Week in Review

Week in Review

What We're Reading:

June 15, 2020

The looming bank collapse. The U.S. financial system could be on the cusp of calamity. This time, we might not be able to save it. (The Atlantic)

Industry players call for a harmonized view of credit insurance during COVID-19. As policymakers pull out all the stops to prevent economic collapse in the face of the COVID-19 pandemic, supporting trade credit insurance to facilitate bank lending has become of prime importance. (Global Trade Review)

Virus pummels global economy, jobs—even without second wave. The virus crisis has triggered the worst global recession in nearly a century—and the pain is not over yet even if there is no second wave of infections, an international economic report warned. (Business Mirror)

North Korea may have benefited from the pandemic after all. With Washington distracted by COVID-19, the crisis allowed Beijing to cooperate with Pyongyang without usual censure. (Interpreter)

Two years after Singapore Summit, U.S.-North Korea relations back to square one.Two years after the first-ever face-to-face between leaders of the U.S. and North Korea—hailed by President Trump as a major breakthrough in relations—Pyongyang on June 12 labeled the historic summit an "empty promise" and accused Washington of hypocrisy. (NPR)

Huawei’s patents on 5G means U.S. will pay despite Trump’s ban. Huawei Technologies Co. owns the most patents on next-generation 5G technology, ensuring the Chinese company will get paid despite Trump administration efforts to erase it from the supply chain, according to a new study. (Business Mirror)

Implementation a “big problem” for any Brexit deal, U.K. inquiry told. U.K. businesses are again raising concerns over the lack of progress in Brexit negotiations—but even if a free trade agreement (FTA) is agreed within the next six months, the government faces crucial questions over how it would be implemented in practice. (Global Trade Review)

Which is the most expensive country in the world? In 2017, Egypt’s average income per person was about $2,200. In Japan, it was about $31,200, almost 14 times more. So, can the average Japanese person actually buy 14 times more stuff than the average Egyptian? Not even close, according to the World Bank’s recently released cost of goods and services statistics. (Quartz)

U.S. manufacturers struggle to keep workers in face of weak demand. Demand in many industrial sectors, from oil and gas to construction equipment, remains depressed, and that underscores the subdued response key policymakers have shown over the big upsurge in hiring in May. (HSN)

Can U.S. end China’s control of the global supply chain? The trade war amplified calls in the U.S. and elsewhere for reducing dependence on China for strategic goods. Now, the pandemic has politicians vowing to take action. (Business Mirror)

France rolls out export credit support to ailing aviation sector after growing calls for ECA backing.After months of appeals for export credit agency (ECA) support to return to the flagging aviation sector, the French government has announced it will boost state guarantees for airline exports. (GTR)

World Bank: Recession is the deepest in decades. A new World Bank report warns that the pandemic has plunged the global economy into a deep recession of historic proportions, and the recovery outlook is grim, particularly for developing countries. (NPR )

Optimism Within the Ranks of the Economists

Chris Kuehl, Ph.D., NACM Economist

The surveys of economists pulled together by The Wall Street Journal are usually pretty accurate and indicative of the thinking within the profession, or at least part of it. Generally speaking, the economists that participate in these surveys are best described as “working economists” as opposed to academics or those employed by the government. This simply means that they are employed by banks, investment firms, corporations and think tanks. There are those that straddle the worlds of academe and business as well. The point is they generally deal with economic issues in a very pragmatic way.

The latest survey of the economists reveals a somewhat surprising level of optimism regarding the performance of the economy through the remainder of the year and into next. Fully two-thirds of those polled (68.4%) hold that the economy will be in real recovery by the third quarter and that this rebound will extend into the fourth and further into 2021. The assertion is that most of the lockdown will have been lifted by the end of the summer. Some semblance of normal will have been established by the end of the year.

There have been some changes to their assessment from the last time they were polled and there are still a set of assumptions that will matter. The expectation of a sharp V recovery has been somewhat tempered. Now, the sense is that recovery will be slower than originally thought—more of a “swoosh” or a U. The decline in GDP for the year will be close to 6%. It will take a while to get these numbers back to some sense of respectability.

The assumptions upon which this assessment rests include a recovery in consumer behavior, a resumption of the global supply chain and consistent policies among the states as far as reopening the economy. All three of these assumptions are risky. The consumer seems ready to resume old habits, but it has to be noted that some 40 million people are unable to do so as they do not have a job. The supply chain is still very shaky and will not fully rebound until the rest of the world gets a handle on the crisis. These analysts are well aware that COVID-19 cases are just starting to crest in most of the developing world. It is the third assumption that will matter most. The patchwork approach to opening the economy is chaotic as businesses do not have the ability to do national planning. They are operating under different restrictions in every state. That is extremely complex and costly.

17

11am ET

Speaker: Kristen Pope, Gates Machine Tool Repair, Inc.

Duration: 60 minutes

18

3pm ET

22

3pm ET

Speaker: Emory Potter, Esq., Hays & Potter, LLP

Duration: 60 minutes

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

24

11am ET

Asia braces for insolvency

storm amid COVID-19 fallout

As global recession looms, Asian businesses tighten their credit management processes in a bid to minimize bad debt risks.

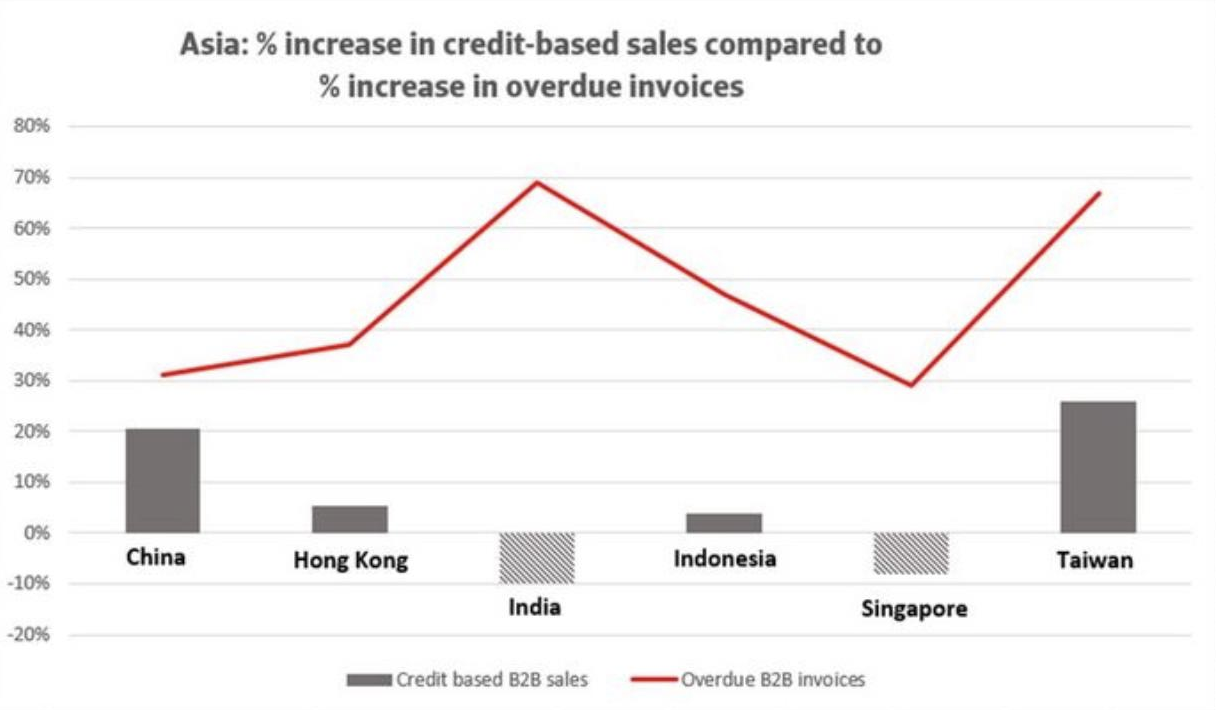

Atradius Payment Practices Barometer highlights importance of risk management to Asian businesses. COVID-19 containment measures around the world have impacted both national and international supply chains and trade. Responses to the 2020 Atradius Payment Practices Barometer (PPB) survey in Asia suggest the resulting delays in payments are largely being financed by suppliers as the use of trade credit in most markets surveyed, and along with it, payment delays, have climbed. Compared to last year’s survey, in four of the markets surveyed, credit-based sales grew an average of 14% while at the same time the value of overdue invoices spiked 56%. In two markets credit sales fell, but overdue invoices still spiked an average 49%. India’s decline in credit use might even be the result of its dramatic rise in overdues.

Sample: businesses interviewed (active on domestic and export markets)

Source: Atradius Payment Practices Barometer Asia - June 2020

Although the Atradius PPB survey indicates a varied approach to trade credit across the region with marked differences between markets, it also reveals a consistent commitment to credit control. Without exception, businesses in every market expressed their dedication to credit management processes, with many seeking to increase their focus on minimizing risk.

Interestingly, despite the gloomy outlook, most of the businesses surveyed across Asia expressed optimism that government support or bank finance would be available to help support their industries and the economy. While this may be true to a certain extent, the results of the PPB survey indicate that many buyers rely on trade credit from their suppliers to finance their operations, and extend that even more by delaying payment of invoices.

With the global economy dipping into recession payment default risks are growing. We expect bad debts and insolvencies to continue rising into 2021. Suppliers need to manage reduced demand and financial stress. Minimizing these burdens with thorough credit worthiness assessments and ensuring adequate financial sustainability will be key to survival for many of these businesses.

This survey was carried out in March 2020, at a relatively early stage in the Covid-19 pandemic and ensuing economic crisis. It represents an important snapshot of business confidence in Q1 2020. Looking forward, it will provide valuable information about the developing payment practices for this key economic region during the early days of the unfolding crisis.

The 2020 Atradius Payment Practices Barometer for Asia was conducted in China, Hong Kong, India, Indonesia, Singapore, Taiwan, and the United Arab Emirates (UAE), this latter featured in the survey for the first time. The reports can be accessed via the Publications section.

Why Cash Management Is Driving Corporate’s Digital Payments Transformation

PYMNTS

Corporates are diving into an unprecedented opportunity to digitize and modernize. Whether it’s the result of necessity in a remote working environment or of a slowdown in business that frees up time to focus on the transformation, organizations are quickly flocking to their banks and FinTech partners to finally do away with paper in the back office.

Now that businesses have gotten a taste of what it means to automate workflows like invoicing, accounts receivable (AR) and cash management, they’re likely never turning back.

But in a recent discussion with Karen Webster, Sandra Blair, executive vice president of MerchantE; Keith Smith, founder and CEO of Payouts Network; and Walter Goracke, senior payments and billing analyst at travel marketing firm Sojern, noted that the digitization journey doesn’t stop once a business is able to send an invoice and receive payments electronically.

The digitization push is propelling the B2B ecosystem closer toward the eCommerce model — and while enabling B2B vendors to sell and collect payments online is a move in the right direction, the adjustments they’ll need to continue making will ripple throughout their approaches to managing cash inflows, outflows and application.

Noticeable Change

Overcoming the fear of change is not easy in any organization — particularly firms that have relied for years on paper and manual processes in financial departments like accounts receivable. Today, the firms that have begun the transformation are quickly recognizing its benefits.

“Those who have started down this path have realized there were a lot of inefficiencies,” said Blair. “They’re getting the taste of being able to get cash flow faster and give their supply chains choices in how to pay. I certainly don’t think it will go back to the way it was.”

On the front lines of implementing some of this digitization shift within Sojern, Goracke highlighted the importance of using technology to reduce days sales outstanding (DSO) — particularly in an industry that’s been hit as hard by the pandemic as the travel sector. This moment of a business slowdown, he said, presented the company with the opportunity to dive headfirst into a modernization initiative, one he said can only be effective through a cohesive cash flow strategy.

That means not only digitizing invoices, but actually integrating payment capabilities on that electronic document, or within the company website itself.

For the customer, this means a seamless payment experience. But for accountants and AR departments, this integration strategy can go even further. Goracke pointed to the value of interconnected banking, invoicing, accounting, payments, cash management and other platforms for a holistic, unified view of financials.

Interconnected Finances

For a global company invoicing in multiple currencies and accepting payments across borders, obtaining that unified view is key to understanding financial positions. According to Smith, the ability to ensure that all back-end platforms and workflows can connect and communicate with each other tackles a key point of friction for today’s financial professionals.

Rather than toggling back and forth between banking portals and accounting apps, organizations can obtain insight into what Smith described as “dynamic capital management.”

Addressing the friction of payment acceptance is essential to digitizing finances, shortening DSO and migrating online, “but that’s not where it stops,” said Smith.

There is a bigger picture that organizations must examine as part of their transformations. Smith pointed to a range of questions businesses must ask themselves once the money flows in, including how to apply cash, which invoices to pay and when (and how) to pay employees same-day.

“How do I manage capital overall?” he said. “Dynamic capital management is the opportunity, and when it comes to B2B, that is really untapped.”

A Competitive Differentiator

Businesses’ digitization initiatives in areas like accounts receivable, accounts payable and accounting are sure to support the broader migration of the B2B ecosystem toward the eCommerce model. But as this shift occurs, organizations must keep in mind the broader impact on cash management.

Typically, change is slow. But in unprecedented times, organizations are acting quickly.

Blair noted that businesses are viewing functionality like eInvoicing and online payment acceptance as competitive differentiators.

“It gives a different level of service to customers, especially in the B2B space,” she said, adding that as more businesses see their own vendors offering these capabilities, they’ll want to follow suit. “I think a year from now, we’ll see a pretty deep adoption and [will] continue to see innovation.”

Indeed, said Smith, the adoption curve has both accelerated and been shortened as a result of the worldwide disruption of the pandemic. Taking the digital leap won’t be a silver bullet to solve all of a company’s financial hurdles — and indeed, it can even introduce some new challenges for cash management strategies. But organizations have already proven to be resilient and more willing than ever to tackle these obstacles head-on.

“Even though we’re living in tough times right now, globally, this has actually helped businesses understand their challenges,” he said.

Reprinted with permission from PYMNTS.com.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations