eNews June 17

|

In the News

June 17, 2021

NACM Celebrates 125 Years, Thanks to Members New and Old

Annacaroline Caruso, editorial associate

The ghosts of credit past, present and future have shaped NACM over the last 125 years. As business-to-business credit evolves, NACM continues to offer world-class credit education and resources for current credit professionals and for those to come.

“Commercial credit is the creation of modern times. … Credit is the vital air of the system of modern commerce. … It has done more, a thousand times, to enrich nations, than all the mines of all the world. … Commerce cannot exist without credit,” said Sen. Daniel Webster to Congress in March 1834 during a speech about the U.S. Bank Charter.

Business-to-business (B2B) credit, commercial credit and trade credit are used interchangeably, but no matter the words used to describe the selling of goods, products or services to be paid for at a later date, the importance of this act cannot be overstated.

“While credit is delicate, sensitive, easily wounded and more easily alarmed, it is also infinitely ramified, diversified, extending everywhere, and touching everything,” Webster said.

A credit manager needs a variety of tools for making decisions that are in the best interest of their company, and NACM is the most thorough toolbox out there, said Mark Balstad, former NACM Commercial Services board chairman and member for roughly 30 years. “I learned everything I needed to know about commercial credit through NACM,” he said. “If you’re involved in what NACM offers, it can have a great impact on your company and in the end save you a lot of money.”

The B2B credit profession only continues to become more complex and critical for company success, leaving big shoes for the incoming generation of credit professionals to fill. That is where NACM comes in.

“I think with the digital age a lot more is being put on the credit managers’ plate and you’re asked to do more with less,” Balstad explained. “The ability to access NACM materials online and network with peers is invaluable for the new people in credit.”

Several long-time members, like Paulyne VanderSloot, CCE, CICP, who has been a member since the mid-90’s, said NACM helped advance their careers and want to see the same for new credit professionals. “Older members should keep encouraging the younger generation to get involved” so they can reap the same benefits from NACM, VanderSloot said.

“Many young people that are entering the credit department, they come with a perspective that this is just a job, not a career,” said veteran member Marshall Kahn, CCE. But for one young credit manager, NACM changed that perspective.

Eve Sahnow, CCE, corporate credit manager with OrePac Building Products, Inc. (Wilsonville, OR), is fairly new to the credit world. “When I joined OrePac it was a job,” she said. “But NACM made it a career for me.”

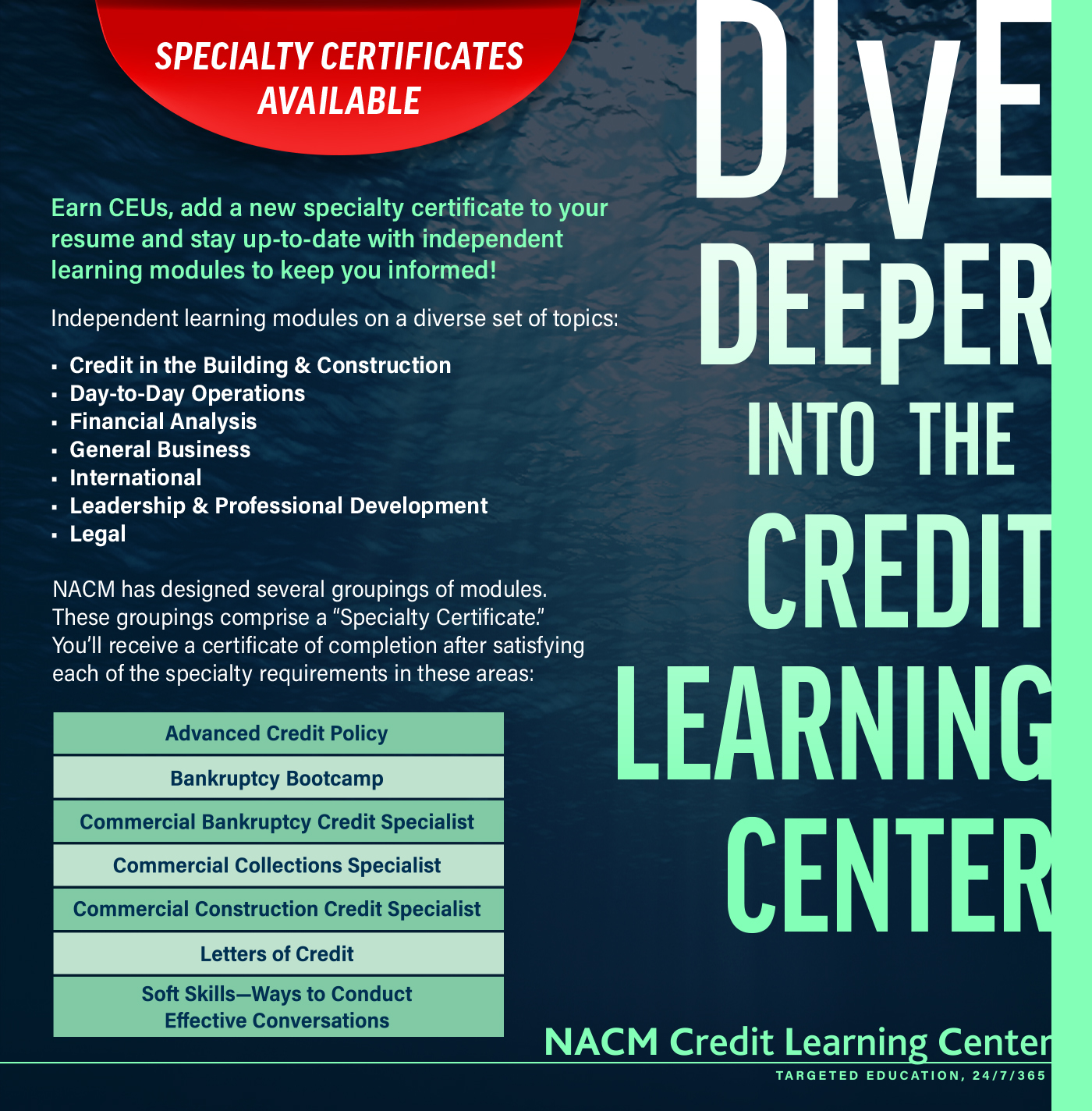

The designations offered by NACM can make credit professionals more marketable and help further careers. Industry groups also give the chance to learn from seasoned credit managers, which Sahnow described as “invaluable.”

“The sense of community and being a part of something is overwhelming, and it makes you want to learn more,” she added.

Missed the Deadline to File a Mechanic’s Lien?

Here are Some Options

Annacaroline Caruso, editorial associate

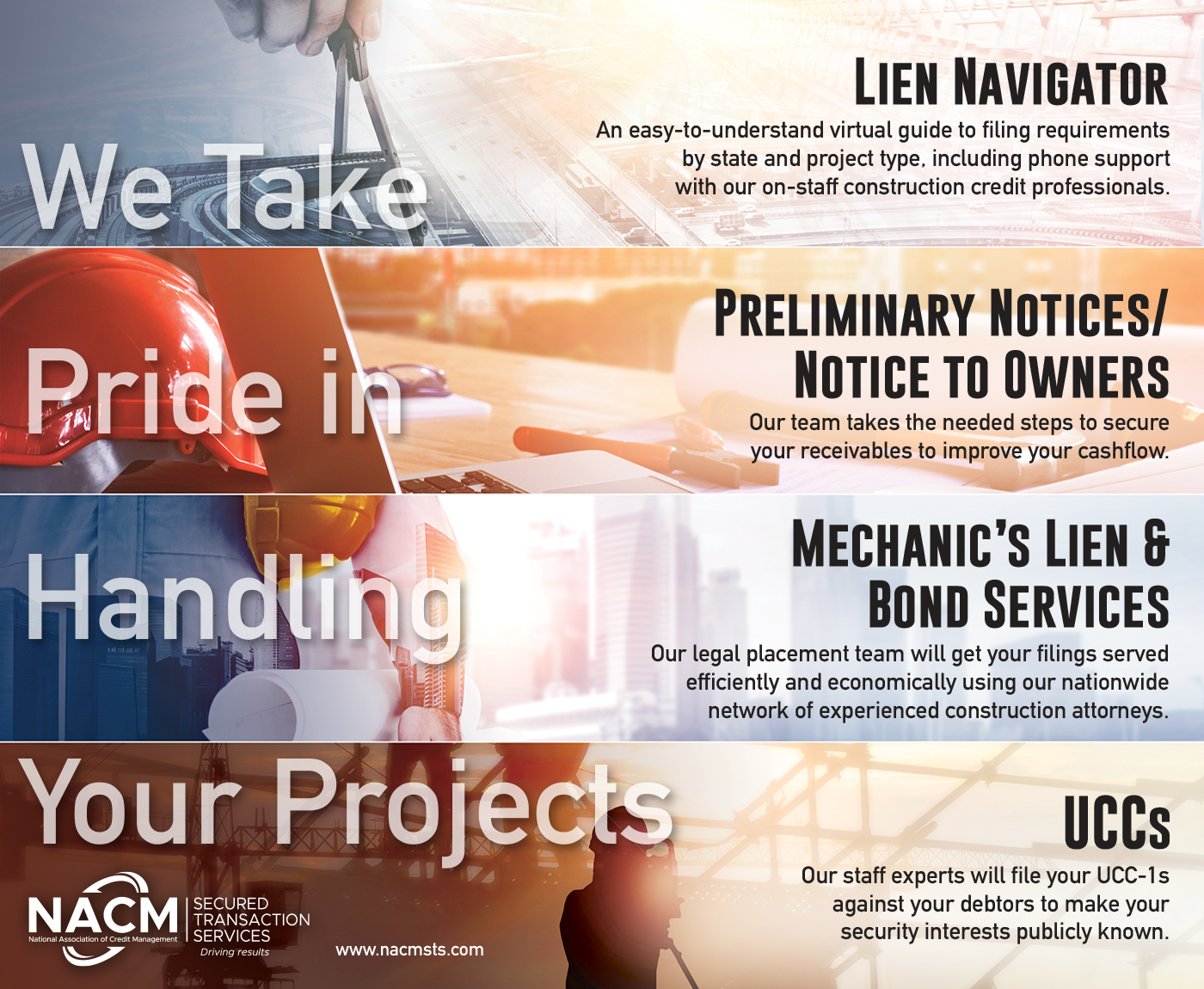

The best way for material suppliers and subcontractors to ensure payment if a debtor files for bankruptcy is by creating a lien ahead of time. As a general bankruptcy rule, in most states, liens that are filed or perfected post-bankruptcy-petition are not successful.

But if a mechanic’s lien was not filed properly, or not filed at all, that does not necessarily mean collecting on your claim is a lost cause.

“When a creditor is unable to file a lien claim and the debtor files a bankruptcy proceeding, there may be avenues of recovery still available to the creditor,” said Randall K. Lindley, partner with Bell Nunnally & Martin LLP (Dallas, TX).

As a first step, Lindley recommends carefully reviewing the bankruptcy filing to make sure the name of the bankrupt debtor matches your contract. “Occasionally, a similarly named entity has filed … but not the actual debtor the creditor has a contract with,” he explained.

Another way to increase the chance of collecting payment is by reviewing contract documents to determine if multiple entities or individuals are liable. While looking at the contract for other liable parties, you should also look for any “misrepresentations or false financial statements that the creditor relied on at the time it entered the original transaction.” Finding misrepresentations could potentially build a case to object to the discharge ability of the creditor’s debt, Lindley added.

If a debtor specifically files for Chapter 11 bankruptcy, he suggested hiring counsel to help with accessing the viability of the proposed reorganization plan and to “determine the treatment of the creditor’s claim through the bankruptcy process.”

Take the SoftBank-funded construction startup Katerra for example. The group filed for Chapter 11 bankruptcy last week in the Southern District of Texas, leaving numerous projects unfinished, between $500 million to $1 billion in assets, and $1 billion to $10 billion in liabilities.

In some cases, retroactive perfection of a mechanic’s lien may be a way to turn back time. “If your lien rights arise pre-petition, and your opportunity to perfect a mechanic’s lien under state law did not expire after the filing of the bankruptcy … the timely post-petition perfection of a lien is okay; it is allowed,” said Bruce Nathan, bankruptcy lawyer with Lowenstein Sandler LLP (New York, NY) during an NACM Secured Transaction Services webinar, Navigating Lien and Trust Fun Rights, When a Party in the Construction Supply Chain Files Bankruptcy.

You will still need to have state law on your side in order to even have a chance at collecting your claim. Lien laws and regulations vary across the country so it is critical to have a clear understanding of your state’s specific rules.

“Lien creation, perfection, enforcement, all those matters are subject to state law and have different requirements,” Nathan said.

NACM’s Lien Navigator breaks down lien laws by state and can help you avoid a missed deadline.

Expo Drawing Celebrates NACM

Bryan Mason, editorial associate

Make sure you check out NACM’s Virtual Plus expo hall. One lucky visitor from each of our six exhibitor’s virtual booths will win a $125 gift card in honor of NACM’s 125th birthday. Although only registered participants can access education sessions, the expo portion of the virtual event is open to everyone. Winners will be notified during the first week of July.

Exhibitors provide a wealth of information that can help you do your job more effectively and efficiently, and NACM has put them together in one location to make it easier for you to navigate. With today’s disruptions and accelerated innovations, the knowledge they have on the ebb and flow of industry trends is invaluable. Take the time to learn from some of the best-in-class service providers about new technologies that are available, the trends they see and the many ways that they can help your company.

Visit the following companies, which offer analytical and assessment services, insight and more, to learn more and get entered into the drawing:

Confirmation, part of Thomson Reuters

Confirmation, part of Thomson Reuters, is the digital platform and global network trusted by audit firms, banks, law firms, mortgage QC auditors and credit managers to quickly and securely verify financial data. Confirmation invented electronic confirmations nearly 20 years ago and continues to bring innovative products, like its credit inquiry solution, to market. Today, Confirmation helps 1.5 million users across 170 countries confirm more than $1 trillion in financial data every year.

Cortera, A Moody’s Analytics Company

Cortera delivers the hard-to-find B2B information that sales, marketing and credit professionals need to increase revenue and minimize risk. They bring insight, innovation and community to the world of commercial credit through one of the largest databases of B2B credit data in North America. With over 1.5 trillion data points, their insights are available across 45 supplier categories and down to the company level.

CreditRiskMonitor

CreditRiskMonitor is a financial risk analysis and news service for credit, supply chain, and financial professionals. Their strength in coverage spans 57,000 global public companies, totaling approximately $69.3 trillion in corporate revenue. They also offer industry-leading accuracy solutions for addressing private company financial risk assessment. Leading corporations around the world—including more than 35% of the Fortune 1000—rely on them to help stay ahead of financial risk quickly, accurately, and cost-effectively.

Experian

Experian’s Business Information Services provides industry-leading predictive insights to organizations, helping them mitigate risk and improve profitability. Their business databases provide comprehensive, third-party-verified information on U.S. and international companies – with unparalleled depth of data on small and mid-sized business. Experian’s data and services provide the tools to support and integrate with the entire customer lifecycle enabling their clients to find new customers, process new applications, efficiently manage portfolios and customer relationships, collect on delinquent accounts and optimize decisioning models.

Fiserv, Inc.

Fiserv, Inc. (NASDAQ: FISV) aspires to move money and information in a way that moves the world. As a global leader in payments and financial technology, their company helps clients achieve best-in-class results through a commitment to innovation and excellence in areas including account processing and digital banking solutions, card issuer processing and network services, payments, e-commerce, B2B payments, electronic invoice presentment and payment, digital ACH, merchant acquiring and processing and the Clover cloud-based point-of-sale solution. Fiserv is a member of the S&P 500 Index and the Fortune 500.

YayPay

YayPay is a leading accounts receivable automation company providing intelligent credit-to-cash software, payment processing and industry best practice. As a Quadient company, YayPay is part of a global organization committed to outstanding customer service that spans 29 countries with over 500,000 customers.

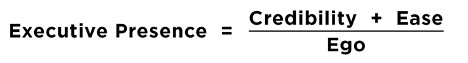

In her work as an executive coach, Brooke Vuckovic says there’s one topic that comes up with almost every single client: executive presence. But, Vuckovic says, even though we so often talk about wanting to improve our executive presence, “we don’t quite know what it means when we’re pressed to define it.”

So Vuckovic, a clinical professor of leadership at Kellogg, created a rough formula for executive presence:

She stresses that while these underlying components are universal, a strong or effective executive presence might look different from one individual, situation or culture to the next. So, she encourages people to think of the pieces that make up these components as dials on an instrument panel. Depending on the circumstance, you can turn some dials up and others down.

“This is not a template, one-size-fits-all formula,” she says. “It is a flexible formula that you can tailor to your needs and the needs of your organization and your team at a particular time.”

During a recent The Insightful Leader Live Webinar, Vuckovic broke down each of the formula’s components and explained how leaders can improve on each dimension. Below is a sampling of her advice.

Credibility

Each component of executive presence is composed of a number of factors.

With credibility, one piece is simply expertise in your role. “Especially early on in your career, intellectual horsepower is essential,” she says.

Along with expertise, credibility can be boosted with preparation and by exhibiting integrity.

But, of course, you need to be able to communicate your credibility to others. So, once you’re sure you know your stuff, how can you work to better convey that? Vuckovic offers a few tips.

For starters, avoid a monotone delivery. (For those who struggle with this, she suggests practicing inflection by reading children’s books aloud.) Try not to talk too fast, which can convey nervousness or even the desire to “pull a fast one” on an audience. And do your best to avoid using too many filler words—er, um, uh—which can be distracting from the message you’re trying to convey.

Additionally, make sure you aren’t fidgeting or using “props” in a meeting. This means no knee bouncing, no pen clicking, no beard stroking or hair twirling, and definitely no phone checking. “The question I like to ask is, ‘What are you in relationship with more than the people in the room?’”

Overall, Vuckovic says, “Credibility has the largest number of dials in the instrument panel, and they are the easiest for you to turn and adjust.”

Ease

As with credibility, ease also has several foundational elements. These include making sure you are eating and sleeping well, have social support and are making time for movement in your day. These things will help build your capacity for resilience under stress.

Vuckovic points to a few key ways to maintain and convey ease.

One involves “emotional agility,” or the ability to manage your feelings, particularly in difficult situations. She stresses the importance of being able to describe what you are feeling in a moment of stress. “As psychologists say, ‘When you name it, you tame it.’”

So, instead of simply sensing that you’re angry, or worse, starting to yell or pound the table, you would instead mentally note what you’re feeling in your body. Vuckovic explains what that may sound like: “’My heart’s racing. I can feel my face is getting flushed. My hands are sweaty. My stomach is getting knots.’ You simply start to describe the physical sensations that are occurring at that time and your central nervous system will de-escalate and calm down.”

Other ways to convey ease include connecting with those you work with, which can mean listening well and maintaining eye contact, as well as authenticity, which signals “a sense of self-assurance.”

Ego

With ego, Vuckovic says, “what we’re looking for is true confidence and true humility.” This means demonstrating that you believe that you have something to contribute—and that you believe other people do, too.

With ego being the denominator in the executive-presence formula, Vuckovic points out that you don’t want to have a miniscule ego, nor do you want an oversized one, since both a negative number and a giant number will mean an erosion of the credibility and ease that you’ve worked to convey.

One tip for both reigning in large egos and boosting small ones: stop thinking about yourself too much. For outsized egos, this introduces more humility into your presence. For small egos, the advice is a little less intuitive. But Vuckovic points to research into underrepresented minorities and women, who may struggle with their own sense of worth in an organization. “When they worry less about what people are thinking about them and how they’re assessing them, and focus more on their purpose, their values, their contributions, why they do the work they do, they typically fare better both in terms of how they’re evaluated as well as releasing some of that psychological weight of considering how other people are assessing them.”

Vuckovic says that for everyone, a focus on doing good work is what will ultimately determine how your peers or your boss or your clients think of you. No level of executive presence can compensate for a lack of ability. But, she says, it’s crucial to display executive presence if people haven’t yet had a chance to evaluate you based on your work.

“These elements of presence are particularly important when you are interacting with someone for the first time or on a superficial level or you just see them quarterly for client meetings,” she says. On the other hand, “those people around you will have a much more complete picture and, ultimately, are going to judge you by the quality of your work and contributions.”

Reprinted with permission from Kellogg Insight.

|

Upcoming Webinars |

|

June 21 |

Output Solutions

Speaker: Susanne Kennedy, Fiserv |

| Advanced Regulatory Compliance: Leveraging Internal Controls and Due Diligence for the Order-to-Cash Process Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC, Doxey Inc. |

June 22 |

|

June 23 |

Finding New Answers to Old Challenges

Speaker: Brian Morgan, Blackline |

| The Life of a Lien in Pennsylvania

Speaker: Justin A. Bayer, Esq., Kane, Pugh, Knoell, Troy & Kramer, LLP |

June 23 |

|

June 24 |

Financial Statements and Red Flags in Credit Risk Management

Speaker: Craig Simpkins, CCE, CICP, Johnson Controls |