Week in Review

Week in Review

What We're Reading:

August 10, 2020

Lebanon's investors wary as blast upends debt revamp plans. Lebanon’s creditors are wary of the risk of even steeper losses as a devastating blast in Beirut complicates an already stalled debt restructuring process. (Reuters)

Trump widens China tech attack, ordering bans on TikTok and WeChat. Orders would bar U.S. residents, companies from doing business. (Bloomberg)

UK says it’s confident of Brexit trade deal as EU changing tone. Britain’s top minister overseeing Brexit talks said on Aug. 7he was confident a free trade deal would be clinched with the EU as there had been a distinct change of tone from the bloc in recent weeks. (EurActiv)

US imposes sanctions on Hong Kong's Lam, other officials over crackdown. The United States on Aug. 7 imposed sanctions on Hong Kong Chief Executive Carrie Lam, the territory’s current and former police chiefs and eight other officials for their role in curtailing political freedoms in the territory. (Reuters)

Spain falls into steep recession, tourism woes bode ill for rebound. The coronavirus crisis has pulverized Spain’s economy, triggering its worst recession since the civil war, with the depressed state of tourism boding ill for any hopes of a swift rebound. (HSN)

Credit insurers' coronavirus losses mitigated by state support. Credit insurers' losses from the coronavirus pandemic are unlikely to be as large as in the 2008 global financial crisis, due to trade credit backstops provided by governments as well as overall measures to aid the global economy. (Fitch)

Argentina debt deal illustrates coronavirus pandemic’s blow to emerging markets. Investors are bracing for more defaults and disruptions in emerging markets after Argentina’s deal with creditors highlighted the pandemic’s stress on many developing economies. (HSN)

Over 60% of global bank rating outlooks are negative. Fitch Ratings' new interactive country-by-country map of bank rating trends shows that the balance of Outlooks globally has turned sharply negative since the onset of the coronavirus pandemic. (Fitch)

COVID-19 and the GCC security dilemmas.May 25 marked the 39th anniversary of the founding of the Gulf Cooperation Council (GCC). Across the Gulf, the occasion was welcomed as an opportunity to reflect on how the COVID-19 pandemic might spur and heal an institution—the GCC. (Global Risk Insights)

Project Defend: UK trade committee warns against supply chain onshoring. British MPs have welcomed government promises that its mysterious “Project Defend” will not involve localizing supply chains, warning businesses that onshoring due to COVID-19 could have unintended consequences for trade. (Global Trade Review)

FX Hedging: Is your strategy still fit for purpose? Managing currency-related risks is a growing concern for many corporates, given significant foreign exchange volatility. Nevertheless, an optimal hedging strategy should always be tailored around the business, rather than the market. (TMI)

US reimposes aluminum tariffs on Canada. President Donald Trump has reapplied tariffs to Canadian aluminum, decrying the alleged "surge" in imports. He accused Canada of flooding its neighbor with the metal and killing jobs in the U.S. aluminum industry. (DW)

Is this the currency collapse Bitcoiners warned about? Nearly three months ago, as America’s first huge coronavirus relief packages reached full swing, Bitcoin advocates struck on one of the most resonant memes in the cryptocurrency’s already meme-heavy history: Money printer go brrr.(Fortune)

Do Americans want the US to leave the WTO?TradeVistas’ inaugural survey of Americans’ attitudes toward trade shows a plurality support the idea, but most Americans seem unsure of the WTO’s role. (Global Trade Magazine)

Putin Faces Major Regional Challenges

Chris Kuehl, Ph.D.

The focus of the U.S. has been on the protests that have exploded over issue of racial equality. This has to some degree obscured the fact that protests are breaking out all over the world and, to some degree, these are all linked. It has been asserted by the intelligence community for years that economic dislocation provokes political and social violence.

In every place where there is economic stress, there has been corresponding social upheaval as people are suddenly thrust into very vulnerable situations. The political response is rarely connected directly to the economic crisis in that people are not marching and rioting in order to get their jobs back, but their economic frustration fuels all manner of other grievances.

There have been riots and protests in France, Spain, Italy, Germany and the U.K. There are significant protests in Brazil, Venezuela and Mexico, and one of the more persistent set of protests has been seen in Russia’s far east. Every day for the past several weeks, there have been tens of thousands of protestors taking to the streets of Khabarovsk demanding Vladimir Putin restore the regional governor.

Sergei Furgal was the elected and very popular governor of the Khabarovsk region. He is not a member of Putin’s party and has defeated all of those that Putin has tried to run against him. A few weeks ago, he was arrested and sent to Moscow for trial on the grounds that he had committed murder. The alleged murder was of a man who had also been a critic of Putin, and the local population is in no doubt as to who really killed him. The protests demanding Furgal’s return started the next day.

The Putin approach to power has been to systematically eliminate regional rivals and centralize all power in Moscow. Regional leaders elected by the local population are somehow eliminated and replaced by Putin’s allies from Moscow, but these tactics have been falling short as there has been less on offer from these new leaders. They used to arrive bearing gifts in the way of additional government money and job opportunities; but as Russia has experienced economic reversal, there is very little coming from the center other than new rules and demands that these communities pay more taxes to the central authority. The protests in Khabarovsk have not been the only regional challenges and as this protest continues, other regions are growing just as restless.

The demonstrations have been entirely peaceful and have even been described as festive. There does not appear to be a leader that can be said to have any control. They have been spontaneous and have been marked by music blaring, street performances and the like. The majority of those that have commented on why they have taken to the streets cite three motivations. The first is that they know that Furgal is being railroaded; second, they resent the attempts by Putin to take charge of their region; and third, they want jobs. The rate of unemployment there is now over 30%; this has been an industrial city that has suffered as Russia’s exports have dwindled. Many analysts assert that it is the issue of jobs that really motivates the anger.

Upcoming FCIB Webinars: Date & Time Title Speakers

Romelio Hernandez

President HMH Legal S.C.

Chula Vista, CA Cengiz Söylemezoglu

Managing Partner

UnitedKS Law Firm

Istanbul, Turkey Roberto Gilardino

Regional Partner

Horizons Advisory

Shanghai China

|

ICC Global Survey on Trade Finance

Confirms Industry Optimism

Supply chain finance (SCF) and digital trade are confirmed as key growth priorities for banks, according to the latest International Chamber of Commerce (ICC) Global Survey on Trade Finance.

Namely, 86% and 84% of respective respondents call them an immediate or near-future priority. However, there is a divide between global and non-global banks on their supply chain finance offerings and investments in digitalization.

Some 64% of global banks surveyed currently offer SCF platforms, compared to just 13% of local banks and 38% of regional banks. Similarly, while 83% of global banks have a digital strategy, only 46% of local banks report having one, highlighting a growing gap between players of different scale and reach.

Survey responses and accompanying commentary continue to reflect evolution and greater receptiveness to innovation in the financing of international trade, whether through traditional techniques or emerging mechanisms in SCF. The underlying optimism reflected in past surveys is evidenced again this year, as are key topics and areas of global industry focus.

Other topics are also gaining traction with participants such as sustainability and financial inclusion, whereby some 67% of respondents indicated that their bank now has a sustainability strategy. What’s more, the majority of banks surveyed are also integrating sustainability risks into their credit risk management procedures.

In terms of ongoing challenges, banks of all sizes remain concerned by the obstacles to their trade finance businesses’ growth posed by regulation and compliance policies, with 56% indicating significant concern regarding regulatory requirements.

Assessing the impact of COVID-19

Meanwhile, to quantify the likely impact of the pandemic on the trade finance industry, the report contains results from two additional projects. The first is analysis from the Boston Consulting Group (BCG) to model scenarios on how COVID-19 could disrupt trade, suggesting that trade flow values could fall by anywhere between 11% and 30% in 2020. Findings also indicate that the longer any lockdowns persist, the more severe the global and systemic impact will be, as businesses of all sizes—domestic and international in nature—fight to meet financial and commercial obligations and to remain viable.

Nearly 350 respondents in more than 80 countries participated in the 2020 ICC Global Survey, bolstered by nuanced contributions from an international array of experts from the Asian Development Bank (ADB), AUSTRAC, BCG, Coriolis Technologies, HSBC, Kountable, SWIFT and TXF.

ICC also conducted a supplementary COVID-19 survey to understand banks’ sentiment regarding the initial impact of the pandemic on trade finance, with banks across geographies reporting an average 0-10% decrease in their trade flows in the first quarter of 2020, and most expecting at least a 20-30% decline for the full year. In addition, results from the survey reveal that many of the participating banks

are supporting their customers during the crisis by extending financing terms, enhancing their digital offerings, and some even relaxing internal policies on original documentation rules.

Despite today’s challenging atmosphere, banks around the world are generally optimistic. Even in the initial, highly disruptive stages of the global COVID-19 crisis, trade finance has remained available and accessible. In turn, the Global Survey confirms and reinforces trade finance’s resilient character and adaptability.

COVID-19 Response in

Emerging Market Economies:

Conventional Policies and Beyond

Martin Mühleisen, Tryggvi Gudmundsson and Hélène Poirson Ward, IMF

The economic impact of the COVID-19 pandemic on emerging market economies far exceeded that of the global financial crisis. Unlike previous crises, the response has been decisive just like in advanced economies. Yet, conventional policies are reaching their limit and unorthodox policies are not without risks.

A pandemic still unfolding

COVID-19 is still to play out fully in the emerging market universe (see chart for country list), posing risks to both people and economies. While countries such as China, Uruguay, and Vietnam have managed to contain the virus, others such as Brazil, India, and South Africa continue to grapple with a rise in infections.

Emerging markets likely to face an uphill battle

The economic impact has been even more severe as emerging market economies were buffeted by multiple shocks. Compounding the effects of domestic containment measures has been a decline in external demand. Particularly hit are tourism-dependent countries due to a decline in travel and oil exporters as commodity prices plummeted. With global trade and oil prices projected to drop by more than 10% and 40% respectively, emerging market economies are likely to face an uphill battle. This is even as capital outflows have stabilized and sovereign spreads retreated compared to the sharply volatile market conditions seen in March.

Not surprisingly, the IMF’s latest June World Economic Outlook Update projects emerging market economies to shrink by 3.2% this year—the largest drop for this group on record. By way of comparison, in the global financial crisis, growth for the group took a significant hit but still bottomed out at a positive 2.6% in 2009.

A decisive policy response

The crisis would have been worse still without the extraordinary policy support. For sure, decisive policy actions in advanced economies led to a turnaround in market conditions that allowed emerging market economies to resume external financing efforts in April and May, which contributed to record levels of bond issuance so far this year—to the tune of $124 billion as of the end of June. But not all countries have seen improved fortunes. Fuel exporters, frontier countries and those with high debt are experiencing a greater financial shock that pushed up borrowing costs, or even worse, denied them further access to markets.

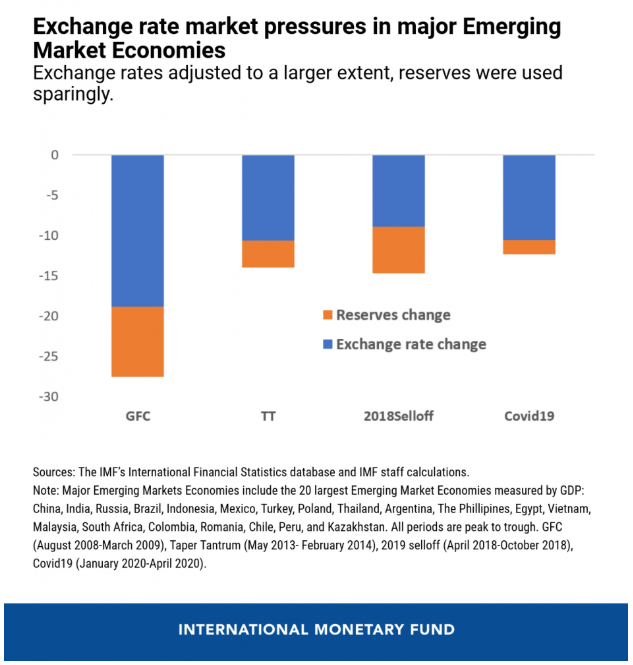

Policy support by advanced economies provided emerging market economy policymakers with wiggle room to soften the economic blow. Unlike previous episodes, where emerging market economies tended to tighten policy to avoid rapid capital outflows and the inflationary effect of exchange rate depreciations, the current crisis has seen emerging market economies’ policy reaction more in line with that of advanced economies (see the IMF’s policy tracker). Most emerging market economies used reserve buffers more sparingly and allowed exchange rates to adjust to a larger extent, while many countries injected liquidity as needed to ensure market functioning. Countries like Poland and Indonesia further eased macroprudential policies to support credit.

Like their more advanced peers, many emerging market economies, including Thailand, Mexico, and South Africa, eased monetary policy during this cycle. In a few cases, limited room to cut policy rates further and distressed market conditions induced use of unconventional monetary policy measures for the first time. These included purchases of government and corporate bonds, although the amounts remain modest so far compared to the larger advanced economies. Conversely, the use of capital flow measures to deter capital outflows has been quite limited so far.

A similar picture is evident on the fiscal policy front. Emerging market economies have relaxed their fiscal stance in an attempt to tackle the health crisis, support people and firms, and offset the economic shocks. While more modest than that of advanced economies, these efforts were significantly greater than during the global financial crisis.

From conventional to unorthodox policies

Despite these actions, the outlook for emerging market economies remains clouded by considerable uncertainty. Chief among many risks is the possibility of a more prolonged health crisis, which would hurt more lives and could have dire economic consequences. Confronting a more severe downturn will be challenging because most emerging markets entered the current crisis with limited room for traditional fiscal, monetary, and external policy support. And much policy room has already been used up by actions undertaken in recent months.

Dwindling policy space may force some countries to take recourse to more unorthodox measures. From price controls and trade restrictions to more unconventional monetary policy and steps to ease credit and financial regulation. Some of these measures—which are also being implemented by some advanced and low-income economies—have significant costs, particularly if used intensively. Export restrictions, for example, could seriously distort the multilateral trading system, and price controls hamper the flow of goods to those who need it most.

The effectiveness of other unorthodox policies will depend on the credibility of the institutions; for instance, whether a country has a track record of credible monetary policy. As we navigate the contours of the ongoing crisis, little time is available to properly analyze the risks and benefits of these actions in a careful manner.

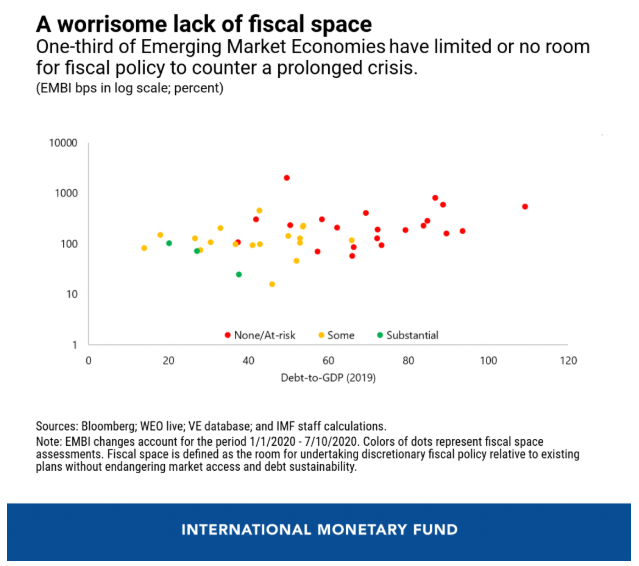

Not out of the woods yet

Emerging market economies have navigated the first phase of the crisis relatively well, but the next phase could be much more challenging. The virus remains present, financial conditions are still fragile, and policy space is lower, particularly for those countries facing high risks to debt sustainability. The latter group of countries is quite large. Approximately one third of all emerging market economies entered the crisis with high-debt levels and are assessed to have no space for undertaking additional discretionary fiscal policy, or as having that space significantly at risk.

As the crisis develops, there is also a high risk that liquidity problems morph into solvency concerns. Besides sovereign debt stresses, corporate default risks are alarmingly high in a number of emerging market economies. Moreover, the crisis has hit poor people much harder, and this increase in inequality will amplify policy challenge in many countries.

The complexity of these challenges requires a multi-faceted policy response. First, domestic policies will need to be designed to allow for more durable and inclusive growth. Second, increased support from bilateral and multilateral lenders will be required where market access remains precarious. So far, the IMF has provided 22 emerging market economies with approximately $72 billion (SDR 52 billion) in financial assistance. Finally, for countries where debts prove to be unsustainable, timely and durable resolution of these problems will be needed, by seeking broad burden sharing across creditors including in the private sector. The latter two policy angles will be analyzed in two subsequent blogs on IMF lending and the IMF’s role in debt resolution.

Reprinted with permission from IMFBlog.

Hurry—Course Starts Soon!

Get the know how to break through the challenges of global credit. The completely revised and updated International Credit & Risk Management course features:

- Practical, fresh content designed for global credit practitioners

- Integrated discussions with other credit professionals worldwide

- Online networking to facilitate learning and the exchange of ideas

- integrated webcasts led by experts and practitioners

- Regular comprehension checks

- Instructor guidance and insight

After successful completion of the course and final exam, you will receive the FCIB’s Certified International Credit Professional (CICP) designation. For more information and to register, please visit the FCIB website.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations