March 7, 2024

Are financial statements still valuable?

Kendall Payton, editorial associate

The short answer is yes, the credit community can still find value in financial statements. But we may need to reconsider the way in which we think about financials.

The value of annual financial statements is being challenged by today’s fast-paced world, where business decisions are made at lightning speed. While these documents have long served as the bedrock of financial analysis and decision-making, their relevance is diminishing. The inherent lag in financial reporting means that by the time statements are prepared and distributed, the information they contain can be outdated.

Why it matters: While financial statements remain valuable in certain situations, credit managers should explore alternative approaches that can provide real-time insights.

Financial statements are reports showing the financial activities and performance of a business. The four major types of financials include:

- Income statements show net income or net loss, tracking all money coming in and out of a business. Money paid out is referred to as expenses, while money coming in is revenue.

- Balance sheets contain assets, liabilities and shareholders’ equity. The assets in balance sheets include cash, inventory or anything else owned by the company. Liabilities typically include accounts payable.

- Statements of cash flow show you where the cash went. Larger companies can have up to three categories (operation, investment and financing activity), whereas smaller companies use two main categories: cash inflows and cash outflows.

- Statements of owner equity show any changes in the owner’s equity between accounting periods.

Whether a customer is long-term or brand new, it is essential to stay abreast of their credit history. Evaluating the health of the business through payment patterns and other proofs of funds are great ways to mitigate risk. Kevin Stinner, CCE, CCRA, credit manager at J.R. Simplot Company (Loveland, CO), said he requests financial statements only after certain credit limit requests. “If it’s a lower credit limit request, we may only require partial financial statements or may not even require them at all,” he said. “Financials are advantageous in the sense that you get a chance to take a deeper dive into the customer’s financial stability, not only the equity but also the short-term liquidity of the customer.”

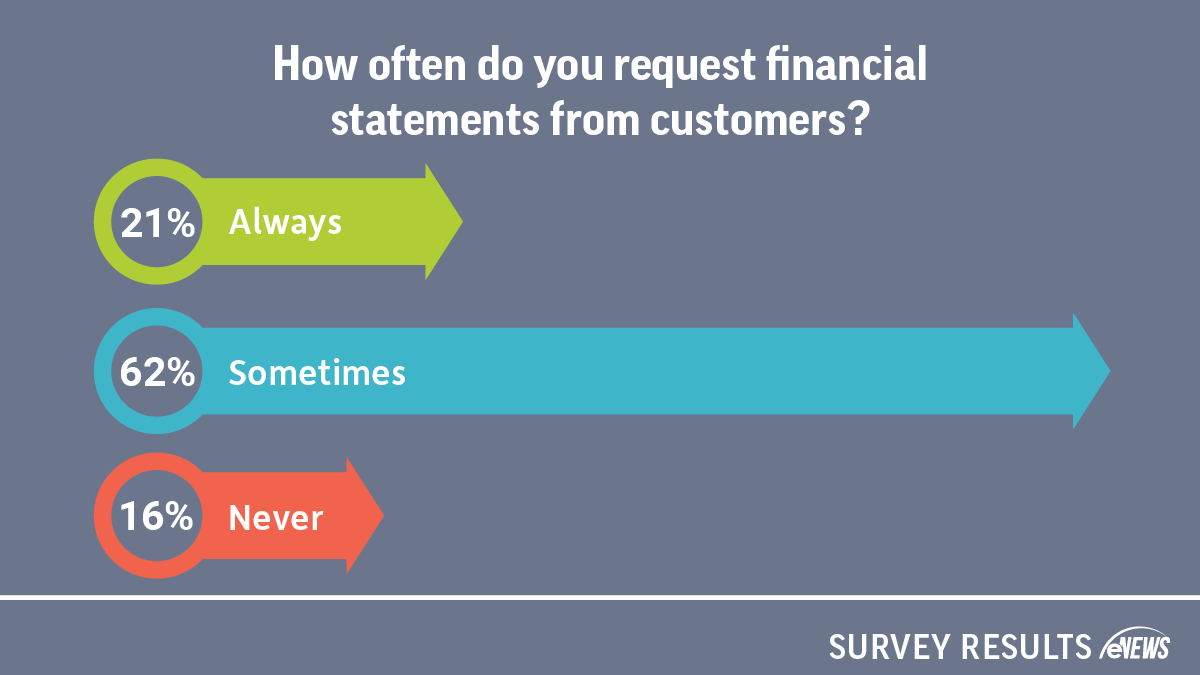

By the numbers: Despite some benefits, 16% of credit managers never request financial statements from customers, according to a recent eNews poll. 62% request financials sometimes and only 21% say they always request financials. This is likely due to some of the pushback credit professionals receive from customers.

Publicly traded company information is usually available to the public eye. However, private companies may operate a bit differently. Confidentiality is a big concern, so it is essential to reassure security when requesting any financial documentation. “Private companies tend to keep their information private, but if they are against sharing financial statements, we will supply a non-disclosure agreement (NDA),” said Scott Chase, CCE, CICP, global director of credit at Gibson Brands, Inc. (Nashville, TN). “Credit people by nature recognize the information they obtain should be held in confidence so offering NDAs usually helps. But some customers will still say no, either because their company doesn’t create financial statements at all, or they are not as savvy in the creation of them.”

Customers tend to be more comfortable with a balance sheet and profit loss statement, but that information is typically only relevant if you also receive a statement of cash flow additionally. “Profit loss and income statements are fluff,” said Chase. “It’s the movement of numbers to make the company look good, but there are only three places that cash comes from. For financial statements to be significant, you have to include a statement of cash flow.”

Yes, but: Though financial statements have several benefits in helping credit managers assess insight on how their customers’ business is financed and their financial health, several factors have impacted the value of financial statements alone.

Rising inflation and interest rates change how information is measured and presented in financial statements. Two factors mainly impacted by economic disruption include the customer’s ability to pay and discount rates. When the cost to fulfill sales increases, those additional costs may not be recovered. “The value of financial statements depends on the customer and the industry,” said Stinner. “If I am looking over a 10-year period, equity has increased. But I have seen in just the last two years that liquidity has taken a sharp decline, particularly the quick ratios.”

Some credit professionals do not use financial statements for information from their customers at all. They may look to use other tools such as credit reports as an alternative. “Any financial data is too old for us to use,” said Ronald Sereika, CCE, director of credit and client payment solutions at Mspark, Inc. (Helena, AL). “One suggestion if a new customer places an order and you cannot get enough information on them is to call the controller and see if you can have an honest conversation with them.”

For example, you can ask the controller about a $10,000 order and express concern with payment terms being Net 30 days and not getting paid within the time frame. If the information obtained from the customer shows they are paying 40-50 days beyond terms, you can request a $3,000 advance and see how the customer pays the balance. “This is where the most important of the five C’s of credit comes in: character,” Sereika said. “Credit reports are a tool that can be helpful in place of financial statements, but you will only get an idea of how they are currently paying instead of an overall picture.”

The bottom line: Be proactive when handling financial information of customers. While monitoring cash flow is crucial, a comprehensive understanding of a business's financial health will always require an analysis of some form of a financial statement.

The changing role of credit applications

Jamilex Gotay, editorial associate

Credit applications serve as the initial safeguard against risk. Risk reduction begins immediately upon receipt of a customer's credit application, either digitally or on paper. But the role of credit applications in the customer onboarding process has evolved over time. Previously, credit applications served to establish a binding contract, but now, alternative methods may be used for this purpose.

Why it matters: Understanding these shifts in the role of credit applications is crucial for credit managers to adapt their onboarding processes.

The credit application is designed to help credit professionals learn as much as possible about the applicant before deciding to extend credit.

What’s new: Credit applications have shifted from paper forms to digital formats, enhancing convenience and efficiency for customers and lenders.

- Digital applications enable quicker processing, simpler document submission and often incorporate features such as electronic signatures.

- Automation has improved credit application processing by reducing errors, expediting approvals and enhancing the customer experience.

What they're saying: “Online credit applications facilitate the customer onboarding process by passing the data back to the customer's ERP system,” said Dominic Biegel, director, sales at Bectran Inc. (Schaumburg, IL). “It helps considering that most credit professionals we work with have a high volume of credit applications coming in.”

Some credit professionals limit their use of a credit application to an as-needed basis. “The only time we use credit applications is to get additional information when we we’re doing analytics on a client, specifically a client where there wasn't information available for us to purchase from a credit provider,” said Ty Knox, ICCE, director of credit and risk at EFCO Corp. (Des Moines, IA).

Without a credit application, how do you adhere to Know Your Customer (KYC) practices? You can collect information and get a sales agreement signed with the terms and conditions. However, credit applications were designed to aid credit decisions. Without them, it's important to conduct a customer background check and verify the legal name of the customer to ensure legal collection.

Credit applications are still part of the credit investigation, but for some professionals, they can collect financial information through other avenues. “We would ask them to fill out a credit application so that we could have bank and trade references,” Knox said. “We also ask for financial information—which we rarely ever get—to make a credit decision. Our credit application therefore did not have any terms and conditions associated with it.”

A Legally Binding Contract

The purpose of having a signed credit application is to protect your company’s interests. For instance, the terms and conditions on the credit application could include an interest provision—your right to collect finance or interest charges if a customer fails to pay on time.

With the rise of ecommerce, it’s easier than ever for businesses to secure agreement to their terms for every purchase, even without a credit application. Ecommerce has transformed the way customers interact with terms and conditions. Customers are accustomed to swiftly scrolling through lengthy agreements, often overlooking the fine print in their haste to complete transactions.

“It used to be you would review the credit file, credit application and credit references,” said Scott Michelsen, CCE, ICCE, director of credit and collections at Pave America (Warrenton, VA). “Today, I'm ensuring every contract includes robust terms to protect us. If a customer fails to pay, they're liable for the ensuing consequences, including interest, legal, collection, lien and court fees.”

The bottom line: The purpose of credit applications has changed over time in B2B trade. Credit managers must carefully decide if credit applications are right for the company.

One-on-ones: Best practices for meaningful conversations

Jamilex Gotay, editorial associate

One-on-one meetings offer a special forum for detailed discussions and personalized support. However, few organizations offer comprehensive guidance or training for managers to hold these individual employee meetings.

Why it matters: Ensuring regular one-on-one meetings can improve team performance and cohesion, leading to a more effective and harmonious work environment.

According to the Harvard Business Review, few organizations provide strong guidance or training for managers on meeting individually with their employees. “Managers who don’t hold these meetings frequently enough or who manage them poorly risk leaving their team members disconnected, both functionally and emotionally,” the article reads.

A one-on-one meeting is a routine interaction between two individuals in an organization, a manager and an employee. It serves to provide feedback, maintain communication, address problems and foster role development.

Checklist for one-on-ones with employees:

- Discuss objectives

- Ask about challenges

- Bring up performance issues

- Ask what your employee needs for support

- Set expectations for next steps

- Discuss any wins

- Document and follow up

But your one-on-one meeting strategy depends on your company size, location, meeting purpose and the individual involved. Being aware of these factors can maximize the meeting's effectiveness.

For instance, if you have a larger team, one-one-one meetings may be more difficult to navigate, especially if your employees are not all in the same location. Wendy Mode, CCE, CICP, division credit manager at Delta Steel, Inc. (Cedar Hill, TX), holds one-on-one meetings on an as-needed basis. “My employees are all decentralized, so we have meetings with them at least once a year, followed by their yearly review or evaluation,” she said. "But if a need arises in the meantime, good or bad, I ensure to make time for in-person visits or virtual meetings to discuss it."

Kevin Chandler, CCE, director of financial services at Zachry Industrial, Inc. (San Antonio, TX), uses an apprenticeship model where he spends a longer time training new people one-on-one. “I employ a ‘role-based competencies’ approach whereby each position has a defined set of skills and abilities necessary for full proficiency in the given role,” he said. “For example, a credit manager is held to higher standards than a credit representative, despite their roles being similar. This aids in assessing their current status, skill level and areas for improvement.”

Approach one-on-one meetings with the individual’s needs in mind. What are they getting out of this? This deeper understanding enables more effective coaching, support and collaboration. “I try to understand what motivates each person and what's important to them,” said Michelle Kelly, CCE, CCRA, senior credit manager at Mansfield Oil Company of Gainesville, Inc. (Gainesville, GA). “It's also a mix of setting goals, addressing challenges and just having an open chat. I find this approach builds trust, keeps the communication lines wide open and encourages transparency.”

Credit leaders should consider encouraging the employee to lead the discussion. They can achieve this by asking them to prepare a list of questions, concerns and topics they wish to discuss. By doing so, you promote a sense of autonomy and responsibility, encouraging them to express their thoughts, concerns and goals more frequently.

Constructive criticism in one-on-one meetings allows for personalized feedback based on an individual's performance, behavior and goals. It creates a supportive atmosphere for learning from mistakes, making adjustments and pursuing continuous improvement. This criticism also enhances the manager-employee relationship by showing dedication to their growth and success.

“Don’t shy away from asking the hard questions but also don't shy away from being asked the hard questions,” Chandler said. “Also, be comfortable with the concept of not having the answer. It's perfectly fine to say, ‘I don't know,’ but it should be immediately followed up with, ‘I'll go find out and I'll get back to you.’ What you're building there is credibility.”

Believe it or not, employees want feedback. According to a report by Zippia, 65% of employees want more feedback, with 98% actively disengaging from their work if they don't get it. “The whole purpose of one-on-one meetings is to let employees feel heard and valued as well as help the manager learn more about who they are, what drives them and how to provide them with the training they need,” Kelly explained.

Receiving criticism yourself will not only help you understand your employee better, but it will influence your leadership. “We are not born perfect managers and we must continue to strive to be better leaders,” Kelly said. “So, sometimes having feedback that you don't anticipate, as long as it's constructive between the two of you, it should benefit both parties.”

Meetings with senior leaders allow managers to align their goals with the organization’s strategic vision. This open communication enables informed decision-making, progress sharing and assistance in tackling challenges. “When I'm talking with upper management, it's more about the strategic game plan, project updates and ensuring our efforts align with the bigger picture,” said Kelly.

Another reason to conduct meetings with upper management is strictly for risk mitigation. “You're teaching them the keys to success in their role from an order-to-cash perspective,” Chandler said. “You can demonstrate the mutual benefits for them and the company. If issues arise, I liaise with upper management to identify and resolve the root cause.”

Meeting with customers individually is beneficial when assessing their creditworthiness, collecting payments or simply maintaining the relationship. But credit professionals must make a detailed agenda to successfully accomplish their goals.

“I've collected payment on Friday instead of Monday when the invoice is due, simply because of the strength of the relationship,” Chandler said. “Having those one-on-one conversations consistently can help solve problems in the long run. Many customers are grateful that I took the time to visit them because not a lot of companies they work with do that.”

It is important to be as fair as possible. “Try to split your time or make sure that you're giving each individual the same amount of attention and focus,” Mode said. “The new hires will require more time as they need training and time to get up to speed but try to make sure that you're being fair and giving each one the same amount of respect.”

The big picture: One-on-one meetings, when conducted effectively and tailored to individual needs, can significantly improve team performance.

Checking all the boxes.

“This has been my goal for a while as the CCE is a very prestigious designation to have behind your name,” Lorielle Champagne, CCE, regional credit manager at H&E Equipment Services, Inc. (Arlington, TX).

Read more...

Achieving credit success.

“The CBA gave me more knowledge and confidence that I needed to jump into the credit world,” said Heather Will, CBA, credit manager at Anchor Industries, Inc. (Evansville, IN).

Read more...

Bridging the Gap: Automation Solutions for Staff Shortages.

On the latest episode of NACM's Extra Credit podcast ... Automation not only helps with staffing shortages, but it can attract the new generation of credit managers.

Read more...

Construction industry outlook is cloudy for 2024

Jamilex Gotay, editorial associate

Rising labor costs, new environmental regulations and a mixed outlook on construction volume present significant challenges to the industry. However, declining fuel costs and controlled inflation offer some relief.

Why it matters: By staying informed about these trends and challenges, credit managers can make informed decisions.

Rising labor costs and hourly wages persist as a significant hurdle in the construction industry. The competition for a finite group of skilled workers is escalating wages. According to the Bureau of Labor Statistics, average hourly earnings for residential building workers were $30.71 per hour in November 2023, increasing 4% from $29.52 per hour a year ago.

Sustained demand for skilled construction workers, coupled with a lack of qualified candidates to fill the positions, has added to the strain, CBRE reports. “This is due in part to an aging workforce and a lack of interest in trade careers among younger generations.”

The unemployment rate remains low both nationally and for construction as the overall workforce contracts by 2%. Construction employment increased in 224 of 358 metro areas between December 2022 and December 2023, according to an analysis by the Associated General Contractors of America. Association officials noted that the industry still has nearly 400,000 unfilled positions nationwide, and likely would have added even more jobs if firms could find more qualified workers to hire.

Weather continues to put negative pressure on the construction industry as several credit managers have noted in the monthly Credit Managers’ Index (CMI). “Nonresidential construction spending fell sharply in January, ending a 19-month streak of monthly gains,” said Associated Builders and Contractors (ABC) Chief Economist Anirban Basu. “Some of this decrease is due to weather-related factors. That’s especially true in infrastructure categories like highway and street and water supply, both of which exhibited steep declines in spending to start the year but should remain elevated through 2024.

According to the AIA Construction Consensus Spending Forecast, the outlook for construction volume is negative for most sectors over the next two years. U.S. Census data indicates that private commercial and office construction volumes have remained almost unchanged since the last quarter and have significantly decreased compared to the previous year.

“Contractor confidence in construction shows a blend of optimism and hurdles,” the CBRE report reads. “Flexibility, creativity and teamwork are crucial for managing unpredictability and securing the industry's robust future.”

What they’re saying: “When you add up the increased labor costs, low unemployment rates, supply chain issues and EPA contractor backlog, they don't paint a great picture,” said Chris Ring of NACM Secured Transaction Services (STS). “Although a lot of indicators show that commercial construction is in good standing, the latest trends are sounding a bit of an alarm bell for construction creditors.”

George Demakis, credit manager at Scafco Corporation (Spokane, WA), said he’s started to see a slowdown in sales volume, fewer projects to bid on and increased supplier competition. “Contractors are asking us to rebid projects more often as they are under competitive pressure from general contractors (GCs),” he said. “This is putting pressure on our margins and profitability. And with falling sales volumes, activity levels at our branches have fallen resulting in layoffs at some of our branch locations.”

While Demakis’ over-60-day past-due figures are the lowest they have ever been, he’s starting to see a rise in 31-to-60-day past-dues. “I attribute this to GCs delaying payments and holding onto their cash longer, stretching out billing cycles,” he said. “We're increasingly noticing contractors using payments from GCs for current payroll instead of settling past material purchases. I've recently discussed delinquent customers with several GCs, who informed me they've already paid our customer for those materials.”

Amid these changes, contractors are struggling to cope with significant labor shortages, the impacts of higher interest rates and input costs and a supply chain that, while better, is still far from normal, according to A Construction Market in Transition: The 2024 Construction Hiring and Business Outlook.

Yes, but: Construction related to manufacturing, transportation and clean energy infrastructure could see a boost, thanks to funding from three crucial laws passed in 2021 and 2022, according to a Deloitte report. “The Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA) and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act are expected to flow into the industry,” the report reads. “As such, construction confidence remains high, with the ABC identifying expectations for an increase in profit margins and staffing levels, particularly in the first half of 2024.”

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

-

MAY

13

3pm ET -

A Grizzled Attorney Presents the Construction Law Battlefield Webinar

Speaker: Randall Lindley, Esq., Partner, Bell Nunnally

Duration: 60 minutes

-

The Economic Outlook for China and the Rest of Asia-Pacific

Speaker: Louis Kuijs, Chief Economist, Asia Pacific at S&P Global Ratings

Duration: 60 minutes -

MAY

17

10am ET