By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Can the Fed React to a Recession Threat?

One of the consistent concerns expressed over the historically low interest rates is they have fallen so far that the Fed no longer has the tools it needs to deal with a recession should one appear. The traditional means by which the Fed reacts is through pushing rates low enough to bolster some expansion, but to employ that strategy, the rates have to be high enough to create some reluctance to lend and borrow. It is the assertion of some at the Fed that rates are already too low and the Fed has too little ammunition; but others insist the Fed can still impact the downturn with asset purchases and solid communication.

PMI Still Shows Weakness

As expected, the latest version of the Purchasing Managers' Index (PMI) trended in a negative direction for the fifth month in a row. The PMI is a reliable gauge of factory activity in the U.S. It has been in contraction territory for five consecutive months with the latest reading falling from 48.1 to 47.2. There are many factors that play a role in the performance of the U.S. manufacturing sector so it is always hard to isolate one or two that would determine the direction of the PMI. Over the last few months, it has been pretty obvious the slowdown in the global economy has been the primary reason the U.S. sector has been affected. The majority of the damage noted by the PMI has been in sectors that are most sensitive to export activity. The various trade wars and tariff battles have been taking their toll and it isn't clear whether the agreement signed with China will alter that situation in the short term.

EU Relationship with U.S. Expected to Get Worse

There are many analysts suggesting the issues between the U.S. and Europe will dominate 2020. The U.S. and China are not done with their trade war by any stretch, but there has been a truce of sorts which may take the edge off for a while. Meanwhile, the confrontation with Europe looks set to take center stage. There is the U.S. support for the U.K. in the Brexit process, arguments over the auto sector, farm imports and regulations and now a very profound break as far as dealing with the Middle East. What was left of the nuclear deal with Iran has been shattered. Europe now has to worry about what to do about Iran and nuclear weapons going forward.

Short Items of Interest—Global Economy

Services Rescuing Eurozone Numbers

The latest numbers for the Eurozone PMI are down in the manufacturing sector—certainly no shock to anyone. The service sector has been surging ahead, which has been a bit of a surprise. The service readings are at a four-month high as the European consumer has been more active than expected. The news may be a bit short lived if there is no turnaround in manufacturing, but the good news is Millennial buyers in Europe are much like their U.S. counterparts with their orientation towards spending more on services and less on things.

Gold Jumps as Tensions Mount

The sure sign that investors are worried about the situation emerging in the Middle East is that gold prices are hitting a seven-year high. The desire for a safe haven has been driving the popularity of gold as well as the Japanese yen and the Swiss franc. This may be the most damaging aspect of the evolving war with Iran—markets that are already nervous getting ever more cautious and reluctant to respond to any sort of stimulus.

British PMI Stabilizes

The fact that Prime Minister Boris Johnson won a decisive victory in the last election means the conversation regarding Brexit is essentially finished in the U.K. It hardly means that a deal with the EU is imminent, but at least the U.K. knows what it is pursuing. The service PMI for Britain rebounded nicely with this news as consumers now start to adapt to the new realities. It is not going to be an easy process and growth will suffer, but there may be more stability.

Sorting Out the Middle East Aftermath

This is not a situation that is going to resolve neatly or quickly. The confrontation has been building in intensity for years and has been getting more intense by the day. The U.S. and Iran are enemies in every sense of the word. The Iranians back terror groups and insurgents that threaten the U.S. and allies such as Israel and Saudi Arabia. The two nations also battle over oil policy. Iran works to destabilize Iraq and allies with U.S. rivals. Iran is at odds with U.S.-supported regimes and, of course, there is the fundamental religious schism between Sunni and Shiite. The killing of Iran's top general certainly ratcheted up the tension, but his actions and strategies had already accomplished this. The question is what happens from here.

Analysis: Iran has promised retaliation, but their ability to do so is limited. The most likely targets will be local—attacks on Saudi Arabia or Israel. There will be attacks on U.S. positions (as has already happened in Kenya). There is the possibility of attacks on naval vessels, but there is no realistic capability to inflict serious damage. The U.S. has been doing much of the saber rattling that has upset the markets—threats to attack cultural sites as opposed to military installations sets Trump up to be accused of war crimes. Iraq's leaders have decided to expel foreign troops, which has led Trump to make more threats. At this point, there has been a great deal of chest thumping, but with every passing day without a major retaliatory move, there is a chance the situation will calm to a degree. The reality is neither the U.S. nor Iran wants to be engaged in a real war, but the slope has become extremely slippery in the last few days. An all-out confrontation is now a distinct possibility.

Market Reactions

The immediate reaction to the escalation of tensions in the Middle East has been more subdued than would have been expected. The usual barometer of concern is the price per barrel of oil. There was indeed a reaction in the oil markets, but not a particularly dramatic one. The price per barrel jumped by 2.1% and reached just over $70. This was about where oil landed a few weeks ago after the drone strike on the Saudi oil facilities. In years past, an event like this would easily have driven per barrel prices up by 10 to 20 dollars, but not now. The world is still not demanding that much oil and the U.S. is a far more important producer than was the case before.

Analysis: The expectation is oil prices will retreat in the coming days and weeks unless there is a series of attacks and counterattacks by the U.S. and Iran. The markets outside oil are nervous and uneasy, but seem to be taking a long view. If Trump follows through with his most aggressive threats, the confrontation will swiftly escalate to a real war. If the Iranians attempt a major retaliatory act against the U.S. or U.S. allies, the war will escalate. Right now, the fury on both sides is rhetorical and symbolic. The Iranian people want revenge on the U.S. and do not seem interested in an attack on either Israel or Saudi Arabia—either one of which would be easier for Iran to pull off. An attack on the U.S. would be much harder. It would either be some kind of naval confrontation which would not end well for Iran, or it would have to be a terrorist attack of some kind on a U.S. facility. That kind of attack would not likely be enough for the U.S. to engage in a massive retaliatory response, but Trump rarely plays by any set of rules and such a response is possible. That is what makes the markets most uncomfortable.

India Drifts Away from U.S. and the Western World in General

It has never been harder to pin down Prime Minister Narendra Modi. Over the last several years, the world has seen a wide variety of behaviors from the Indian PM. The only thing anybody can agree on is that he is a consummate politician with the ability to reinvent himself over and over again. There are those who assert his emergence as an ultra-nationalist is simply to shore up his political base, while others assert that he has always been that ultra-nationalist and isolationist and only seemed to transform into the pro-business leader when it suited him politically. The latest moves by his government have been clear enough. They have started to create real strains between India and the rest of the world as well as internally.

Analysis: Modi was considered an extremist at one point when he was governor of Gujarat. It was under his leadership that Hindu-Muslim riots exploded and resulted in the deaths of hundreds and the displacement of thousands. He became the leader of the overtly Hindu nationalist Bharatiya Janata Party and extolled the virtue of a national policy biased towards the Hindu, but as he set about to compete to be the nation's leader, his approach seemed to soften and he played the role of economic reformer and pro-business candidate. There were even overtures to the Pakistani leader at the time—Nawaz Sharif.

As his economic reforms have stalled and the nation has become disenchanted with his strategies, he has returned to his Hindu nationalist roots and the confrontations within India have become ever more intense. There have been more attacks on Muslims by Hindu gangs. Riots and demonstrations have been breaking out everywhere, but especially in areas where the two populations are living close to one another. The attacks have started to spread as Hindu extremists have been attacking secular institutions and those connected to Christianity as well.

At the same time, Modi has been abandoning his pro-business reforms when it comes to foreign trade. There had been a move towards open trade and lowering tariff barriers in the first few years of his government, but that policy seems to have been abandoned. Now the push has been to limit imports and promote exports aggressively. The U.S. has been threatening to impose restrictions in reaction to all this and the same threats have been coming from Europe and Japan. There has been a developing trade war with China as India has tried to take advantage of the restrictions placed on China.

More Chaos in Global Politics

Thus far, 2020 is starting with major explosions of political fireworks. The headlines have been preoccupied with the Middle East, but there have been several other dramatic events that will shape the year and we are just getting started as far as the U.S. elections are concerned. There has been a great deal of economic pressure globally over the past year. That seems to have contributed to the political explosions taking place now.

Analysis: The Maduro government in Venezuela has essentially staged an internal coup with the removal of Juan Guaido from his post as the head of the National Assembly. This had been the only elected body in the country and Guaido had claimed to be the legitimate leader of the country due to his position. Now that Maduro has ousted him and rigged the body to support an ally of Maduro, there is no alternate leadership left. The only way Maduro will be removed from office will be through violence and a coup. The U.S. has not shown a willingness to go that far and the neighboring nations lack the ability or the will to support such a coup.

The Turks are getting behind the interim government in Libya. That threatens to put them at odds with the Egyptians and others who back a rebel general that controls the eastern half of the country. This is the part of Libya that hosts the majority of their oil. Thus far, the confrontation between the government and the rebels has limited Libya's oil output to a fraction of what it once was. Libya has been a staging area for a variety of terror groups for years and this government chaos has only intensified this trend.

In the U.K., the confrontation is certainly not as violent and chaotic, but there are major issues for the British and Brexit. Now that it is clear the U.K. is going to leave the EU the debate starts up again. How will the separation be handled and what will come in its place? The EU has shown no desire to move from its original positions and the British have not altered their demands much either. The chances are a "hard exit" will take place at some point and the economic impact will be severe for both the British and the Europeans. There is a chance that issues surrounding Ireland and what to do with Northern Ireland will bring back "the troubles." There is also movement for Scottish independence again.

Back at It This Week

The break is over—at least for those who generate all that juicy data we economists look forward to every month. It may seem like we either just make things up or guess a lot, but the reality is we depend upon data and observation. The challenge is that the economy is a moving target with 330 million consumers, 157 million workers, hundreds of thousands of businesses and the actions of hundreds of nations with their own consumers and businesses. It takes a mammoth effort just to keep track of all this and an even greater challenge to make sense of it all. This week we get some of the more important and relevant reports.

Analysis: Tomorrow (Jan. 7) brings the latest trade data. It will likely show imports have been declining for another month. The U.S. consumer has been purchasing less from China, but there have been reduced purchases from other nations as well. The deficit shrank to $47.2 billion in October and will likely have reduced a little more in November. The question is how much the decline owes to the tariff and trade wars and how much to general slowdowns in the global economy. The retail season was healthy enough, but there was a pattern as far as spending was concerned—a focus on items that had been discounted to the exclusion of all else. That meant good revenue numbers and good traffic numbers for the retailers, but not very good profit numbers.

On Friday (Jan. 10), there will a jobs report released by the Labor Department. The expectation is positive. There was a larger than expected gain in last month's data and few expect another jump of over 200,000 jobs again. The hiring that takes place during the holiday season is generally followed by a series of layoffs as the new year begins, but this time, the numbers will likely be somewhat subdued as there was not a huge increase in retail jobs and transportation jobs as had been the case in past years. The sense is some 160,000 jobs will be added—certainly not a bad number. As has been the case for the last several years, the real issue in terms of employment has been the aging workforce and retiring Boomers.

Coping Mechanisms

This is shaping up to be a stressful year, but what else is new? It seems there are new reasons to get worried or upset every day. Maybe this is a sign of becoming an old fogey—everything seems to irritate or concern these days. Maybe it is due to an excess of information as it is harder and harder to escape the outrage. Maybe things really are far worse than they used to be. Whatever the reason, it is increasingly important to develop some level of escape if one is to hang on to any shred of sanity.

There is always an abundance of advice on coping from all corners. Since I am not one attracted to chanting or essential oils, I expect I will retreat to my old reliable means of contending with the chaos of the world around me—books, cats and family. At home, I have the perfect setup as I can snuggle down with some members of the cat tribe when it all gets to be too much. My charming and lovely wife provides me ample opportunity to look on the bright side. It might be with her singing or with one of her splendid meals or through her garden or just from a well-timed embrace. Once on the road, the challenge is greater. This is where books come in.

I will resume my old habit of having a volume with me at all times. When I need to cut loose from the travails, I can quickly bury myself in a book. I plan to return to my old patterns of reading whenever I am without some pressing duty that needs attention. My preferred means of mental protection are books on travel, history and science. Right at the moment, I have combined all three with a book that details the race between Ronald Amundsen and Robert Scott to reach the South Pole. Perfect winter reading.

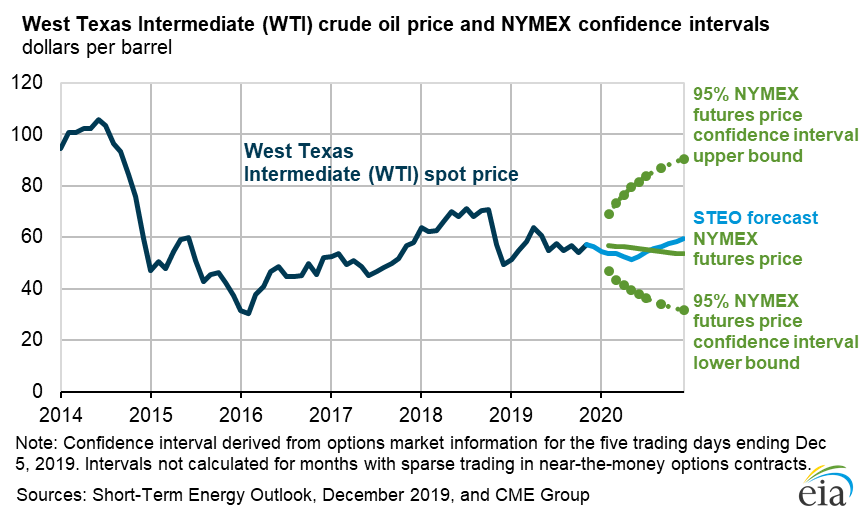

Crude Oil Prices

The price per barrel for crude oil has not been near $100 since 2014. Even the events of the last few days have been unable to alter that pattern. The projections for the price deviate strongly and there has been little consensus as to what the drama over Iran will mean in the short to medium term. Even the more pessimistic assessment has the prices remaining well under that $100 level for the duration of this year.