By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy

Fed Plans

This is the week the minutes from the December meeting of the FOMC are released, and this will provide an opportunity to learn what was on their mind at that session. The decision at the time was to leave the rates alone, and there was no dissent from the doves who had been advocating for a further reduction. The sense seems to be that the economy is doing well enough and that a rate reduction would have little impact at this point. The fears of the hawks will have been discussed, and that may dominate the conversation this year. Is inflation starting to be a concern with the recent rise in wages? Are commodity costs starting to climb as production is diminished?

Where is the Consumer's Head Now?

Later this week, the Conference Board will release its latest consumer confidence survey, and it will be examined closely. The report from the retail community was mixed in the post-holiday analysis. The sales numbers were better than they were expected to be, and it seemed that consumers remained pretty exuberant throughout. The concern stems from the fact consumers seemed to be interested in sales, and discounts exclusively, which translates into good revenue numbers but lower profits. There is an expectation of more retail bankruptcies in the next few weeks and months. The consumer no longer has the holiday to look forward to, and now the interest will start to shift towards issues like the election and perhaps inflation.

Recession Chances

The chances for a recession will dominate the conversation through the bulk of this year. The topic of most interest will be whether the old indicators of an impending recession are still all that accurate. For years, the two signals that mattered to investors were the status of the yield curve and the rate of employment. An inverted yield curve was a warning shot and so was a low rate of unemployment because that always meant an inflation surge based on higher wages. Today, the Philips Curve seems to be failing as rates are low, and there has been little wage inflation. The inversion of the Curve has not had much impact either. Right now, about 35% of economists polled think a recession is likely in 2020—twice the number that thought so last year, but still a minority.

Short Items of Interest—Global Economy

Turkish Engagement in Libya

To note that the Middle East is in turmoil is certainly nothing new—it has become a permanent situation. The latest provocation to capture the attention of the global community has been Turkey's interest in Libya. The Erdogan government in Turkey is backing the official government against a militia led by Khalifa Haftar of Libya. The current regime in Libya is backed by the UN but opposed by Saudi Arabia, Egypt and most of the Arab oil states. The U.S. has not been directly opposed to Libya's Fayez al-Sarraj, but President Donald Trump has not been a fan and has opposed the Turkish gestures. The U.S. is now going to have its hands full with Iran, and Turkey will exploit the opportunity.

Little Benefit to Canada from EU Deal

There was much enthusiasm from the Canadians when a pact was signed with the EU that promised extensive trade expansion. Two years down the road and there has been very little to show for it. The rules and regulations have been very hard to navigate and the other, less formal trade barriers have been hard to maneuver around. Many have suggested the Canadian deal would be a good model for the U.K. after Brexit, but it is painfully obvious that this deal has not been all that positive as far as Canada is concerned, and a deal with the U.K. would be even more questionable.

Refugee Crisis in Venezuela Still Festers

Other issues have chased Venezuela off the front pages of late. The attempt to get rid of President Nicolás Maduro has failed as the government has received support from Cuba, Russia and China, but the exodus of Venezuelans continues with millions now living in Colombia and Brazil as well as other state in the area. There is no money for these refugee camps and conditions have deteriorate to dangerous and deadly levels.

It Matters Why a Job Is Lost

There is a great deal of complexity involved when considering the job market. It matters whether people are employed, but it matters more that they are employed in a good job that pays well. Economists are interested in employment because employed people can consume and produce. It also matters when the issue is unemployment. How did people lose their job and what options do these unemployed people have? There are three broad categories as far as job loss is concerned. There are those that lose their jobs to layoffs that are related to temporary conditions. These are companies that reduce the workforce to react to slow business and in most cases these companies will staff up again when conditions improve. This is common in seasonal work such as construction, retail or outdoor services. The second broad category is job loss connected to reorganization. This can be due to a merger or acquisition or a decision to move operations to a different state or country. It can be in reaction to increased automation or even a change in what the company produces or offers. The good news is that the company is presumably growing and expanding due to these decisions and there will be more hiring later. The third category is the most problematic. These are layoffs due to the failure of the company. As the rate of bankruptcies has started to rise there have been more people laid off because the company they worked for has gone completely out of business or has been forced to radically scale back operations.

Analysis: In the last year there have been over 60,000 jobs lost to bankruptcy, and that is the highest level since 2005. The vast majority of these jobs have been in the retail sector as there have been waves of business failure at all levels of the retail trade. There have been many large chains that have been shut down—Payless ShoeSource, Forever 21, Gymboree, Barneys New York and so on. There have also been hundreds of smaller operations unable to compete and survive.

The culprit in all this is no surprise—internet competition. Those stores that have survived have not been doing all that well, and it is expected that another 72,000 jobs will be lost in the next few months as retailers tally up the impact of a holiday season that saw decent revenue numbers but very low profits due to all the sales and discounts. The most pressing issue when it comes to this kind of unemployment is that these are traditionally "starter" jobs, and these large bankruptcy actions have had an impact on the ability of people with somewhat limited skills to find that first job. There are also a great many part time workers in retail and their options are also dwindling.

C-Levels Prepare for a Slowdown

The mood in the corporate suite is best described as "cautious" at the moment. In surveys of C-level officers there has been an emerging theme—whether they are CFOs, CIOs, CEOs or COOs. The economy right now is in decent shape and many of the indicators are trending in a positive direction but this has not been enough to dispel concern in many sectors. There is a sense that emerging issues will be more pressing in the coming year—the impact of the trade wars, increased consumer stress, the prospect of an intensely divided election year, global growth slowdown and the sense that the current recovery is starting to run on fumes.

Analysis: The most common response thus far has been delay, and that has been showing up in a variety of measures. The level of capacity utilization has been falling consistently for the last several months and there has been less capital investment as companies are adopting a "wait and see" position. The threat is that this caution becomes something of a self-fulfilling prophecy. If the business community reduces investment out of a sense of caution there will be less growth, fewer hires and generally less activity and this quickly reverberates through the entire economy.

Crisis in Australia

The fire season has engulfed Australia to an unprecedented degree and summer has only just started in the country. The entire east coast of the country is essentially ablaze and the authorities have indicated that even with 10,000 additional fire fighters, they could not bring the blazes under control (and there is no indication the nation will get even a fraction of that number). The focus now has been on evacuation in the path of the massive fires—the bulk of the Australian navy has been deployed for that purpose.

Analysis: This has rapidly become a political crisis that will likely cost PM Scott Morrison his job in the not-distant future. He has been an ardent defender of the coal industry and has denied the impact of climate change until this last week. He elected to take a vacation in Hawaii as the fires were getting out of control, and when he has made an appearance in the last week or so, he has been booed and heckled to the point he has been forced to retreat to his car and flee. The anger in the fire affected zones has been palpable.

The challenge for the economy is that coal exports are one of the most important sources of national income. To reduce these exports would cost billions in tax revenue and lost jobs. The further complication is that Australia is not contributing much to the output of greenhouse gas—its coal is being shipped to China where almost 70% of its power is generated by coal fired plants. This compares to 30% in the U.S. The Australians are "enablers" to an extent, but it is not as if China will stop using coal if the Australians stop supplying it, they will simply buy it from somewhere else or use their own coal (poorer quality and more polluting).

Some Additional Data to Review in the New Year

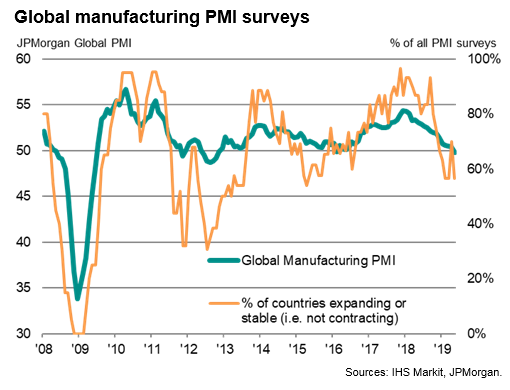

The holiday period means less economic data to look over—it seems that even the statistics wonks get a little break from the routine. Now that the holiday has come to an end the data is flowing again, and there will be quite a bit to look over this week. The highlights will be provided by the various editions of the purchasing managers' index (PMI). The Chinese version is expected to show a second straight month of improvement and that would seem to signal that there is more stability in their manufacturing community despite the impact of the trade war and tariffs. China has seen more domestic activity, and they have been selling more to their Asian neighbors. There will be many similar releases for the rest of the world, and the expectation is that the slump noted at the end of 2019 will continue for most nations. The U.S. is expected to see yet another month in contraction territory (numbers under 50), and the decline in the eurozone is expected to worsen as well. Last year the PMI for the top 20 U.S. export destinations was below 50 and in contraction territory for all but three of the nations surveyed and not one of these were in the top 10.

Analysis: The PMI is closely watched for a variety of reasons. In most cases, economic data is limited in one of two ways. It is the old adage that one can have data that is either accurate or timely but rarely both. It takes a while to collect data and by the time the collection process and analysis is complete the information can be stale. It takes several months before we know for sure what the quarterly GDP numbers are.

Surveys are used to get the most current information regarding the economy, but this has limits based on how accurate the surveys are. It is not uncommon for people to lie when responding to a survey—they either want to disguise the reality of their situation, or they are compelled to give an answer they think the questioner wants to hear. There are also those that simply don't know enough to answer a question accurately. The purchasing manager has a specific job and one that puts them at the center of business activity. They are not the ones that are deciding what to buy or why. They are executing the directives of others in the organization and thus their information is not biased by their personal observations or opinions. It is what it is. Buying more will suggest expansion and growth and buying less will signal decline.

It was only a year ago that PMI numbers for the U.S. were close to 60 and today these readings are in the high 40s. This is not yet catastrophic. If the decline was into the low 40s and upper 30s, the concern would be far more intense, but this is not the trend that anybody wants to see. It is especially worrisome that most of the rest of the world is looking at numbers that are even lower than those in the U.S. right now.

The U.S. Assassination of Iranian General: Two Likely Outcomes

There has been a major escalation of the conflict between the U.S. and Iran and it is already reverberating through the entire region. The U.S. has carried out attacks on a wide variety of terrorist leaders over the past several years and many have been prominent. The common factor was these were all "unofficial" leaders—heads of terrorist organizations and therefore unconnected to any government directly. The targeting of an Iranian general and commander of Iranian-backed forces in the region is a major provocation and Iran is both stunned and extremely angry. Qassem Soleimani is a very high-ranking general in the Revolutionary Guard and they are already the most radical and anti-American element in Iran.

Analysis: There is no doubt that Soleimani has been active in attacking U.S. forces albeit indirectly as he has been coordinating the actions of the pro-Iranian militias but there had been a hesitance to go directly after him. It was only a few months ago that U.S. commanders were working with him and others in Iran to fight their mutual enemy—the ISIS combatants. Now that the U.S. has killed a top Iranian general and done so deliberately, the Iranians will retaliate and hard. This will mean an active response by the Iranian militia but it could be more than this as reports have been pouring in of increased naval activity and air force action. The UDS obviously has the ability to defend and counterattack, but there is the very distinct possibility the U.S. will be faced with two unpleasant options. There will either be a major return of U.S. troops to Iraq and the region, or the U.S. will have to retreat almost completely from the area to avoid Iranian actions. This move will empower the Iranians to a significant extent and that is not what the U.S. has desired in the past. Look for a very significant buildup of U.S. forces.

Resolutions

Of course I do this—don't we all? At least we think about it. This is the time of year that I get ambitious and think I can do things differently than in the past. This is the time of year that I don't travel and the time of year for fewer meetings and my brain starts to clear a little. I decide that I can adopt all kinds of useful habits as I feel rested and energetic. Even though I know that energy and enthusiasm will soon be sapped by the return of the routine, there is hope that springs eternal.

My resolutions tend to fall into three categories. The first is the "get organized" group. My goal is to spend less time panicked over a forgotten deadline and to avoid all the wasted time and effort that comes with failing to plan. Karen greets this resolution with deserve skepticism as I have made this pledge a few times before. The second category is personal health and well-being. I have resumed my exercise routine and have the sore muscles to prove it. The gluttony of the holidays is over, and I am striving to shed those new pounds. Finally, there is the "fun" category. I get too busy through the year and too often forget to kick back so this year there will be more attention paid to friends and family. More nice dinners at new places, more outings and just more using weekends to relax. We shall see—with any luck, these goals will survive the first month of the year.

Global Manufacturing PMI Surveys

This chart shows that global PMI numbers have been falling for the last several months and there is little reason to assume they will reverse course anytime soon. The number of countries that have been retreating has been expanding fast and the fall has been significant. This trend will continue and likely accelerate through the majority of 2020.