eNews May 27

|

In the News

May 27, 2021

May CMI Reflects Economic Recovery

Annacaroline Caruso, editorial associate

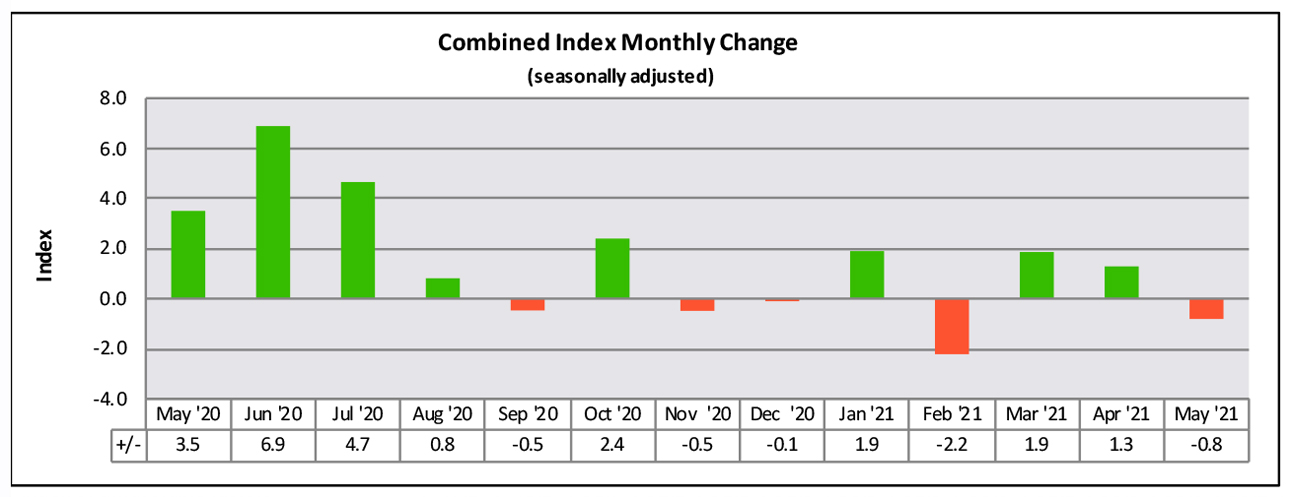

Despite a slight cool down month on month, NACM’s May Credit Managers’ Index (CMI) data remains healthy and firmly in the expansion zone.

“When numbers are as consistently good as they have been the last few months, it’s a sign economic conditions will be positive in the next quarter or two,” said NACM Economist Chris Kuehl, Ph.D.

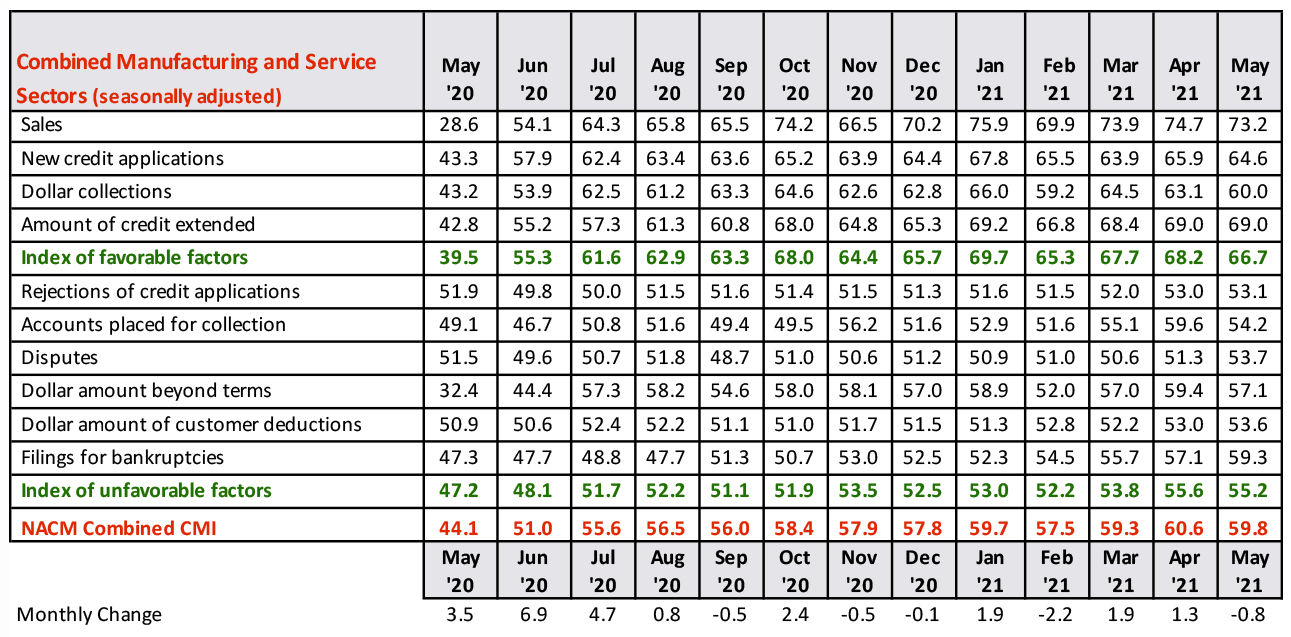

The combined score for the manufacturing and service sectors dipped slightly, but it remains well above May 2020—the last time the combined numbers were in contraction territory.

Although three of the four scores for favorable factors dropped, overall, the index remained strong as it went from April’s reading of 68.2 to 66.7. The index of unfavorable factors also slipped a little as two of the six scores declined, but it remained firmly in expansion territory with a reading of 55.2 compared to 55.6 last month.

Sales have been beyond robust for months now, Kuehl noted. “The memories of low readings in the 20s and 50s are fading as the latest index readings have been above 70 for six of the last eight months.”

Of all the favorable factors, dollar collections slipped the most month on month, dropping from 63.1 to 60.0.

“This is hardly concerning given that the number remains above 60, but this is a category we watch aggressively, after all ‘it isn’t a sale until we are paid,’” Kuehl said.

Within unfavorable categories, accounts placed for collection noted the biggest change from April as it fell from 59.6 to 54.2, while the reading for disputes saw the biggest improvement going from 51.3 to 53.7. Dollar amount beyond terms took a 2.3 point hit as it registered 57.1.

Filings for bankruptcies at 59.3 had its best reading since January 2014’s reading of 60.5.

“The shake-out in most of the business community seems to have taken place, and those companies that were severely weakened by the pandemic have met their fate and left the survivors to seek market share,” Kuehl said.

May’s data supports the notion that 2021 is continuing to be the year of rapid recovery, he added. “Not only are the numbers positive, but the acceleration out of the 2020 doldrums has been relatively swift.”

For a complete breakdown of the manufacturing and service sector data and graphics, view the May 2021 report. CMI archives may also be viewed on NACM’s website.

Get More Bang for Your Buck by Selling Your Bankruptcy Claim

Bryan Mason, editorial associate

As COVID business assistance programs and funding come to an end, a rise in bankruptcy claims is expected to follow. Creditors can decide whether to ride out the bankruptcy process if their customer files for bankruptcy, or look for buyers to sell their claims.

“A trade creditor’s most obvious and primary motivation for selling its claim is to quickly monetize the claim through an immediate cash payment,” said Bruce Nathan, partner of Lowenstein Sandler LLP (New York), in NACM’s February issue of Business Credit. “The sale of a trade claim eliminates the delay and risk associated with holding and monitoring a claim throughout the lengthy bankruptcy process.”

Claim buyers are more likely to pursue certain types of bankruptcy claims over others, so sellers should understand the type of claim they are selling and how the process works in order to achieve the greatest profit, while mitigating risks. In general, the majority of claims being pursued by buyers are relatively large, are not disputed liabilities, have been filed with the bankruptcy court and are recognized as valid.

Some bankruptcy claims are entitled to “priority of payment” over others. This refers to priority claims that must be paid in full by the debtor from the money available in the bankruptcy estate before other lower-level general unsecured claims are paid. Check with your attorney to see if your claim qualifies for priority of payment status over other general unsecured claims.

The bankruptcy court procedures only govern the sales of claims that occur after the customer files bankruptcy and after a proof of claim has been filed. Therefore, if the creditor sells the claim prior to filing a proof of claim, no involvement of the bankruptcy court is needed. The bankruptcy court is not responsible for negotiating or approving prices.

With that being said, credit professionals should be aware of the following steps in selling bankruptcy claims, as well as how they should approach these steps in correlation with the buyer:

- Sale offer—when a buyer approaches you with an offer to purchase, note that it is unlikely they will purchase the entire claim.

- Confirmation of the sale—document prepared by the buyer outlining key terms, amount to be purchased and pricing.

- Claim assignment agreement—document that transfers the claim from the seller to the buyer.

- Evidence of transferred claim—required by the bankruptcy court to notify other parties that the claim has been transferred, such as banks and the debtor, and provides parties in interest 20 days to file an objection to the transfer.

Sellers should include provisions for a possible increase or decrease of the claim as more information of the creditor’s recovery becomes evident—a provision that protects both the buyer and the seller. The agreement should also:

- Provide for payment on the date that the claim is assigned.

- Establish means of timing and enforceability of payment by the buyer for all disputed portions of the transferred claim.

- Require buyer to purchase any excess claim amount, resulting from an increase in the claim amount allowed by the bankruptcy court, at the agreed percentage.

- Require buyer to notify seller of any objections the debtor files to the claim that provides enough time for the seller to defend against any such objection.

Buyers may try to get a cheap discount when pursuing a claim to maximize their profits. Therefore, attorneys advise creditors to critically analyze their agreements.

Phillips and Thomas LLC states in its article, Buying and Selling Bankruptcy Proofs of Claim: Understanding the Risks, that buyers often put “crafty language” into their agreements to shift their risks back onto sellers. “Some of these provisions are buried in the fine print of the agreements.”

Consulting an attorney is an excellent first step to exclude yourself from potentially falling victim to this language. Researching the specifics of your claim will also help to understand key assets that play an important role in determining a reasonable price.

Lastly, attorneys recommend refraining from signing the first offer made to you to ensure you are getting the best offer.

“Faced with increased competition, buyers are often forced to increase the purchase price—and reduce their profit—in order to close a sale,” Nathan said.

5 Ways to Get the Most out of a Mentor–Protégé Relationship

KelloggInsight

Mentorship can be an enormously valuable experience for aspiring and established business leaders alike. Working with a supportive, more experienced colleague can help you develop into the best version of yourself. And guiding a colleague toward their full potential can help you hone your coaching skills while shaping the next generation of leaders.

But whether a relationship develops organically during coffee breaks or stems from a formal corporate mentorship program, many mentors and protégés suffer from misconceptions about the mentoring process—such as the myth that there is only one right way to do it.

“The most important thing that you need to remember about a mentoring relationship is that it’s individual, because it’s about the person,” says Diane Brink. “There’s not a script or a standard operating procedure.”

Brink was IBM’s chief marketing officer for Global Technology Services until retiring in 2015, and now works as a consultant and board director. She also serves as a senior fellow and adjunct professor at the Kellogg School. Over the course of her career, she has mentored dozens of protégés—and had her own mentors as well. Brink draws on that extensive experience to highlight five best practices for mentors and mentees to get the most out of these relationships.

Create a Penalty-Free Environment

The word “mentoring” might bring to mind the image of a student sitting subserviently at the teacher’s knee. Erase that. The mentor might have more experience than the protégé, but this relationship is about the exchange of ideas, rather than the operation of power dynamics.

Brink stresses the importance of creating a comfortable environment so both mentor and protégé can speak candidly and freely.

“The whole idea behind the mentoring relationship is that it’s a penalty-free environment,” she says. “If you don’t create an environment that is open and trusting, you might not necessarily get what’s on a person’s mind. The most important thing you can do is say, ‘Look, we’re just two people getting together. Hopefully, I can share some perspective for you.’”

Commit to the Process

Sharing those perspectives requires commitment from both mentor and protégé. This means making sure you are fully present when you do get together.

“Some mentors fail because they haven’t really embraced the role,” Brink says. “They’re there just to listen, but not to engage. Ask yourself: Are you really there when you’re meeting with your protégé, or are you continuing to multitask all the other things on your calendar? That’s not very helpful.”

“If you don’t create an environment that is open and trusting, you might not necessarily get what’s on a person’s mind.”

For mentors, being present also gives you a better chance of gaining deeper understanding of the issues your protégé is facing.

“As a mentor, your role is to help guide and facilitate how that individual solves a problem or tackles an opportunity,” Brink says. “You’re asking questions and providing context for greater clarity. You’re not the person who’s going to have all of the answers.”

Let the Protégé Lead

For protégés, commitment means more than sitting back and nodding in agreement with every suggestion the mentor makes. Mentees need to own the relationship.

Brink describes a protégé who would always send an agenda for their mentoring meeting a week beforehand: “I thought ‘Oh, my gosh. This guy is really thinking about not only how he can use my time effectively, but how he can really move the relationship to something that is going to be beneficial for him.’ That was pretty impressive.”

In any mentoring situation, it should be the protégé who sets the priorities. Brink likes to remind mentees that they really drive their own careers.

“You’re going to have a lot of people providing their point of view on what you should be doing with your career,” she says, “and it’s not their decision.”

Agreeing to make the mentee’s agenda a priority keeps him or her from being swayed towards a career path he or she may not be interested in following. And it takes pressure off the mentor to act as an all-knowing guru.

Brink recalls a situation early in her career, when she was offered a position that represented a step up—but that she did not really want. Panicking, she called her then mentor, who told her to follow her gut.

“He never judged me,” Brink says. “He just put it back on me to answer.”

Practice Big-Picture Thinking

The mentor’s chief task is to help the protégé realize his or her potential, offer perspective on problems, develop strengths, and remedy weaknesses. It is not to dig up an immediate promotion. That is something that Brink has had to teach at least one mentee.

“When we met, she sat down, and two minutes into the conversation she started talking about the next job she was going to get and how I was going to help her get there,” Brink recalls. “I had to stop the conversation.”

Instead, Brink likes to encourage her protégés to think about the type of work they see themselves doing several years from now.

“Roles come and go,” she says. “If I look at how the marketing profession has changed in the past 18 months, there are new roles that I couldn’t have even dreamed of. It’s more about: ‘Do you see yourself running a company? Do you see yourself working overseas?’ I think it forces the person to think more broadly about their development plan and the types of potential assignments they should consider.”

Recognize Learning Opportunities

Mentorship offers learning opportunities for both mentors and protégés. For mentors, it is of course satisfying to know that you are contributing to the success of your next-generation colleagues. But the process has more immediately useful rewards as well.

For example, Brink has found that mentoring provides insights into both an organization’s political environment and the effectiveness of an organization in communicating strategy to employees at different levels.

“I might think it’s pretty clear from my seat, but then I might have a [mentoring] conversation and begin to appreciate the fact that wow, this individual missed this aspect of the strategy,” she says. “That’s an important learning, because it helps me to be better at understanding what we need to do to make sure we’ve got the strategy in place.”

There are other potential benefits for mentors. For example, Brink recently mentored a young woman who is a “digital native” with cutting-edge social and digital marketing skills. This relationship helped Brink keep current in a quickly evolving field.

“There was no way, in my role, that I could continue to stay apprised of all the new tools and techniques and applications,” she says. “Just by talking with her, it allowed me to stay current in an area that was interesting to me and essential to my role.”

Reprinted with permission from KelloggInsight.

Analysis of Job information is Vital Before Starting Work or Supplying Materials

Bryan Mason, editorial associate

When it comes to assessing a customer’s creditworthiness, information is king. Gathering the critical information upfront helps subcontractors and suppliers set limits, reduces the chance of nonpayment and helps secure lien rights.

“The security of mechanic’s liens and payment bonds afford you greater flexibility in extending the lines of credit to customers that may not be so deserving,” said Chris Ring, of NACM Secured Transaction Services (STS), in the webinar “Managing Construction Credit and the Importance of Gathering the Right Job Information." Complete and accurate information at the start of a project is critical and supports filing a valid preliminary notice, which is the foundation of securing your rights.

“Serving a proper preliminary notification is the first step in securing your right to lien,” Ring explained. “While it mainly serves as a notice to owner, it also serves as the foundation for collecting funds owed along with preserving mechanic’s lien rights.”

When extending credit on job accounts, Ring suggests using a job information sheet to set clear guidelines and to capture all of the project information for credit managers to review and verify. Given that lien rights vary by state, it’s important to collect information based on the statute that covers the state in which the project takes place. (Subscribers of NACM’s Lien Navigator can use the database to locate state specific guidelines.)

A job information sheet should identify where materials are being delivered, and provide information about the jobsite, the owner, general contractor and more. In situations where materials do not go directly to the project site, “you have to have some assistance with these orders,” Ring cautioned. “The people who are receiving those orders must ask where the job site is located.” It’s extremely important to mark orders that aren’t going directly to the jobsite with the job name, location and purchase order number, he added.

Once your job information is gathered, Ring emphasizes that credit managers must verify critical pieces of that information. “First and foremost, you must identify the customer’s role,” he said. “For example, is it a subcontractor, sub-subcontractor, supplier or the general contractor? Knowing where your customer falls in the construction tiers will help you know what your rights are based on state statute and type of project.”

Identifying the exact location is also “really critical,” Ring continued. The job site address and the owner’s address are typically different so verify the address listed for the project location is accurate. “Did the customer or sales team give you a ship to address instead of the job’s address?” Ring said. “A simple Google search of the job name and address can help identify a potential issue with the job’s address.”

Listing the type of project is also important. For example, add on the job sheet whether the project is private, public, federal, Native American, residential condos or leasehold.

The job information sheet should include details for all of the parties subject to notification of the preliminary notice. Ring recommends using a service such as NACM’s Lien Navigator to determine who those parties are as well as timing of notification to protect lien rights. Not serving a required party will invalidate your notice. Does a notice need to be served on the owner, general contractor, subcontractor, lender, surety or mechanic’s lien agent?

The amount and type of information may vary based on the customer’s role in the project. If it is a private job, verify the address and who owns it, the general contractor and who hired your customer, Ring said. If it is public project, verify the property owner, general contractor, who hired your customer and bonding information linked to the project. Federal Miller Act projects would also need the same information as Public Little Miller Act jobs.

Even if your contract is directly with the general contractor, Rings advises that credit managers know who the property owner is. “This is crucial because the owner determines the type of project,” he said. Lastly, when your contract is directly with a subcontractor, you may have to gather additional information such as obtain and verify the bonding info if the property owner is public or federal.

Lien Navigator subscribers can access Ring’s entire webinar to learn more through the link provided above, and you can catch him as part of NACM’s Virtual Plus Credit Congress as he presents with Mike Murray, Esq., of Lanak & Hanna, P.C., Session 30110, Job Information—The First Critical Step.

|

Upcoming Webinars |

|

June 3 |

Challenges Remain as Global Economy Recovery Emerges in 2021 Speakers: Aaron Rutstein, Atradius |

| Blockchain Technology & Decentralized Finance

Speakers: Anjon Roy and David Wasson, SIMBA Chain |

June 15 |

|

June 17 |

NACM and FCIB Present Author Chat: Dr. Lisa M. Aldisert

Author: Dr. Lisa M. Aldisert |