October 7, 2021

In the News

Aluminum Will Continue to Get More Expensive and Here’s Why

Annacaroline Caruso, editorial associate

By now, creditors are well aware of the inflation and material shortages created by ongoing supply chain issues. However, as the prices and movement of some goods begin to normalize (like lumber), others are getting much worse.

The price of aluminum has increased for 16 consecutive months, more than any other commodity—partly due to product scarcity, according to the Institute for Supply Management’s (ISM) September Report On Business. The metal recently reached a record 13-year high of $3,000 a ton in London, according to Bloomberg, and the cost is likely to continue rising for the foreseeable future.

“Supply chain concerns are growing beyond electronics and chips into most other commodities. Lead times are extending, shipping lanes are slowing, and we will not see an end to this in 2021,” one ISM survey respondent in the electrical equipment, appliances and components industry said.

The shortage is making some companies panic, but stockpiling aluminum will add to the problem. “Consumers are ordering more than 100% of their expected needs,” Adam Jackson, director of metals trading at Aegis Hedging, told Bloomberg. “They don’t expect to receive 100%, but if they overorder, maybe they’ll land on the right amount and not forfeit sales. Such a practice has a serious risk if prices fall and you’re carrying extra unhedged inventory.”

In addition to the surging demand, production crunches in China also are driving up the cost of aluminum. According to Morgan Stanley, roughly 7% of aluminum production in China is halted due to power rationing in the country, forcing many factories to cut hours of operation or temporarily shut down. That would equal 1.5 million fewer tons of aluminum produced and a loss of $4.5 billion in metal sales.

"The aluminum supply chain has been ravaged by an unforgiving series of disruptions, which created asymmetries in price action that have helped propel prices towards decade highs," analysts at TD Securities said in a note. "With Chinese output significantly curtailed, imports of primary metal could eventually become a more recurring feature of the global market.”

Traditional aluminum requires a lot of energy to produce, so some Chinese companies are looking at low-carbon alternatives for the future. But there is not enough renewable energy to support the total need, Reuters says.

The effects from political unrest that took place in Guinea—the second largest global producer of bauxite used to produce aluminum—in early September are still playing out in the market one month later. The United States and European Union also are working on coming to an agreement regarding tariffs imposed on aluminum imports from the EU during the Trump administration.

On November 11, at 11 a.m., NACM will hold an online panel discussion, The Current Headache of Supply Chain Issues, so members can stay up to date. Visit the Event Calendar to register.

Strategies to Push for Payment Before Writing Off Bad Debt

Bryan Mason, editorial associate

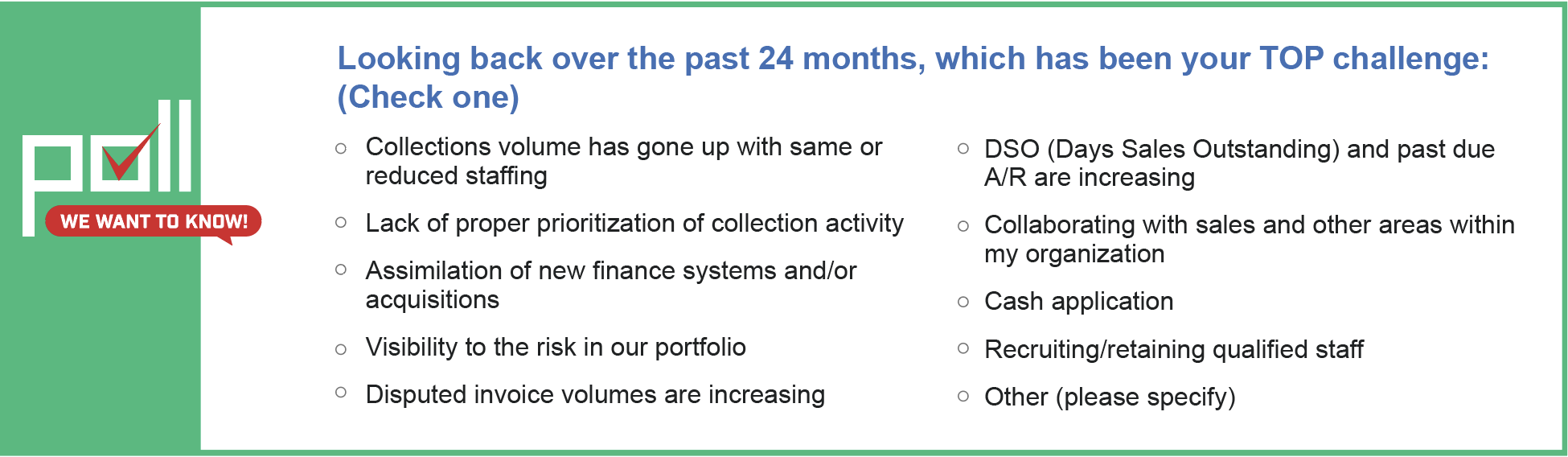

Because a sale is not a sale until your company gets paid, last week’s eNews poll question asked readers what collection tools they have used successfully to avoid writing off a bad debt. The majority of poll responders (70.37%) indicated their last attempt often goes through a third-party collector. Strategies that placed second and third, respectively, were legal intervention (37.04%) and customer visits (33.33%).

“We use lien and bond laws to secure a great portion of our accounts receivable,” said Ginger Kaladas, a customer financial services manager for Border States Electric Supply (Phoenix, AZ). “We will let customers know that we may take action by contacting their customer, the general contractor or the owner regarding the balance.”

These strategies usually get her company paid, said Kaladas, adding her company also may file a lien or bond claim. “On unsecured AR, the credit analysts continue to collect as they can, once an account surpasses 90 days with no payment. I will follow up with a final demand letter from myself, noting the [agreed upon] terms and conditions.” In some situations, her company will rely on personal guarantees that were obtained when an account was opened. Kaladas estimates that these methods have helped her team successfully collect 98% of the time. “We run a tight ship as a material supplier,” she said.

Attempts to collect before resorting to your final collection tool can vary depending on team strategy. Alicia Gorski, CBA, CCRA, regional credit manager for the Chamberlain Group, LLC (Oak Brook, IL), uses a five-step process prior to involving a third-party collector, including:

- Dunning letters

- Contacting the customer via email

- Contacting the customer via phone calls

- Engaging with the sales representative/visiting the customer

- Ensuing legal action letters

“We don’t have a deadline when the debtor account must be turned over to third-party collections,” Gorski said. “Each instance is different. As long as we are able to reach the debtor, we will try to collect. Once they refuse to work with us or stop responding, then we reach out to third-party collections or legal intervention.”

Stuart Epstein, accounts receivable manager at NAPA Auto (Roxboro, NC), and his team send monthly statements and follow up with phone calls and emails about a week after issuing them. If a customer fails to pay on time, Epstein will then use demand letters to begin the lien process. According to Epstein, 60% to 70% of his customers pay on time.

To avoid writing off uncollected funds, Epstein recommends credit professionals stay organized in the accounts receivable department so their teams have the opportunity to exhaust all options before doing so. “For the most part, it’s all about maintaining your accounts,” he said.

What Economic Slowdown in China Means for the Rest of the World

Annacaroline Caruso, editorial associate

Experts predict at least two years of strong global economic recovery, with above-trend growth of 5.6% projected for 2021 and 4.2% in 2022. However, “Despite the strong growth, global activity has peaked and is starting to face several headwinds,” said Cedric Chehab, global head of country risk at Fitch Solutions, during the Global Macroeconomic Update.

Economic recovery is still highly dependent on the state of the pandemic, which varies greatly from country to country, Chehab said. The ongoing vaccination campaign is one of the key players in helping a country resume economic activity.

“A key driver of the recovery is significant policy support from a monetary and fiscal perspective; but equally, if not more important, has been the ongoing vaccination drive, which is allowing economies to reopen,” he added. “Higher levels of fully vaccinated populations are associated with higher levels of PMI [purchasing managers' index] readings. In other words, higher vaccinations equal higher outputs.”

While vaccines undoubtedly play a significant role in boosting economic activity (or holding back economic activity), other trends are putting additional pressure on global trade. For example, the Chinese economy is beginning to falter, which will impact economies around the world. “We can expect to see a sharp slowdown in both Asian and global exports over the coming months,” Chehab said.

Some countries will struggle more than others to offset a shock like economic slowdown in China, i.e., Chile, Malaysia, Peru, Thailand and Vietnam. “Emerging markets are exposed to China’s economy more so than many developed markets,” he explained. “Certain economies are very reliant on Chinese imports as a driver of growth.” The U.S. ranks as one of the least exposed economies, Morgan Stanley analysts told Business Insider.

China also is going through a transition of tightening regulations on property and pollution, leading to a power crunch and potential default of giant property developer Evergrande. “If China were to have a serious economic issue because of China Evergrande, the rest of the global economy would have contagion from it,” Jimmy Chang, a chief investment officer, told CNBC.

Credit Quality Remains Strong as Long-Term Risks Rise

Bryan Mason, editorial associate

The Kamakura Troubled Company Index for September reflects “very low” short-term default risk, but an increase in long-term risks—new and old. The index measures the percentage of 40,500 public firms in 76 countries that have an annualized one- month default risk of more than 1%.

Short-term risks have remained fairly low due to low interest rates, narrow spreads and a generally good macro-economic environment supported by both government fiscal stimulus and Federal Reserve bank actions, said Martin Zorn, president and chief operating officer of the Kamakura Corporation. However, risks of inflation and the need for central banks to quickly and aggressively raise interest rates or taper bond purchases could produce a liquidity shock that will impact more leveraged firms first, Zorn added.

“September ended with an increase in crosscurrents for portfolio managers to digest,” Zorn said. “As of the end of the month, there were an estimated 500,000 containers sitting on cargo ships off the Southern California coast, providing a daily reminder of the continuing challenges plaguing the supply chain,” he said. Among the litany of other risks, Zorn included the S&P500’s worst monthly performance since March 2020; China’s power crisis; the Evergrande debt crisis; and global energy markets’ commodity shortages.

Despite the challenges, credit quality in September only decreased slightly, going from 2.61% in August to 3.56% (an increase in the index reflects declining credit quality). Worldwide corporate credit quality remains at the 99th percentile for the period of 1990 to 2021, with 100 indicating “best conditions.”

At the close of September, the percentage of companies with a default probability between 1% and 5% was 3.24%, an increase of 0.81% from the previous month. The percentage with a default probability between 5% and 10% was 0.26%, an increase of 0.26%. Those with a default probability between 10% and 20% amounted to 0.05% of the total, representing an increase of 0.05%; and those with a default probability of over 20% amounted to 0.01%, an increase of 0.01% prior month.

Among the 20 riskiest-rated firms, nine reside in China, seven in the U.S. and one each in Brazil, India, Ireland and Spain. The index also identifies GTT Communications, Inc., a U.S. multinational telecommunications and internet service provider, as the riskiest-rated firm with a one-month default probability of 14.19%--up 1.69% from the previous month. Three global defaults also were noted in the Kamakura coverage universe: two in China and one in the Philippines.

“Given the number of risks that are arising in the market, the first step to hedging them is to determine the macro-economic factors that have the highest correlation to payment risks or default risks that one is exposed to,” Zorn said. For example, he added, the value of the dollar as part of foreign exchange rates or interest rates that should correlate to inflation expectations. Zorn also suggests credit insurance as a viable option.

“Determine what risks you are exposed to and whether they correlate to the market, are specific to your counterparty or relate to your contractual terms,” he said. “The increasing number of economic crosscurrents are a red flag telling you to look at your risks a little more closely.”

Based on commentary by Nouriel Roubini (Goldilocks Is Dying) and Mohamed El-Erian (Taming the Stagflationary Winds), Zorn outlined four possible outcomes for today’s macroeconomic crosscurrents:

- Supply chain bottlenecks will disappear and no new Covid variants will emerge.

- We could see growth accelerating as bottlenecks clear, with inflationary pressure continuing to build and central banks scrambling to catch up.

- Stagflation could force central banks to walk a tightrope as they try to normalize rates without triggering a crisis amid high public and private debt ratios.

- Pressures on the demand side will lead to a global slowdown.

“In sum, looming ahead, there is one possible good outcome and three possible bad ones,” Zorn said. “The Kamakura Expected Cumulative Default Rate continues to show very low short-term default risk and very high long-term risk. We need to heed these warnings. even if we think the risks can be managed.”

A strong recovery in the supply chain can help avoid these long- and short-term risks, he explained. In the meantime, Zorn recommends credit professionals to focus on other drivers of the economy. “The implication is to stay flexible and nimble, and employ risk management practices appropriate for the set of uncertainties that currently exist in the market. The main takeaway for credit managers that have longer term exposures is a return to fundamentals to ensure that the counter-party is financially sound with both a good track record and good management.”

-

APRIL

29

3pm ET -

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minutes

-

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes -

MAY

7

11am ET

-

MAY

8

11am ET -

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary

-

A Grizzled Attorney Presents the Construction Law Battlefield Webinar

Speaker: Randall Lindley, Esq., Partner, Bell Nunnally

Duration: 60 minutes -

MAY

13

3pm ET