March 21, 2024

Balancing speed and risk in credit decisions

Jamilex Gotay, editorial associate

Customer onboarding is arguably the most important part of a business transaction because businesses can enhance revenue and cultivate enduring customer relationships. However, the time-consuming onboarding process, coupled with the urgency for swift credit decisions due to sales or competitive pressures, can escalate loss risk.

Why it matters: Understanding and improving customer onboarding is crucial because it not only influences the company's revenue but also shapes long-term customer relationships.

A seamless and comprehensive onboarding process accelerates time-to-value, maximizes product adoption and reduces customer churn, thus leading to many positive outcomes.

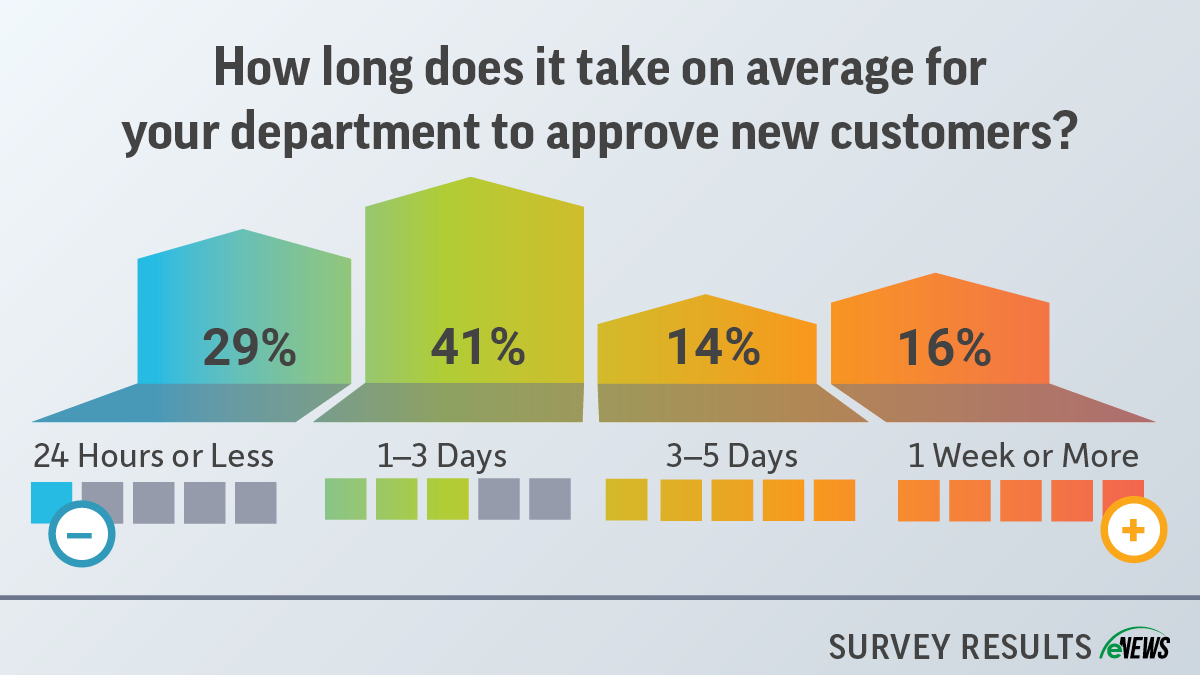

By the numbers: According to a recent eNews poll, most credit professionals said it takes them one to three days to approve new customers (41%).

- While others said it takes them 24 hours or less (29%) to do so.

- Fewer said it takes them one week or more (16%).

The timeline to accept and onboard a customer depends on a variety of factors.

Missing or insufficient customer information, such as contact information, financials or references, can slow the onboarding process. Incomplete data hinders credit professionals from accurately assessing risks.

“Applicants with limited business report information, no personal guarantee and delayed responses from trade references will delay my credit decision,” said Laura Castillo, CBA, territory credit manager at Crawford Electric Supply Company, Inc. (San Antonio, TX). “For qualified applicants, we use business credit reports, trade reports and trade references from our local and national groups to process applications quickly.”

Shane Stewart, credit assistant at NEBCO, Inc. (Lincoln, NE), said his department takes one-to-three days to accept a new customer. “If I don't have enough information, I will request credit reports,” he said. “If we require a personal guarantee, we'll use credit information systems for a three-part credit report. The company owner signing our application must personally guarantee it. We also need the owner's Social Security number, which may extend the approval process.”

Risk tolerance refers to an organization’s willingness and ability to endure or accept uncertainty or potential losses in pursuit of its financial goals. Assessing the level of risk is essential for credit professionals to make sound lending decisions.

The riskier the customer is, the more research needed to approve an account. “This typically happens with large credit requests over $100,000 or riskier product lines due to contract complexities,” said Alaina Worden, CCE, credit and collections manager at CECO, Inc. (Portland, OR), whose department takes three-to-five days to onboard new customers. “The CFO and owner's approval of credit department recommendations highlights our dedication to risk assessment and informed decision-making in line with company policy and values.”

Yes but: Pressure from sales or the competitive marketplace can cause credit professionals to overlook potential risks to make the sale. “Sales has to send the account to us before we even agree to open them,” said Anna Puryear, CCE, credit manager at Kontoor Brands, Inc. (Greensboro, NC). “They have to vet the customer, make sure that they're in an area that they want to open and visit them to make sure they have a decent looking store. Our tax department and our master data team have to look into the customer, too.”

Company Size and Customer Volume

The speed of customer onboarding often hinges on company size and customer volume. “Although I’ve been in credit for a long time, it takes time to research and review the data as well as make sure that the credit application is filled out properly with the correct signatures,” said Dawn Collar, CBF, credit manager at Southern Plumbing & Heating Supply Corp. (Gloucester, VA). “I usually give my customers up to three days depending on the information that comes back. This way, I can be prepared for any challenges or surprises. It also allows extra time to address potential application issues or missing data.”

Collaboration with Other Departments

Customer onboarding may involve a lengthy approval process with multiple departments, potentially causing delays due to thorough application reviews. Sherry Bushman, director of credit and collections at Partners Personnel (Santa Barbara, CA), waits for approval from sales and legal teams before she officially approves and activates an account. “Risk management verifies if a job description is on our insurance's prohibitive list due to high claim levels or policy mismatch,” she said. “If we can mitigate the risk, we proceed with the client. But on average, the process takes 24 hours or less.”

For Puryear, it takes the tax team a couple days as they have to call the state and verify tax exemptions. “That in combination with the credit review of the account, it can take between one to three days to approve a customer,” she explained.

Streamline the Onboarding Process

Educational resources will keep you informed on the latest trends and grow your credit knowledge. This can also lead you to make better credit decisions. “NACM credit reports and member relationships are my most efficient tools,” said Collar. “If there's questionable information, I can discuss it with another member for a clearer picture.”

Streamline customer onboarding by reducing paperwork, using digital tools and automating tasks. This makes it simpler for customers to begin using your products and services. “We’re trying to develop a program that is consistent and helps us to improve efficiency in our workflows, but we will still use the human aspect of credit decisioning,” Worden said.

The bottom line: Effective customer onboarding boosts revenue and nurtures lasting relationships, but it demands risk control and data collection. Digitizing and automating this process, along with cross-departmental cooperation, can speed up approvals while ensuring solid credit decisions.

When to engage upper management

Kendall Payton, editorial associate

Most decisions require careful consideration before reaching a conclusion because all decisions have consequences. When it comes to business decisions, there’s a lot more at stake because of the potential impacts on the financial health of the company and the risk that comes with making the wrong choice.

Why it matters: The decision to involve upper management in credit matters can have far-reaching implications for the financial health and stability of a company.

When involving upper management or any other teams in credit decisions, communication throughout the process is essential. Information flows top-down and bottom-up within an organization, so everyone’s input can be useful when it comes to making difficult decisions. Cross-communication ensures the thought process behind any decision happens cohesively and can be adaptable to any unforeseen circumstances.

Some credit departments involve upper management early in the decision process. “We communicate regularly with our leadership teams such as our area sales managers and directors every other week to discuss key accounts,” said Susan Thorn, CCE, area credit manager at Ferguson Enterprises LLC (Lakewood, NJ). “Upper management’s point of involvement usually varies but is more likely to happen when anything indicates a change that could impact the ability to be paid or potential to raise the risk of nonpayment. We’ll discuss positive updates too, such as learning a customer gave us strong financials, and we’ll want to go after them. It’s not always necessarily coming to upper management for raising red flags.”

Yes, but: When customers start to show obvious signs of red flags, such as late payments, it could lead to bigger trouble down the line. In this case, credit professionals will seek advice from upper management to make their final decision—especially when sales disagrees.

For larger customers, Michelle Achondo, CBA, CICP, director of credit American Fast Freight, Inc. (Fife, WA), involves the sales rep first before elevating to management. “If we have a customer submitting a credit application and the credit limit, they require is above my credit limit authority, then we get upper management involved,” said Achondo. “It doesn’t happen often, but it’s worked out when they’ve decided to go with sales over us. The customer didn’t have the financial history to support the credit limit required for that particular job, but it turned out well. Sometimes, someone above you needs to take the risk and it’s a business decision.”

Compromise is an important value in the decision-making process. Each department involved analyzes situations differently. A variety of perspectives leads to informed decisions. “We’re making the decision together, so we can either be heroes or zeroes together,” Thorn said. “We either win or don’t win as a team—but we take away the lessons learned and know how to move forward.”

On the opposite end, there are credit professionals whose approvals are limitless—upper management involvement is little to none. However, some companies don’t rely on a hierarchical structure, which leaves room to break the bottom-up, top-down process. For example, George Demakis, credit manager at Scafco Corporation (Spokane, WA), said his department does not have any limits at all. “I can approve anything up to a certain level,” he said. “The only time I involve the CFO or COO is if my salesperson is pushing hard for an account and I don’t believe it should be opened. At that point, I’ll go to upper management and let them know that if they want to open the account for salespeople, they can do it, but I’m not voting for it.”

Delegation of authority (DOA) also plays a key role in the decision-making process. It identifies the most effective model of distributing responsibilities and power to those involved in certain decisions. For example, those at the entry level handle the more routine responsibilities while senior management can focus on strategic tasks.

“At times when I think something may not be the best decision, upper management may have more information than I do because I don’t always have all the information that sales may be looking at,” said Achondo.

For example, there may be customers who provide additional revenue in another market. That can also play into the final decision upper management makes. “With credit limit authority, no one wants to be responsible for a million-dollar credit limit if it goes bad,” Achondo added. “Customers and companies are doing great until they are filing for bankruptcy. Sometimes there are no warning signs, and I’d rather have a million-dollar credit line approval be a group decision with other levels in the organization saying yes.”

The bottom line: Involving upper management early in the decision-making process can help mitigate risks and ensure a more comprehensive evaluation of potential impacts on the company's financial health and stability.

AI is revolutionizing the construction industry

Jamilex Gotay, editorial associate

Artificial intelligence (AI) has arrived in the construction industry, promising to revolutionize it. From preconstruction to site safety, the construction industry is using more AI technology to facilitate the various stages of the construction process.

Why it matters: As we delve into this new era of construction technology, it's important to comprehend AI and its potential to enhance industry productivity and performance.

AI, comprises computer systems that perform intricate tasks like reasoning, decision-making or problem-solving, traditionally done by humans, is used in various industries. Recently, the construction industry has increased its use of AI-based tools and techniques in workflows and construction processes.

AI in Preconstruction

The preconstruction process in commercial construction aids in timely, budget-friendly project completion that meets client satisfaction by outlining the necessary sequence of personnel and events.

“Various forms of AI software exist at the general contractor (GC) and subcontractor level,” said Chris Ring of NACM’s Secured Transaction Services (STS). “Mostly for plans and specifications to get a clear picture of the project before construction begins.”

AI in the pre-design or initial project planning and development phase is helpful for feasibility studies to determine if a project is viable, reads a Construction Connect article. “AI-based tools can be used to automate the process of extracting, analyzing and processing data from construction documents. For example, natural language processing (NLP) can be used to analyze project requirements and create a detailed project scope document based on two-dimensional construction plans like PDF files.”

NLP, a subset of AI, can convert complex legal jargon into plain language, making contracts more accessible to non-legal professionals. It can also be used to automate many of the tasks involved in manual contract review, such as identifying key clauses, identifying risks and comparing contracts. This allows legal professionals to concentrate on intricate and strategic tasks. Moreover, NLP enhances inter-party communication, minimizing dispute possibilities.

Beyond preconstruction, AI is increasingly used in other construction areas to enhance performance and safety.

- Predictive maintenance: AI can analyze data from building systems, such as HVAC and electrical systems, to predict when maintenance will be needed and prevent equipment failure.

- Site safety: AI-powered cameras and sensors can monitor construction sites for potential safety hazards and alert workers and managers to potential dangers.

- Robotics: With machine learning, AI can assist in bricklaying, welding and building with 3D printing.

- Project management: AI can optimize the allocation of labor and materials, making the scheduling of construction tasks more efficient and cost-effective.

- Quality control: AI-powered cameras and sensors can monitor the quality of construction work, identify defects and alert workers and managers to issues that need to be addressed.

- Building performance: AI can analyze data from building systems to optimize energy efficiency, indoor air quality and other performance metrics. Simulating building efficiency with AI, for instance, allows the identification of potential energy-depriving areas for better design and construction.

Risk Mitigation

From safety hazards, quality issues, delays and cost overruns, construction sites are prone to risk. The larger the project, the greater the risk, due to the numerous subcontractors concurrently working at job sites. By leveraging artificial intelligence, GCs can monitor and mitigate risk instances on the job site, allowing the project team to focus on their core functions.

What they're saying: “AI algorithms automatically prioritize issues based on unsafe scaffolding, waterlogging, and personnel lacking essential protective equipment like gloves, helmets and safety glasses,” reads a report by Appinventiv. “It empowers contractors to prioritize projects based on risk rankings and proactively address potential safety concerns.”

Construction Contracts

AI is revolutionizing the way construction contracts are managed and executed in the following ways, according to Black Boiler:

- Enhanced contract review and management: AI-driven contract analysis tools can automate the review process, allowing for faster and more accurate contract assessments.

- Predictive analytics for risk mitigation: AI can analyze historical data, project-specific information and external factors, predicting potential risks in construction contracts.

- Smart contract automation: Smart contracts, powered by blockchain technology and AI, can enforce terms and conditions, ensuring that all parties adhere to the agreement. For example, payments, timelines and milestones can be automated, reducing the need for intermediaries and enhancing transparency.

- Improved decision-making: In construction contracts, AI can assist in decision-making processes by offering data-driven recommendations. For instance, it can help with selecting the most cost-effective suppliers, optimizing resource allocation and managing project timelines more efficiently.

- Real-time monitoring and reporting: AI-powered systems monitor the progress of construction projects in real-time. If any deviations from the contract occur, AI can alert project managers and stakeholders promptly, enabling them to take corrective actions promptly.

- Environmental and regulatory compliance: AI can help construction firms avoid costly fines and delays due to regulatory violations.

Yes, but: Despite the marked rise of AI within the construction industry, it will take some time before relevant legislation and regulations are established. Moreover, the use of AI has not yet permeated the field of B2B credit.

Martin Smith, CCE, CICP, credit manager at Ash Grove Cement Company (Sumterville, FL), said he’s used ChatGPT for researching customers and composing collections letters but has not come across AI in construction. “I suspect that AI has already influenced reports that I receive from D&B, Cortera and NACM,” he said. “I know that advanced analytics will be in place with the next A/R software upgrade.”

The bottom line: AI is revolutionizing the construction industry by enhancing preconstruction planning, site safety, predictive maintenance, project management and contract execution while also aiding in risk mitigation and regulatory compliance.

Checking all the boxes.

“This has been my goal for a while as the CCE is a very prestigious designation to have behind your name,” Lorielle Champagne, CCE, regional credit manager at H&E Equipment Services, Inc. (Arlington, TX).

Read more...

Achieving credit success.

“The CBA gave me more knowledge and confidence that I needed to jump into the credit world,” said Heather Will, CBA, credit manager at Anchor Industries, Inc. (Evansville, IN).

Read more...

Bridging the Gap: Automation Solutions for Staff Shortages.

On the latest episode of NACM's Extra Credit podcast ... Automation not only helps with staffing shortages, but it can attract the new generation of credit managers.

Read more...

Why accounting matters to credit managers

Kendall Payton, editorial associate

Credit is the lifeblood of every business. Its role in managing cash, identifying risks and evaluating potential for loss are only a snippet of the entire picture. But there’s another key function that cannot be overlooked: accounting. As credit is the lifeblood of a business, accounting is the language of a business.

Why it matters: Credit managers must understand basic accounting concepts to effectively communicate financial health and make informed decisions.

While accountants are known for operating in the realm of black and white, adhering to strict principles and standards, credit managers often find themselves navigating the complexities of the grey area, balancing risk and opportunity in credit decisions.

Despite these differences, it is imperative for both accountants and credit managers to understand each other's roles, challenges and objectives.

Applying accounting principles in the credit department helps businesses predict future cash flows, monitor financial statements and protect against financial crises. Accounting’s process of recording and analyzing all financial transactions plays an important role in compliance with financial regulations as well. It is helpful for credit to understand:

- Accruals

- Reserves

- Month-end account reconciliations

- Audits

What they’re saying: “Knowing how bad debt and disputes are coded and accommodated in our financial results lays a foundation for how I attack the AR and work collections,” said Chris Cude, market credit manager at Ferguson Enterprises (Birmingham, AL). “I know that if a certain account goes bad, it will have a measurable impact on the business unit and drives the urgency in resolving as quickly as possible. So, accounting plays into both the credit analysis and collections management tasks of my day-to-day.”

Accounting processes typically overlap with credit tasks daily—and it is especially important for credit managers to understand the transactional impacts (i.e., impacts on the balance sheet for investment decisions and impacts on income statement for operating decisions.) A few more overlapping functions in credit and accounting include:

- Sales tax understanding and treasury functions

- Generating monthly accruals and reserves

- Budgeting and calculating ROI on non-standard terms

- Reconciliation and balancing of accounts

Accounting skills are important to succeed in the many roles of a credit manager. Being knowledgeable about accounting functions can also increase your value with your company. “When credit sells to a customer and the sales order is billed as a transaction, we all should be aware of what the balance sheet transactions are and the matching principle states the income statement transactions,” said George Schnupp, CCE, instructor of NACM’s Financial Statement Analysis 2: Credit and Risk Assessment. “This generates both the investment gross margin on the balance sheet and the operating gross margin on the income statement. These transactions also prove that sales and credit are on the same team!”

Just like any successful relationship, both sides need to learn from each other to coexist. The more knowledge credit and accounting gain from each other, the better overall company performance. For example, from a credit perspective, learning about accounting can improve your conversations with customers. “Being educated about accounting functions helps me explain some of the ‘whys’ to my internal associates when I’m trying to explain the reasoning for asking for certain things,” said Cude. “For the accounting side, when reviewing financial data for the business, having insight as to what may be happening to cause certain issues like an increase in AR or bad debt probably helps them with understanding the company better.”

Both credit and accounting are a function of the other. Working together as a team is important to ensure the company’s investment in AR is of the highest quality possible. In the daily accounting cycle, credit makes hundreds of operating decisions in processing sales orders and cash collections. “Accountants need to understand that credit is a relationship-based function with internal and external functional teams,” said JoAnn Malz, CCE, ICCE, NACM chair and director of credit and collections at The Imagine Group, LLC (Shakopee, MN). “There is, of course, a transactional component when it comes to cash application and account reconciliations. Credit is not just picking up the phone, sending an email asking for money or sending an invoice copy. Like accountants must adhere to GAAP or IFRS, credit teams have a multitude of UCC laws that we are required to work within.”

The bottom line: Accounting and credit management are interdependent, with the understanding of both being essential to effective business operations, risk mitigation, compliance with financial regulations and maintaining a healthy cash flow.

Registration is now open for NACM’s online accounting course. Reserve your spot now for Financial Statement Analysis 2 at Credit Congress!

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

-

MAY

13

3pm ET -

A Grizzled Attorney Presents the Construction Law Battlefield Webinar

Speaker: Randall Lindley, Esq., Partner, Bell Nunnally

Duration: 60 minutes

-

The Economic Outlook for China and the Rest of Asia-Pacific

Speaker: Louis Kuijs, Chief Economist, Asia Pacific at S&P Global Ratings

Duration: 60 minutes -

MAY

17

10am ET