Week in Review

Week in Review

What We're Reading:

May 25, 2020

Brazil readies to become No. 2 most-infected coronavirus nation. Brazil has climbed up the charts in the last week, beating every country other than Russia and the U.S. The country is living its worse public health crisis since the Zika virus outbreak in 2015. (Forbes)

EU says Britain not automatically entitled to any trade benefits.The European Union’s Brexit negotiator said on May 20 that Britain was not automatically entitled to any benefits that the bloc had previously granted to other partners on trade. (HSN)

EU meat and cars will face tariffs in no-deal scenario, warns U.K. The U.K. will slap tariffs on EU meat and cars from January 2021 if a new trade agreement with the bloc is not finalized by the end of the year, Prime Minister Boris Johnson’s government said on May 19 (EurActiv)

It’s too late for the U.S. to get rid of Chinese stocks. Ringing the ceremonial bell on an American stock exchange is a career highlight for many Chinese entrepreneurs. But those stocks haven’t always panned out for U.S. investors, and fewer of them may be listed on America’s iconic markets in the future. (Quartz)

North American ports largely shielded from coronavirus fallout. North American ports generally have numerous safeguards and a strong financial cushion on their side in being able to weather the sizable ripple effect of the coronavirus pandemic. (Fitch)

Japan sinks into recession with steeper fall looming. Japan’s economy sank last quarter into a recession that’s likely to deepen further as households limit spending to essentials and companies cut investment, production and hiring to stay afloat amid the coronavirus pandemic. (Business Mirror)

Stale beer turned into animal feed and distance drinking: Irish pubs in the age of coronavirus. The pandemic has been brutal for the world’s pubs, which were shut quickly due to social distancing. This has been particularly painful in Ireland, where they are critical to the country’s economic and social life. (DW)

Spain ready to approve new credit lines to help companies cope with COVID-19. Spain said on May 19 it would approve new liquidity lifelines to help companies and households weather the coronavirus crisis after releasing another tranche of the 100 billion euros (89 billion pounds) of state-backed credit announced in March. (HSN)

Trade in a galaxy far, far away. As a general matter, items launched into space are considered to be in international commerce. U.S. Customs, for example, deems the launch of an article into space as an “export” under its regulations. (Global Trade Magazine)

India’s economic momentum lags most emerging market peers. As India relaxes one of the most stringent economic lockdowns in the world, the economic damage is becoming increasingly apparent. After a sharp slide in the emerging market league tables in March, India continued to languish at the bottom of the heap in April. (HSN)

When black swans turn green. The coronavirus (COVID-19) is the latest black swan to blight the financial markets. But it’s not only black swans that treasurers need to recognize the importance of— grey and green swans are equally deserving of attention. (TMI)

U.S. Senate approves bill to delist Chinese firms from exchanges. The Senate overwhelmingly approved legislation on May 20 that could lead to Chinese companies such as Alibaba Group Holding Ltd. and Baidu Inc. being barred from listing on U.S. stock exchanges amid increasingly tense relations between the world’s two largest economies. (Business Mirror)

The economy is finally recovering from the coronavirus, but the ill-effects aren’t going away for a long time. If the end of the great toilet paper shortage is any indication, the U.S. economy has already bottomed out and a fragile recovery is underway. (HSN)

Global Reaction to Virus

Chris Kuehl, Ph.D., NACM Economist

The pressure that has been mounting in the U.S. to reopen business is nothing compared with the pressure applied to many other nations. The emerging market states, such as India, Brazil, Indonesia, South Africa, Mexico and others have been slammed as hard as any nation when it comes to their economies. Add in nations, such as Russia and China, where they also face massive economic issues that they are fundamentally unprepared to deal with.

For all the damage that has been inflicted on the U.S. and European economies, these are developed nations that have been able to find ways to partially compensate for the impact of the shutdown. Granted, the U.S., EU nations, Japan and other wealthier states have had to go into significant debt and are running very high deficits as they cope with the disruption, but the point is they have the ability to do this. Most other nations do not have the options that wealthier states have.

In almost every case, these less developed nations are still facing rising infection rates and increased numbers of fatalities related to the outbreak. Brazil has seen 16,000 deaths and has one of the highest rates of infection in Latin America. The position taken by President Jair Bolsonaro has earned him a place in the “Ostrich Alliance” as he has asserted that the disease is not real and deaths are from panic. This has resulted in the resignation of all of his health officials. He joins such luminaries as Daniel Ortega of Nicaragua, Aleksander Lukashenko of Belarus and Gurbanguly Berdymukhamedov of Turkmenistan. All of these leaders have chosen to ignore the threat and all of these nations now have very high rates of infection.

As serious as the viral threat has become, the economic threat has become even more intense. These are states whose economies are not in great shape under normal conditions. A shutdown threatens to push them over the edge into a depression that will last for years. These are nations that depend heavily on exports. The governments lack the ability to replace the income lost by people whose jobs have vanished. The unemployed person in the U.S. has options. Most will be able to survive this period of financial stress. The person whose livelihood is interrupted in India, Brazil or Russia is going to be in crisis immediately and will be facing deprivation within days.

This has led these governments to end the containment efforts even as the virus spreads and there are rising numbers of fatalities. This has long-term implications for their economies as well. As the developed nations start to get a handle on the virus, there will be a strong desire to keep that second wave from devastating a weak economy that is just starting to rebound. That will provide a very strong incentive to block contact with these developing nations. There will be restrictions on travel to and from these nations and stricter limits on migration between nations. This will combine with the impact of the virus to stunt economic recovery even more.

17

11am ET

Speaker: Kristen Pope, Gates Machine Tool Repair, Inc.

Duration: 60 minutes

18

3pm ET

22

3pm ET

Speaker: Emory Potter, Esq., Hays & Potter, LLP

Duration: 60 minutes

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

24

11am ET

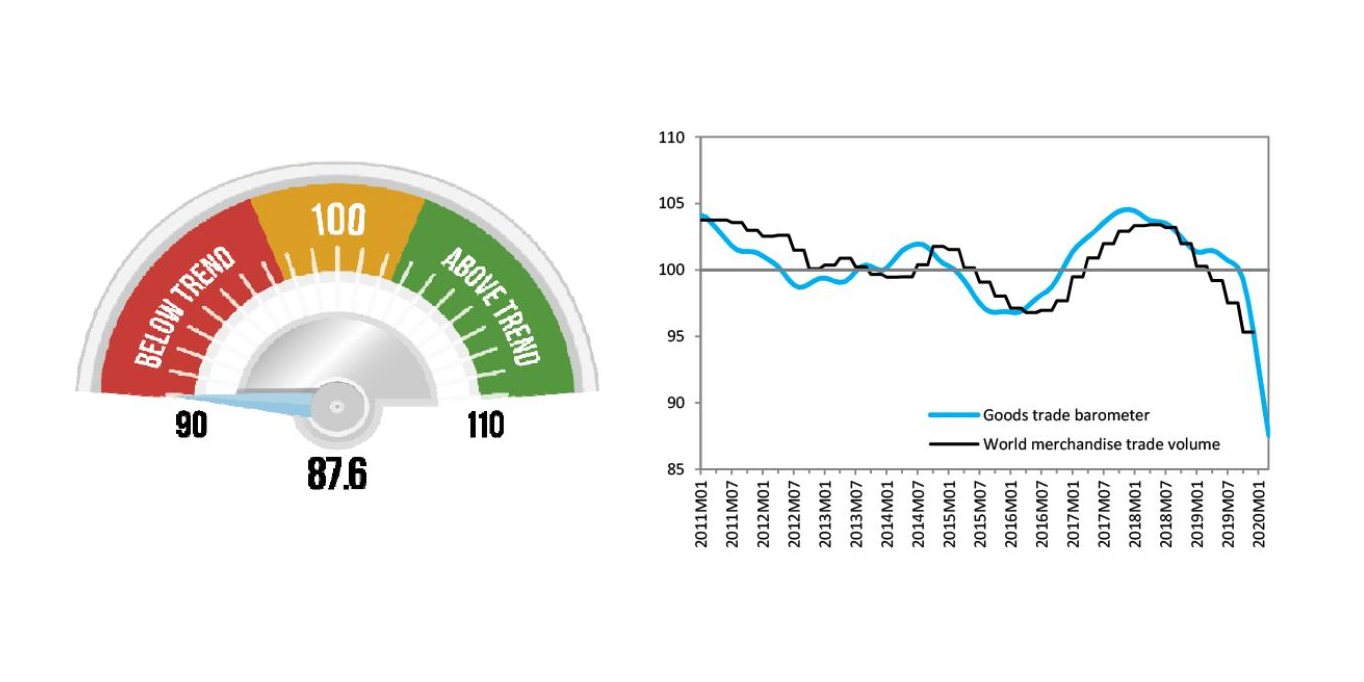

WTO Goods Barometer Flashes Red as

COVID-19 Disrupts World Trade

The volume of world merchandise trade is likely to fall precipitously in the first half of 2020 as the COVID-19 pandemic disrupts the global economy, according to the WTO Goods Trade Barometer released on 20 May. The index currently stands at 87.6, far below the baseline value of 100, suggesting a sharp contraction in world trade extending into the second quarter. This is the lowest value on record since the indicator was launched in July 2016.

The Goods Trade Barometer provides real-time information on the trajectory of world merchandise trade relative to recent trends. The current reading captures the initial phases of the COVID-19 outbreak, and shows no sign of the trade decline bottoming out yet. This measure is consistent with the WTO's trade forecast issued on 8 April 2020, which estimated that world merchandise trade could decline by between 13% and 32% in 2020, depending on the duration of the pandemic and the effectiveness of policy responses.

All of the barometer's component indices are currently well below trend. The automotive products index (79.7) was weakest of all, due to collapsing car production and sales in major economies. The sharp decline in the forward-looking export orders index (83.3) suggests that trade weakness will persist in the short-run. Declines in the container shipping (88.5) and air freight (88.0) indices reflect weak demand for traded goods as well as supply-side constraints arising from efforts to suppress COVID-19. Only the indices for electronic components (94.0) and agricultural raw materials (95.7) show signs of stability, although they too remain below trend.

Trade had already been slowing in 2019 before the pandemic, weighed down by persistent trade tensions and weakening economic growth. WTO trade statistics show that the volume of world merchandise trade shrank by 0.1% in 2019, marking the first annual decline since 2009, during the global financial crisis. Trade was relatively weak in the final quarter of 2019, but this is unlikely to have been influenced by COVID-19, which was first detected very late in the year.

Like its counterpart for services, the WTO Goods Trade Barometer aims to gauge momentum and identify turning points in global trade growth. As such, it complements trade statistics and forecasts from the WTO and other organizations. Readings of 100 indicate growth in line with medium-term trends; readings greater than 100 suggest above-trend growth, while those below 100 indicate below-trend growth.

Can the Pandemic Be a Catalyst

for Global Trade Digitization?

CTM file

The paper-driven nature of trade processes has long been a frustration to corporates that have been successfully automating various other areas of the treasury and finance functions. Paper-based processes are time consuming, inefficient and costly.

Writing in South Africa's FAnews, Vinod Madhavan, head of Trade for Standard Bank Group, says that in the current environment of COVID-19 related lockdowns, many of these processes that work to facilitate cross-border and international trade have been impacted and may temporarily have been rendered obsolete to a certain degree.

"Existing technological solutions are available for logistics and trade," Madhavan says. "Rapidly implementing them out of necessity from the current environment will be an excellent step in the right direction for trade digitization. This however, requires a collaborative approach between governments and industries to remove barriers by amending and aligning regulatory frameworks."

This is a point well made, as the acceptance of digital trade documents can vary considerably from country to country, particularly if you look at an instrument like the electronic bill of lading.

Looking specifically at trade in Africa, Madhavan writes that those who were previously hesitant to accept an electronic bill of lading, for example, are now ready to embrace and adopt the technology for its benefits. "The impetus that the virus has brought to trade digitization should therefore not be underestimated," Madhavan says.

In many countries, temporary concessions have been made to digital trade processes in order to prevent shipments grinding to halt.

"Standard Bank is currently in conversations with multiple regulators, exploring how we could go about amending regulations, even though it may be a temporary dispensation for the duration of COVID-19, to facilitate digital trade," Madhavan writes. "These engagements are happening in multiple markets across our network. With the challenges brought about by the virus outbreak, there is now an exciting dialogue in markets that will help to influence some of the necessary changes."

Temporary changes in regulation to permit additional digital solutions are great if they do help support the global trade network during this time of extraordinary stress. Hopefully the practical demonstration of the benefits a digitized trade network can bring will see such temporary changes become permanent.

Digitization Pushing Forward

One thing for sure is the innovation happening on the digital side of trade has been carrying on at a pace. Most recently on CTMfile we covered the successful transaction between Baosteel and Rio Tinto on the Contour open trade finance network, and there have been plenty of other examples this year of pilot transactions and industry partnerships, all designed to make the process of trade easier for corporates.

This week it has also been confirmed that IBM has enhanced its partnership with the we.trade digital trade finance network. The collaboration is designed to enable network enhancements and accelerate the global commercialization of the platform. IBM has also become a new shareholder along with the 12 existing bank shareholders.

Already one of the largest blockchain-enabled trade networks in production, we.trade is designed to improve the trade finance lending process, supporting companies as they grow their business and expand into new markets. Over the last few months, we.trade has seen momentum continue to build as companies move to replace paper-based trade finance processes with a digitized solution.

From July 2020, we.trade says it will extend services to additional banks and clients across Europe before expanding the network globally, starting with Asia. At the same time, work will continue to help enable the platform to interoperate with other distributed ledger-based trade finance networks, such as the work already completed with Hong Kong-based eTradeConnect, a blockchain-based trade finance platform formed by 12 Asian banks.

The press release that announced the news makes the point that, with disruption in many services that support traditional trade finance methods, there's now an added incentive for international trade to go digital, including embracing platforms which offer digitized versions of once manual business processes to ensure signatures, contracts and trade financing agreements can be virtually linked.

Built on the latest version of the IBM Blockchain Platform, we.trade is backed by banks including CaixaBank, Deutsche Bank, Erste Group, HSBC, KBC, Nordea, Rabobank, Santander, Société Générale, UBS and UniCredit. It is designed to connect buyers, sellers, banks, insurers and logistics organizations in a network that simplifies cross-border trading.

The we.trade network helps automate many of the processes around trade finance, as well as provide traders with access to insurance, credit rating and logistics services. Once on the network, traders can initiate orders, manage the order-to-payment process and attain financing. They can also search the network to discover new trading partners.

A recent IBM Institute for Business Value survey of more than 1,000 organizations globally found respondents said that accessing new markets is among the top motivating factors to join an existing blockchain network such as we.trade. Meanwhile 64% of respondents indicated that reducing friction in current processes and services was a top reason for using blockchain technology to augment existing trade digitization investments.

"The strategic direction for we.trade and IBM is focused on driving growth and transparency across the entire trade ecosystem, collaborating to enhance the network effect of blockchain, and expanding access to trade finance and other services to the market place," said Jason Kelley, GM Blockchain Services, IBM. "Innovative technology and new pricing structures will help more banks align to internal production controls using their choice of cloud services. Meanwhile we.trade aims to help banks create new trusted trade corridors and expand markets by interconnecting with other regional trade services platforms."

Reprinted with permission from CTMfile.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations