eNews January 28

In the News

January 28, 2021

Forecasting Credit Risk for Today’s Environment

Despite the ongoing administration of the COVID-19 vaccine and stimulus programs, economic recovery is not expected to be swift. Revenue Management Associates’ John Salek points to the Great Recession as a reminder of what credit professionals should expect. Although the recession technically ended in 2009, “the number of business bankruptcies took five years to return to their prerecession levels,” he said. “There’s a long tail on bankruptcies so that credit risk is going to stay here for a while.”

As part of his webinar presentation for NACM on his must-have and nice-to-have metrics, Salek shared a tool for estimating credit risk during the pandemic economy. “It kind of falls under the metrics umbrella, but it doesn't fit like a glove,” he acknowledged. However, “I think it’s important not only for your company, but also for you as individuals.”

Salek’s recommendation starts with an update of customer credit risk ratings. “Then calculate your company’s break-even sales volume,” he said. “What do you need to sell to break even?”

Next, estimate what you can realistically sell to low- and medium-risk customers over the next year, quarter by quarter. And then back into how much you’re going to have to sell to your high-risk accounts.

“Be realistic,” he warns. “What’s the gross margin? If you can sell enough to your low- and medium-risk customers to get to within 90% of your break-even total, then you’ll only have to sell 10% to high-risk accounts. That’s a good position to be in.”

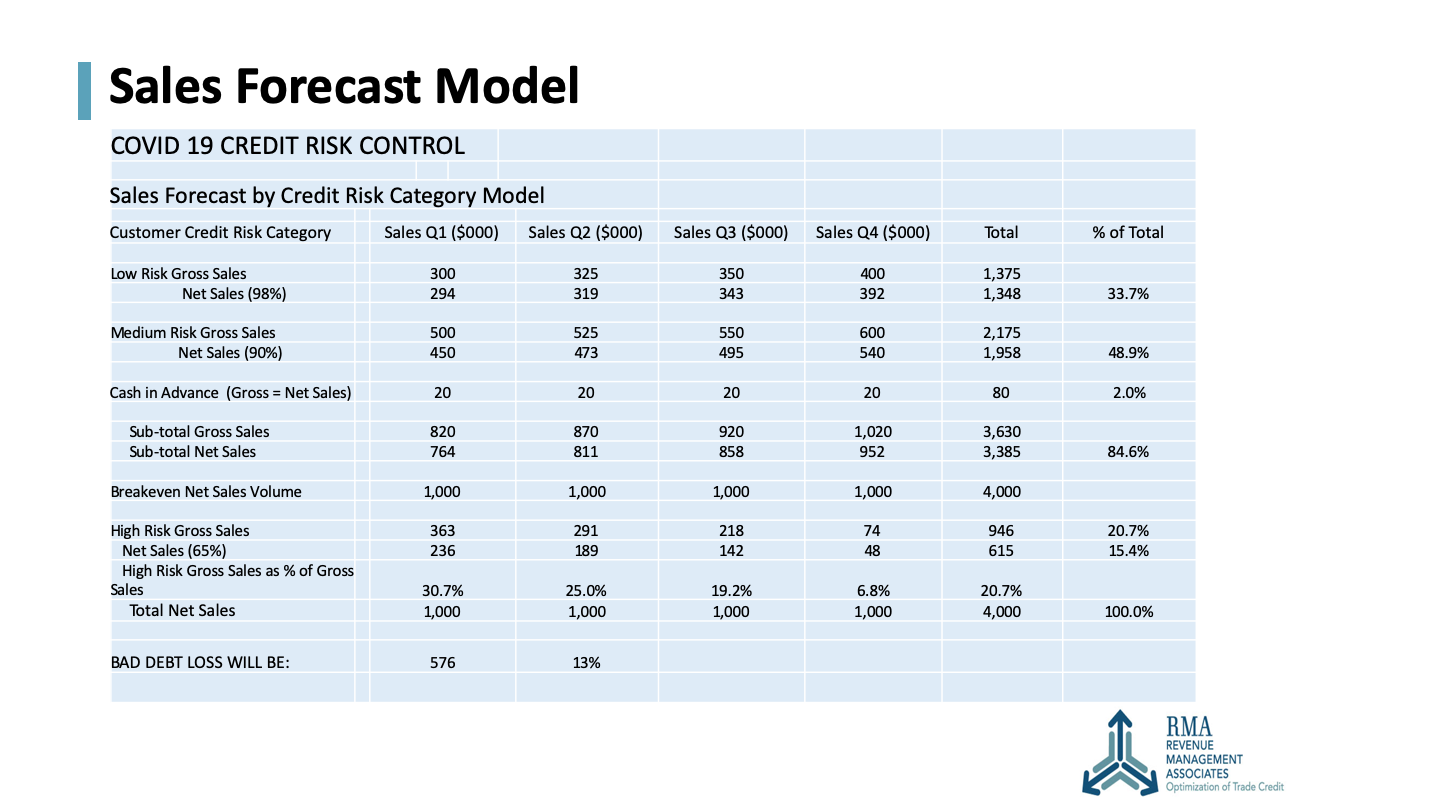

Salek shared an example to demonstrate how it works. His model included four categories: low, medium and high risk and cash in advance. The chart breaks down the forecast in sales by risk group.

“We actually did it on both gross and the net sales basis,” he said. “For the low-risk customers, we plugged a collection of $0.98 on the dollar, for medium risk $0.90 on the dollar and high risk only $0.65.”

He acknowledged his example projects a high bad-debt loss, but added “you can use your own categories and estimates.” In Salek’s example, about one-third of the sales will go to low-risk accounts, about half to medium risk and about 15% to high risk.

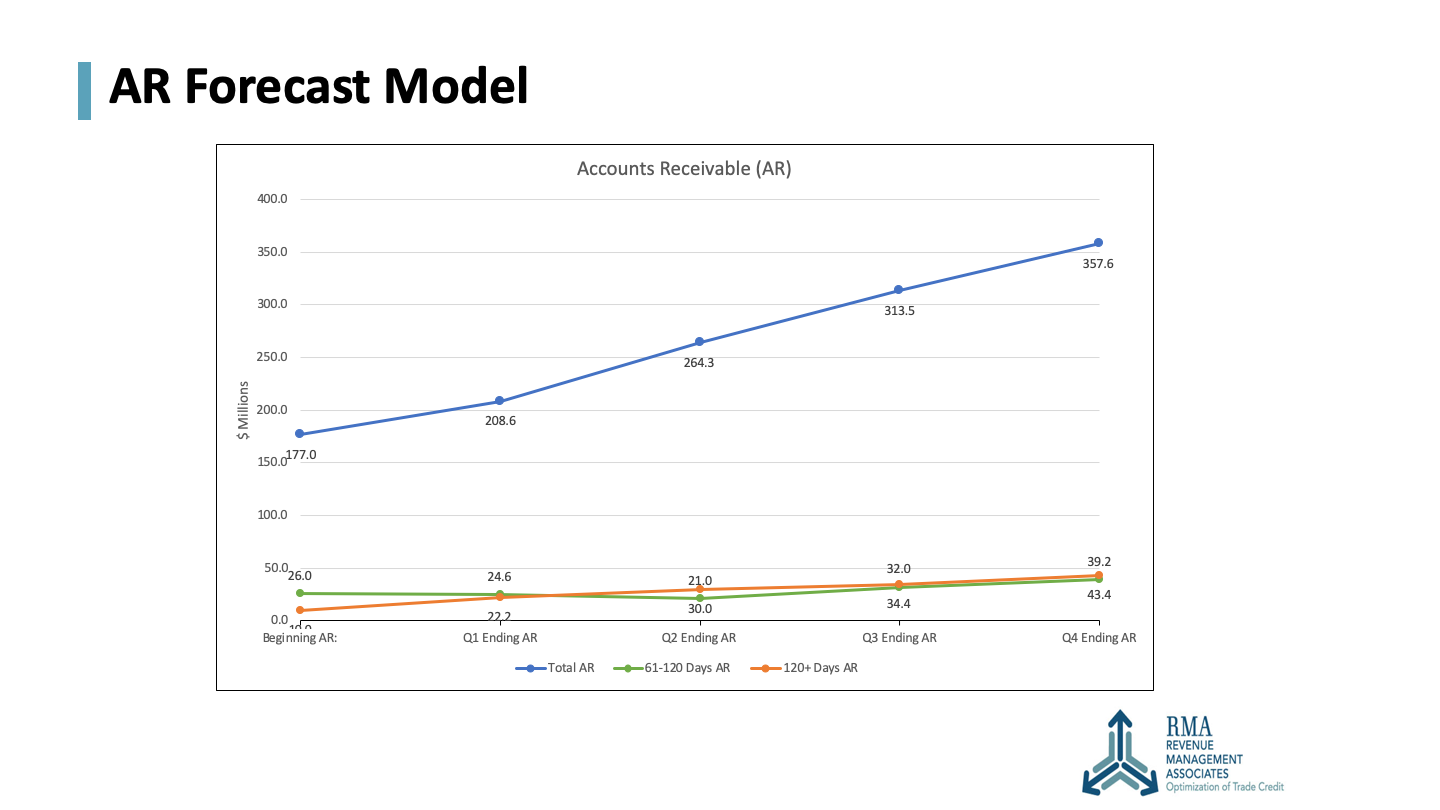

The next step considers what that means in terms of AR and cash flow. “Now you have to forecast that,” he explained. “You have to project when you're going to get paid.”

Although companies may have historical data for each risk category, “you might have to adjust it and expect slower payments today,” Salek said. Even typically strong customers have been asking for extended payments, he added.

Salek suggested creating a variety of scenarios to model the cash inflow and ending AR. Again, in his example, AR basically doubles, going from $177 million to $358 million, and aged receivables went up significantly. “When your AR doubles on relatively stable revenue, that means your cash flow has dropped way off and of course the aging raises the specter of significantly higher bad debt risks.”

Despite the dismal results in his example, Salek says it’s a good forecast for credit professionals to share with their C-suite. “Finance and credit management can provide some guidance to the senior management and become known as a trusted advisor. With this pandemic credit risk forecasting, you can position yourself as a leader in your company.”

Share your results, he advises. “Come to a consensus with senior managers about how much you are going to sell to high-risk customers.”

John Salek, president of Revenue Management Associates presented Metrics: Managing & Monitoring AR Health, available on-demand. Salek shares his expertise on using metrics for managing and monitoring AR health. He explains his 14 must-have and eight nice-to-have metrics, in an attempt to find the right balance between using too many metrics and too much reporting. This webinar focuses on metrics for gauging credit risk today and for forecasting the AR and cash flow impact from selling to a suboptimal mix of low-, medium- and high-risk customers.

World Economic Outlook Revises Up Slightly

The latest World Economic Outlook released Tuesday projects global growth for 2021 at 5.5%, 0.3 percentage points above its previous forecast. The outlook estimates growth of 4.2% in 2022.

“Much depends on the outcome of this race between a mutating virus and vaccines and the ability of policies to provide effective support until the pandemic ends,” said Gita Gopinath, the International Monetary Fund’s chief economist, during a World Economic Outlook press conference Tuesday. There remains tremendous uncertainty and prospects vary greatly across countries, Gopinath added.

The economic upgrade comes with the onset of vaccinations in many countries and additional fiscal policy support provided in some economies such as the U.S. and Japan. Gopinath cautioned that outcomes could shift in line with changes in vaccine rollout and policy support.

Although the estimated collapse for 2020 is somewhat less dire than projected in October, “the crisis in 2020 still remains the worst peacetime global contraction since the Great Depression,” she said.

If downside risks prevail, a tightening of financial conditions is expected, which could have a real negative impact on the economy given debt is at record highs in many countries. More than 150 economies are expected to have per capita incomes below their 2019 levels in 2021, and that's expected to decline modestly to around 110 economies in 2022. The cumulative output loss sits at $22 trillion.

The strength of the projected recovery varies significantly across countries with large differences in projected output losses in 2022. For example, China returned to its pre-pandemic projected level in the last quarter of 2020, ahead of all major economies. The U.S. is projected to surpass 2019 levels this year.

“With advanced economies generally expected to recover faster, the progress made towards convergence over the last decade is likely to reverse,” Gopinath said. “Over 50% of emerging market and developing economies that were converging towards advanced economies per capita income are now diverging over the three years between 2020 and 2022.”

Economies dependent on oil exporters and tourism have been hardest hit and prospects for the near-term remain dim.

Even within countries, the crisis has been felt unequally across different groups, Gopinath said. “Workers with less education, youth and women, and those informally employed have suffered disproportionate income losses. Now 19 million individuals are expected to enter extreme poverty over 2021, reversing the trends of the past two decades.”

Gopinath stressed the need for ramping up the production and access to vaccines. “New virus strains have made abundantly clear that the pandemic is not over until it's over everywhere,” she said. “We estimate that the benefit of more rapid progress towards ending the health crisis will add $9 trillion cumulatively to the global economy between 2020 and 2025, with benefits for all countries, including advanced economies of around $4 trillion.”

Gopinath called for “well targeted economic lifelines” to keep households and viable firms afloat. “Once infections are durably declining and we have broadening immunity to the virus, we could think of gradually rolling back these lifeline so as to enable mobility of workers and to prevent the risk of having zombie firms that would then end up negatively impacting productivity.”

Regulatory Onslaught?

—Chris Kuehl, Ph.D.

The majority of the business community is pretty agnostic when it comes to politics. There is as much diversity of opinion in the ranks of businesspeople as there is in the population as a whole. Not many issues will attract significant unanimity, but regulation is often one of them.

The perception is that business is anti-regulation in general, but that is fundamentally untrue. The vast majority of the rules and regulations that affect the conduct of business are welcomed and supported because these factors often weed out incompetent and untrustworthy competitors.

No legitimate business wants to endanger its employees, produce dangerous and inferior goods, or damage the community it inhabits. The challenge lies in trying to achieve a balance between these goals. Despite the many cases of inadequate control and regulation, there are many cases of overreach and unrealistic regulation. The last four years saw a reduction of regulations, and many would assert the pendulum swung too far away from ensuring businesses played a responsible role. Now, the fears are that pendulum will swing too far in the opposite direction.

In many cases, the regulation is appropriate in one sense, but it undermines other goals. The entire context is not recognized. As an example, regulations have been promulgated by some states and communities regarding construction. The goal in some states and communities has been to impact climate change and speed acceptance of alternative energy so new homes are mandated to have solar power installed and to have the ability to charge an electric vehicle. In one sense this is an admirable goal but, in another sense, it undermines another goal. These same communities want to expand the availability of affordable housing, but the requirement to add this technology adds to the cost of the home. For the wealthier home buyer, it is just an added expense and one they might even use. However, lower income buyers are unlikely to need to charge their Tesla and are being forced to pay for something they neither want nor need. In general, regulatory demands in housing account for close to 20% of the cost of a home.

The most common criticism of regulatory efforts is that they are often very short sighted. There is a stated goal to be achieved and the effort fails to take into account the impact on other issues. Of course, the same can be said about business goals because the mission of a business is to make money for its owners and investors. In fact, the business and the regulators have the same customer. The business that doesn’t worry about what the customer wants will not survive long, and neither will the company that fails to take account of its employees or the community around it. Regulations that do not take into account the whole environment will address one problem, while making another problem worse.

Another area of potential conflict that will emerge soon concerns employment in the face of a pandemic. The core issue is whether a business can demand that an employee return to work. There is an assertion that companies can’t require employees to resume their duties if there remains a chance that they could contract the virus. It is further asserted that if employees do become ill, they could sue the employer.

The challenge is that a company will not be able to resume its operations under these circumstances. If a person refuses to return to work, the company will have to find another worker and that means firing the worker who refuses to return to the office. If that is prohibited, the company is being asked to pay people who are not producing anything at all.

If the company faces lawsuits, they are running expensive risks. The most logical course of action under these circumstances is to simply shutdown altogether and fire everyone. That is clearly not a desired outcome. It is reasonable to expect a company to take precautions and to try to reduce the threat. However, there will remain a trade-off decision for the employee as well as for the business. This dilemma has already manifested in many situations and will become ever more common.

Stepping into Leadership: The Formality of Talking Like a Leader

—Andrew Michaels, editorial associate

Communication is a key facet of effective leadership. Whether ushering in new changes to the credit department or offering guidance to your team, credit leaders should understand the difference between formal and informal communication styles, when to use each one, and how to do so successfully.

Formal communication means having a predefined idea or thought prior to engaging with an audience. Cheryl Pinson, CCE, CICP, is among the credit leaders who find the use of formal communication effective in the credit department because of its structured approach. Formal communicators may outline their message before speaking with their audience or even prepare a more comprehensive speech.

“If you are in front of an audience of more than 10 people, you should use formal communication in my opinion,” said Pinson, the global director of credit for Bunge Ltd. “It is easy to get sidetracked and off topic. You are usually given a time limit; and if you do not plan accordingly, you will likely get to the end of your time having not addressed all of the planned topics.”

In the credit profession, formal communication may be used when leading a conference room meeting or participating in a speaking engagement such as an educational session at NACM’s Credit Congress & Expo. Pinson’s past speaking engagements for NACM often involved PowerPoints to keep the presentation on track, while maintaining the audience’s attention. Charts, graphs and other aids also can assist speakers in defining their points. However, it’s important speakers not rely too heavily on them. Otherwise, their audience may lose interest.

Informal communication is more impromptu and off the cuff, said Tim Bastian, ICCE, the senior director of risk at Rain for Rent. Credit leaders can also use informal communication with larger audiences, but it is more likely used within a department or on a smaller scale. It gives leaders the ability to converse with their audience on a more personal level.

“Most speaking events I have done are geared toward teaching a topic,” Bastian said. “Yes, you need to cover the core material, but you are able to adjust to the wants of the audience. Consistent engagement creates opportunities to lead.”

KIE Supply’s Credit Manager Sam Bennett uses informal communication techniques when she meets with a few employees to provide a sense of direction such as sharing information on a new customer or addressing a customer’s payment status. These conversations aren’t necessarily planned or scheduled, but they may include a one-on-one discussion with an employee. This also gives leaders the opportunity to relate to their audience.

“Real language makes the message relatable and making a clear message will be more easily acknowledged,” Bennett said.

So, the next time you plan to communication as a leader, ask yourself whether a formal or informal approach is the right way to go.

For more information on leadership in the credit profession, be sure to check out NACM’s Stepping into Leadership series as well as the March/April issue of Business Credit magazine on Building Leaders.

|

Upcoming Webinars |

|

Feb 2 |

How to Improve Your DSO: Ramp-up Your Collection Cycle

Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC |

| Letters of Credit Series: Understanding the Letter of Credit Process: What Every Exporter Needs to Know Speaker: Richard “Chip” Thomas |

Feb 4 |

|

Feb 9 |

How to Reduce Supplier and Buyer Friction

Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC |

| Letters of Credit Series: Roles and Responsibilities of Banks in the Payment Process Speaker: Richard “Chip” Thomas |

Feb 11 |