Week in Review

Week in Review

What We're Reading:

May 18, 2020

Britain remains optimistic about EU trade deal. A senior British official involved in the negotiations with the European Union about a trade deal said on May 15, he remains optimistic about the chances of a deal being reached although significant differences remain. (Rueters)

Germany plunges into recession with biggest slump in decade.The German economy shrank 2.2% in the first quarter, the most in more than a decade, offering an early flavor of the damage from the coronavirus outbreak. (Bloomberg)

U.S.-China tensions rise as Trump administration moves to cut Huawei off from global chip suppliers. The U.S. Commerce Department said it was amending an export rule to “strategically target Huawei’s acquisition of semiconductors that are the direct product of certain U.S. software and technology.” (CNBC)

UN forecasts pandemic to shrink world economy by 3.2% in 2020. The United Nations forecast on May 13 that the COVID-19 pandemic will shrink the world economy by 3.2% this year, the sharpest contraction since the Great Depression in the 1930s. (Business Mirror)

England tiptoes out of lockdown as economy dives. England tentatively began easing its coronavirus lockdown on May 13, with some people who cannot do their jobs at home urged to return to work, as stark economic data showed the disastrous impact of the pandemic. (HSN)

In beef over barley, Chinese economic coercion cuts against the grain. Beijing has become adept at punishing countries with legally “dressed up” informal economic sanctions. (Interpreter)

EU seeks trade truce with U.S. amid virus crisis. The EU’s top trade official hopes the economic fallout of the coronavirus pandemic will spur efforts to heal U.S. trade ties, bogged down in a tit-for-tat tariff feud. (EurActiv)

How COVID-19 is shifting human behavior around the world. d. Understanding to what degree the virus has changed how we buy, sell and communicate is essential to all businesses—from the largest corporation to the self-employed. (Bloomberg)

Second waves are plaguing Asia’s coronavirus recovery. After containing their outbreaks through measures from strict lockdowns to rapid testing regimes, the Asian economies that have seen some of the most success in quelling the coronavirus—Hong Kong, South Korea and China—are now facing resurgences that underscore how it may be nearly impossible to eradicate it.(Business Mirror)

Virus compounds U.S. dollar liquidity strains for emerging markets The U.S. dollar has been the lifeblood of international trade for decades, but fears are emerging that coronavirus-induced “strains” in dollar liquidity could hit businesses in emerging markets particularly hard. (Global Trade Review)

Divisions open over “lower agriculture standards” in future U.S.-U.K. pact. Divisions have opened within the U.K. government following reports that Boris Johnson’s administration is preparing to offer increased access to the U.K. market for U.S. agriculture exports and possibly lower the bar on environmental and health standards. (EurActiv)

Nigeria’s immediate future looks bleak without oil revenue—it doesn’t have to be that way. Amid a crippling coronavirus pandemic, demand for oil has crashed as global economies have been shut down. The resulting steep drop in oil prices mean Nigeria is back in painfully familiar territory: shorn of revenue and on the brink of its second recession in four years. (Quartz)

How to travel in Europe in the era of coronavirus. The European Commission unveiled a series of measures aimed at ensuring people can start travelling safely across the continent again as governments try to revive tourism and airline industries brought to a halt by the coronavirus. (HSN)

Most Vulnerable Nations Now

Getting Hit the Hardest

Chris Kuehl, Ph.D., NACM Economist

The COVID-19 virus took the world by surprise, and it continues to do so. It is not as if the world had never dealt with a viral outbreak before; various versions of a coronavirus have been around for decades.

The problem from the start has been that COVID-19 is especially virulent—rivaled only by the measles in terms of its contagion. It is also a disease that very often leaves people with mild symptoms or none at all. It takes two weeks to incubate, so millions of people become unwitting carriers and infect millions more. It has progressed from its epicenter in China to the rest of Asia and then to Europe and North America. The virus impact has started to fade perceptibly in Asia and Europe. It shows signs of abating in the U.S., but that is not the case in Latin America, Africa, South Asia and in other parts of the developing world. Latin America seems to be hitting its worst period as the U.S. and other nations have started to see some progress.

The same patterns are emerging in Latin America as have appeared in other parts of the world. It spreads faster in urban areas with tightly packed populations than in the countryside. It has affected the elderly and those that have preexisting medical conditions. The virus has exploded through these nations because there is a great deal of congestion in the cities, there is a large elderly population and there is a very large number of people with compromised health. The death toll has been high and infection rates are high as well.

To make matters worse, these nations lack even a fraction of the resources available in Europe, the U.S. or even China. The worry in the U.S. and Europe was that hospitals would be overwhelmed, but that is a given in Latin America. The medical community was in crisis from the very start. There is not enough of anything—respirators are rare and even simple masks are impossible to obtain. The reaction of the governments in the region often border on the criminal. Both Brazil’s Jair Bolsonaro and Nicaragua’s Daniel Ortega have been dubbed charter members of the “Ostrich Alliance” because they have ignored the threat altogether. There has been no policy applied in Brazil or Nicaragua as far as isolation or lockdown. These leaders have even been denying that anybody has died from the disease. Other leaders in the region have not been in denial, but they have been unable to do much to protect the population. Their efforts at containment have been stunningly ineffectual. The majority of the population remains unaware of what is expected of them. This has especially been the case in the poor neighborhoods that crowd the larger cities.

Many of the nations in the region have not engaged in lockdowns, or at least not effective ones, so this has not affected their economies to the degree it has affected those in Asia, Europe and the U.S. The economic impact has been just as devastating but indirect. The business community is losing its workforce as people become sick and others elect to self-quarantine. These are states that depend on exports to survive; the slowdown in the global economy has been severe. The levels of exports have tumbled by as much as 70%. That has left most of these nations with savaged budgets.

If this region is to survive the viral outbreak, it will be due to the impact of herd immunity. That will take considerable time and will require the infection of around 70% of the population. These nations have long been the hardest hit when it comes to disease outbreaks. There are many more deaths from the flu in a given year than in any of the developed nations.

24

11am ET

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute

29

3pm ET

7

11am ET

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

Author: Clay Scroggins

Duration: 90 minutes | Complimentary

8

11am ET

Japan: Abe Struggling in the Home Stretch

PRS Group

Prime Minister Shinzo Abe had hoped to burnish his political legacy during the remainder of his final term in office by implementing crucial structural reforms, amending Japan’s pacifist constitution and successful hosting the 2020 Olympic Games this summer. Instead, he has encountered strong political headwinds, the result of a combination of political obstacles (in particular, the lack of supermajority backing for changes to Article 9), an economic setback arising in part from the long-delayed implementation of a planned increase in the VAT from 8% to 10%, and the COVID-19 pandemic, which has forced the postponement of the Olympics until 2021, and is expected to push the already wobbly economy into recession this year.

In a best-case scenario, the economy will rebound quickly and the Summer Games will be held in mid-2021. But nothing can be taken for granted at this point. The timing and strength of a recovery will depend in part on purely epidemiological factors, such as whether immunity is gained after contracting the virus, and how quickly a vaccine can be developed, tested and manufactured. In any case, the health crisis will necessarily remain the government’s top priority for the foreseeable future, necessitating delays in action on the reform agenda and other domestic and foreign policy matters.

Statistics on the spread of novel coronavirus suggest that Japan has managed the crisis better than many other countries, but the number of cases was rising at a steeper angle by the end of March, and the country’s very high proportion of elderly creates the potential for health care services to be overwhelmed if infections increase rapidly. Widespread perceptions that Abe was slow to respond to the crisis has sharpened the focus on who might succeed him. Former LDP Secretary-General Shigeru Ishiba and Environment Minister Shinjiro Koizumi are the current front-runners, and the LDP would likely coast to victory with either at the helm, if only because of the lack of credible alternatives to the governing party.

The analysis above is taken from the April 2020 Political Risk Letter (PRL). The best-in-class monthly newsletter, written by the PRS Group, provides concise, easy-to-digest briefs on up to 10 countries, with additional recaps updating prior month’s reports. Each month’s Political and Economic Forecasts Table covers 100 countries, with 18-month and five-year forecasts for KPIs such as turmoil, financial transfer and export market risk. It also includes country rating changes, providing an excellent method of tracking ratings and risk for the countries where credit professionals do business. FCIB and NACM members receive a 10% discount on PRS Country Reports and the PRL by subscribing through FCIB.

Tracking Trade During the COVID-19 Pandemic

Diego Cerdeiro, Andras Komaromi, Yang Liu and Mamoon Saeed, IMF

With the current fast-changing developments, policymakers need to know what is happening to the economy in real time, but they often must settle for data telling them what happened many weeks ago. And international trade, which links countries through a complex web of supply chains, is an area where timely information is especially valuable from a global perspective.

Most trade takes place by sea, and—for navigational safety purposes—virtually all cargo ships report their position, speed and other information many times a day. A new IMF methodology using these data can help better inform us how international trade is affected by the COVID-19 pandemic.

Building on machine-learning techniques, we can provide better answers to simple questions, such as: How big is the drop in trade activity? Should it be attributed mostly to exports or to imports?

A new approach

Using over one billion messages from ships over a period of five years, the newly developed methodology closely replicates official trade statistics for many countries and for the world in aggregate. It is available at a daily frequency in real time, while official statistics are typically delayed by many weeks. At the global level, our indicators built from ships’ radio signals closely approximate monthly official trade statistics (with a correlation of nearly 0.9 in levels, and around 0.4 in quarter-on-quarter growth rates).

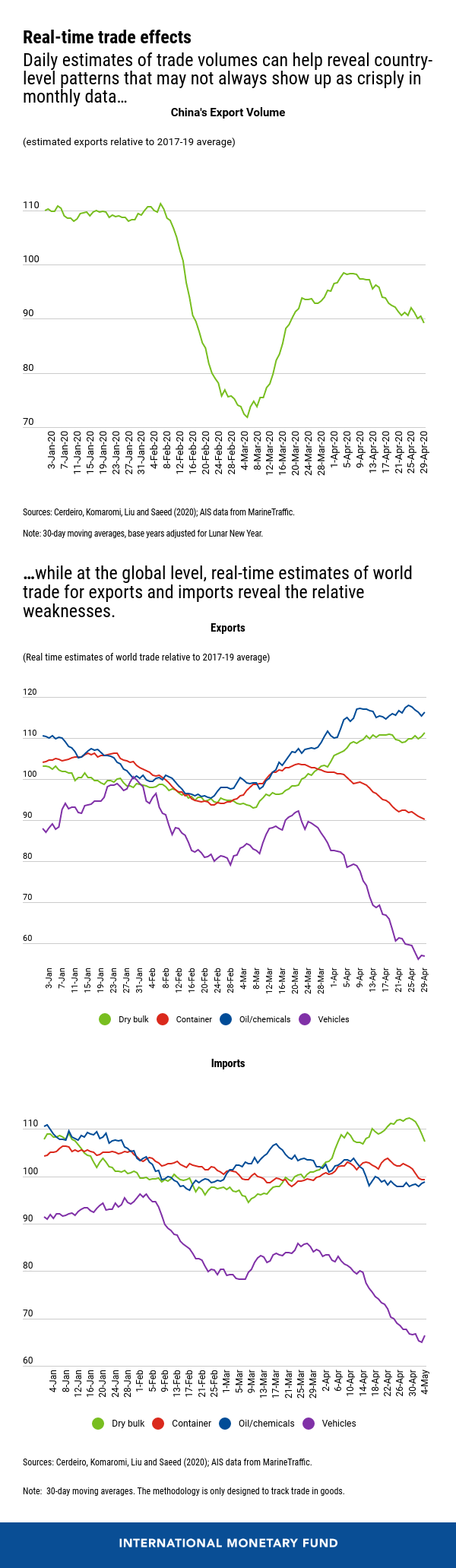

The top panel of our Chart of the Week shows a dramatic fall in Chinese exports in the wake of initial lockdown measures to contain the spread of the virus. Exports resumed in early to mid-March, though in late-April the recovery remained incomplete and showed renewed signs of weakness.

The lower two panels show that as China started reopening its economy, world exports initially recovered across the board. In the specific case of oil and related products, the recent export performance is especially strong but is not fully matched by an increase in world imports—in line with reports that crude oil is being stored at sea.

However, more recently, exports of less commoditized goods (those transported in containers, and finished vehicles) appear on course for a second dip. The situation is perhaps best reflected in the very weak readings for vehicle exports and imports as companies across the supply chain halt production and households postpone purchases of durable goods.

Daily monitoring of trade developments in real time will help provide a reliable early warning regarding potential economic contagion effects amid the pandemic.

Reprinted with permission from IMF Blog.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations