be more attentive and focused on course material.

Knowing what to expect and preparing adequately will empower you to successfully complete any exam, course or educational program you pursue. “Due to my high anxiety about taking tests, the three-month delay between the end of our graduate program and the exam for the Certified Credit Executive (CCE) designation was a good amount of time for me to prepare, organize my study materials and make flash cards and really focus on the end goal,” said Erin Stammer, CCE, vice president of credit at PNW Railcars, Inc. (Portland, OR).

Stammer successfully passed the final CCE exam after completing the Graduate School of Credit and Financial Management (GSCFM), a hybrid program that covers four essential business and professional growth disciplines: Advanced Financial Statement Analysis, Legal Environment of Credit, Advanced Negotiations and Leadership. Not only was the graduate program a success, but Stammer became the recipient of the peer-elected GSCFM Student Leader Award for 2023.

Stammer advises that students purchase the books recommended in the courses. “I read through the book and reviewed chapters that we hadn't gone to in-depth during class,” she said. “I also spent time on areas that I wasn't sure of until I felt more confident that I had mastered them.”

Manage Your Time Wisely

Effective time management enables individuals to achieve their goals, reduce stress and maintain a healthy work-life balance. One way is to create a study plan, or an organized schedule outlining study times and learning goals. Students can create a weekly study schedule, incorporating quizzes, tests and exam dates, along with paper and project deadlines.

Tina Rodgers, CBA, credit manager at Spartan Chemical Company, Inc. (Maumee, OH), created an organized schedule with time set aside to study for her Credit Business Associate (CBA) exam. “I used various study materials such as the live Zoom meeting for exam review,” she said. “On the NACM website, I used the practice exam and downloaded the recorded CBA exam review.”

Andrejs Semjakins, CICP, global credit analyst at BioMarin International Ltd (Portmarnock, Ireland), made use of days off to catch up with course material for his CICP. “If you're falling behind, use your breaks so that you can go through the most difficult modules again and redo the quizzes to refresh your memory.”

Make sure your study schedule is realistic and fits into your schedule, increasing comprehension and retention. “Try to study in 20- to 30-minute bursts at a time up to the final exam for at least 30 days to retain the information best,” said Tim Cain, CBA, director of global credit and collections at Keen, Inc. (Portland, OR).

Improve Note-Taking Skills

Mastering note-taking skills can significantly enhance information retention and comprehension, thereby improving academic performance and long-term professional success.

Here’s a few ways to do so:

- The Sentence Method: Points are written as sentences and categorized under headers. After class, lecture notes are simplified and reorganized for readability.

- The Outline Method: It simplifies note organization into headers and bullet points. Each point can be converted into study questions for review.

- The Cornell Method: A notebook page is divided into a bigger notes column and a smaller recall column for relevant questions and keywords.

- The Charting Method: It uses columns for each topic, with details added underneath and relationships noted across rows.

- The Mapping Method: Organizes topics into related subtopics, allowing for detailed notes and easy highlighting of concept relationships.

“It's a lot of information to read but taking good notes is important to be able to study the material,” said Marcela Rolon, CBA, credit manager at RCP Block & Brick, Inc. (Lemon Grove, CA).

Practice. Practice. Practice.

Our capacity to process multiple stimuli is limited and without proper focus, information is lost. By regularly practicing or repeatedly performing an activity or exercise, you can improve or maintain your proficiency. Through practice, you can enhance your speed and ability in accessing information, enabling you to tackle more complex data and issues.

“Even if you get an answer correct on the multiple-choice practice exam, challenge yourself to learn thoroughly about each of the possible answer choices,” said Steven Prensner, CBA, senior credit analyst at MasterBrand Cabinets, Inc. (Jasper, IN).

Start applying what you learn to your work right away. “The process of applying the coursework to a direct example is a phenomenal way to study," said Jessica Kempton, CBA, junior credit analyst at PNW Railcars (Portland, OR).

Partner Up

Working with your professors and other students will make studying more efficient. Concepts and topics can be understood faster when ideas are exchanged between different people.

“Pick a study partner to discuss the material with because how you interpret the material will differ from how another person does,” said Linda Niffenegger, CBA, CCRA, credit analyst at Anchor Packaging (Manchester, MO). “With both of you discussing it, you can come up with the outcome of what's really being asked and learn from that. It's also important to rest and eat well to maintain your health so that you're not overwhelmed while studying."

Use Your Resources

Making use of the materials, environment and people around you will help you study more effectively. Reach out to your professor, peers, mentors or colleagues. Visit a library or search the web. Use the tools around you to enhance your retention and fill knowledge gaps.

Ultimately, you know what study methods suit you best. Don't shy away from customizing your approach to enhance your grasp of the course content. “If I'm doing something else with my hands, I retain the information better than if I just sat and listened to it,” said Heather Spencer, CBF, senior district financial manager at The Sherwin-Williams Company (Lenexa, KS). “So, when I was listening to the lectures, I would build a Lego so that I could listen better.”

The bottom line: Developing strong study habits and time management skills is not only crucial for academic success but also for professional growth, as it sets the foundation for continuous learning and advancement in one's career.

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

-

MAY

13

3pm ET -

A Grizzled Attorney Presents the Construction Law Battlefield Webinar

Speaker: Randall Lindley, Esq., Partner, Bell Nunnally

Duration: 60 minutes

-

The Economic Outlook for China and the Rest of Asia-Pacific

Speaker: Louis Kuijs, Chief Economist, Asia Pacific at S&P Global Ratings

Duration: 60 minutes -

MAY

17

10am ET