February 29, 2024

CMI: Recession-like conditions persist

Annacaroline Caruso, CICP, editor in chief

NACM’s February Credit Managers’ Index (CMI) remains stubbornly close to contraction territory despite improving 1.3 points to 52.4. “We did not fall into formal recession in 2023 and we might not in 2024, but for many credit managers, it’s as if a recession is well underway,” said NACM Economist Amy Crews Cutts, Ph.D., CBE.

The index for favorable factors improved 2.6 points to 58.1.

- Leading the improvement was a 4.9-point jump in sales to 55.6 and a 4.4-point jump in new credit applications to 59.5.

The index for unfavorable factors improved 0.4 to 48.6 points. Unfavorable factors recorded its eighth consecutive month in contraction.

- Dollar amount beyond terms led the increase with a 7.0-point jump to 50.6, moving into expansion after seven months in contraction.

- Accounts placed for collection fell to a nearly 15-year low of 42.9, marking its 21st month in contraction territory.

“With the sudden leveling off of dollar amount owed that is beyond terms and the rising number of accounts being referred to collections, I think credit managers are tired of promises to pay and cries for extensions,” Cutts explained. “Instead, they are moving more accounts to collections to stem losses. This to me is the strongest indication yet of the deep stresses affecting businesses.”

What CMI respondents are saying:

- “I’ve noticed within the wholesale industry; trends have fallen flat over the past six months. There is very little movement in bad debt recovery of receivables.”

- “There are still issues with slow paying customers and customers requesting or simply taking extended terms. We have more accounts with paydowns that have ceased their agreements forcing us to turn them over to a collection attorney.”

- “We saw a decline in sales, mostly due to weather (slabs not able to be poured), but things seem to be improving now.”

- “We are still working under a backlog of orders.”

- “We see a dip in new accounts.”

- “Customers are taking longer to pay their bills.”

The bottom line: Despite a slight improvement in the February Credit Managers' Index, credit managers are experiencing conditions akin to a recession.

Sign up to receive monthly CMI survey participation alerts. For a complete breakdown of manufacturing and service sector data and graphics, view the February 2024 report. CMI archives also may be viewed on NACM’s website.

How technology has transformed credit

Jamilex Gotay, editorial associate

The role of credit professionals in modern organizations is multifaceted and challenging, with numerous responsibilities and pressures. The evolution of technology, from computers to artificial intelligence, has transformed the credit management field, improved productivity and eliminated repetitive tasks. However, for some credit departments, technology has become a burden.

Why it matters: Understanding the impact of technology on credit management can inform us about the evolving demands and challenges in this profession.

1980s

The personal computer, which began to proliferate in the 1980s, is one of the most significant technological advancements in business credit.

The launch of the World Wide Web (WWW), the leading information retrieval service of the Internet (the worldwide computer network), in 1989 ensured that credit professionals would have access to vast amounts of data and information instantaneously. This ease of access has contributed to the rise of online credit applications and customer portals that streamline credit processes and ensure timely payment.

"Now, we can email dunning notices with a link for invoice downloads or direct bill payments via Credit Card or EFT," said Lee Tompkins, director of credit and collections at MPW Industrial Services, Inc. (Hebron, OH).

In 1988, credit professionals saw a ‘software explosion.’ This online collection of software packages stored customer files, eliminating the need for index cards and excessive computer printouts. Since then, automated systems have evolved to help credit professionals make faster and more accurate credit decisions, reduce manual errors, improve cash flow and enhance efficiency in managing credit relationships with customers.

“Credit experts know they have everything they need and can access it anytime," said Leon Zhang, credit operations manager at SRS Distribution Inc. (McKinney, TX). "Our greatest benefit is our automated scoring process that uses algorithms to evaluate creditworthiness more efficiently.”

1990s

Telecommunication, or communication over a distance by cable, telegraph, telephone or broadcasting transformed business credit in the late 90s. This meant that employees could work remotely from home, a satellite office or even a neighborhood work center. Telecommunication has led to what we consider ‘remote work’ today, where employees perform their job responsibilities outside of the traditional office setting.

Although remote employees require more technology for effective communication and collaboration, it allows for schedule flexibility and greater productivity. “It's just been interesting to me how some members of my team focus more when working in their cubicles while others give me much more by working from home,” Tompkins said.

Not only has technology helped credit managers, but it has enhanced customer relationships because people are easier to get a hold of, whether it’s through email, Microsoft Teams or by phone. “You can more easily remind the person of invoices that are past-due or if there's some disconnect,” Tompkins said.

2000s

The turn of the millennium ushered in a digital revolution that reshaped industries across the globe. For example, the rise of digital payment technologies, including electronic invoicing, online payments and automated clearinghouse (ACH) transfers, revolutionized the way B2B transactions are conducted. Digital payment solutions accelerated cash flow, reduced payment processing times and enhanced transparency, driving efficiency and liquidity in credit management operations.

The proliferation of mobile technology empowered credit managers to access critical information and perform essential tasks on the go. Mobile applications enabled remote credit approvals, customer communication and portfolio monitoring, enhancing flexibility and responsiveness in credit management operations.

Today

Although artificial intelligence (AI) is not new, its presence in the financial industry has grown significantly in recent years. Customer onboarding, predictive analytics, centralized data, scorecards and cash forecasting are just a few ways AI can be used in the credit department. The customer onboarding, for example, can go from a five-hour manual process to five minutes with the help of AI. The anticipation of customer behavior through predictive analysis and making the right decisions when it comes to collections can be used through an AI-powered solution.

OpenAI’s ChatGPT, launched in 2022, assists trade credit professionals in the rapid gathering of information, saving time spent on rigorous research required to onboard new customers. “We may have better ways of knowing who we should contact without just having a Post-it that's stuck next to our phone,” said Eleanor Hartman, CCE, credit manager at Autodesk, Inc. (Portland, OR). “But the core of the credit department in managing relationships hasn’t changed.”

Yes, but: Advanced technology has been confronted with considerable challenges due to resistance towards these novel systems and a deficiency in employee training. “I think the biggest challenge that a lot of people end up facing is a disconnect with how comfortable people are using technology,” Hartman said. “Some people dive into it and there are other people who are afraid to do anything with an Excel spreadsheet.”

Technology can lead to information overload. So, how do you identify what's pertinent and where to concentrate? Tompkins calls this predicament 'analysis paralysis,' a state of indecision caused by overthinking a problem or an overload of data. “With so much data available, you're less sure what you should really be focused on,” Tompkins said. “You also can't solely rely on technology to make credit decisions, otherwise, you're going to be missing out on some opportunities with potential customers.”

As technology continues to advance, credit professionals must strike a balance between leveraging automated systems for efficiency and maintaining the personal touch required for effective relationship management with customers. “The key part that's stayed the same in my 30+ years in credit, regardless of time and technology, is the relationship that the credit manager establishes with the customer,” Tompkins said. “That relationship, regardless of how it's cultivated, is key.”

What’s next: As new automation tools become available, the credit management profession will continue to evolve.

“The next step then will be what comes with AI processing and data modeling on the data that is now captured and is being added to each day,” said Danny Wheeler, AR solutions strategy manager at BlackLine Systems, Inc. (Birmingham, UK). “Being able to accurately predict customer trends and behaviors and enable continually updating payment forecasts or better insight into seasonality impacts on customers or payments and then have that information being fed back into the process as actionable data to enable even better process management and customer relationship management.”

Some digital platforms help credit teams automate and offload the tedious parts of analyzing credit applications such as data collection, automation of trade and bank references, credit reporting and account monitoring. “Our system helps remove low-value work and gives credit professionals more time to focus on key aspects of their role and unlocks more of their time, insights and capabilities,” said Nauman Hafeez, chief executive officer at NetNow (Toronto, Canada).

The big picture: The evolution of technology from the 1980s to today has significantly transformed the credit management field. Yet it also presents challenges such as information overload.

How and when to use trade credit insurance

Kendall Payton, editorial associate

Insurance is a form of protection and risk mitigation tool to protect against contingencies or unexpected loss. It serves its purpose in several instances—whether it’s your car, health or even your pet. Most people want to have a cushion to be prepared for unexpected circumstances, so, they pay for the protection. But how exactly does insurance function in the B2B trade credit industry?

Why it matters: Uncertainty is an ever-present companion in B2B trade. Businesses constantly face the challenge of balancing opportunity with risk. Trade credit insurance is one of the many tools available to mitigate risk, but you must know when and how it should be used.

Trade credit insurance protects the accounts receivables of a seller in exchange for a premium. An insurance policy can cover the entire AR portfolio, a specified segment of the portfolio or a single buyer. It also serves as protection against customers’ inability to pay due to circumstances such as bankruptcy or insolvency. Credit insurers can be public insurers, such as government agencies, or non-governmental firms, referred to as private insurers.

When evaluating the risk of a business or customer, most insurers do so based on sales volume, creditworthiness, the industry of operation and repayment terms agreed upon. For a lot of companies, credit insurance is a way to increase sales of existing customers without taking additional risk. Others argue their use is to protect against catastrophic losses for larger accounts. But companies that do not use credit insurance may argue that the cost of insurance is not worth the loss.

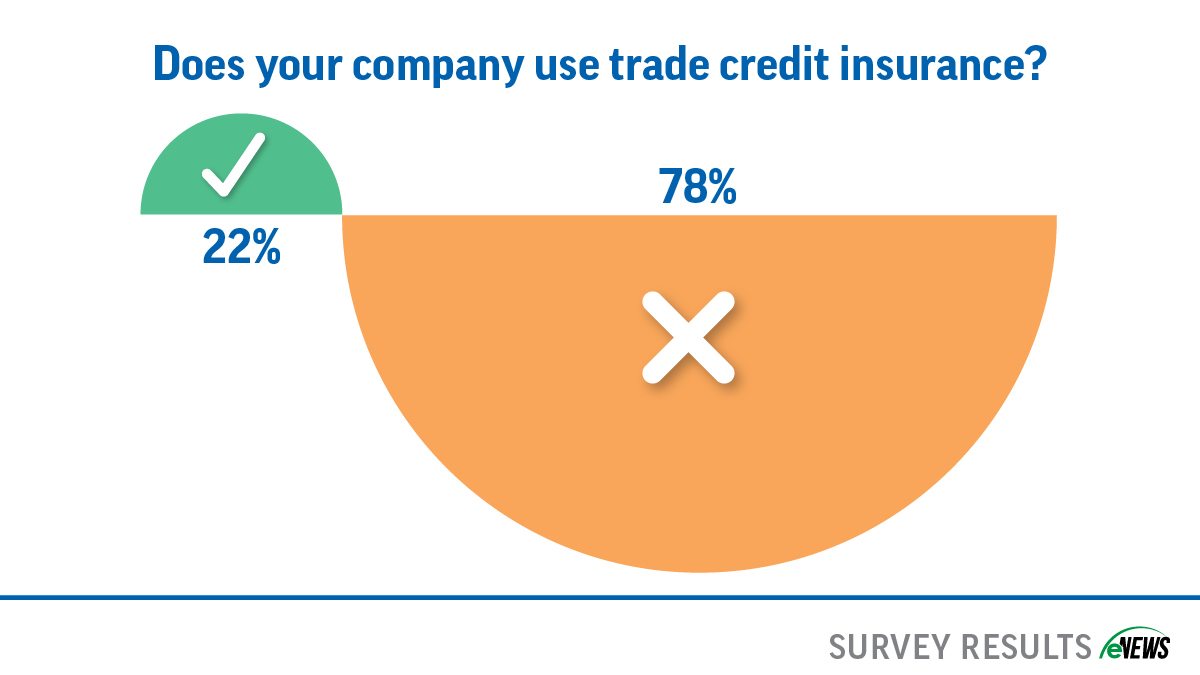

By the numbers: A recent eNews poll revealed that most (78%) credit professionals do not use trade credit insurance. For the 22% who do use insurance, they have a few reasons why:

Offering generous credit terms to customers can attract larger buyers and expand opportunities into new markets—creating a competitive advantage. Businesses that use trade credit insurance tend to feel more secure when extending credit because the risk is shared.

“We buy credit insurance for our higher risk customers because usually the larger balance has more exposure,” said Kenneth Zanolini, CCE, director of credit at Temperature Equipment Corp. (Tinley Park, IL). “A big part of the insurance is customer history. Whether it’s a long- or short-term customer, payment patterns and average days to pay are some key factors to consider. For example, in the insurance policy, you may ask for a $1 million coverage plan and they may only cover half a million or $100,000 based on the customer’s history, risk assessment and likelihood of default.”

Businesses can scale their insurance coverage to fit their budget and risk profile. Depending on the structure of the credit insurance policy, insurers can take on the credit underwriting process, eliminating or reducing the cost of credit investigations by the seller.

Global economic uncertainty is a popular reason why companies may have adopted insurance in recent years. As the trade credit market has grown in recent years, the compound annual growth rate (CAGR) is predicted to grow 9.2% this year compared to 2023, according to the Trade Credit Insurance Global Market 2024 report. Companies are more likely to use insurance to protect against unexpected bad-debt losses beyond the control of those who are insured due to current commercial, political or economic risks.

Valarie Hardesty, CCE, CICP, director of credit at Elevate Textiles, Inc. (Charlotte, NC) said her trade credit insurance policies are used for all non-U.S. receivables. “It gives us more security when making credit decisions,” Hardesty said. “We only pay a premium for our insurance if the company we’re selling to does not pay us. Rather than taking the full risk ourselves, we pay every month to be able to get that security. Based on the country we’re selling to, we get a discretionary credit limit that is allowed.”

If they need more than the discretionary limit provided, Hardesty’s company will apply for a special buyer’s credit limit. “To get the special buyer’s credit limit (SBCL), we have to give our credit insurance company a credit report, two years of financials on the customer and pay the premium every month,” she said. “It typically doesn’t matter the size of the customer, it’s more based on the country risk. We’ve been turned down from the SBCL before, but we’ve had overall good luck with putting the policy into place.”

Yes, but: Companies that do not use credit insurance or are self-insured see how insurance can be more disadvantageous than beneficial. For example, companies that rarely face bad debt—even in the current economic state—do not think third-party insurers are worth the premium.

Self-insured companies put a reserve on their balance sheet to cover any bad debt that may occur over a financial year. If the losses are predictable, the company is more likely to lean toward self-insurance. “Though we’ve seen a little bit of an uptick in economic disturbance, tremendous sums of money are not at risk, so it’s better for us to self-insure,” explained Barry Hickman senior director of credit at Dal-Tile Corporation (Dallas, TX). “I also find that credit insurance policies can be very complicated. One of the big disadvantages I find is that insurance puts a cap on a certain dollar value whether it’s a portfolio or a single account, and if you go over that value, you are no longer insured.”

Hickman said insurance caps can limit quick-strike sales opportunities as well. “As a credit professional, when you begin to weigh the cost of credit insurance with the ability to make sound risk decisions on your own with the tools you have, it can become a lopsided opportunity or business decision,” Hickman explained. “However, in other parts of the world, it’s essential. Some countries don’t have access to third-party vendors, so they rely heavily on credit insurers.”

The bottom line: Trade credit insurance serves as a risk mitigation tool in the B2B industry, protecting sellers against customers' inability to pay. However, it is important to know what is best for your company’s needs and balance the benefits for expanding opportunities and managing unexpected losses.

Checking all the boxes.

“This has been my goal for a while as the CCE is a very prestigious designation to have behind your name,” Lorielle Champagne, CCE, regional credit manager at H&E Equipment Services, Inc. (Arlington, TX).

Read more...

Achieving credit success.

“The CBA gave me more knowledge and confidence that I needed to jump into the credit world,” said Heather Will, CBA, credit manager at Anchor Industries, Inc. (Evansville, IN).

Read more...

Bridging the Gap: Automation Solutions for Staff Shortages.

On the latest episode of NACM's Extra Credit podcast ... Automation not only helps with staffing shortages, but it can attract the new generation of credit managers.

Read more...

The softer side of credit management

Jamilex Gotay, editorial associate

At first glance, credit management may appear to solely require hard skills such as financial data analysis, risk assessment and cash flow forecasting. But as a profession based largely upon trust, credit managers must not forget to develop their soft skills.

“In most cases, credit professionals are playing the role of a middle person between operational functions and the customer or distributor,” Craig Simpkins, CCE, CICP, finance director at Johnson Controls, Inc., Building Efficiency Division (Milwaukee, WI) said during a live NACM webinar, The Softer Side of Credit Management. “Within shared services, your role is to influence opinions and behaviors of others without direct authority. To be successful, credit professionals must possess the necessary soft skills, or emotional intelligence.”

Standard soft skills consist of personality traits, social agencies, communication, language skills, personal habits, friendliness and optimism. When you’re going into a credit management role, you want to establish yourself or brand yourself as an individual through these key soft skills:

- Emotional maturity

- Communication

- Accountability

- Trust

- Integrity

- Analytical

- Drive for results

- Influence

- Relationship-building

The influence of credit management pervades all departments within an enterprise. “Therefore, timely responses are required to prevent situations such as credit holds and legal intervention,” Simpkins explained. “Thus, it is crucial to ensure continuous and effective communication.”

By the numbers: A recent LinkedIn survey found that 9 out of 10 global executives agree that soft skills (aka “human” or “durable” skills) are more important than ever. Communication ranks number one on the 2024 list of “most in-demand skills.”

“Credit professionals can influence customers simply by evaluating why there are challenges with the collection process,” Simpkins said. “They should be able to show them facts in a positive manner. It also goes a long way with establishing that partnership between you and your customer.”

Soft skills play a pivotal role in fostering positive relationships within companies, facilitating effective communication, conflict resolution and teamwork. Additionally, they enhance external relationships with customers and stakeholders. For instance, prompt communication, a positive demeanor and surpassing client expectations are crucial customer service skills. These not only foster a strong relationship with your client but also enhance your professional credibility. This credibility, in turn, cultivates trust, which is vital for risk reduction and ensuring long-term payment.

Networking involves mutually beneficial interactions and engagements. Your network can offer advice for business challenges, and you can reciprocate by sharing your expertise to fortify these relationships. “Understand that networking is a life skill, not something you do only when you want something from someone else,” said Simpkins.

Enhancing soft skills is crucial as it enables credit professionals to effectively navigate complicated interpersonal situations, communicate ideas clearly and collaborate with diverse teams. It also provides them with the adaptability and empathy needed to enhance job performance and grow within their field. Simple ways to enhance soft skills are through:

- Recognition

- Understanding

- Self-assessment

- Experimentation

- Skill practice

- Feedback

“Even if you’ve been in credit management for a few years, it’s always good to get a refresher to make sure that you’re staying ahead of the curve on the soft skills aspect of the job,” Simpkins explained.

The bottom line: Developing and honing soft skills in credit management is not just a bonus, but a necessity for professionals to succeed.

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

-

MAY

13

3pm ET -

A Grizzled Attorney Presents the Construction Law Battlefield Webinar

Speaker: Randall Lindley, Esq., Partner, Bell Nunnally

Duration: 60 minutes

-

The Economic Outlook for China and the Rest of Asia-Pacific

Speaker: Louis Kuijs, Chief Economist, Asia Pacific at S&P Global Ratings

Duration: 60 minutes -

MAY

17

10am ET