Short Items of Interest—U.S. Economy

Economic Indicators Flashing Yellow

Of course there are a wide variety of indicators to choose from and no two economists will look at exactly the same ones, but some of the more widely used indicators are not as robust as they were even a few months ago. There has been talk of a recession in 2019 or 2020 depending on what the Fed decides it wants to do about inflation. Even without an actual decline to sub-zero numbers, there will be a reduction in growth sufficient to affect the economy. Housing markets are down and now we have the fact that GM is laying off a bunch of people. It has been a while since big layoffs, but more of these are expected through the end of the year and into next. The holiday season is not going to be strong enough to rescue all the retailers that have been under strain.

Fed Likely to Be Less Predictable

Do not expect a firm commitment to future rate hikes when the Fed meets in the next few weeks. It is clear enough that rates will come up another quarter point this month as this has been essentially promised for many months. The action taken in 2019 has been referenced, but nothing has been set in stone. There are factors that will start playing a bigger role. The first is the behavior of the dollar. It has been gaining strength for the last two years. That has had a major impact on exports and imports. The Fed will also be paying close attention to the signs of slowdown as they will not want to accelerate that process. There remains a consensus opinion that rates will go up another two times in 2019 at least and four more is not out of the question.

Government Interference

It has been a mantra of the GOP for years that government should stay out of the affairs of business. This has been the primary objection to the demands made for regulation. In truth, there will always be a role for government in establishing the rules of business, but the GOP is no longer the champion of hands-off behavior under Trump. There have been dozens of attempts to force or cajole the business community to take a stance of some kind or another. The latest has been attacking and threatening GM over its decision to shut plants. The steel and aluminum tariffs would be another example. It seems that messing in the affairs of the business community is tempting to both sides of the aisle.

Short Items of Interest—Global Economy

Confrontation in the Black Sea

Several years ago, Russia essentially seized control of the Crimean Peninsula from Ukraine, an action that spawned a whole series of other assaults and attempted land grabs. The protests against the Russian move were feeble at first and have intensified as more territory was seized, but the Crimea is still an issue. The Russian seizure of Ukrainian ships has been a thinly disguised attempt to cut off shipping lanes for Ukraine. This will likely escalate as Russia prepares for the G-20 meetings. Ukraine has tried to rekindle opposition to Russian moves, but these pleas have fallen on deaf ears.

Mexico's Trump?

In certain circles, the new president of Mexico is being referred to as Juan Trump. He already has the nickname of AMLO, but Andrés Manuel López Obrador has quite a lot in common with his neighbor to the north. Both are populists and nationalists and both tend to ignore the traditional power bases in their nations. The conflicts will be emotional as neither man will be able to stray far from the base that put them in power. This will make progress on the border very hard indeed.

No Progress as Far as Brexit in U.K. Is Concerned

There has been no progress as far as getting the Tory Party to support the plan that was worked out by Prime Minister Theresa May. The sense is the government is headed for a no confidence vote that will knock her from power.

European Reaction to Climate Change Debate

The European Union (EU) is not nearly as skeptical of the issue as has been the case with many in the U.S. There are few politicians from the left or the right who take the position that the issue is not real. There remain significant differences as to causation and especially regarding what is to be done. For the most part, the issue has been separated into three parts. The first is whether there has been climate change at all. Only the most hard-line die-hards assert there has been no impact on the climate. The second concerns causation. There is more legitimate debate here although most recognize human activity has contributed to the problem—along with more natural cycles. The third part of the debate is the most controversial of all as this concerns what is to be done. The dominant schools of thought can be separated into prevention and amelioration. In most situations, there will have to be some of both. There will be efforts to reduce the production of greenhouse gases, but there will also have to be plans to address the impact of climate change through technology and cultural adjustment.

Analysis: Until the recent U.S. government report, there had not been much serious attention focused on how much all of this could cost, but the Europeans have been much further down that road. The costs are also separated into two categories. There is the cost of addressing climate change threats seriously and the costs of doing little or nothing. The U.S. report focused mostly on the latter issue and pointed out that damage to the environment will cost billions and peel as much as a point off overall economic growth. A recent EU report focused on how much it will cost to address the problem so that it doesn't get any worse or actually improve.

The estimate from the EU is that complying with the requirements of the Paris Accord will cost close to $330 billion a year, and for many years in a row. No matter how one looks at this expenditure, there is no way the EU could afford this. The budget for the whole of the EU in a year is about $163 billion. Granted the EU budget amounts to about 1% of the wealth of the EU member states, but there are wide differences between what the various members can afford. The bulk of the spending to deal with climate change would obviously have to come from the budgets of the countries themselves. There are few that have any significant amount of budgetary wiggle room to afford this kind of investment.

The dilemma is that acting on climate change will be very expensive. Not acting will be equally expensive. There will be money to be made by certain companies in either scenario. If steps are not taken to deal with the impact, there will be those that benefit from all the reconstruction and repair that will take place after storms and other disasters. Farmers in the southern parts of the world will lose and those in the north will gain. If steps are taken to deal with the challenge, there will many companies involved in the effort that will make money. It comes down to whether one wants controlled spending directed at a solution, or chaotic spending that is reactive and dependent on where the damage impact might be.

The Great GM Debate

It seems everything that takes place in the U.S. auto industry can become front-page news. The political response is always swift and the impact on bigger economic issues is significant. There is little doubt this sector is crucial to the U.S. manufacturing community as the big carmakers are really car assemblers that take parts from smaller companies all over the world. In past years, the automotive sector has leveraged its influence to receive massive bailouts funded by taxpayer's dollars. The anger that was directed at the banks that got money from the TARP program was never extended to the automotive giants that also got their share of that rescue. At the same time, decisions are made that compromise the ability of the domestic auto industry to thrive. The latest move to protect the steel industry with tariffs on imported metal has meant billions in extra costs for the sector. (Ford already computed the extra cost to be over $1 billion). General Motors has just announced plans to shut down several of its operations and eliminate several brands in addition to a layoff of thousands of workers. This has triggered howls of outrage from the local communities and from President Trump. Thus far, the threats of retaliation appear to be all rhetoric and little action. That could change as President Trump is now on the spot to deliver on promises made to those who work in these plants. Realistically, there is not much that can be done other than complain about the decision.

Analysis: The reality is GM is reacting to market conditions in the only way a responsible company can. If the decision was reversed at this stage and the plants continued to produce vehicles that few want to purchase, it would only be a matter of time before GM would be back with hat in hand asking for another taxpayer bailout. This time it would be based on the assertion that politicians forced the company to make decisions that were clearly not in the best interests of the company.

The most important factor involved in this decision is the preference of the consumer. The plain and simple fact is most car buyers are simply not attracted to the small cars these factories produce. The surge in small car popularity was driven by only one factor: the price of gas. As these prices soared past $3 a gallon and seemed headed for $5 or even $6, the drivers had to find ways to reduce that strain on their budget. Then, the price of a barrel of crude oil collapsed and has struggled to move back up. There is not much pressure even as oil prices have risen by some 30% since the start of the year. The bottom line is that motorists no longer fear high fuel prices and are indulging a desire to own a large vehicle such as an SUV, truck or large sedan. The small cars are accumulating in dealers' lots and outside the factories. There is no point in making a product that people do not want to buy.

If there was a real desire to shift people's attention away from the large vehicle, the means to do so is readily available. It is simply a matter of making it more expensive to drive. Add in extensive gas taxes and one would presumably kill two birds with one stone. The price at the pump would shoot up to that $5 or $6 level immediately and make operating a gas guzzling machine very impractical. At the same time, there would be far larger budgets available for everything from highway repair and bridge work to subsidizing new technologies such as electric cars. To note that this decision would be immensely unpopular would be the understatement of the century. It is highly unlikely any politician will ever suggest anything more than a few cents in increased revenue—far too little to get people to change their preferences.

There has also been pressure on GM to make fewer cars in China. This may have political importance, but the economic impact is not helpful. This is now GM's largest market. There are more people employed by GM in China than in the U.S. To some this is a problem, but for the company, it is economic survival. Over the years, GM has steadily lost market share in the U.S. Its survival as a company has relied on its ability to make money in other places such as China. The production there has little to do with production in the U.S. as there is no export of cars from China to the U.S. (some parts are sold to the U.S. however). In China, GM is a domestic producer competing with Chinese companies and other foreign automakers.

GM Decision Adds to Nervousness

There have been more signs of an impending slowdown in the last several months. GM's decision to close operations and lay off some 15,000 people is just the latest. The housing sector has been slumping through the majority of the year. There have been signs of consumer confidence erosion as well. The latest data from the Purchasing Managers' Index was weaker than it had been the previous months and so on. This is not signaling an imminent recession at this point, but it seems to suggest the boom that has been in evidence has started to fade.

Analysis: The sense is that this has been a longer than normal recovery. It was also a slower-paced recovery, which would seem to have allowed it some longevity. There are several schools of thought as far as the economic slowdown. Some see this as a precursor to a real recession towards the end of 2019. Some simply see this as the expected impact of expiring stimulus efforts. The tax cuts have done their job and the Fed has been hiking rates so the artificial boosts are no longer in place. That allows the economy to settle into a more natural pattern—not in recession, but not growing all that robustly either. Others are pointing to decisions that affect economic growth as the government has interfered in business decision-making more than usual with the imposition of tariffs, trade restrictions and direct calls for opposition to a variety of business strategies. One can add factors such as labor shortages, a strong dollar that restricts exports and even the anticipation of total political gridlock.

Immigration Decline Predates Trump

The emotional debate over illegal immigration has dominated much of the U.S. political scene for the last few years. This has been building in intensity despite the fact the numbers of illegal migrants into the U.S. have fallen dramatically. This decline started far before the Trump administration added more restrictions and talked of the border wall. The reason for the reduction in illegal migration has been simple, but is hard to organize or orchestrate. It has little to do with border enforcement or the kinds of threats that have been issued the last few years. It has been economically motivated. This is an important point to note as it will be economics that feeds future movements of people.

Analysis: The short answer to the reduced number of migrants into the U.S. has been lack of employment opportunity. Contrary to myth, the majority of those are coming across illegally know where they want to go and why. They know there will be jobs offered in the places they strive to get to. When the U.S. economy was stuttering and growth was hampered, there were fewer job opportunities available for the migrants and they elected to stay home. It helped that during this period there was better than average growth in Mexico and people were able to find jobs at home rather than risk the cross into the U.S. The conclusion to reach is that good economic growth in Mexico and a slump in the U.S. will reduce the number of migrants—legal and illegal. The migrants coming from Central America are also economically motivated, although many are also fleeing political violence.

It's the Little Things

To be honest, the majority of the time I encounter stuff that works as promised. It should be a point of wonder that with millions of planes in the air at any given moment, the majority are getting where they are supposed to go and safely. We see over 3,000 deaths from car accidents every day, but plane crashes almost never occur. We turn on the light switch and the power is there. Our homes have heat and running water; we are surrounded by conveniences. The wonder is that all of this stuff works the vast majority of the time. That said, we still tend to obsess over that which doesn't. Here is where sweating the small stuff comes in.

I have noted before (as have many others) that detail matters. The Navy Seals start their daily mission with the admonition to make their bed. If one does not have control over the small stuff, the larger stuff will be an even bigger problem. Inevitably there are breakdowns in technology and process. That is when the human element has to come into play. Yes, it is another airport story. It has been a couple of days since the storms, but the system is still struggling. On one side was Southwest and the other side of the space was United. Both were dealing with delays. The United folks were losing patience by the second and started snarling and yelling at the passengers who were snarling and yelling right back. It looked like a riot was about to start. The Southwest side had just as many unhappy passengers, but right in the middle of the process, a grounded flight attendant who had purchased a big bag of chocolate bars was handing them out to the people waiting. Tension vanished and was replaced with smiles and a thank you.

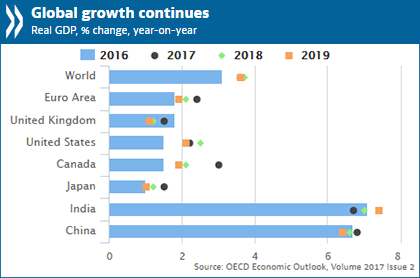

Global Growth Continues

The chart below is from the Organization for Economic Cooperation and Development (OECD). It is basically pretty upbeat about the prospects for global growth in the coming year. As a whole, the growth the world has seen this year will be repeated next year, but some regions will end up behind where they are right now and others may advance a little. The biggest decline will likely be in China as they will fall below levels seen in 2016, 2017 and 2018. India, on the other hand, will be growing faster than they had been. Japan is in retreat and so are Canada, the U.S. and the Euro area. The U.K. is also reversing course. So, if all these regions are losing and yet the world economy is still holding its own, what accounts for this? The simple answer is India looks to be the global growth engine for 2019.