Week in Review

Week in Review

What We're Reading:

September 21, 2020

West Coast fires will cost US economy dearly. The wildfires ravaging America's West Coast have sent thousands fleeing and will leave behind destruction, uncertainty and huge bills. The disruption to the economy should not be underestimated. (DW)

Argentina currency crackdown dims investor hopes of economic rebound. Argentina’s standing in global markets is at risk once again after it moved last week to further restrict access to dollars as foreign reserves dry. (Reuters)

Managing trade credit exposures in times of crisis. Staying on top of trade credit exposure is fundamental for companies to help manage working capital and mitigate liquidity issues. This aspect of supply chain management and treasury operations is even more crucial during periods of market volatility and stressed economic conditions. (S&P Global)

WTO finds Washington broke trade rules by putting tariffs on China; ruling angers US. The World Trade Organization found on Sept. 15 that the United States breached global trading rules by imposing multibillion-dollar tariffs in President Donald Trump’s trade war with China, a ruling that drew anger from Washington. (HSN)

China warns US of ‘serious damage’ to relations over Taiwan trade talks. China warned the United States on Sept. 14 of potential “serious damage” to their relations if it does not withdraw from an upcoming economic meeting with Taiwan that is expected to be attended by a senior American official. (Business Mirror)

Johnson faces revolt over plan to break Brexit treaty. British Prime Minister Boris Johnson tried to persuade rebellious lawmakers in his party to vote on Sept. 14 for a bill that would break international law by breaching parts of the Brexit divorce deal and that Brussels says will wreck trade talks. (HSN)

Global economy to lose around US$12 tn by 2021 as health systems suffer. The International Monetary Fund projects that despite the $18 trillion already spent to stimulate economies around the world, the global economy will lose $12 trillion or more by the end of 2021—the biggest global GDP loss since the end of World War II. (HSN)

Pandemic upends emerging market investment thesis. The years-old trade of piling into emerging markets to capture higher returns afforded by faster growth may be losing its luster, putting capital flows at risk as investors take a more nuanced approach to the asset class. (Reuters)

EU diplomacy on Turkey runs aground ahead of summit, envoys say. European Union diplomacy to resolve a dispute with Turkey in the Mediterranean has become bogged down in competing initiatives a week before a summit meant to show Ankara a united front. (Reuters)

How can organizations ensure data security. The continuously growing scale of breaches and cyber-security attacks should be a major concern for all organizations. (Global Trade)

Assessing risk in export markets. Risk is an inherent part of everyday life, be it private, social or business. Risk is unavoidable, and if you do not manage it, it will manage you. (Shipping Solutions)

Asian trade finance stages a V-shaped recovery while SCF demand surges. Trade transaction volumes in Asia have reverted to 2019 levels over the past couple of months, leading to optimism for the prospects of a V-shaped post-pandemic recovery in the region, according to HSBC. (Global Trade Review)

AI and cryptocurrency–How they can work together effectively. There is no doubt that both the technological realms can be merged to create a more advanced and efficient machine learning blockchain system to benefit the masses. Let’s have a look at how Blockchain and AI are a perfect match. (Global Trade)

The Rise of Chinese Belligerence

Chris Kuehl, Ph.D.

Chinese leadership views President Donald Trump’s U.S. trade policy toward China as acts of war. These policy moves have fueled an increasingly nationalistic vision for China. The countries closest to it have noted that China is palpably more aggressive and belligerent than it has been and they are increasingly concerned that open conflict will occur. Few see the U.S. and China coming to blows because neither nuclear power wants to risk an escalation. However, analysts now anticipate an increased risk of regional clashes and what amount to proxy wars.

China’s behavior towards the U.S. was considered a strategic rivalry for years. There have always been many factors that differentiate the two nations. The two countries have always had a rivalry based on which has the influence in Asia and the Pacific. That competition was tempered by the fact the two nations developed a mutual need for one another.

U.S. consumers depended on China to supply the lifestyle they had become accustomed to, and China got rich supplying this vast collection of eager consumers. Today those ties are frayed as China grew its own domestic market and actively worked to reduce that dependence on foreign markets at the same time the U.S. moved towards some version of protectionism.

China is reacting to three major developments over the last year. The first has been the explosion of protests in places like Hong Kong and Xinjiang province. There is no tolerance for this kind of political discord. The Chinese are blaming foreign influence for the outbreaks. These revolts are being put down brutally, and steps are being taken to isolate the country as a whole from these influences. The Western business person is a potentially subversive influence.

The second development is the emergence of Xi Jinping’s regional and global strategy. It is based on establishing China’s dominance over its periphery and the Asia-Pacific region as a whole. China views itself as surrounded by enemies— India, Japan, South Korea, Vietnam and, of course, the U.S.

The third factor is the pandemic. China remains furious that it has been blamed for the global outbreak. Its perspective is that the disease broke out in China and the world stood idly by and offered no help as millions were sickened. That narrative does not fit reality very well, but that is the story that comes from China today and fuels resentment. Furthermore, the Chinese economy is coming out of the crisis faster than many other states and it will take full advantage of that.

This threatens a number of regional clashes in the near future. The hotspots will be familiar. Taiwan remains a very high priority. Its new nationalist government will doubtless provoke Chinese ire. There will be more confrontation over the South China Sea and over the disputed islands the Chinese call Diaoyu and Japan calls the Senkaku. China’s military superiority over Taiwan is vast. If it makes a move, the only hope for the island state is direct U.S. engagement. The Chinese army numbers two million to Taiwan’s 163,000. There are over 59 submarines, 107 warships, 603 surface-to-surface missiles, and 3,500 fixed wing aircraft to Taiwan’s four subs, 12 missiles, 26 ships and 568 planes. Not a very fair fight.

-

APRIL

17

11am ET

-

Vendor Verification: Mitigating Risk, Maximizing Returns

Speaker: Kristen Pope, Gates Machine Tool Repair, Inc.

Duration: 60 minutes -

APRIL

18

3pm ET

-

APRIL

22

3pm ET -

Do You Know Who You Are Selling to?

Speaker: Emory Potter, Esq., Hays & Potter, LLP

Duration: 60 minutes

-

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes -

APRIL

24

11am ET

India: Controversies Sustain Modi’s Popularity

PRS Group

More than 15 months after leading his BJP and its allies in the NDA to a second landslide victory at the May 2019 elections, Prime Minister Narendra Modi continues to enjoy strong popularity, despite ample grounds for criticizing the government’s management of the COVID-19 crisis. Although there have more recently been signs of an economic revival, India is on track to record its largest real economic decline in four decades in the fiscal year to March 2021, which critics are already blaming on the government’s tepid fiscal policy response to the crisis. Adding insult to injury, the lockdown strategy has failed to tame the health threat, with COVID-19 deaths averaging close to 1,000 per day in the month of August.

The apparent disconnect between the government’s performance and current popular sentiment toward the NDA administration is largely the result of two factors. The first is Modi’s commitment to delivering on a Hindu nationalist program that was a centerpiece of the governing coalition’s campaign platform in 2019. The other source of Modi’s enduring popularity is the nationalist fervor stoked by escalating tensions with China over a longstanding border dispute in the area where the Ladakh union territory meets the Tibet Autonomous Region in the Himalayas.

Diplomats are attempting to restore calm, but both sides have announced tit-for-tat retaliatory economic measures, and a fresh confrontation was reported near Gadong Tso Lake in late August. The heightened bilateral tensions come at a time when China is negotiating with Thailand to build a canal across the Malay peninsula that has the potential to significantly undermine India’s security in terms of its ability to counter hostile action by China’s navy.

Of course, at least some credit for the buoyancy of Modi’s popular support goes to the bumbling of the main opposition INC, which since suffering another crushing defeat at the hands of the BJP last year has been consumed by infighting. Defections at the state level have accelerated the erosion of the opposition’s numerical advantage in the 245-seat Rajya Sabha. Although the NDA is still a handful of seats short of a majority in the upper chamber, the UPA’s reduced total of just 60 seats leaves it in a much weaker position to cobble together a majority coalition capable of impeding approval of government-backed measures.

The government has set a goal of attracting $100 billion of FDI through the end of the 2021/2022 fiscal year. The pandemic has no doubt had a dampening effect on investment inflows and has also provided the government with an excuse for inaction. However, the business community will press for a more aggressive approach to liberalization as the crisis recedes, and the government will need to respond if it hopes to hit the FDI target. Given the uncertain outlook for the economy, the government may never be in a stronger position to deliver than it is right now.

The analysis above is taken from the August 2020 Political Risk Letter (PRL). The best-in-class monthly newsletter, written by the PRS Group, provides concise, easy-to-digest briefs on up to 10 countries, with additional recaps updating prior month’s reports. Each month’s Political and Economic Forecasts Table covers 100 countries, with 18-month and five-year forecasts for KPIs such as turmoil, financial transfer and export market risk. It also includes country rating changes, providing an excellent method of tracking ratings and risk for the countries where credit professionals do business. FCIB and NACM members receive a 10% discount on PRS Country Reports and the PRL by subscribing through FCIB.

On Sept. 29, K. Singhania & Co.’s Krrishan Singhania and Manoyog GRC Advisors Pvt. Ltd.’s Manoj Sonawala will present Insolvency Law in India. Visit the FCIB event calendar to learn more.

Building Confidence Crucial Amid an Uncertain Economic Recovery

With the COVID-19 pandemic continuing to threaten jobs, businesses and the health and well-being of millions amid exceptional uncertainty, building confidence will be crucial to ensure that economies recover and adapt, according to the Interim Economic Outlook from the Organisation for Economic Cooperation and Development (OECD).

After an unprecedented collapse in the first half of the year, economic output recovered swiftly following the easing of containment measures and the initial re-opening of businesses, but the pace of recovery has lost some momentum more recently, the report finds. New restrictions being imposed in some countries to tackle the resurgence of the virus are likely to have slowed growth.

The OECD reports uncertainty remains high and the strength of the recovery varies markedly between countries and between business sectors. Prospects for an inclusive, resilient and sustainable economic growth will depend on a range of factors including the likelihood of new outbreaks of the virus, how well individuals observe health measures and restrictions, consumer and business confidence, and the extent to which government support to maintain jobs and help businesses succeeds in boosting demand.

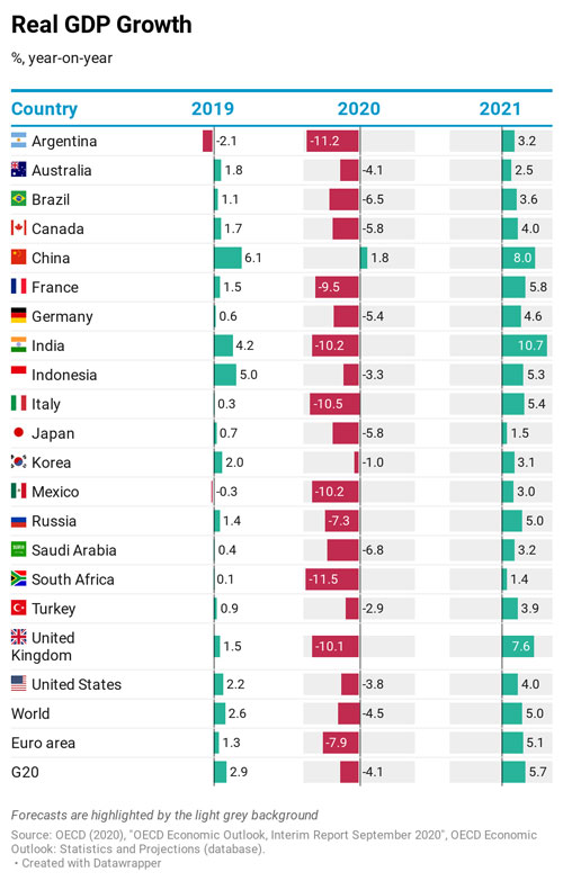

The Interim Economic Outlook projects global GDP to fall by 4.5% this year, before growing by 5% in 2021. The forecasts are less negative than those in OECD’s June Economic Outlook, due primarily to better than expected outcomes for China and the United States in the first half of this year and a response by governments on a massive scale. However, output in many countries at the end of 2021 will still be below the levels at the end of 2019, and well below what was projected prior to the pandemic.

If the threat from COVID-19 fades more quickly than expected, improved business and consumer confidence could boost global activity sharply in 2021. But a stronger resurgence of the virus, or more stringent lockdowns could cut 2-3 percentage points from global growth in 2021, with even higher unemployment and a prolonged period of weak investment.

The report warns that many businesses in the service sectors most affected by shutdowns, such as transport, entertainment and leisure, could become insolvent if demand does not recover, triggering large-scale job losses. Rising unemployment is also likely to worsen the risk of poverty and deprivation for millions of informal workers, particularly in emerging-market economies.

The Interim Outlook says it is essential for governments not to repeat mistakes of past recessions but to continue to provide fiscal, financial and other policy support at the current stage of the recovery and for 2021. Such measures should be flexible enough to adapt to changing conditions and become more targeted. The report acknowledges that a balance needs to be struck between providing immediate support to strengthen the recovery while encouraging workers and businesses in hard-hit sectors to move into more promising activities.

Support also needs to be focused on viable businesses, moving away from debt into equity, to help them to invest in digitalization, and in the products and services our society will need in the decades ahead. Far stronger commitment needs to be devoted to address climate change in recovery plans, in particular conditioning support on greater investment in green energy, infrastructure, transport and housing.

At the same time, and with the virus continuing to spread, investing in health professionals and systems must remain a priority. The OECD says global co-operation and co-ordination are essential, as greater funding and multilateral efforts will be needed to ensure that affordable vaccines and treatments will be deployed rapidly in all countries when available.

Real GDP Growth

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations