September 16, 2021

In the News

From Peer to Leader: Tips for Making a Seamless Transition

Annacaroline Caruso, editorial associate

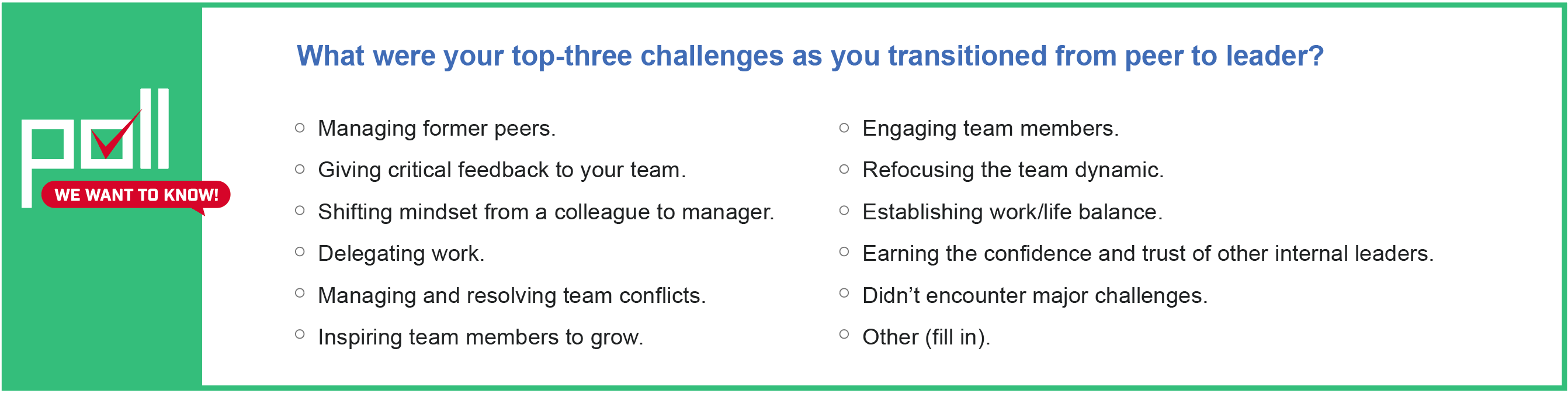

Climbing the ladder to a top position at a company takes years of hard work and dedication. The challenges, however, do not just disappear once you have finally reached the leadership level. As you make the transition from a peer to a supervisor, you are likely to encounter new obstacles.

You will need to find ways to navigate these difficulties in order to successfully lead your new team. Several professionals, some of whom have made the transition firsthand, offered tips and tricks to help adjust to a leadership role.

Managing former peers might feel awkward at first. Smith Hanley Associates suggests using your past experience as a peer to your advantage. “You know the strengths and weaknesses of your former peers, and you can set them up for success,” the article reads. “Delegate work to them you know they can do well and give them the autonomy to do it.”

Another challenge that may emerge as you take over a leadership role is maintaining a positive work relationship with former peers, while establishing authority. According to Harvard Business Review, there are ways to show you are the boss without seemingly gloating about your promotion. “You are walking a bit of an edge,” Michael Watkins, author and chairman of Genesis Advisers, told Harvard. “You don’t want to come in as Alexander Haig, and you don’t want to act as a super-peer either.”

Communication is a key skill that most likely helped you get to a leader position in the first place. As you make the change from teammate to supervisor, communication will become even more crucial. “Help people ease into the transition by having one-on-one meetings with the new team members,” Gia Ganesh, member of the Forbes Coaches Council, said in a Forbes article. “Lay out the vision for the team and seek input from each person. Understand their desires, frustrations and expectations. Gain their trust with inclusivity.”

Believe in your own leadership skills and your teammates will follow. This might be a more effective way to establish that “accountability and credibility,” which is so important when moving into a leadership position, Frances McIntosh, member of the Forbes Coaches Council, told Forbes. “Remember you have been chosen for a reason,” he said. “People higher up in the organization have noticed something in you that makes you leadership material. If your leaders believe it, enhance your skills and start believing it too.”

The next meeting of NACM’s Leadership Thought Discussion Group is 2 p.m. EST, Sept. 23. NACM has a variety of Thought Leadership groups, which meet around a specific topic such as leadership, construction credit, technology or metrics. The groups provide a forum for experts in the credit industry to network and build best practices. Contact Education Director Tracey Lerminiaux at This email address is being protected from spambots. You need JavaScript enabled to view it. if you would like to know more about how to join one of the groups.

Be sure to read NACM’s November/December issue of Business Credit magazine to learn more about how to ease the transition into a leadership position.

Collection Strategies After the Pandemic and How to Prepare for the Next Disaster

Annacaroline Caruso, editorial associate

Collecting past-dues can be a bit of a guessing game. Throw a natural disaster into the mix such as a hurricane, tornado or derecho, and collecting cash becomes even more difficult. The pandemic, however, has created more obstacles for debt collection compared with other more common disasters because of its simultaneous reach worldwide, said Matthew Jameson, attorney at Jameson and Dunagan (Dallas, TX).

When it comes to natural disasters, “the question always is ‘What do you do after a whole area has been wiped out?’” Jameson said. “With COVID, it’s not just one area; it’s the entire world.” Because the economic impact has been widespread, it forces creditors to change the way they go about getting cash from customers.

For example, credit professionals should think of collection calls differently. Instead of an aggressive where-is-my-money approach, focus more on the personal relationship with your customers, Jameson said. “Traditional collection calls are not going to work because this has affected everyone going on 18 months now,” he added. “It’s more about just touching base and cementing your relationships; being firm about payment but also being sensitive to the economic impact caused by COVID.”

Being too cold toward debtors could drive customers to competitors, Jameson explained. Showing some sympathy goes a long way when it comes to debt collection after any type of disaster, not just the pandemic. “Put yourself in your customers shoes,” he said during a Credit Congress session, Collection Strategies After a Natural Disaster. “You can’t predict these disasters; you have no idea when they’re going to hit, but you can put yourself in the best possible position by preparing.”

Credit professionals might not be fortune tellers, but doing some leg work before disasters strike is key to protect your company, Jameson added. “Creditors should make sure they have policies and procedures in place to protect themselves and make sure they are taking advantage of all potential lien and bond claims on construction projects.”

Some other pro-active best practices Jameson recommended for credit departments to follow in case of future disasters include:

- Keeping an organized credit department.

- Implementing a clear course of action for late payments.

- Establishing a credit standard that describes the profile for an acceptable credit customer.

- Creating a strong credit application document for new customers and verify information.

- Obtaining a personal guaranty.

- Using promissory notes when you have a reached a settlement with a customer before filing a lawsuit.

- Being proactive in placing accounts for collection.

Now that you know ways to increase your chance of payment before a disaster hits, what are your options to get paid right now? Try to negotiate and offer discounts for immediate payment of past due invoices, Jameson said. “You may be taking less, but it will help in a situation where you need money now to help keep the doors to your business open.” This will not work as a blanket solution for all customers, but he said it works best for problem accounts.

One of the last options is filing a lawsuit; the legal world is moving at a “snail’s pace,” Jameson said. However, “a lawsuit may be enough to get someone’s attention so you can get your payment.”

Be sure to register for Jameson’s session at the 2021 Credit Congress, Turning Your AR into Cash After a Pandemic, to learn more about this topic.

Price Increases, Product Delivery a Struggle for Contractors

Diana Mota, editor in chief

The prices contractors pay for construction materials continued to increase in August, while many firms reported struggles to get those materials delivered on time, according to a recent analysis of government data by the Associated General Contractors of America.

“July was the seventh-straight month of double-digit price increases for construction inputs,” said Ken Simonson, the association’s chief economist. “Adding to the challenge, contractors are struggling to pass along even a fraction of these added costs onto their clients.”

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—rose 5.6% over the past 12 months. That was little more than a quarter of the 20.6% increase in the prices that producers and service providers such as distributors and transportation firms charged for construction inputs, Simonson noted.

There were double-digit percentage increases in the selling prices of materials used in every type of construction for the past year for the following indices:

- Steel mill products, 123%

- Lumber and plywood, 15.9%

- Copper and brass mill shapes, 45.3%

- Aluminum mill shapes, 35.1%

- Plastic construction products, 29.6%

- Gypsum products such as wallboard, 22.9%

- Insulation materials, 17.2%

- Prepared asphalt, tar roofing and siding products, 15.8%

In addition to increases in materials costs, transportation and fuel costs also spiked. The index for truck transportation of freight jumped 14.1%. Fuel costs, which contractors pay directly to operate their own trucks and off-road equipment, as well as through surcharges on freight deliveries, also have jumped.

Association officials added that a survey of construction firms finds that most contractors were experiencing delays in shipments of many types of construction materials. The association officials urged the Biden administration and Congress to take steps to improve the supply chain and address price inflation, including removing tariffs on key construction materials.

“Contractors are having to pay more for materials even as it becomes harder to predict when those supplies will show up,” said Stephen E. Sandherr, the association’s chief executive officer. “Removing needless measures that are artificially inflating the cost of key materials, such as tariffs, will help employers who are struggling to cover the costs of inflation and uncertainty.”

China's Anti-Sanctions Law Poses Compliance Challenges for Businesses

Jon Yormick and Emily Mikes, Flannery Georgalis LLC

China passed an anti-sanctions law on June 10 to counteract the sanctions imposed by Canada, the European Union, the United Kingdom and the United States against various Chinese entities and officials, in recent years. The new law permits China to penalize individuals or entities involved in the design or implementation of foreign sanctions, including those entities engaged in “discriminatory practices” against Chinese citizens and organizations. The phrase “discriminatory practices” is not defined in the new law, but the broad language appears to encompass those companies who comply with U.S. and other foreign sanctions. The law extends to Hong Kong as well.

Under the so-called “blocking statute,” individuals and entities engaging in “discriminatory practices” can be sanctioned by the Chinese government—a decision which is final and non-appealable. If an individual or entity is sanctioned, it could result in individuals or their family members having visas denied as well as having property seized and being blocked from conducting transactions with Chinese institutions.

The passage of this new law puts U.S. and other foreign companies with a presence or operations in China in the difficult position of determining whether to comply with their home-countries’ sanctions or to comply with this new Chinese law. For U.S. companies operating in China, there will undoubtedly be questions as to how a U.S. company is expected to decline to do business with a sanctioned or listed Chinese entity, such as Huawei, without running afoul of China’s new law. Similarly, businesses that refuse to source cotton or tomatoes from the Xinjiang Province because of the U.S. Customs and Border Protection’s Withhold Release Order on such products may similarly be subject to sanctions by China under this new law.

The Office of Financial Assets Control (OFAC) within the U.S. Department of Treasury implements and enforces U.S. sanctions. OFAC requires all U.S. persons, including U.S. incorporated entities and their foreign branches regardless of location, to comply with sanctions. In certain circumstances, foreign subsidiaries owned or controlled by U.S. companies must also comply with OFAC sanctions. China’s new anti-sanctions law presents a clear conflict with OFAC compliance obligations.

It is still too early to determine how China will employ this new law when it comes to foreign businesses. But the language is broad enough to present real compliance issues until those businesses receive additional guidance. However, if a party is subject to OFAC jurisdiction, there is little to no doubt that OFAC will still require compliance even in the midst of the uncertainty surrounding the application of China’s new anti-sanctions law.

Emily Mikes serves as an associate attorney with Flannery Georgalis LLC and focuses her practice on international business and trade, white collar criminal defense, and federal criminal investigations. You can reach her at This email address is being protected from spambots. You need JavaScript enabled to view it..

Jon Yormick serves as a partner with Flannery Georgalis LLC and has practiced for 30 years and has experience as an international business and trade attorney and litigator. You can reach him at This email address is being protected from spambots. You need JavaScript enabled to view it..

-

APRIL

29

3pm ET -

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minutes

-

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes -

MAY

7

11am ET

-

MAY

8

11am ET -

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary

-

A Grizzled Attorney Presents the Construction Law Battlefield Webinar

Speaker: Randall Lindley, Esq., Partner, Bell Nunnally

Duration: 60 minutes -

MAY

13

3pm ET