February 22, 2024

Credit managers return to the office

Kendall Payton, editorial associate

Four years after the start of the pandemic, many credit managers still work from home. But a growing number are back in the office five days a week.

Why it matters: Understanding these labor market shifts and trends is key for credit professionals as it directly impacts their work environment, job security and workload management. Credit managers must remain aware of these pressures as workforce trends continue to change in 2024.

By the numbers: A recent eNews poll revealed 32% of credit professionals said managing an increased workload was their biggest challenge. Other labor-related challenges include:

- Hiring and retaining skilled credit managers (14%).

- Understaffing due to layoffs and reduced team size (14%).

- Maintaining team morale amid the fear of potential layoffs (7%).

- Managing layoffs without affecting credit management operations (4%).

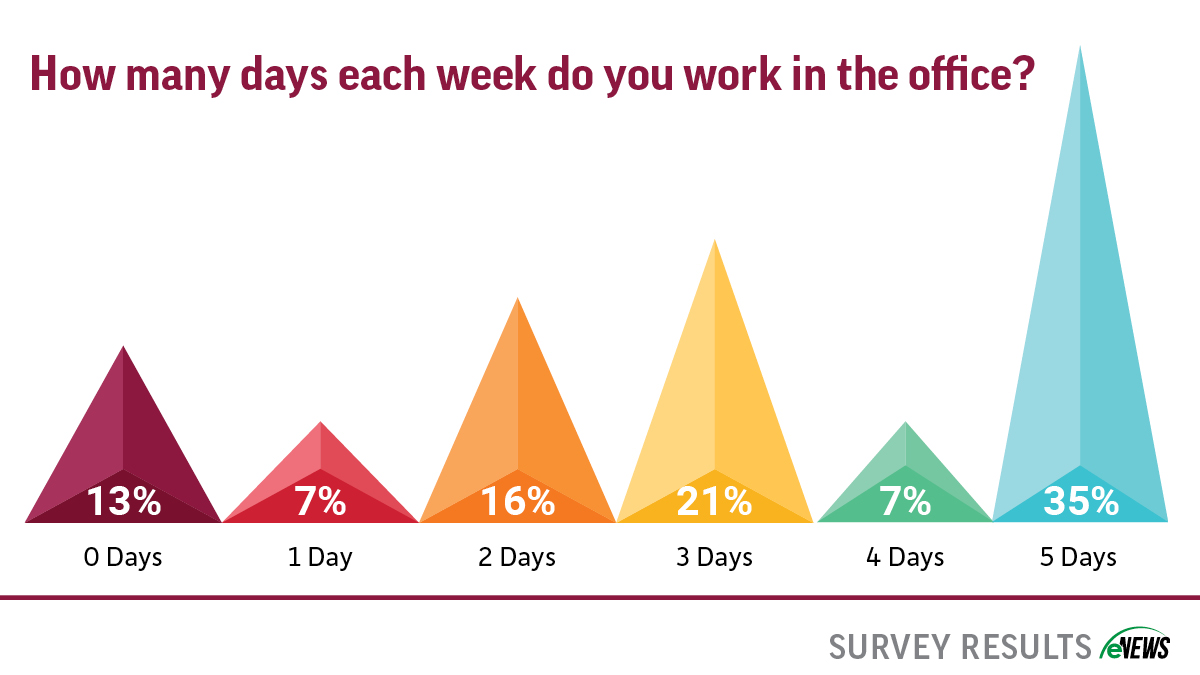

Another eNews poll revealed that 35% of credit managers work in the office five days each week, while:

- 21% are in the office three out of five days; and

- 13% are fully remote.

What labor experts are saying: “What we’re seeing is some softening in the market, and the last few years post-COVID were more of a candidate market where they had a lot more of the leverage,” said Chris Myers, president and CEO of Professional Alternatives (Houston, TX). “But power is starting to shift back towards the employer now. With more layoffs happening nationally than what we’ve seen in a while, the expectation on our end is that the market will soften a bit but not substantially. It won’t be a full-scale recession to where jobs will be shed in high quantity—but it’s definitely shifting back towards where the companies have a bit more control than what they’ve had in the past.”

What’s next for labor trends in 2024:

We’re heading back to the office. Return-to-office mandates started to increase in the last two quarters of 2023. However, feelings about returning to the office are mixed. Tangible costs, such as gas, add up. The intangible cost of time wasted in hours of commuting also creates an argument against in-office work.

“Most recruiting managers or third-party agencies have mentioned how much the talent pool opens the second you mention working from home,” said Jake Merriman, credit manager at Masons Supply Company (Ridgefield, WA). “75% of the time, the main question from applicants is if the position is remote and, if not, it’s one of the main reasons they won’t want to join—especially with the younger generation, we’re seeing that it’s not an option but a necessity.”

Although fully remote roles are less common, hybrid schedules seem to be a winner in the workplace. As of 2023, 12.7% of employees work from home full-time, while 28.2% work a hybrid model, per a report from Forbes. When employees had more leverage during the peak of the pandemic, most employers did not have much of an option to fight for coming in even in a hybrid environment.

Kimberly Darling, senior credit analyst at OrePac Holding Company (Wilsonville, OR) said her company uses a hybrid work model. “My company recently announced that we’re going back into the office three days a week instead of two,” Darling said. “Most of us think there are less distractions when we’re at home. When we are in the office, you can see our email volume drop considerably because people like to stop to chat and interact with each other. It’s very likely that you’ll lose that focus when going into the office more days.”

AI is here to stay. AI has fundamentally transformed the labor market, reshaping the nature of work and employment dynamics. While these advancements have brought increased efficiency and productivity, they have also raised concerns about job displacement and the future of work. Roles that involve repetitive tasks or routine information processing are increasingly being automated, leading to a shift in the skills demanded by employers. However, AI has also created new opportunities. Credit managers can use AI to help make more confident credit decisions.

Employees want more to stay put. Credit managers must find more creative ways to keep staff. This starts with being upfront about job responsibilities so that candidates know what to expect—especially as credit managers oversee more tasks.

“In previous instances of staffing challenges, our team addressed increased workloads by redistributing job duties among team members,” said Jonathan Chandler, CBA, CICP, senior credit analyst at Wonderful Pistachios Almonds (Bakersfield, CA). “The goal of the redistributing of responsibilities should be equity. This approach fostered a collaborative environment and provided opportunities to gain valuable insights into various roles, such as accounts payable, customer services, accounts receivable and credit. Embracing additional responsibilities across different units has been instrumental in enhancing efficiency and effectiveness.”

Employers must also find efficient ways to appeal to their potential candidates in 2024. Pay increases are now more difficult to provide as a benefit, but some employees value benefit packages outside of monetary compensation. Only 11% of employees in the workplace are satisfied with their current benefits. Tiger Recruitment data shows more than half of U.S. professionals (56%) would like to see their benefits adapted to the rising cost of living, while 30% want more personalized benefits.

The bottom line: During any workforce changes or adjustments, credit professionals should always focus on skill diversification and stay informed about the latest industry trends. Labor trends are ever-changing—making the ability to adapt an inherent skill.

AI in credit: Policy considerations

Jamilex Gotay, editorial associate

Artificial intelligence (AI), a machine’s ability to perform the cognitive functions we associate with the human mind, is being used to facilitate processes and improve efficiency in business. As different forms of AI gain popularity in the finance sector, credit professionals must become experts on how AI can support their role and simplify workflow.

Why it matters: Even if your company isn't utilizing AI, it's critical to establish credit policies to safeguard against risk.

ChatGPT is AI … but all AI is not ChatGPT. AI allows for enhanced creativity and efficiency in a variety of sectors that include customer support, predictive analytics and risk management. It is important to differentiate between ChatGPT and other forms of AI when building a policy.

“To simplify the relationship, consider generative AI as a broad field of study and innovation, with ChatGPT being a standout product within this domain,” reads an Upwork article. “Generative AI encompasses foundational techniques and concepts, and ChatGPT puts these principles into practice.”

By the numbers: According to a recent eNews poll, most credit professionals (95%) surveyed do not have a written credit policy in place for the use of AI or ChatGPT.

Steve Frederiksen, credit manager of global business at Underwriters Laboratories LLC (Northbrook, IL), said that his company banned ChatGPT usage due to its novelty and complexity, making it difficult to comprehend the specific applications of different AI tools. “My company is observing the pros and cons of ChatGPT, as well as the polices of other institutions, before creating its own policy,” he said. “Personally, I’d consider using AI when performing financial analysis for nonpublic readily available companies.”

The benefit to using AI is that it is adaptable and can learn over time. “The bad thing is that we don't have the transparency and some of the control that we have when credit professionals are doing the research and looking through the customer’s files themselves, making the decision based on the information in front of them,” said Kathleen McGee, partner in the Emerging Companies and Venture Capital, White Collar Criminal Defense Department of Lowenstein Sandler LLP (New York, NY).

McGee suggests that every company establish and adopt policies and procedures for staff to follow. Effective policy will include topics such as training and an awareness of how AI impacts a particular industry or company. “It should also include external facing policies, whether that be terms of use, privacy policies or contractual language,” she said. “Other external policies include your website disclaimers with respect to AI usage and data collection, as well as indemnifications, representations and warranties.”

Here are some areas to consider when creating an AI policy, according to Corporate Governance Institute:

- Data privacy and security: A policy should be put in place that outlines how the company will collect, store, and protect the data used by AI systems. This includes ensuring that only authorized personnel access the data and that it is stored securely.

- Bias and discrimination: AI systems can reflect and amplify human biases and prejudices. The policy should address how the company will ensure that AI systems do not discriminate against individuals or groups based on protected characteristics such as race, gender or age.

- Transparency: The policy should require that AI systems used in the workplace are transparent and explainable. This means employees should understand how AI decisions are made and why specific outcomes are generated.

- Employee training: The policy should mandate training for all employees working with AI systems, covering effective and ethical use, understanding of its limitations, and potential work impact.

- Accountability and responsibility: The policy should clearly define who is responsible for AI systems’ decisions in the workplace. This includes holding individuals and departments accountable for the outcomes generated by AI systems.

- Ethical considerations: The policy should address ethical concerns surrounding the use of AI in the workplace, such as the potential impact on employment and the ethical use of AI in decision-making.

- Continuous monitoring and improvement: The policy should require ongoing monitoring and modification of AI systems used in the workplace to ensure that they are functioning as intended and are not causing unintended consequences.

Credit professionals should discuss with AI software vendors about the program's functionality. They should inquire about regular testing for consistent results and the possibility of auditing the program. “Ask if there’s a way to describe with a sufficient degree of transparency what the outcome was based on so that we can as a company relay that along with an adverse credit determination,” McGee said. “I strongly advise against using ChatGPT or any open-source AI software for creditworthiness decisions due to the uncertainty of the data's accuracy and source.”

The psychology behind leadership

Kendall Payton, editorial associate

Leadership serves as a catalyst for change, knowledge and growth. Leaders are individuals with a wide range of expertise providing guidance to those around them—and in the workplace, it’s crucial to earn the respect and trust of your employees. But this doesn’t happen overnight. Mutual trust and respect develop over time.

Several layers exist to get to the core of how your team functions both together and individually, which is why psychology plays a significant role in leading effectively.

Why it matters: Psychology can be a valuable tool for effective leadership because it provides deeper insights into human behavioral patterns, motivation and decision-making. Some of the greatest leaders with high-performing teams are emotionally intelligent and know how to inspire motivation.

“By aiding decision making, hiring, team dynamics and communication, psychology can be a time saver and reach more people so they can do their jobs more effectively,” said Francis Eberle, Ph.D., instructor at NACM’s Graduate School of Credit and Financial Management (GSCFM). “Leaders can now add science as one of their tools to assist them in their role in moving the company forward. By some estimates, $12,500 annually is lost to businesses due to poor communication.”

Communication goes further than talking. Leadership is about knowing how to connect deeper than surface-level interactions. Effective communication fosters a more positive work environment, which helps with employee engagement.

Teams are dynamic. When you know how your team members function, it’s easier to find out how far is too far? As a leader, it’s essential to push your employees outside their comfort zone just enough for personal growth—but not too much to where it becomes anxiety-inducing.

“I bring members of my team with me when I do presentations, even if they’re only standing up there and I let them get comfortable presenting one slide,” said Jill Burns, regional credit analyst at ABC Supply Co. (Beloit, WI). “It’s a simple action to get them used to the experience. Public speaking can be intimidating, so we alternate for everyone to practice. I’ve had the same person come up with me four times, and the first three times, they did not say a word—but this last time, she presented six slides. She did great and was excited afterwards, so it felt great to witness!”

Learning styles can change. The ability to adapt quickly is part of the psychology behind great leadership. Different people have different personality traits and cognitive styles that have massive impacts on team dynamics and behavior. Also, your team can consist of people from multiple departments who have many different responsibilities.

Treating everyone as an individual is a big part of leadership, explained Mike Wierzchowski, senior financial services analyst at Werner Electric Supply (Pewaukee, WI). “You have to treat everyone slightly differently and coach them in the direction they feel comfortable,” he added. “You also have to consider generational nuances when leading because one person may not be as receptive as another to an authoritative or passive leadership style. It’s an individual aspect more than anything. Everyone wants to feel special and matter, regardless of their generation, and getting to that can be difficult.”

Every individual has a hierarchy of needs. When individuals can use their own unique strengths within their team, productivity will thrive. Motivating your team comes from helping them see their own roles and overall reason to participate. “I give my team the autonomy to do their job without micromanaging them, educate them and push them into NACM classes to champion my company to invest in training,” said Michelle Kelly, CCE, CCRA, senior credit manager at Mansfield Energy (Gainesville, GA). “I have developed a lot of talent long-term, but now we’re navigating ways to find someone to fulfill other shoes without them having to take on too much more work. It’s all about balance.”

Leadership Training

Giving your team the opportunity to learn their strengths and weaknesses is your duty as a leader.

- NACM’s Graduate School of Credit and Financial Management (GSCFM) creates credit leaders.

- Register for the Executive Leadership Workshop at Credit Congress.

- Join other credit leaders during NACM’s monthly Thought Leadership Forums.

- Watch on-demand webinars about leadership or sign up for any upcoming live webinar.

The bottom line: Effective leadership hinges on understanding psychology to foster trust and respect, effective communication and helping team members realize their full potential.

Checking all the boxes.

“This has been my goal for a while as the CCE is a very prestigious designation to have behind your name,” Lorielle Champagne, CCE, regional credit manager at H&E Equipment Services, Inc. (Arlington, TX).

Read more...

Achieving credit success.

“The CBA gave me more knowledge and confidence that I needed to jump into the credit world,” said Heather Will, CBA, credit manager at Anchor Industries, Inc. (Evansville, IN).

Read more...

Bridging the Gap: Automation Solutions for Staff Shortages.

On the latest episode of NACM's Extra Credit podcast ... Automation not only helps with staffing shortages, but it can attract the new generation of credit managers.

Read more...

Performance bonds mitigate risk on public projects

Jamilex Gotay, editorial associate

Contractors are prohibited from filing mechanic's liens on public projects like highways, schools or fire stations, as this would lead to public real estate foreclosure. Instead, they are offered alternative security in a performance bond as a guarantee against the failure of the other party to meet the contract obligations.

Why it matters: Understanding the prohibition of mechanic's liens on public projects and the role of performance bonds is important for contractors to secure their financial interests and ensure fulfillment of contractual obligations.

Payment Bond vs Performance Bond

Typically, a general contractor (GC) on a public project is required to provide a payment bond to ensure all subcontractors and suppliers are paid. The GC acts as the principal on the bond, with a third-party surety guaranteeing payment to eligible claimants.

A performance bond is often required for government construction projects to ensure the GC completes the work on time and on budget. It is typically provided by a bank or insurance company to guarantee the contractor finishes the designated projects.

“A performance bond was primarily meant to protect against the GC filing for bankruptcy and leaving public entities with no way to fulfill the obligation of the general contract,” said Chris Ring of NACM’s Secured Transaction Services (STS).

Pros of Performance Bonds

- Protects an obligee from additional costs if work is not completed.

- Reduces the risk for developers in construction and other large projects.

Cons of Performance Bonds

- Bond issuers may attempt to deny payment.

- If the obligee underestimates the cost of non-performance, they will have to absorb the extra costs on their own.

- Performance bonds add an additional cost to the contractor that may be passed on to the obligee.

Once one of the public entities calls upon the surety bond, then that company must find a contractor to finish the project. “Usually, the surety company gets involved by attempting to get compliance from the original contractor by the surety,” said Beau Hays, partner at Hays & Potter, LLP (Peachtree Corners, GA). "So, if the bonded company and the owner dispute over project completion incentives, the bonding company prefers resolving it early without involving a third party. This also motivates the contractor to finish the job."

This was the case for Miami-based American Empire Builders, who wasn’t able to fulfill the obligations of a general contract to complete bridges in Florida. On Jan. 19, the City issued a Notice of Default to the contractor, which “confirmed that the contractor has failed to complete the project on schedule and that the City will be sending the surety bond company a Demand for Performance,” reads a Tampa Bay article.

Occasionally, the GC may not only fall short of fulfilling their responsibilities outlined in the general contract but may also face bankruptcy or cease operations altogether. Martin Smith, CCE, CICP, credit manager at Ash Grove Cement Company (Sumterville, FL) encountered this situation over a decade ago when his company took over a financially troubled concrete and cement supplier in Florida. "In this instance, many were adversely affected, including the bonding company,” he said. “It's unfavorable when others must step in to complete the job, as they have to hire contractors who lost the initial bid. These contractors won't be doing anyone any favors, resulting in higher costs to finish the project.”

The cost of a performance bond depends on a variety of factors, such as the project's size, the contractor's creditworthiness, their license history and the bonding party's financial strength. In general, the rate usually ranges between 1.5% and 3.5% of the total value of the performance bond.

Bonds are not required on every public project. Accordingly, contractors should make a practice of obtaining a copy of the bond on the project in their initial credit evaluation of the project and customer. “From a diligence standpoint, supplier of materials should confirm that there is a performance bond on that project and who that bonding company is,” Ring said. “When they hear about a GC struggling financially, that's when they need a copy of the performance bond to make sure that there is a bonding company there to support the complete obligation of the general contract.”

The government contracting officer may require performance and payment bonds for contracts even if not required by law. “Payment bond claimants should always check the bonding requirements with the owner or contracting officer, especially once payment problems exist,” reads a Fullerton and Knowles article. “A payment bond may exist on unexpected projects.”

The bottom line: Performance bonds are essential in public projects as they offer financial security to contractors, ensuring the fulfillment of contractual obligations and mitigating risks associated with non-completion or bankruptcy; however, understanding their pros and cons, along with diligent evaluation of bonding requirements for each project, is crucial.

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

-

MAY

13

3pm ET -

A Grizzled Attorney Presents the Construction Law Battlefield Webinar

Speaker: Randall Lindley, Esq., Partner, Bell Nunnally

Duration: 60 minutes

-

The Economic Outlook for China and the Rest of Asia-Pacific

Speaker: Louis Kuijs, Chief Economist, Asia Pacific at S&P Global Ratings

Duration: 60 minutes -

MAY

17

10am ET