By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Test for Gig Economy—

The future of the "gig economy" may be determined by the battle being waged in California over how to classify those who are engaged in activities such as ride sharing, delivery services and the like. The companies such as Uber, Lyft, DoorDash and many others rely on people serving as independent contractors as opposed to employees. The proposed legislation in California would change that so people working for these companies would be considered employees and entitled to minimum wage, vacations and other benefits. This would instantly change the nature of the service and would result in much higher fees for users. It has been estimated that roughly a third of those who now use ride sharing would no longer choose that option due to the added cost.

Trade Policy

There has been much criticism of the Trump trade policy and its free use of tariffs and other restrictions. These have been blamed for much of the global slowdown, but if there is a hope that these policies would be changed under a different president the statements from many of the current contenders are not encouraging. The position taken by Elizabeth Warren, Bernie Sanders and others is that the U.S. should not import from nations that do not observe strict labor standards, strict environmental standards and which are not taking steps to deal with climate change. If these were upheld as outlined by Warren, the U.S. would restrict roughly 80% of all imports coming to the U.S.

GDP Numbers Down but Not as Much as Feared

The expectation had been that GDP growth in the third quarter would be quite miserable—as low as 1.6%. The data that has been released thus far shows there was a decline, but not as steep as had been feared. The growth in Q3 was 1.9%—somewhat respectable. The sense is that growth in 2020 will average around 2%. These latest numbers suggest that assessment remains accurate. The consumer is still driving growth, which is a good sign at this time of year.

Short Items of Interest—Global Economy

Future of Islamic Terror

As more and more details emerge regarding the death of the ISIS leader al-Baghdadi, there is increased concern regarding the future threat. It appears much of the intelligence that led to the attack came from two sources—the Kurds and breakaway factions of ISIS. The U.S. troops would not have known where to find him without this. The factions breaking away from ISIS are even more dangerous to western interests than was ISIS under Baghdadi as they want to return to classic terror attacks as opposed to taking land. The Kurds are no longer interested in helping the U.S. and have cut off all further intelligence assistance. The expectation is that more attacks on the western states are in the offing.

Global Concern Regarding 'Peak Car'

The automotive sector is paramount in the majority of the developed nations. It is the most important sector in the U.S., Germany, Japan, South Korea and several others. In all of these nations, the sector has been in decline. The simple fact is the industry has reached saturation at the same time that costs are rising. The biggest emerging threat is the attitude of the global Millennial who has not been as enthusiastic about their cars as those in the Boomer or Gen-X cohort. They buy fewer and they like them smaller. The recession in Germany has been attributed to the slowdown in the auto sector.

French Resilience

While Germany staggers and much of Europe remains mired in slow growth, the French economy is staging a comeback with an unexpected growth rate of 0.3% in the third quarter. Granted this is still pretty anemic, but it is bucking a trend. The other states in the EU are slowing—so is the U.S., China and Japan, but France is growing. The strength seems to be in the consumer and their willingness to spend.

Back to the Ballot Box in the U.K.

The British are going to be facing another election in the next few months as the decision on Brexit has been pushed off until January of next year. The threat to tumble out of the EU has been temporarily averted as the EU agreed to extend the deadline and Parliament prohibited the actions Prime Minister Boris Johnson wanted to undertake. Now there will essentially be another referendum on Brexit as this will be the sole issue in the coming election. The decision by the Labor Party to support the election was the key to calling a new vote.

Analysis: The polls suggest voters are not in a very positive frame of mind. Neither Boris Johnson or Jeremy Corbyn are popular with the majority of the voters. Most of those who have responded to the polls indicate they will be voting on a Brexit policy rather than for either of these candidates. It will now be up to Labor and the Tories to articulate just what that policy will be.

The reality is the EU will continue to have final say over what the British do as far as withdrawal. It is not likely that Britain will change its mind and want to stay in the EU and even less likely the EU would take them back. There are some positions the EU will not budge on. One of them is the status of Northern Ireland. The EU will not accept a situation where Ireland becomes a back door to the EU, while the U.K. doesn't want a hard border between the Irelands. That has been a major sticking point and will remain one. There are dozens of other issues involving trade, residency, immigration, rules and regulations and overall obligations. None of these can be worked out until there is a government in place in the U.K. with a new mandate.

The sense at this point is the election will not provide that clear mandate. The polls suggest a very deep split in the voting population. It is one that is likely to yield a divided Parliament with no clear path to a Brexit plan. Pundits have suggested both parties should jettison their current leaders and find people more popular with the public, but both Johnson and Corbyn play to their hardcore base. That has been enough to keep them in place even as they continue to fall in popularity with the bulk of the British voting public. The one development that could shake things up would be the emergence of the Social Democrats as king maker in a divided parliament.

Labor Shortage Elsewhere

The complaints from the U.S. business community have been coming for years. The lack of skilled workers has been the No. 1 issue for manufacturing, construction, transportation, health care and many other sectors. The worker shortage has been acute in many parts of the country and is the single-most relevant factor for business expansion. For years, there has been an assertion that other nations in Europe, Japan and elsewhere had a far better handle on the issue. Their educational system has been praised as far more attuned to the needs of the business community than the system in the U.S. Now, it has become obvious that every other nation is facing the same crisis—there are not enough skilled workers in Europe and Japan or anywhere else for that matter. In the U.S., the rate of unemployment is very low. Some of the shortage has been attributed to the limited numbers of people available to work, but a rate of 3.5% is not the whole story. There is also the fact that close to 40% of the eligible population is not in the workforce.

Analysis: There is a common root as far as labor shortages are concerned. The same issue affects the U.S. as affects Europe, Asia and everywhere else. There is not enough money devoted to the training and education of the population. It really is as simple as that. The Europeans once had a distinct advantage over the U.S. in terms of worker training, but several years of economic distress led to drastic cuts in the funding of these trade schools and vocational programs. The lack of funding support in the U.S. has been a chronic problem that has become steadily worse.

Unfortunately, governments can cut education far more easily than almost anything else. In every nation and in every state, province or district, it is the education system that ranks as the largest budget category that is not mandated. In any given budget at almost any level, the majority of the spending is nondiscretionary. There are pension obligations, interest on debt, matching expenditures and the like. On average, the discretionary part of a budget is around 20% to 30% and education falls into that category. When there is a budget crisis, the education system takes a big hit. The trade schools are hit the hardest as they can't avoid the costs involved with their curricula. Training someone on the wrong or antiquated technology is not acceptable. The reduced budgets for education have thrown the burden on tuition as a means to finance schools. That means on to the backs of the students as they have to take out more and more loans to complete their training. In the end, the business community is hampered by that lack of talent to hire and the economy experiences reduced growth.

Unfortunately—There Is Always the Need to Pay for Things

The 2020 election will hinge on a variety of factors, but it is a safe bet that health care will be close to the top of the list. The idea of "Medicare for All" has been a key part of the campaign for most of the Democrats and figures high on the list of priorities for most voters. It doesn't take long to point out the gaps which exist in the current health care system. Very few people have expressed much satisfaction with how it works in the U.S. The problem is changing the system to some form of single-payer system will be very expensive—estimates from a variety of researchers (both for and against the notion of Medicare for All)—assert the cost to the government would be around $3 trillion—about what the government brings in annually now. Obviously, there will be a rather large need for additional revenue. Where would this come from?

Analysis: A group called the Committee for a Responsible Federal Budget has assessed some of the options suggested by the candidates. The group is nonpartisan and is led by a Board which includes people like Mitch Daniels, Leon Panetta, Erskine Bowles, Dan Crippen, Vic Fazio and others. One suggestion has been a tax of 2% on the very wealthiest (those making $408,000 a year), but that would fall way short—even a 100% tax on that population would miss the target by over $2 trillion. There has been a suggestion that a national sales tax would provide the needed revenue, but that tax would need to be 47%. Not only would that destroy the consumer economy, but sales taxes are regressive and would severely impact lower income people. There has been a suggestion that payroll taxes rise to 32%. This would be split between the employee and employer. It would significantly impact the employee and would discourage the business from hiring additional people. There has been a plan to impose a 25% income tax surcharge which is essentially raising the income tax by 25% on top of what is already being paid. Another idea would be to divert 80% of the current federal budget to health care. That leaves next to nothing for everything else. Given that the government would still have obligations, such as Social Security, interest on the debt and the military, there isn't much left.

It is important to note that a single-payer or government-run system would also mean savings for the average consumer. Given all the variables involved, it is near impossible to compute an average cost of insurance, but very rough figures put it at around $10,000. It has been reported by the Health Affairs Journal that collectively the U.S. consumer pays around $3.4 trillion. One way or the other the consumer would pay—either directly or as a taxpayer.

Housing Market Still Has Life in It

There have been some signs of a slowdown in the housing market of late—both in the new home category and in the existing home arena. These indicators have not been enough to suggest a real extended slump as there have been factors that continue to drive progress. The major motivator continues to be the low mortgage rates even though they have increased a bit from where they were in past months. The average price of a home has also increased. That served to dampen demand a bit, but it also benefited the sellers of existing homes. There has been an increase of 3.2%. The rate of home ownership has improved slightly, but still remains below the level over the long run. The rate now is 64.8%. The long-term trend has been 65.2%.

Analysis: There has been real concern that housing was starting to tank. This would slow the economy enough to invite some fears of recession. The low mortgage rates have served to stall that development for now. That would be one positive coming from the lower interest rate policy of the Fed as well as the performance of the bond market. Mortgage rates are tied more closely to those long-term bond yields than the Federal Funds Rate. The demand for homes has been improving as Millennials have finally started to take an interest in home ownership. They remain burdened by debt, but at least there is now some desire to move out of the loft.

What Next for the Fed?

The odds are that the Fed will drop rates again today—down to 1.75%. It is also likely there will be at least two dissenters again as there has been no indication that either Esther George or Eric Rosengren have changed their minds on where rates should be. The impact of this cut has been debated intensely and few expect any dramatic reaction. The real issue is what the Fed does next.

Analysis: The concerns raised by the Fed hawks will remain and presumably will carry more weight going forward. It is not really a matter of inflation control at this point; there have been few signs of that threat as yet. In fact, these low rates have been distorting the overall market and economy. Small banks struggle to get and keep depositors with no interest to offer on that savings. People who want to save in general are not finding many options. There are also concerns about the availability of cheap money and the high-risk behavior it provokes among some investors. Then there is the fact the Fed now lacks much ammunition in the event of another recession. The motivation for the rate cuts has been the poor performance of the global economy and the fear this slowdown will envelope the U.S. at some point. The cuts have been described as "insurance" on more than one occasion by the Fed. Now the question is whether more of that insurance will be needed in the future.

Halloween Stress

I am essentially a big kid—just ask my long-suffering wife. I tend to sport the maturity of a 12-year-old. One manifestation of this has been my attachment to Halloween. Each year, I drag out the various accoutrement of the occasion—pirate skeleton, animated witches, werewolves and specters of all kinds. There are ground zombies as well as a zombie cat, dog and squirrel. All of this goes up in one day and is down the next—my wife has better taste and only tolerates this stuff on a temporary basis. We prepared little bags of treats for the oncoming hordes that contain candy and seasonal toys like vampire teeth, mini coloring books, pirate booty, etc. We get around 200 of the trick or treaters every year.

This year has been stressful in the extreme as there have been predictions of the snow of the century all week. At one point, it was warned that Kansas City would get 36 feet of snow, 10 feet of ice, winds at over 128 miles per hour and a plague of locusts—all on Halloween night. That was later revised to maybe an inch or two the day before Halloween and I breathed a sigh of relief. I am still likely to be dealing with snow, but at least I am not contemplating what to do with 200 bags of candy. The yard will take on its ghoulish best tomorrow and I will get my chance to terrify a whole new collection of costumed invaders. I predict the most popular outfit will be a Yeti—warm and it will fit in with the snow!

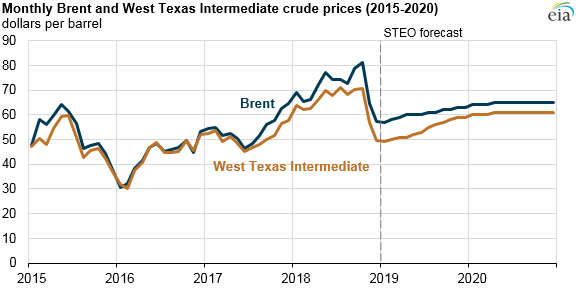

Monthly Brent and West Texas Intermediate Crude Prices

The oil price forecast for 2020 looks pretty benign. That is something of a surprise given the events of the last few weeks. The attack on Saudi Arabia barely moved the needle as far as prices are concerned. That would not have been the case even a few years ago. The driver now is demand. This has been slipping for the majority of the year. The expectation is that 2020 will bring another year of slow global growth and, therefore, continued reduced demand for oil. That translates into prices under $70 for the foreseeable future.