eNews October 8

In the News

October 8, 2020

Paper Checks Losing Traction in B2B Payment World

—Andrew Michaels, editorial associate

The push to modernize B2B payments has yet to extinguish the paper check, a form of payment dating back to the mid-1700s. Most credit professionals have at least one customer that uses checks as their go-to payment method, but according to A/R automation experts at VersaPay, COVID-19 is forcing the hands of companies to accelerate the elimination of paper checks and shift toward an automated payment process.

In September, VersaPay Chief Operating Officer Bob Stark and Sales Director Dan Blackburn hosted a webinar, “The Death of the Check and Future of B2B Payments,” during which they discussed the slow yet inevitable death of paper checks. The presenters said the death of the check sped up over the past seven months in part by the current economic climate under COVID-19; however, Stark noted check usage has steadily declined over the past 15 years. AFP’s recent Electronic Payments Survey reinforced this finding, stating 75% of suppliers received B2B payments in the form of checks in 2004, a percentage that plummeted to 36% in 2019.

“[AFP] reiterated that 97% of organizations use checks, but they’re only using them a fraction of the time,” Stark said. “It’s almost down to one-third of those payments are checks, whereas two-thirds are ACH and digital payments.”

More than 80% of all suppliers surveyed by AFP said they would likely convert the majority of their organization’s B2B payments from checks to electronic payments within three years, while only 19% said such a transition was unlikely. In light of COVID-19, Stark said “it’s no secret” that the pandemic is driving digital payments as manual and paper payments are much more challenging now than before.

If companies aren’t using checks, Stark and Blackburn said their options include traditional payment methods, such as ACH and wire transfers, or online (digital) payment networks, each accompanying their own share of pros and cons. For example, Blackburn said, the obvious benefit of ACH and wire transfers is faster settlement times. Most ACH and wire transfers settle within 24 to 48 hours and many banks are moving to same-day settlements. These traditional payments are also more secure than checks and less manual to process.

“But there are still some downsides,” he added. “There’s the inherent challenge of the payment not being processed immediately, so insufficient funds can happen. Remittances travel separately, which adds some complexities to cash application.”

From a digital standpoint, Blackburn said, payment cards are great for speed because the payments process instantly and they’re the most secure form of payment. On the other hand, companies must invest in the technology required for such payments as well as the higher interchange costs; therefore, leaving companies to balance the trade-offs between faster cash and higher costs.

As a supplier, there are two fundamental approaches in the transition from check to digital payments: customer centric and supplier centric. Blackburn said the former focuses on the frontend customer experience of the invoice-to-cash process, starting with the customer self-service portal and working to drive high customer adoption. This effectively eliminates the majority of the repetitive work through the A/R process, such as disputes, collections, deductions and cash application. As the adoption number climbs, he said, the work queue will shrink.

The supplier centric approach deals solely with backend processes, such as cash application and collections, with a focus on managing the work more efficiently by applying various tools and insights. Unfortunately, Blackburn said, the end result and payoff aren’t quite as high.

“A customer centric approach may introduce more change that’s required and needs to be managed,” Blackburn said. “It’s not for everybody, but we firmly believe the frontend approach is fundamentally better because it’s truly transformational and it drives a lot more value in the end result. Customers are happier and more loyal because you removed friction for them and made it easier to do business with you, and employees are happier because you eliminated much of the repetitive and mundane tasks that nobody really likes to do in the first place.”

How is That “Work at Home” Going?

—Chris Kuehl, Ph.D., NACM economist

The concept of working at home rather than at an office was supposed to be a temporary reaction to the pandemic but that now seems to have become a permanent shift in the way that millions of people work. There has been enough time for people to evaluate this development—employees and employers. The opinions are starting to diverge radically with few being in a neutral position. One either welcomes the opportunity to avoid commutes, eschew pants, and labor away in peace and quiet or one hates the isolation and inefficiency.

In the beginning, the support for work at home schemes was substantial—among both the employee and their supervisors. After all, there have been workplace gurus calling for management-by-objective for years, and in many offices, people essentially worked alone anyway. Nobody seemed to miss those interminable meetings and all the workplace drama that only served to distract.

As time has gone on there has been less and less enthusiasm and more recognition that working at home has severe limitations that can’t be overcome with virtual meetings and waves of email. There are some emerging pros and cons. The most immediate advantage and the reason for the move toward working at home is that it contributes to the effort to control the virus by limiting contact between people. It is assumed that this is still a temporary motivation, but given the continued spread of the pandemic, it is not clear how temporary. The chief advantage seems to lie with the worker at this point as the majority of employers and supervisors have not been fans. It generally makes their jobs much harder.

The person now working from home indicates three advantages over working at the office. The first and most important is that it saves them time and money as they no longer have to commute, and in many cases, that daily grind was costing them an hour or two in traffic. The second advantage is the lack of unwanted distractions as people are no longer hanging around their cube or catching them in the hallway. The third advantage is the ability to work when it is most convenient. Morning people can hit it early and nighthawks can kick in at midnight. If there is a kid that needs attention or a dog that needs a walk this can be accommodated.

The employee also has some cons to consider. Social people are miserable and miss the interaction of the workplace. Getting help is harder, and the longer that people are away from the office the less they know their colleagues, making it even harder to ask for help. That ability to work at any time of day cuts both ways as people are now getting messages and demands from their supervisors at all hours of the day. It is very hard for the person working from home to set hours and on average people find they are now working 10 or 12-hour days routinely.

The people who have always been self-motivated are not a problem, but most of their staff has required motivation and observation. Collaboration and team building are next to impossible, and bringing new people up to speed is immensely more difficult. Management-by-objective is a great concept, but if one can’t observe the process the likelihood is that the finished product is not what was desired or expected.

The office environment allowed casual interactions to gauge progress and now it is a series of exchanges by email and video calls, and supervisors comment that their workload has tripled and quadrupled as they try to monitor all this remotely. The sense is that fewer and fewer people are as enamored of the work at home concept. The assumption that offices were a thing of the past may have been premature as most want at least a partial return to old patterns. The expectation now is that there will be more hybrid work environments with people doing their jobs at home a couple of days a week and working out of an office the rest of the time. This all depends on whether the threat of the virus has faded enough to allow such a relaxation.

Nonpayment Protections for Material Suppliers Start with Data

—Michael Miller, managing editor

Defensive driving is a tactic that protects motorists. It saves lives and reduces the possibility of accidents. Mastering the skill puts you in the driver’s seat, so to speak, to avoid obstacles and stay in control. Acquiring this prowess and self-awareness in other areas of life can be just as important, and it can provide similar protections. In the world of construction credit, that means staying on top of job information.

Wayne Kishbaugh, a NEDCO supply senior credit analyst, gathers the property owner’s name and address, and the name and address of the general contractor at the start of a project. That way his team can begin the process for mailing notices within 30 days of first furnishing for Nevada private projects. It’s important to build in time to gather job information and mail certified letters to the owner and general contractor, Kishbaugh noted.

Material suppliers must identify and verify the address of the piece of property where their materials are being installed, who owns the property and who the general contractor is, said Chris Ring, a NACM Secured Transaction Services representative in a recent webinar. This process is typically known as the gathering of job information.

Ring recommends using a job information form to capture the critical details that will support the use of a mechanics lien. “It’s a template to gather information,” he explained. It identifies the piece of property being improved, the owner and the role of the creditor’s customer in the construction project. Companies may already have a form or one that needs updating, Ring said. For those companies that don’t, he noted that they could reach out to him at This email address is being protected from spambots. You need JavaScript enabled to view it. to receive one.

Material suppliers must identify the property being improved, where the materials are being installed, the property owner, the general contractor and their customer, Ring noted. Suppliers are some of the last construction project participants to receive payment. Money to pay them has to funnel down from the property owner through the general contractor and subcontractor.

Complete and accurate job information also supports extending larger lines of credit, Ring said. For example, information contained in a credit application might qualify a customer for $5,000, but the purchase order is for $40,000. However, the information on the job information sheet could qualify the customer for much more based on the value of the property with the use of a mechanics lien. This is one way to turn a no into a yes, instead of denying a customer a line of credit, Ring explained.

Fallout from the COVID-19 pandemic has also led NEDCO to implement other strategies to mitigate nonpayment risks. A lot of business, comes from the casino industry, supplying to casinos for tenant improvements, Kishbaugh said. However, travel restrictions and closures at the onset of the pandemic impacted the industry and the ability to get paid.

“Accounts payable people were not always available during shut downs and closures,” he said. “The AP team was furloughed except for the AP supervisor or manager or even the controller. Payments from casinos have seen delays, and some casinos are still not open.”

The company now requests deposits on larger orders based on customer credit limits. “We’re more cautious now when making credit decisions,” Kisbaugh said. “Even though we have lien rights, we’re asking for a down payment.”

He said they also are doing more on the frontend when they receive credit applications. Recently, NEDCO had to write-off unpaid invoices for electrical equipment due to fraud from an entity claiming to be an out-of-state university. “We’re doing our due diligence by asking for additional credit references and checking customer websites—extra steps to verify credit applications,” Kisbaugh added. “We’re calling customers to avoid fraudulent orders.”

NACM’s Secured Transaction Services will host a free 30-minute webinar on Nevada’s mechanic’s lien and bond claim statues on Monday, Oct. 12 at 3 p.m. Eastern. Register for the webinar here.

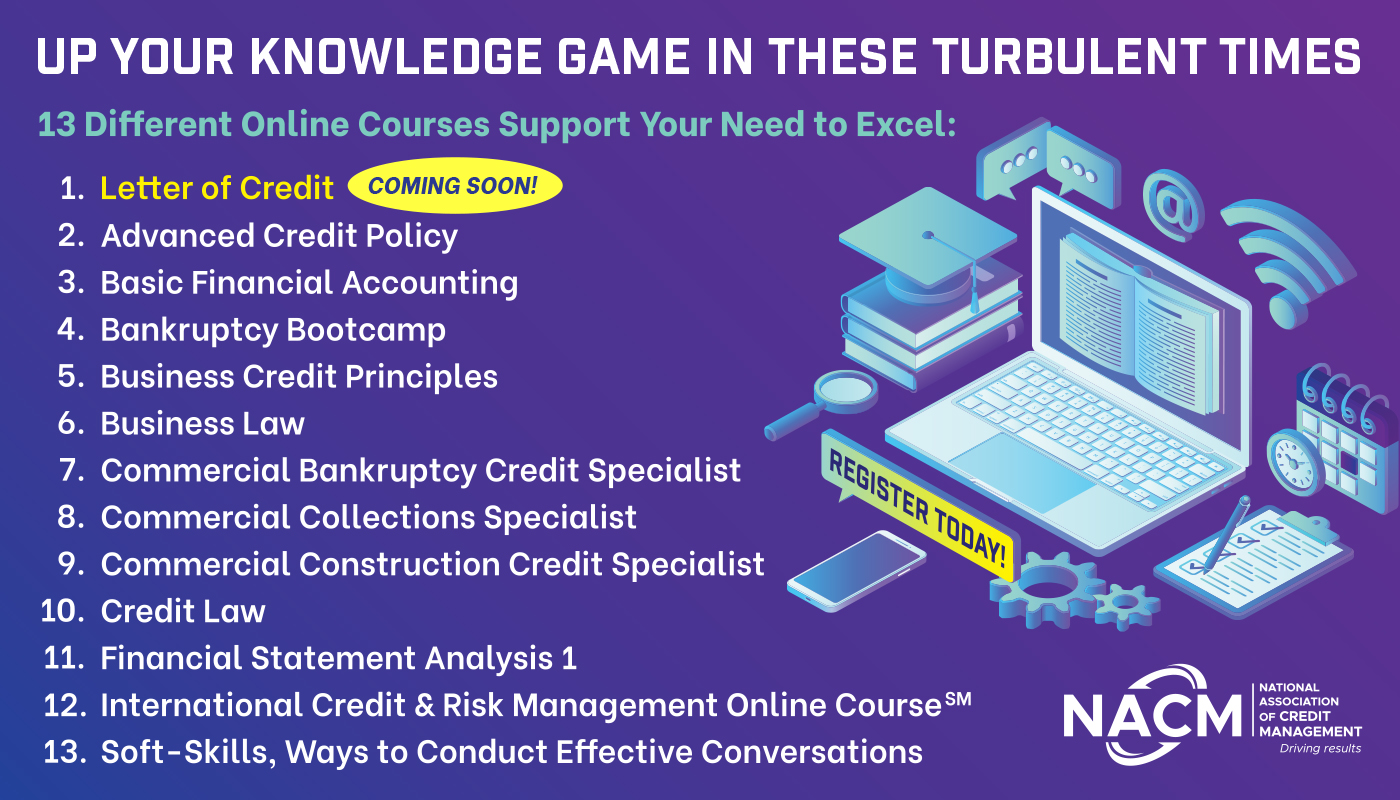

It is important to understand letters of credit from a technical perspective such as how, when and why to use them. However, credit professionals need information that goes beyond the mechanics and perfect world usage. They need to understand how to manage real-life scenarios.

Join a live discussion on letters of credit from the perspective of two experienced and seasoned credit managers. Credit managers Karen McLaughlin, ICCE, and Val Venable, CCE, ICCE, will speak with Deutsche Bank’s Fred Dons about the frustrations, challenges and issues credit managers face when using letters of credit.

The webinar will seek answers to questions that credit professionals have:

- Why don’t banks offer alternatives to LCs in high risk areas?

- Why does it take so long to get an LC in place?

- Why aren’t banks embracing online documentation for LCs?

The Bankruptcy Code defines a “claim” to include any right to payment against the bankrupt entity (called the “Debtor”), regardless of whether the claim is reduced to judgment, liquidated, unliquidated, fixed, contingent, matured, unmatured, disputed, undisputed, legal, equitable, secured, or unsecured. It’s a broad definition.

Claims break down into four basic categories: (1) secured claims; (2) administrative expense claims; (3) priority claims; and (4) general unsecured claims.

It is no surprise that in bankruptcy there is seldom enough money to pay every creditor in full. Order of priority, therefore, is critical. Imagine the creditors forming a line: secured claims, followed by administrative expense claims, priority claims, and general unsecured claims. Equity claims—the owners’ stake in the Debtor—are technically at the end of this line, but since the estate is often insolvent, they usually do not receive any payment at all.

Outside of bankruptcy, the creditor probably thinks about the money that the Debtor owes as a single debt. As we shall see, however, the Bankruptcy Code’s payment hierarchy can slice and dice this debt into several tranches according to what portions of the debt qualify as administrative expense, priority, or general unsecured claims. Creditors need to think about the money they are owed according to these claims, which can differ in value significantly. A $100,000 administrative expense claim could be worth far more in real dollars than a $1 million general unsecured claim, for example, and consequently worth investing more resources to pursue.

Secured claims are secured by a lien on the Debtor’s real or personal property (called “collateral”), and the creditor may, under certain conditions, levy and sell collateral in satisfaction of its claim. The perfection and priority of liens is determined by non-bankruptcy law (usually Article 9 of the Uniform Commercial Code and real property law). A secured claim is really just one of the other kinds of claims plus collateral. Once the collateral is liquidated and applied to the debt, any remaining debt will be treated as an administrative expense, priority, or general unsecured claim.

Creditors assert priority and general unsecured claims by filing a short and simple form with the bankruptcy court called a proof of claim. This can be done for little cost. If no one objects to the proof of claim, the claim is allowed. Administrative expense claims require a more extensive application filed through counsel. The bankruptcy court must approve the application before an administrative expense claim is allowed.

In a successful reorganization, administrative expense claims and priority claims are paid in full, while general unsecured claims can receive as little as nothing or as much as 100% plus accrued interest if the estate ends up being solvent. In most cases, the dividend on general unsecured claims is very small.

If the creditor owes the Debtor property (including money), it cannot receive payment until it has turned such property over to the Debtor. This allows the Debtor to net out liabilities with its creditors as part of the claim administration process.

CLAIMS FOR THE SUPPLY OF GOODS AND SERVICES TO THE DEBTOR

Suppliers (or “trade creditors”) typically provide goods and services to the Debtor on credit (i.e., payment is due X days after goods are delivered). The bankruptcy filing divides the Debtor’s payment obligations into pre-petition and post-petition obligations. With limited exceptions, pre-petition obligations are treated as general unsecured claims and post-petition obligations are treated as administrative expense claims. If the Debtor is operating under a court approved budget, which includes paying that creditor, then payment for post-petition goods and services will typically happen under the parties’ usual business terms.

With limited exceptions, a trade creditor who owes a debt to the Debtor may set that debt off against its claim. This effectively gives the creditor a secured claim up to the amount of the debt it owes the Debtor. “Payment” of this secured claim, however, merely reduces or eliminates an in kind debt obligation.

1. Payment for the Supply of Goods

A trade creditor will have an administrative expense claim for the value of goods that the Debtor receives within 20 days before the bankruptcy filing. This does not apply to services. If the trade creditor provides both goods and services as part of its contractual performance, the court will probably limit the administrative expense claim to the value of the goods, and the services portion will be classified as a general unsecured claim (this is an open question, with some courts applying a “predominant purpose” test to determine whether the contract is for goods or services). This administrative expense claim only arises if the Debtor “receives” the goods. Several cases say that the creditor does not get an administrative expense claim, if it drop-shipped the goods directly to the Debtor’s customer. Finally, there are several bankruptcy court opinions deciding that natural gas and electricity are “goods” and, therefore, the utility provider is entitled to an administrative expense claim for the value of such goods delivered within 20 days of the bankruptcy.

Other than goods received by the Debtor within 20 days of the bankruptcy, the trade creditor’s claim for goods and services supplied pre-petition is treated as a general unsecured claim. Some courts in limited circumstances will permit a Debtor to invoke the “doctrine of necessity” to pay the outstanding invoices of certain trade creditors whose relationships are deemed “critical” to the Debtor’s business. This relief is controversial because it effectively elevates certain creditors over others.

Trade creditors might exercise their right under the Uniform Commercial Code to “reclaim” goods delivered to an insolvent Debtor. To do so, they must make a written demand identifying the goods they wish to reclaim no later than 45 days after the Debtor receives the goods or 20 days after the bankruptcy filing if the 45-day period expires after the filing. But this remedy has limits: the trade creditor’s reclamation claim is subordinate to a secured creditor’s prior perfected lien on the same goods. In many cases, the presence of a first-priority lender with a “floating lien” on inventory whose outstanding debt exceeds the value of the goods will render the trade creditor’s reclamation claim valueless.

2. Payment for the Supply of Services

Like vendors who supply goods, persons who provide services to the Debtor are entitled to an administrative expense claim for the value of their services rendered post-petition. Payment for services rendered prior to bankruptcy, however, is treated as a general unsecured claim, with limited exceptions discussed below.

If you are under contract with the Debtor (including an employment agreement), the Debtor may assume or reject that agreement prior to the conclusion of the bankruptcy case. While you will have an administrative expense claim for services rendered post-filing, any liquidated damages arising from contract rejection will be treated as a general unsecured claim. Typically, the Debtor will wait until the end of the case to decide whether to assume or reject a services contract. Because such contracts are personal, the Debtor is not able to assign a services contract without the service provider’s consent. This may provide leverage to C-Suite executives and other critical employees with employment agreements if the Debtor proposes a going-concern sale of its business during the bankruptcy.

If you are employed by the Debtor, you are entitled to a priority claim for pre-petition wages, commissions, vacation, severance, and sick leave earned within 6 months of the filing date, up to a capped amount of $13,650 per employee. To the extent there are funds remaining under the cap after paying the forgoing, employees have an additional priority claim for contributions to benefit plans. Although a Debtor does not have to pay priority claims until a plan is confirmed, the Debtor will typically seek court approval to pay employee wages immediately and pay other benefits (including vacation, severance and sick leave) as they are incurred in the ordinary course of business as a necessary expense of maintaining its workforce.

If you are a “critical” employee, the Debtor might seek court approval of a “key employee retention plan (KERPs)” or “key employee incentive plan (KEIPs).” The Bankruptcy Code imposes several restrictions on KERPs to avoid excessive transfers to C-Suite executives that provide no tangible benefit to the estate. KEIPs must be structured as an exchange for value: the employee must meet performance goals such as helping the Debtor successfully reorganize or meet sales targets.

3. Special Protections for Certain Suppliers

Trade creditors who supplied fresh (and frozen) fruit and vegetables to the Debtor, might have a claim under the Perishable Agricultural Commodities Act (“PACA”). PACA is a federal law that says that a Debtor who receives proceeds from the sale of any perishable agricultural commodity holds such funds in trust for the benefit of an unpaid supplier (essentially anyone in the supply chain). PACA claims are incredibly powerful in bankruptcy because the claimant’s rights to the Debtor’s cash are superior even to a secured lender with a first-priority lien. Suppliers of beef and poultry can make similar trust claims under the Packers and Stockyards Act in the bankruptcy of a meat packer or live poultry dealer.

Persons who supply grain or fish to Debtors who own storage or processing facilities for those commodities have a priority claim of up to $6,725 worth of grain or fish product. The Bankruptcy Code has special procedures for the expedited determination of interests in, and abandonment or other disposition of grain assets.

Utility providers are prohibited from discontinuing service to the Debtor simply because it has filed for bankruptcy. The utility is entitled to adequate assurance of payment, however, which the Debtor must deliver in the form of a cash deposit or other liquid securities. If the Debtor fails to provide this assurance, the utility may cut off service. Older bankruptcy court opinions hold that cable and internet providers are not utilities entitled to this protection because they do not provide services that are necessary for a minimum standard of living. Opinions may differ in the future.

David Mawhinney is an attorney at the law firm of Bowditch & Dewey LLP, where he focuses his practice on commercial disputes, business restructuring, and insolvency.