eNews June 10

|

In the News

June 10, 2021

Managing Cross-Border Receivables and Credit Risk

in Today’s Global Market

Annacaroline Caruso, editorial associate

The COVID-19 pandemic magnified many of the common challenges associated with global trade and supply chains, including managing relationships with customers.

“When you are half a world away understanding and managing those relationships is much more difficult, and understanding the accuracy and what the information is actually saying is also much more difficult,” said John Loy, of Bank of America Merrill Lynch (Chicago), during one of the live sessions of this week’s NACM 2021 Credit Congress Virtual Plus.

The bank’s director and product sales manager of global trade and supply chain solutions shared trends that emerged over the past year and strategies that credit professionals could use to mitigate risks and prepare for challenges ahead.

Certain countries have been slower to pay than others, Loy pointed out. “Part of that is cultural and part of that is the reality of dealing with certain governments.”

Some companies outside the U.S. may not have as much access to the U.S. dollar as they once had. For example, “if you are selling to a small or medium-size company in China, its ability to get U.S. dollars and its cost for U.S. dollars may be higher to pay you. It’s not necessarily the cost, it’s more the access to U.S. dollars.” So, holding onto U.S. currency may be more of a benefit to the company.

And in Brazil, the government was controlling how many U.S. dollars were leaving the country so it allocated first to banks and then to corporates, he explained. “If that continues then there’s some advantage to using bank products such as letters of credit to get paid faster.

“It’s helpful to know what your counterparties access to cash and liquidity is,” he added.

Loy also outlined some potential global trade risks to be on the lookout for in 2021-22 such as U.S. trade disputes with China, Mexico’s growing dependence on U.S. trade, and political instability in Argentina and Hong Kong.

Global trade is expected to grow 5% in 2021, which means a strong but possibly uneven recovery after the pandemic, according to World Trade Organization data Loy shared. World merchandise trade volume is expected to bounce back by 8% in 2021, which is nearly a full recovery from the pandemic, Loy said.

Global GDP is also expected to grow in 2021 by 5%, while Emerging Asia is predicted to increase by only 6%. Historically, the difference between global GDP and Asia’s is greater, Loy pointed out. Emerging Asia has been a driver of GDP, he added. Loy explained this change could indicate Asia’s recovery has been "slower to come back or is maturing and is no longer going to be the driver that pulls overall GDP.”

Credit managers should approach cross-border sales strategically to avoid the possibility of slow or nonpayment, Loy said. “There’s a number of solutions. Talk to your advisors and do your homework. You need to make sure you have a captain that’s used to sailing a complex ship.”

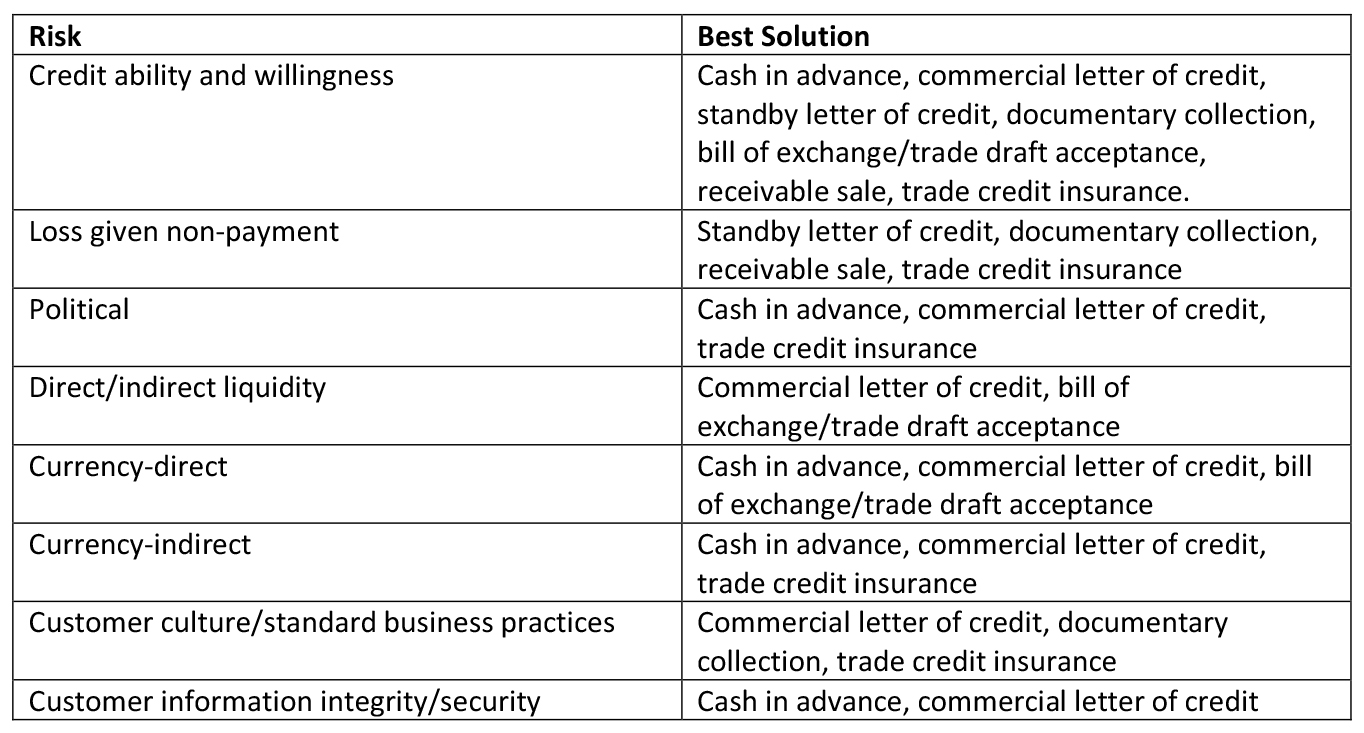

But not all risk mitigation tools work best for all risks. Here’s Loy’s breakdown of the best approach to getting paid faster depending on the risk situation:

As with anything, there are pros and cons associated with each tool, so it’s important to weigh your options. For example, the cash in advance approach is where most creditors start with new customers, but doing so puts the customer at a disadvantage and “may make it difficult to win that business,” Loy said.

“You have to focus on the basics when selling to a new export customer,” he explained “The objective is to know when and how to ask for help.”

This Virtual Plus Credit Congress seminar could not be recorded by NACM due to proprietary concerns, but it’s not too late to register and watch several other seminars on a wide variety of topics.

Benefits of Having a Master Service Agreement

Bryan Mason, editorial associate

Master service agreements (MSAs) can set the stage for ongoing, open-ended business relationships between a seller and buyer. The agreements are legal documents that “consolidate separate but related agreements between the same signing parties,” according to Black’s Law Dictionary. The key elements that comprise the agreement, also known as a master contract, are negotiated between the two parties and form the foundation for business going forward.

MSAs aren’t the same as work orders. Instead, they are “meant to layout the terms and conditions,” said Chris Ring, of NACM Secured Transaction Services (STS). These terms and conditions are negotiated between the seller and buyer and offer more flexibility than a standard credit agreement. This flexibility can allow for more leeway such as extended payment terms or predetermined dispute resolutions to allow business to run smoothly.

Darci Graves, senior credit and collections analyst with Baseline Energy Services LP, says her company typically uses MSAs for “customers whom they consider high risk.” MSAs are useful in this instance because they provide legal support along with any additional credit risks that may arise from negotiating extended terms, dispute resolutions and more within the MSA.

MSAs can also help eliminate the battle of the forms, the scenario where a buyer and seller continuously exchange documents with conflicting terms and conditions, Ring said. “In any contractual relationship, the last contract executed with overriding terms and conditions traditionally wins the battle of the forms,” he said.

A recent eNews poll by NACM asked credit professionals what type of information their companies incorporate into documents such as MSAs, long-term agreements and blanket purchase orders. Of the credit professionals who responded, nearly 67% of them included payment terms and just less than 42% also include product warranties.

Additional categories that MSAs typically address include:

- Business ethics

- Corporate environmental and social governance policies

- Dispute resolution solutions

- Geographic location

- Limitations of liability

- Intellectual property ownership

- Permissions for network access

- Country of governing law

- Choice of legal venue

In addition to these items, MSAs can include information on force majeure and company solvency issues, Graves said. “MSAs can set more detailed terms of a working relationship with the customer,” she said.

“The goal is to hammer out as many details as possible in broad strokes,” according to UpCounsel. “That way, corporations don’t waste too much time and money in negotiations.”

Benefits of Using an MSA

MSAs work well with repeat customers. In the event of future business transactions, the buyer and seller will not need to renegotiate the entire agreement—only the details specific to the latest deal. So, when drafting an original MSA, it is important to note that this agreement can serve as a strong foundation for future business.

MSAs also protect through indemnification and risk allocation. According to Vethan Law Firm, P.C., indemnification is a method to allow one party to hold harmless or safeguard another party against existing or future losses. The indemnifying party agrees to pay for damages it has caused or may cause in the future, regardless of fault, while the indemnified party agrees not sue the party responsible for damages, pays lawyers to defend the party at fault and pays for any damages inflicted to the third party.

“MSAs let a business implement a comprehensive risk allocation strategy that takes business realities into consideration,” said Vethan Law Firm. Comprehensive risk allocation strategies provide details that outline the risk and responsibility of both parties in the MSA for the duration of the project. It can eliminate the need to negotiate and reduce disputes if and when the project work changes, per Vethan Law Firm. This saves time and effort for the seller and buyer.

Graves cautions credit professionals to ensure liability issues are addressed within your MSAs because they are not always included within credit agreements. “Not having an MSA in place can leave a company open to potential litigation and liability issue that may not work in your favor,” Graves said. “Having a properly negotiated MSA can be beneficial to both parties. Such as providing knock for knock protection [a reciprocated agreement which divides liability for certain losses between both parties] in cases of injury or property damage.”

Construction Startup Katerra Files for Bankruptcy,

How Are Creditors Protected?

Annacaroline Caruso, editorial associate

SoftBank-funded construction startup Katerra filed for Chapter 11 bankruptcy this week in the Southern District of Texas, leaving numerous projects unfinished, between $500 million to $1 billion in assets, and $1 billion to $10 billion in liabilities. The company blamed its downfall on a number of factors in a recent statement, including financial hardship from the pandemic and “unexpected insolvency proceedings of Katerra’s former lender.” The lender, Greensill Capital, another SoftBank-backed entity, reportedly filed for insolvency in London in March.

The company does not plan to reorganize in the traditional sense through Chapter 11 bankruptcy, said Andrew Behlmann, partner at Lowenstein Sandler LLP (New York, NY). “When most people think of Chapter 11, they think these people will be coming out of it, but that’s not necessarily the case,” he added. “A few days before filing bankruptcy, Katerra sent some project owners a letter indicating that it is ceasing operations and would be doing no further work on their projects. On its first day in bankruptcy, Katerra filed a series of motions to reject the prime contracts for a number of projects and announced that it is conducting an expedited sale process for the remainder of its business. In a few months, Katerra will no longer exist in its current form.”

Overall, it sounds like Katerra grew too large, too fast, and took on too much debt. It’s not an uncommon story. Creditors should consult with their management and legal counsel for how to proceed, but here are some steps you may want to consider when any debtor files for bankruptcy.

Bruce Nathan, partner at Lowenstein Sandler LLP (New York, NY), said the odds of any cash flowing down to unsecured creditors is very slim in this case. “As an unsecured creditor, they won’t see much recovery,” he said. “Your best chance is to look at liens in their state to try and collect on their claim.”

Some of the best actions that creditors can take to protect themselves is actually done before a debtor ever files bankruptcy. Credit analysts may have been able to see the red flags months ago if they were running credit reports on an ongoing basis.

A mechanic’s lien also should have been filed ahead of time, said Chris Ring, of NACM Secured Transaction Services. “Now that the Chapter 11 bankruptcy is filed, some statutes will bar you from filing a mechanic’s lien at this point,” he said. “If credit managers didn’t do the preemptive things first, now that the bankruptcy is filed, they may be facing a pretty bad write-off.”

If you have a profitable project, it’s possible whoever buys Katerra may want to continue, which would increase your chances of repayment. However, it would “take creative thought on the side of the project owners to make that happen,” Behlmann added. Some project owners reportedly have taken over their projects, presumably utilizing the termination provisions in their prime contracts to remove Katerra as construction manager and (perhaps more importantly from a subcontractor’s standpoint) directly assume agreements with subcontractors.

Katerra said it would try to “maximize value for its stakeholders.” The company has secured commitments for $35 million in debtor-in-possession (DIP) financing from SB Investment Advisers (UK) Limited, another SoftBank affiliate, to fund operations during the Chapter 11 process, according to the statement.

Registrants of NACM’s 2021 Credit Congress & Expo Virtual Plus event can still view Jason Torf, Esq., Ice Miller LLP’s session, Tips to Assess a Bankruptcy Case, until June 30.

During NACM’s Credit Congress Virtual Plus this week, Chris Kuehl, Ph.D., NACM economist, discussed the pandemic’s effect on the U.S. economy and what to expect as the country resumes normal business behavior.

Kuehl outlined five economic issues that may play a large role in how the economy recovers:

- Inflation

- Consumer behavior

- Business normalcy

- Global economy

- Market reaction

The U.S. inflation rate through the end of May spiked to 5%, up from the typical rates of 2% and 3%. Inflation can reduce economic growth long term due to a potential rise in costs and interest rates. However, Kuehl links this spike to the recent surge within the commodity market, stating “core rates are still below 2%.” Core inflation rates exclude the price of food and energy services due to their unstable nature.

“Demand was spiking when supply was limited,” Kuehl said. This came with a sharp increase in prices, which may deter consumers from spending. Although a high demand for commodities remains strong, Kuehl indicated that demand is starting to fade and the economy must rely on consumers to maintain a strong rebound.

“It all comes down to consumer behavior,” Kuehl said. He explained how the nationwide shutdown resulted in consumers being more likely to save. According to Kuehl, a normal savings rate for U.S. consumers generally hovers around 4% or 5%. Last year, it peaked at 24%.

As every day patterns return to normal, the expectation is that business behavior will follow the same trend. But that has not been the case so far as many people continue to work remotely, or not work at all. Kuehl expressed how government aid programs may have perpetuated that trend, which has extended into the credit industry.

“The biggest problem [with unemployment] is skills,” Kuehl said. “It’s hard to train credit people too because a lot of their decisions are based on experience.” He continues to say how it can take up to three years to train newly hired credit professionals who lack this experience and education.

As working from home continues, the construction industry has endured a large shift of its own. Commercial projects are down and residential projects are up, Kuehl said. “We’re seeing a radical change in the supply chain.” This results in struggles to acquire materials.

Aside from any struggles to adapt, the Federal Reserve has conveyed a promising economic outlook for GDP. Kuehl reports that the fed originally projected a 4.5% growth in GDP at the beginning of the year, but that projection has quickly risen to 6.5%.

Additionally, NACM’s Credit Manager Index (CMI) indicates more confidence of what’s to come for future business cycles for credit professionals. For the month of May, the CMI’s combined index is 59.8, after dipping as low as 40.6 in April 2020—a contraction that mirrored the drop during the 2008 recession.

However, this time around industrial production has bounced back much more efficiently, Kuehl said. “Projections have us past where we were, compared to the 2008 recession, and we’re now recovering much more rapidly.”

Registrants of NACM’s 2021 Credit Congress & Expo Virtual Plus event can still view Kuehl’s entire session, Where Do We Go from Here?, as well as more than a dozen others until June 30.

|

Upcoming Webinars |

|

June 15 |

Blockchain Technology & Decentralized Finance

Speakers: Anjon Roy and David Wasson, SIMBA Chain |

| NACM and FCIB Present Author Chat: Leadership Reflections: 52 Leadership Practices in the Age of Worry Author: Dr. Lisa M. Aldisert |

June 17 |

|

June 17 |

Regulatory Compliance 101: What is regulatory compliance and why is it important? Speaker: Chris Doxey, CAPP, CCSA, CICA, CPC, Doxey Inc. |