May 26, 2022

Will Taiwan Suffer a Similar Fate as Ukraine?

Diana Mota, editor in chief

The invasion of Ukraine has fueled concerns over whether China will follow Russia’s example and use force to take control of Taiwan. News reports weigh reasons that could push China over the edge and reasons that could keep it in check—at least for now.

“An attempt by Beijing to claim Taiwan by force has just become more likely,” reported The Atlantic, the day Russia crossed into Ukraine. “That’s not necessarily because there is a direct link between Putin’s invasion of Ukraine and Beijing’s menacing of Taiwan, but because the war for Ukraine is the most unfortunate indication yet of the frightening direction of global geopolitics: Autocrats are striking back.

“President Xi Jinping’s nationalist fervor, commitment to the restoration of Chinese power, and more aggressive approach compared with his predecessors when it comes to territorial and maritime disputes, relations with the U.S. and its allies, as well as the international system writ large, have already become a destabilizing force in Asia,” The Atlantic article points out.

President Joe Biden’s pledge on Monday to militarily support the island added more fuel to the possibility of a Taiwan invasion—despite the White House’s assurances a day later that the U.S.’s policy of strategic ambiguity remains the same. Strategic ambiguity has been the cornerstone of U.S.-Taiwan relations and a central sticking point in U.S.-China relations, according to Wikipedia.

“Under the ‘One China’ policy, the U.S. acknowledges China’s position that Taiwan is part of China, but has never officially recognized Beijing's claim to the self-governing island of 23 million,” CNN reported. “The U.S. provides Taiwan defensive weapons, but has remained intentionally ambiguous on whether it would intervene militarily in the event of a Chinese attack.”

Chinese foreign ministry spokesperson, Wang Wenbin, cautioned on Tuesday that the U.S. should “avoid sending any wrong signal to the ‘Taiwan independence’ separatist forces, lest it should seriously undermine peace across the Taiwan Strait and China-U.S. relations.” Wenbin warned that China would take firm actions to safeguard its sovereignty and security interests.

Whether the current geopolitical environment pushes China forward or deters it from further action beyond intimidating military exercises is a bit of a guessing game. For now, Jay Tenney, managing director of Trade Risk Group, a trade credit insurance broker, is not worried about an imminent invasion of Taiwan. “Most of the trade credit insurers I have spoken with think if China was going to do something in the near term that’s probably been put off by what they see happening in the Ukraine and the sanctions that have pummeled Russia.” A waive of sanctions on China would cut off all trade in and out of the country, he added. Many feel that time is on China’s side, and it does not need to take immediate action.

On the other hand, China might believe “that economic sanctions could be more difficult to implement against China without significant collateral damage to global trade, supply chains and financial institutions,” the Foreign Policy article states.

The impact to supply chains would be severe, according to the webinar, Taiwan, China and the Risk of Global Supply Chain Disruption, by supply chain service provider, Interos. More than half, or just under $450 billion, of Taiwan’s economy comes from exports, and more than 23,000 U.S. companies buy directly from Taiwan. Moving further up the supply stream, the combined total touches 237,000 U.S. connections.

The webinar presenter pointed out that Taiwan’s importance to the global economy is heavily skewed toward semiconductor manufacturing, and it dominates the manufacturing of cutting-edge chips; those are the ones that are used in most advanced commercial and military technologies. One Taiwanese company, TSMC, has more than 50% of the global market share and is the world’s 10th most valuable company. Both the U.S. and China are heavily dependent on Taiwan’s advanced chipmaking capabilities.

The webinar also outlined the reasons China could vs. the reasons it won’t invade Taiwan. Among the reasons supporting an invasion are:

- China has maintained that Taiwan is sovereign territory and has vowed to bring it back under mainland control—with force, if necessary;

- President Xi Jinping encountered little resistance in integrating Hong Kong;

- US supply chains have shut out China’s semiconductor firms, which are years away from having Taiwan’s advanced technologies; and

- The West is distracted by Russia’s ongoing invasion of Ukraine.

Reasons against include:

- China fears being drawn into a direct military conflict with the U.S., Taiwan’s principal protector;

- A Chinese invasion would lead to new Western export controls and economic sanctions that could weaken China’s trade performance;

- A botched invasion could severely harm China’s huge electronics industry, the biggest importer of Taiwanese semiconductors; and

- There is no guarantee that China would be able to seize control of TSMC and other Taiwanese foundries in the event of an invasion.

What Should Exporters Be Doing

Several credit professionals mentioned they keep their exposure to a minimum in Taiwan—just one or two customers covered by trade credit insurance. “We are monitoring but only slightly due to our very limited exposure there,” a credit manager explained. “We get occasional updates from our credit insurance broker who is keeping a close eye on it all. Other than that, we are watching for negative trends on the few accounts we have there that are on net terms.”

Recommendations in the webinar included:

- Begin to assess your dependence on, and risk exposure to, Taiwan by understanding the direct, (Tier 1*) relationships you have with Taiwanese suppliers and the components, parts, raw materials and products you buy from them.

- Build transparency of your indirect connections (tiers 2 and 3) to Taiwan by getting visibility of your extended supply chain in the country.

- Evaluate the extent to which key semiconductors, electronic components and other items you depend on from Taiwan-linked supply chains are single- or sole-sourced, and where you have viable alternative options already in place.

- Where your dependence on Taiwan is deemed unacceptably high, according to your organization’s risk appetite, develop a strategy aimed at diversifying your supply base footprint to their geographies—either by sourcing from new suppliers and/or by working with existing partners to use alternate capacity.

- Ensure that you continuously monitor your Taiwan-dependent supply chains for both geopolitical and operational risk events, alongside those of a financial, cyber-security and ESG nature.

*Tier 1 suppliers are partners that you directly conduct business with; Tier 2 suppliers are the sources that supply Tier 1; and Tier 3 suppliers typically provide raw materials.

New Indo-Pacific Trade Deal: What We Know So Far

Annacaroline Caruso, editorial associate

President Joe Biden unveiled a new trade agreement with 12 Indo-Pacific countries earlier this week. This move is partly aimed at repairing the tattered global supply chain and strengthening the economies of nations involved in the deal, among several other goals.

The Indo-Pacific Economic Framework (IPEF) is meant as an alternative to the Trans-Pacific Partnership, which the U.S. pulled out of in 2017, per the Associated Press. “Many related trade deals, regardless of their content, had become politically toxic for U.S. voters, who associated them with job losses,” the article reads.

The nations joining the trade pact include Australia, Brunei, India, Indonesia, Japan, South Korea, Malaysia, New Zealand, the Philippines, Singapore, Thailand and Vietnam. When combined with the U.S., they represent 40% of world GDP. Officials say other countries may join the pact in the future.

“This framework is intended to advance resilience, sustainability, inclusiveness, economic growth, fairness and competitiveness for our economies,” the group said in a joint statement. “Through this initiative, we aim to contribute to cooperation, stability, prosperity, development and peace within the region.”

Details of the pact are still being finalized, but as of right now the agreement is based on four main pillars: connected economy, resilient economy, clean economy and fair economy, per a government fact sheet. White House national security adviser, Jake Sullivan, told the AP that IPEF is “focused around the further integration of Indo-Pacific economies; setting of standards and rules, particularly in new areas like the digital economy; and also trying to ensure that there are secure and resilient supply chains.”

Some experts say the trade deal will give the U.S. a better economic strategy when trading in the Indo-Pacific. “We’re a Pacific power but not an Asian country,” Matt Goodman, a global economic expert at the Center for Strategic and International Studies who worked in the Obama administration, told USA Today. “To be considered a real partner and player in the region, we have to engage on all levels. And it’s not just about our military or our diplomatic capabilities.”

However, critics of IPEF are concerned about the lack of both tariff reductions and greater access to U.S. markets, which has historically accompanied other trade deals— “making it less attractive in a region that has existing regional free trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP),” reads a VOA News article.

Details about the initiative are still being negotiated and the trade deal likely won’t be finalized for at least another 12 months, the AP reports.

Want to Network Like a Pro? Get Your Story Straight

Kellogg Insight

As an executive at any rung of the career ladder, you are going to meet people—lots of people. It may be at a conference, an event or socially; but regardless of the context, you will have to talk about who you are, what you do and why others should care.

Like any good businessperson, you are conditioned to network. But are you prepared?

According to Craig Wortmann, a clinical professor of innovation and entrepreneurship at the Kellogg School and author of the book What’s Your Story?, convincing potential colleagues that you would be a great collaborator and a trustworthy partner means getting your story straight.

Based on more than 20 years of experience in sales and entrepreneurship, Wortmann offers tips on how to turn any professional situation into an opportunity simply by being prepared for networking conversations.

Prepare Your Movie Trailer

The first question many people ask upon meeting is: “What do you do?” While most of us have answered the question a million times, we have not necessarily considered the valuable storytelling real estate the question provides.

“It’s the most common question you get asked in your life, period,” said Wortmann. Yet, many people never take the time to compose the answer to this fundamental question. It’s important to be ready with a clear, concise and compelling response, which will help people connect to you and your motivations. “Why not take an opportunity to say something interesting?”

Instead of simply stating your profession—“I’m an accountant”—add a short tag line or pitch. When Wortmann launched his most recent company, his movie trailer became, “I run a firm called Sales Engine. We help companies build and tune their sales engine.” In two sentences, he was able to give the name of the company, his position and the purpose of the business.

This “movie trailer of you,” as Wortmann calls it, is a handy tool for initial discussions with potential clients or investors. It is helpful also to tweak your trailer for different contexts. If you are an educational consultant, you may have a social version—for times you do not want to talk shop—and a slightly more nitty-gritty version for networking at an education conference.

“It’s not really about the length of your response, but its context. For example, the superintendent of Detroit Public Schools is going to have a different level of understanding—and interest in—certain details.”

Tell the Right Story, at the Right Time, for the Right Reasons

Wortmann identifies four types of stories all business leaders should have on hand: success stories, failure stories, funny stories and stories of legends. These tales need to be crisp, he said, and when told at the right time, can show character, reveal your ability as a leader or demonstrate your drive.

“Storytelling is a discipline of capturing the stories, distilling them down to make them good for business and then producing them at the right moment,” said Wortmann.

Choosing the best story for a given situation, however, is less intuitive than it seems. If you are in an interview with a potential client, you might tell a story of failure instead of one of success. “By doing this, you show that you’re humble, that you’re a learner and that you’re good to work with.”

On the other hand, success stories may come in handy once you’ve landed a client, but while you are still winning over their trust. As you are onboarding the client, sharing how you helped another client through that same process can reinforce their sense of confidence.

And other stories have other purposes. Wortmann knows a CEO who tells a particular “funny failure” story to reinforce the importance of asking good questions. The CEO relates how he once spent an entire summer cultivating a giant, once-in-a-lifetime opportunity through a contact at a global consumer-packaged-goods company. On their fourteenth phone call, he grew impatient. When he finally asked his contact when her company would be signing the contract, she informed him that she was an intern.

“She thanked him for all she had learned that summer,” Wortmann said. “It turned out she wasn’t a prospect at all. She was a college student. But he never asked her.”

“Gear Up” to Network More Effectively

“At any networking opportunity, there are likely five people you meet who could help you build your business,” said Wortmann. “It’s your job to seek them out, give disciplined answers and move on if they can’t help you accomplish your goals.”

Moving in and out of conversations effectively and efficiently takes practice and planning. Wortmann suggests envisioning any conversation as having four forward gears—and a reverse gear.

In first gear, make small talk while being prepared to reverse course. This can be done by mentioning what a great event it is and that there are a lot of people you look forward to meeting. This brief mention builds in an “exit door” to your conversation.

In second gear, exchange information about what you do—this is the perfect place to play your movie trailer.

Shifting into third, you give a little more information about your work, but be careful not to fall into the common trap of talking a lot just because you are familiar with the subject. Remember: less is more.

Fourth gear is where you dig deeper to determine if the person you are talking to is right for your business, a person who can help you, or a person you might be able to help. Ask how they think about some of your central concerns. Their answers may show how you could benefit from working together.

At any of these points, if you find that the person you are talking to is perfectly pleasant, but not a fit for your business, shift into reverse by delicately reminding them that you are here to see a lot of people—the reverse gear you established earlier—thanking them, shaking hands and moving on.

“People are hesitant to do that because it makes them feel like they’re being gruff, transactional, or harsh,” Wortmann said. “I suggest it’s the exact opposite. It saves everyone time.”

Ask Unexpected Questions

There is a lot to learn from asking questions that people do not expect, questions that “get behind someone’s eyes,” as Wortmann puts it. If you are prepared, your questions can get people to reflect, analyze and share their true feelings.

Design questions with an eye on issues and solutions that may arise in the future. Asking what three big changes someone would make this year if they could, for example, has the potential to show you how much vision the person has.

“These questions have to come from your natural curiosity,” Wortmann said. “I should authentically care how a successful businessperson would respond to questions such as, ‘What would happen if your company fails? What would it feel like? What would you say to people?’”

It helps to keep some things in mind when asking such substantial questions, however. For one, you need to earn the right to ask. A question that may make sense fifteen minutes into a conversation—“What do you want your life to be like?”—may sound creepy just ten seconds in.

Another suggestion? Preface tough questions with a warning along the lines of, “Let me ask you a bigger-picture question …” or “This may be a bit off-vector, but ….” These signal to people that a big question is coming, softening the blow.

Finally, keep in mind that some of your questions may land flat. After all, not everyone expects to be challenged by someone they have just met. But, said Wortmann, that’s okay.

“Take risks. This is so much better than being Mr. Vanilla at a networking event.”

This first appeared in Kellogg Insight. Reprinted with permission.

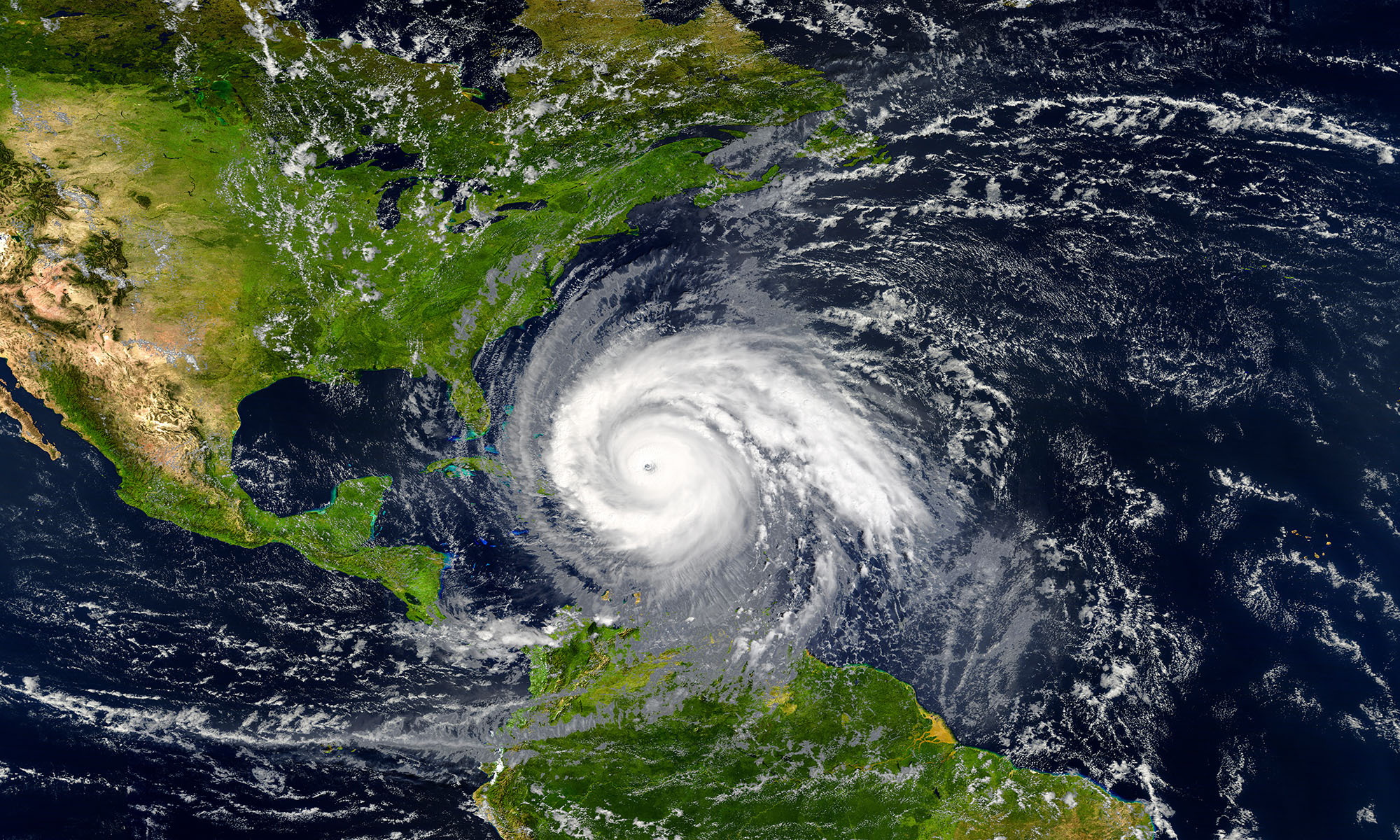

Hurricane Season Could Mean Large Economic Losses

Annacaroline Caruso, editorial associate

The start of hurricane season is one week away, and the National Oceanic and Atmospheric Administration (NOAA) expects another above-average year with up to 21 named storms (winds of at least 39 mph), of which six to 10 could become hurricanes with winds of 74 mph or higher—including three to six major hurricanes with winds of 111 mph or higher.

If NOAA’s predictions are correct, 2022 would be the seventh consecutive year with above-average storm activity—the longest streak in recorded history, per NPR.

Aside from the devastation and loss of life created by natural disasters, these events pose significant risk to businesses and come with severe economic consequences. Last year, natural disasters losses totaled $280 billion, of which about $120 billion were insured, according to Munich Re.

So, if this year is expected to be another destructive hurricane season, it likely means another expensive hurricane season as well. “The hurricane seasons have become increasingly costly over the last five years, causing financial loss to total over $20 billion per year,” according to DTN, which specializes in subscription-based services for the analysis and delivery of real-time weather, agricultural, energy, and commodity market information. “Conservative storm loss projections in the next 50 years could reach above $35 billion in materials, wages and economic interruptions.”

Roughly 40% of domestic jobs and 46% of GDP come from the coastal regions, which experience the majority of hurricanes, DTN stated. But that does not mean other states are completely protected. “Hurricane Ida spanned nine states, demonstrating that anyone can be in the direct path of a hurricane and in danger from the remnants of a storm system,” said Federal Emergency Management Agency (FEMA) administrator, Deanne Criswell. “It’s important for everyone to understand their risk and take proactive steps to get ready now.

Natural disasters present “an important opportunity for companies to assess their incident preparedness, data backup and business continuity plans—before disasters strike,” according to IT technology services company, CMIT Solutions. The company recommends the following in case your company or your customers’ company is impacted:

- Make sure your data is backed up and can be accessed if disaster strikes. Many businesses have both comprehensive image backups on-site (on physical hard drives) and off-site (safely stored in the cloud). Disaster preparedness plans should outline the steps required to reinstall important data, who can perform those steps and the chain of command to make those decisions.

- Create a way to work offsite in case a company’s physical infrastructure is damaged. Detail which computers to use to reinstate and rebuild compromised data—and what happens if a company’s physical infrastructure is damaged to the extent that no functioning machines are immediately available.

- Create a business continuity plan with short-term and long-term steps needed to get a business back on its feet. Past disasters that your company faced can help shape different contingencies.

- Come up with an incident management plan with defined roles and responsibilities for your employees so everyone knows what to do in the face of a disaster.

For credit professionals, hurricanes and other natural disasters can create a tricky situation. On one hand, creditors want to get paid no matter the circumstance. But on the other, they want to maintain a positive relationship with their customers.

You have to go above and beyond your regular duties as a credit professional and look at your customer relationships as more than just a business transaction, said Mary Lou Schwartz, credit manager at Ferguson Enterprises LLC (Metairie, LA), who has several customers impacted by Hurricane Ida last year. “If all you’re doing is dialing for dollars and not getting to know your customers, you’re not doing your job. That’s only part of your job,” she said in the April edition of Business Credit magazine.

-

APRIL

29

3pm ET -

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minutes

-

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes -

MAY

7

11am ET

-

MAY

8

11am ET -

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary

-

A Grizzled Attorney Presents the Construction Law Battlefield Webinar

Speaker: Randall Lindley, Esq., Partner, Bell Nunnally

Duration: 60 minutes -

MAY

13

3pm ET