Short Items of Interest—U.S. Economy

Private Sector Job Gains?

The official Labor Department numbers do not come out until Friday of this week, but there has been a release from ADP, the payroll company. This report is generally seen as fairly accurate, but there have been times when the data did not match up well with the official numbers. The ADP report this month is stating that 129,000 new jobs were added. This is a long way from the anemic 20,000 gain officially reported last month, but it is also a long way from the 200,000 rate that had been more common over the last few years. The most significant detail in this data is that the majority of these jobs have been in the service sector, and at the low end of the pay scale at that. Thus far, there is not much evidence of wage inflation given the concentration of new jobs at the lower end of the pay scale.

More Trump Attacks on the Fed

Despite the fact the Fed has taken actions that go along with some of the comments President Trump has made in the past, there has been an increase in the attacks on Fed Chair Powell and the Fed as a whole. Trump states that the economic slowdown and the volatility in the markets have been attributable to Fed policy, but this interpretation has been rejected by most economic analysts save those who work for Trump. The Fed has not hiked rates to anything approaching an historical high point and has even cut back on its sales of assets. Short of lowering already low rates, there is not much else the Fed can do. On the other hand, the economy has definitely suffered from the incessant threat of escalating trade wars and tariffs. If there is a single dominant cause for the sluggish economy, it would have to be the trade policy.

Speaking of Tariff Impact

The latest study of the Trump trade and tariff policy demonstrates it is costing the U.S. significantly. There are indeed some sectors of the economy that have benefited from the tariffs (most notably steel), but these sectors have gained at the expense of others (such as manufacturing). The current set of trade talks between the U.S. and China are still at an impasse, but at least they have delayed the imposition of a 25% tariff on all imported goods from China. Such a tariff would cause the U.S. economy to lose as much as 0.6% of its GDP. Given that most analysts are suggesting growth this year will be between 2% and 2.5%, this kind of drop would take the U.S. economy to numbers between 1.5% and 1.9%. That is drifting closer to recession.

Short Items of Interest—Global Economy

Italy Urged to Do More for Growth

The deal that Italy worked out with the EU was predicated on growth numbers that Italy is unlikely to achieve. The warning sounded by the EU was pointed and attacked the populist coalition of the Northern League and the Five Star Movement as preoccupied with all the wrong issues. The prospects for growth are very limited. It is even likely Italy will be violating many of the covenants that came with the loans it received.

Erdogan and the AK Party Challenge the Election Results

The voters in Istanbul and Ankara rejected Erdogan's AK party. He is not taking this well. The first reaction has been to deny the elections were fair, but by all accounts, the only interference was from the AK party. The voters essentially ran out of patience with Erdogan as the economy has deteriorated. It would suggest that people are willing to overlook a lot as long as they feel the economy is healthy, but when there are economic issues, the incumbents are held responsible.

U.S.-China Talks Come Down to Enforcement Issues

The two sides have settled most of the outstanding issues, but there has not been agreement on how the new agreement should be enforced and who has the right to assert that it is not working.

The Role of Manufacturing in the World

Manufacturing's role in a given economy shouldn't be all that controversial, but it seems it is. The U.S. was convinced it was no longer a manufacturing nation a couple of decades ago. The Chinese and Indian economies geared up to be the manufacturer for the world, but both have questioned whether they really want to depend on that role. There have been some fundamental changes in the way manufacturing is conducted in the U.S., Europe and elsewhere in the world. It is not the jobs engine it once was—the U.S. alone lost 20 million manufacturing jobs between 1985 and 2000. Europe has seen a similar decline. The robot revolution brought manufacturing back to the forefront for the U.S., but it also created a significant job shortage situation as there are too few people trained to work in the current manufacturing climate. What tends to get missed when this sector is discussed is that it accounts for a truly significant segment of the overall economy—both directly and indirectly.

Analysis: If one separates the manufacturing sector from the total U.S. GDP, it becomes immediately obvious what importance this segment has. It is a $2.8 trillion chunk of the total U.S. GDP. This is larger than the total GDP of India. It has been noted there are substantially fewer people working directly in manufacturing, but there are millions indirectly employed. For every autoworker on the line actually building a car, there are 12 people who depend on that worker—the back-office people at the plant, the designers, the sales people, the people that arrange car loans and so on. Almost two thirds of the employees at Ford have nothing to do with physically building a car.

There are many measures designed to track the progress of the manufacturing sector—everything from durable goods orders and factory orders to capacity utilization and productivity. One of the more reliable and regular has been the Purchasing Managers' Index (PMI). Part of the reason for its reliability is based on it being conducted all over the world with exactly the same system. The U.S. relies on the version put out by the Institute for Supply Management, but there are global versions from Markit, governments and various banks. They use the same diffusion index and ask the same questions in the same format. The latest set of PMI numbers show there has been a recovery in the manufacturing sector in the U.S. and in China, but the eurozone manufacturers are still in a slump. The U.S. index rose from 54.2 to 55.3. These numbers looked even healthier when the new orders were examined. The fact is manufacturers are still ramping up and preparing for more activity. There are several theories as far as this growth is concerned. One is that there is still reaction to the potential for a trade war. That has companies building inventory in case there is a shortage later. Now there is even concern that Trump will close the border with Mexico and utterly destroy that supply chain. Another theory is that manufacturers expect to see renewed consumer demand once the winter is truly over.

At the same time U.S. manufacturing is recovering a little, there is also progress as far as Chinese manufacturing is concerned. The latest reading is 50.5. Last month it was at 49.2. Granted this is not a major movement, but it is significant to have moved out of the contraction zone (under 50) to expansion—even if only by a narrow margin. The more important observation is that steel output rose significantly (along with the production of more power). The additional steel output was not expected given all the attention that has been paid to impacting the Chinese steel sector, but it appears U.S. tariffs on imported steel have actually benefited the Chinese. The Chinese share of the global steel market is roughly 50%, but due to previous tariffs and other restrictions, the Chinese have never been more than the number 12 importer of steel into the U.S. The tariff regime imposed by the U.S. affected producers like Canada, Mexico, Germany, Turkey and others. Some of the companies in these countries have been forced to shut down or restrict production. That has meant market expansion for the Chinese steel makers.

Eurozone manufacturing is still slipping further into the doldrums with a reading of 47.5 after notching one of 49.3 in February. This is the sharpest drop in six years and doesn't bode well for the coming year. The slump in the eurozone has been profound. It is even more intense in the countries that are supposed to be the drivers of economic growth—Germany is only growing at a rate of 0.7%. There are many reasons for the slump with Brexit chaos as only the most salient at the moment. The growth of populism is concerning as well given the hold that has been established in Italy, Spain and Greece (among others).

Supply Chain Challenges

There is always some kind of supply chain challenge to deal with—this is why those supply chain managers get paid the big bucks. There are constant threats from weather-related disruptions, suppliers going out of business, political challenges that make border crossings challenging, tariffs and other trade restrictions and so on—the list is very long these days. The new wrinkle in the last few years has been the dramatic role politics has played in disrupting the supply chains of companies all over the world. The U.S. has been engaged in tariff wars against the Chinese that have altered the dynamic of supply to and from China. There have also been ongoing threats delivered to the Europeans as regards the importation of vehicles and vehicle parts. The latest set of threats have been aimed at addressing immigration concerns by closing the border between the U.S. and Mexico. It is not just the U.S. that faces a new series of politically motivated supply chain crises. The U.K. is losing access to the EU market. If a deal is not developed, there will be a hard border separating Ireland from Northern Ireland. Colombia is fighting with Venezuela over border issues that involve people but also trade. It is a long list.

Analysis: There are a limited number of options for a supply chain manager when they see a pattern disrupted in this way. They can try to switch suppliers and develop new systems. They can elect to frontload their operations as quickly as possible in anticipation of future limits. They can find a way to live with the new restrictions. All of these are costly responses. The last thing a supply chain manager wants to do is add to the costs of doing business.

Right now, the most common response has been to try to beat the restrictions with additional inventory. This has been taking place over the last year when it comes to U.S. business with China. The levels of imports from China grew dramatically as soon as the tariff plan was announced. Companies did not want to be trapped without access to key inputs and commodities. This was reflected in the worsening trade deficit between the U.S. and China even as the level of U.S. exports to China had started to increase. Now, that same push to build inventory is taking place as a result of Trump's assertion that he is close to closing the border between the U.S. and Mexico. The challenge is that billions of dollars of goods are moved across the border every day and shutting down this access will instantly affect business in an adverse way. The latest comments from Trump have only confused the situation as it sounds like the closure would be partial, but thus far nobody knows what that means.

There are two problems with loading up on inventory now to avoid a supply problem later. The first and most obvious is that companies will start accumulating far more inventory than planned and will have to determine how to reduce the size of that stockpile should the demand not match up with the supply. With the prediction that 2019's economic growth will be slower than that of 2018, there is real fear that inventory levels will climb to levels that are not appropriate for the pace of growth and these will sit on the books of many companies as liabilities. The second issue starts to develop once the barriers are lifted to one degree or another. The companies that overbought inventory are not going to be buying much now. That creates stress for their suppliers as well as all the other companies involved in the process—freight transportation, warehousing and so on.

The motivation for the border closure threat is frustration with the massive number of migrants seeking asylum in the U.S. The Trump White House wants Mexico to do more to stem this flow as the majority are coming from Central America—fleeing the violence that has made life in these nations untenable. It is very hard to understand what is accomplished by closing the border to freight movement other than this is supposed to pressure Mexico.

Algeria Plunged into Confusion

For the last several weeks, there has been a demand that the longtime ruler of Algeria step aside. Abdelaziz Bouteflika is 82 and has been in poor health of late. He had resisted these demands and stated he planned to run for office again, but yesterday he gave in to pressure from the military as it had sided with the bulk of the population. Even as this was the demand, the system was not prepared for his decision. Now the question is—who takes control?

Analysis: It is unlikely that protestors will be content with someone else from the old regime. The most likely outcome will be some form of military junta that holds power until some other system emerges, but many expect the military to remain in control for a while.

Auto Sector Not Looking All That Healthy

One part of the manufacturing sector has not perked up much, and it is an important one. The auto sector is slumping as consumer demand has been fading. The original expectation was that sales would fall by between 3% and 4%, but now it appears the fall in sales will be closer to 5%. That is as anemic a performance as has been seen in well over five years. This pace ensures sales will dip below 17 million vehicles this year, the worst performance since 2014.

Analysis: Analysts point to a wide variety of problems—everything from higher prices and fewer discounts to an abundance of used cars and the reluctance by lenders to run much risk. For the last few years, it has been the marginal buyer who has been sustaining the industry. This has resulted in a much larger than expected wave of defaulting auto loans; lenders are getting very picky again. The most important factor seems to be that pent-up demand from the recession has played itself out. There are simply not that many people in the market for a new vehicle these days. It is expected that demand might jump if there are real threats of imposing tariffs on imported vehicles as there will be an attempt to beat the imposition of the tax.

Animal Devotion

I have been watching a fun little series about the inner workings of the Bronx Zoo. It has been fascinating to see all the behind the scenes activity in a zoo that is dedicated to the conservation of species through a breeding program. There are several aspects of the program that are engaging, but the part that stands out is the dedication and passion of the people who work with the animals. Every single species seems to have a champion—from the most magnificent predators like the big cats to the excruciatingly cute penguins to the weird little lizards and other reptiles. These are people who exhibit immense patience and care and clearly bond with the animals in their charge even as they work to ensure that they do not lose their wild natures.

For most people, the interaction with animals is among the most rewarding activities they can engage in. There are those who do not seem to be moved, but I suspect (and hope) they are in the minority. Animals really do bring out our best instincts for patience, care and protectiveness. The staff at that zoo (and doubtless other zoos) are a bunch of "mother hens" looking after their charges. One can tell that very little is more important than the well-being of those creatures. Those of us with pets can certainly relate.

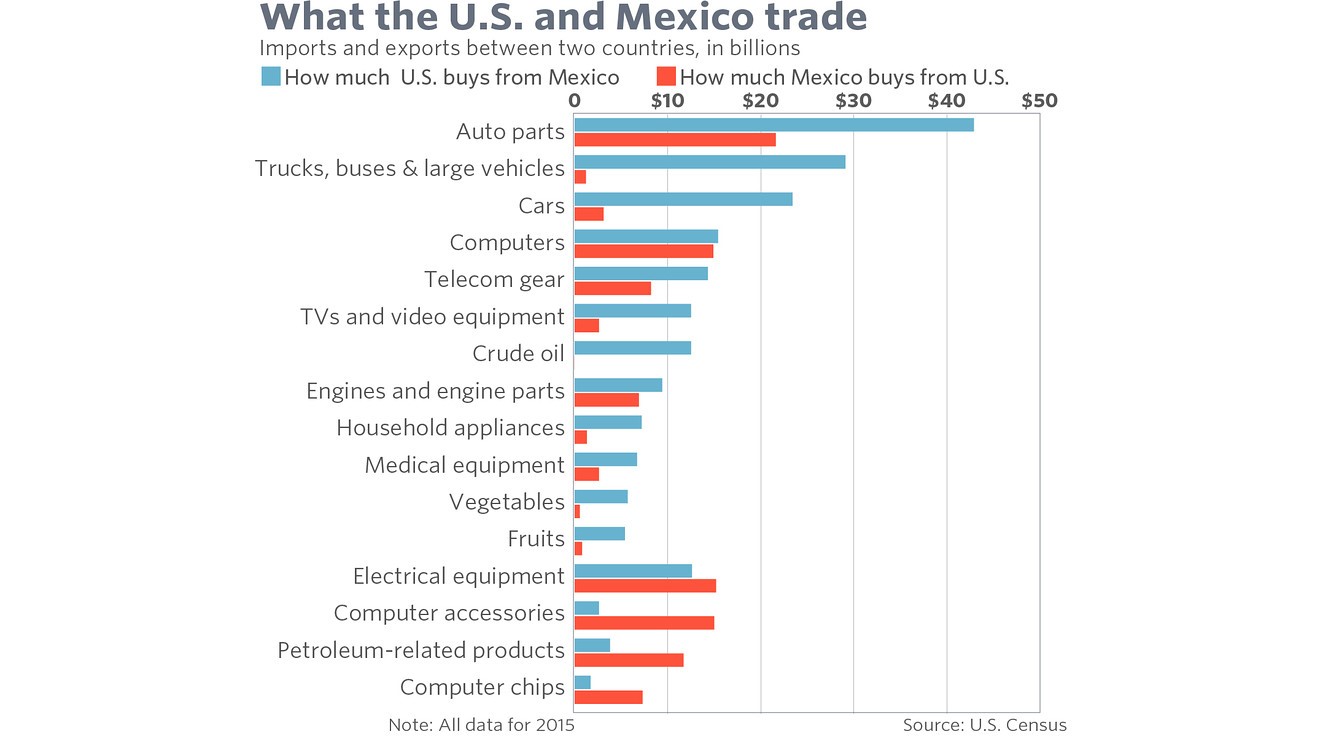

U.S. Mexico Trade in Goods

There is no question the U.S. imports more in the way of goods than it exports (although it is just the reverse when it comes to services). This is not really the case with Mexico, however. The U.S. sells a good bit to its southern neighbor and it buys a lot as well. Just as with Canadian trade, the bulk of U.S. trade with Mexico is inter-company trade or at least intra-industry. The Mexican manufacturing sector has grown dramatically in the last 10 to 15 years. That has allowed Mexico to become a platform for U.S. manufacturers that otherwise planned to shift operations and supply chains to Asian states like China, India, South Korea and Taiwan (among others).