Week in Review

Week in Review

What We're Reading:

September 28, 2020

Europe is facing a double-dip recession as coronavirus second wave arrives. Economists predicted a rebound in the second half of 2020, but they are now questioning those forecasts. (CNBC)

Visits to US stores, restaurants stall as concern over economic recovery grows. Foot traffic to U.S. restaurants and stores showed little improvement last week, high frequency data show, and signs emerged of deepening stress for small businesses as economists worry the recovery from coronavirus lockdowns continues to slow. (Reuters)

Winners and losers of ‘pandemic economy.’ Much economic commentary nowadays focuses on “divergence.” While broad equity market indexes are at or near all-time highs, much of the wider economy struggles to recover from one of the most severe downturns ever. (HSN)

Belarus faces imminent sanctions as pressure mounts on Lukashenko. The United States, Britain and Canada may impose sanctions on Belarus as early as Friday, four sources told Reuters, and the European Union told President Alexander Lukashenko it did not recognise him as the country’s legitimate leader. (Reuters)

Germany revives hopes for EU-Mercosur deal. German Economy Minister Peter Altmaier on Sept. 21 said he still believes ratification of an EU trade deal with South America is possible, despite European anger over deforestation in Brazil. (EurActiv)

Fears rise over widening trade finance gap and SME rejection rates in Africa. Rejection rates for trade finance applications for SMEs in Africa are rising, with bank participation in activities decreasing. The continent’s trade finance gap, estimated to be more than US$81bn, is also growing, finds a new report by the African Development Bank (AfDB) and the African Export-Import Bank (Afreximbank). (GTReview)

Currencies: Is the dollar in danger? Recent declines in the dollar have once again raised questions about its status as the de facto global reserve currency. But the current depreciation in the greenback is more the result of a perfect short-term storm, as opposed to a permanent international retreat from the dollar. (Global Risk Insights)

How much US debt does China own? There’s a lot of fear, confusion, and misapprehension about why the U.S. is in debt to China and what would happen if China were to call it in. Here are answers to the most common questions about U.S. debt to China. (Quartz)

Witnessing Deutsche Bank's tailspin. No matter how dodgy the deal, profits are everything. That was clearly the motto at Deutsche Bank—and attempts to justify the wrongdoing uncovered by the FinCEN scandal seem pointless. (DW)

US-China mutual investment slumps as ties sour. Two-way investment between the U.S. and China slumped to the lowest in almost nine years during the first half of 2020 as relations between the world’s biggest two economies deteriorated to their worst in decades. (Business Mirror)

Thailand’s economy and the pandemic: Facing delays and difficult choices. Thailand is one of the few countries that can claim to have restricted the internal spread of COVID-19 so far. The country has yet to reach 3500 total cases, with limited deaths, currently at 58. A timely border closure supported by initiatives that were broadly embraced by Thai citizens has contributed to this arguably successful containment, especially considering the size of Thailand’s population at nearly 70 million citizens. But has it truly been a success? (Global Risk Insights)

Bounce Back in Global Trade?

Chris Kuehl, Ph.D.

When the pandemic hit in March, the collapse in global trade was nearly overwhelming and prompted more than a few analysts to start proclaiming that the end of globalization was at hand. There was always a certain amount of hyperbole in all this, but it was easy to see what the disruption was doing to the system and what it could continue to mean.

Even several months after the crisis, deep wounds in the traditional supply chain remain. It is not clear whether old patterns will be able to resume. The big concern was that consumption patterns would alter permanently. Thus far, that has not been taking place, although there has been an acceleration of the changes that had started to take place even before the pandemic became a factor.

Even though trade volumes are still below the levels that were set prior to the pandemic, the recovery has been swift. At this point, a 50% recovery took place in June. This is a far quicker pace than the recovery that took place after the 2008 recession because it took almost three years to gain what has been recovered this time in a matter of months. Data show in 14 of the 38 nations that Markit reviews a substantial gain in the levels of new export orders. In June, only four nations were able to say that. These are also widely disparate nations with some in the developed world and others in the developing category.

One of the nations to see the most dramatic recovery has been China as it saw a 9.5% rebound in outbound shipping in the month of August alone. The South Koreans have seen trade volumes return to last year’s levels, and Vietnamese growth has been far greater than many had presumed possible. If one looks at global freight volume data, it is apparent that normalization is underway as well. Freight rates are hitting record highs, reflected by record levels of capacity and spot prices for containers from Shanghai to California.

The increased demand for goods in the U.S. has been a major driver of all this activity. Consumers once spent a good deal of their disposable income on services (up to 65% for some age cohorts). Now, that money has been going toward goods rather than going to events, eating at restaurants and attending concerts and games. The majority of the unemployment damage has been done in the low paid service sector. These consumers have not traditionally been the bulwark of overall consumption. The higher paid population has kept their job and is now trying to do that job under different circumstances. The work-from-home shift has dramatically increased demand for all kind of office furniture and equipment to the point that office chairs and desks are in short supply.

The assertion was that supply chains would be forever altered. To some degree, that seems to be true as many companies work to diversify their suppliers and many rely more heavily on warehousing than was the case. The fact remains that most of these alternatives to China are not able to pick up the slack. Vietnam has seen a 65% increase in activity, but it is now running into issues of power generation with persistent blackouts and brown outs. Many other nations are stressed to the same degree. The major problems that stalled much of global cargo have started to ease, but they are still there—everything from stranded crews under quarantine to the need to skip ports that have been placed under restriction.

-

APRIL

24

11am ET -

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

-

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute -

APRIL

29

3pm ET

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

Turkish Insolvencies Expected to Rise

Trade credit insurer Atradius has listed Turkey among the economies with large increases in insolvencies. The firm expects “a sizeable economic contraction that mostly explains the large increase in insolvencies.” In addition, Atradius considers the effectiveness of Turkey’s fiscal response for preventing insolvencies lower because it “has limited focus on providing liquidity to firms.”

Although the Turkish economy started out stronger in 2020, Atradius says the coronavirus pandemic will crush the economic rebound. “The Turkish economy is on track for a deep recession this year as restrictions to mitigate the spread of COVID-19 deal a severe blow to both domestic and external demand. The government’s modest fiscal response to the crisis has put the onus on the central bank to support the post-pandemic recovery.

Atradius expects a modest recovery in 2021. “The current account deficit is forecast to turn sharply negative this year (-6.4% of GDP). Turkey relies on net inflows of capital from abroad to finance its current-account shortfall, and attracting sufficient inflows could prove problematic.”

Trade credit insurer Euler Hermes forecasts the country’s economy to contract about 4.7% this year. Euler Hermes notes the country as having an adequate business environment, though it’s deteriorating. Its exchange rate remains highly vulnerable to domestic and external shocks. Turkey has a “history of persistently large current account deficits, largely financed through short-term external debt, which has risen to a very high level in the meantime,” Euler Hermes says. The firm adds that external trade activity will drop significantly. “Looser monetary policy and strong fiscal stimulus should bring some relieve as long as it can be upheld, mitigating pressures on individuals and corporates.” However, Euler Hermes projects a 31% rise in business insolvencies in 2020-21.

Euler Hermes identifies the following key risks in its country report on Turkey:

- Renewed balance of payment crisis on the horizon

- Worrisome decline in FX reserves as external financing needs remain high

- Corporate debt

- Nonpayment

On Oct. 1, UnitedKS Law Firm’s Cengiz Söylemezoğlu will discuss general information about enforcement methods in Turkey for the collection of debt. During the FCIB webinar, Söylemezoğlu will review legal procedures for bankruptcy and the consequences associated with a granted bankruptcy decision. Visit the FCIB event page to learn more about the webinar or to register.

Digital Solutions for Small Businesses in the Middle East and North Africa

Inutu Lukonga, IMF

Small- and medium-sized enterprises dominate the business landscape in the Middle East and North Africa region. These enterprises account for more than 90% of the region’s businesses and, in some countries, contribute as much as 50% of employment and 70% of GDP.

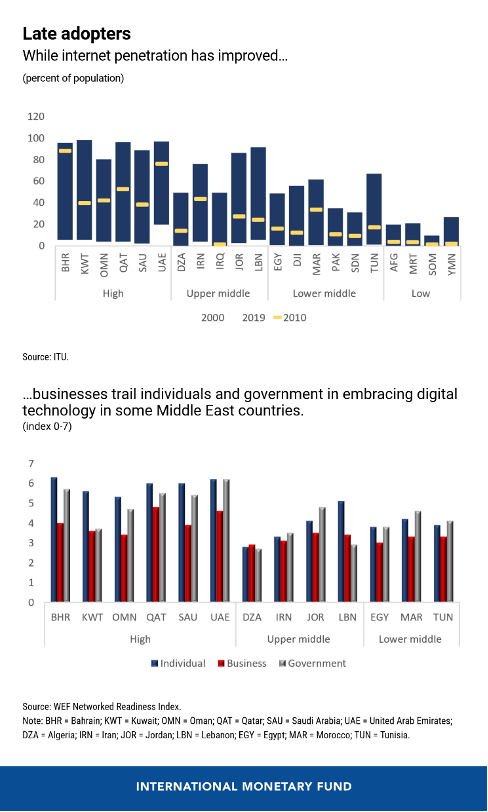

Yet they face impediments to growth, and their contribution to employment is below potential. In much of the region, small- and medium-sized enterprises are handicapped by limited access to credit, unfavorable business environments, and talent gaps. Digital technologies present new opportunities for these businesses to achieve faster growth. Emerging technologies and broadband internet can facilitate operational efficiencies, innovation, access to markets and finance, and can enable firms to operate remotely during lockdowns. The flexibility of remote working can help integrate women and youth in the labor market. But so far, small- and medium-sized enterprises in the region have been slow to embrace digital technologies and e-commerce, and businesses trail governments and consumers in internet usage.

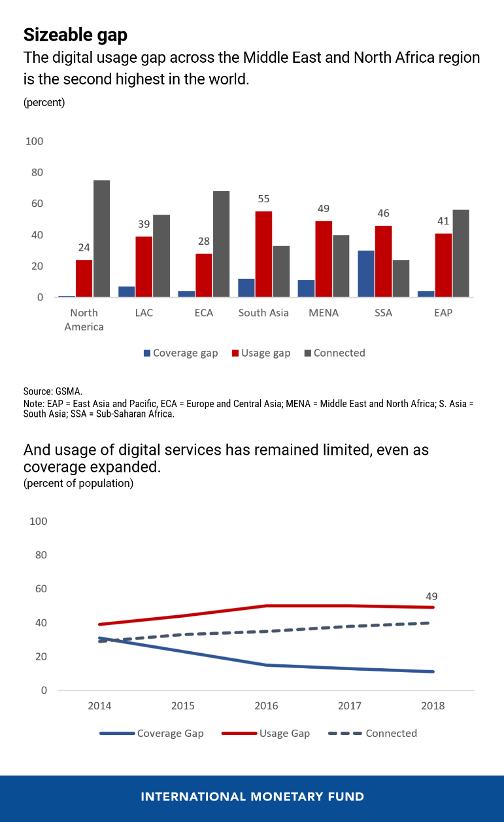

As consumers rapidly shift to online shopping and increasingly prefer rapid and convenient services, smaller businesses will need to adopt digital solutions to remain competitive and survive. Because small- and medium-sized enterprises hold the key to employment generation, governments can help expedite their digital transformation by developing and implementing national strategies that address both supply and demand constraints standing in the way of digitalization.

On the supply side, priority should be given to removing barriers to competition and increasing investment in information and communications technology to ensure universal access to affordable high-speed internet. Currently, while all countries have easy access to international fiber optic networks, many maintain barriers to entry such as government monopolies or restrictions on foreign participation and network peering. These, coupled with high capital investment requirements, have slowed deployment of advanced network technologies and internet exchange points. Apart from the Gulf Cooperation Council states of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (GCC), many countries have limited access to high speed broadband internet, and internet services are often slow, unreliable, and unaffordable, constraining use of the internet for business creation.

Educational and labor market reforms are needed to reduce the digital skill gaps. Digital skills are in short supply across the Middle East and North Africa region and some countries with high levels of digital expertise, such as Lebanon and Egypt, sometimes suffer brain drain to higher income countries, including the GCC. Mandating science, technology, engineering and mathematics subjects and providing technical and vocational education and training through public-private partnerships can increase supply of tech skills in the medium term. At the same time, easing labor restrictions to facilitate expatriates in highly technical areas can reduce the skill gaps in the near term.

Reforms are also needed to improve e-commerce logistics and reliability of electricity, without which the internet cannot function. Deficiencies in e-commerce logistics—unified address systems, area codes, postal service, land and customs clearance—currently delay delivery and increase costs for online trading.

Regulatory and other reforms are also essential to facilitate development of digital financial infrastructures. Digital financial services currently do not provide a strong foundation for digital transformation as the infrastructure and instruments for accepting electronic payments—such as point-of-sale terminals, credit and debit cards—have limited penetration, and payment systems are mostly not interoperable.

Digitalization of government services and procurement can incentivize small- and medium-sized enterprises to follow suit given the significant size of the public sector in most countries and the pervasiveness of making payments to, or receiving payments from, governments.

On the demand side, the digital usage gap—the disparity between people who live in areas covered by broadband but who are not using internet—is several times the coverage gap. This suggests that demand is being constrained for reasons other than the non-availability of internet access.

To increase demand for digital services, governments should develop digital literacy and awareness programs as well as foster consumer trust by strengthening frameworks for cybersecurity, digital identification, data privacy, and consumer protection. Across the region, consumers reportedly do not trust websites to handle their information and are unaware of their consumer rights. In some countries, consumers are not well equipped to adopt digital solutions as large segments of the populations are not connected to the internet and are unbanked. In parts of the region, including North Africa and Iran, ownership of smartphones and other internet-enabled devices is below the global average.

Finally, for digital benefits to materialize, the digital strategy must be underpinned by financial sector and business environment reforms, particularly strengthening financial infrastructures—credit registries and bureaus, modernized bankruptcy laws, collateral registries—and business support, all of which will help SMEs access credit.

Reprinted with permission from the IMF Blog.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations