Week in Review

Global Roundup

October 7, 2019

Global trade to see weakest growth since Great Recession. Global trade is forecast to weaken this year to its slowest pace since the depths of the Great Recession due to the U.S.-China trade war, the World Trade Organization said Oct. 1. (AP News)

WTO allows U.S. to hit EU exports with record tariffs over Airbus case. The World Trade Organization (WTO) authorized the United States to impose tariffs on EU goods worth up to $7.5 billion, as a response to illegal subsidies given by European governments to aerospace giant Airbus. (EurActiv)

Peru's Vizcarra swore in a new cabinet as rebellion in Congress fizzled out. Peru’s centrist President Martin Vizcarra unveiled a new cabinet on Oct. 3 as a dramatic challenge to his leadership by dozens of dismissed lawmakers appeared to fizzle out. (Reuters)

Learn and grow professionally through open and frank discussions with other credit professionals who will share their best practices and lessons learned during this year’s FCIB's International Credit & Risk Management Summit in Hamburg, Germany.

Prepare yourself, your department and your company for the changes that come your way. From risk management to more efficient processes to career development, the Summit will help provide the answers.

| Register Now! |

The impact of U.S. sanctions on European goods: A closer look. Scotch single-malt whisky, German decals, Spanish stuffed olives, British cotton bed linen. These products have one thing in common: The U.S. plans to tax them at 25%. (EurActiv)

China investors face increasing sanctions risk. China-bound investors are facing risks beyond trade tariffs. Sanctions are now part of the process, with major shipping company COSCO getting sanctioned on Sept. 25 as part of Washington’s anti-Iran policies. (Forbes)

China to send its top trade negotiator to U.S. for talks. China’s top trade negotiator will lead an upcoming 13th round of talks aimed at resolving a trade war with the United States, a senior Chinese official said Sept. 29. (AP News)

First-ever drop in South Korean prices would flag deflation risk. South Korean consumer prices likely dropped for the first time ever in September, raising the specter of deflation for a nation struggling with falling exports and cooling household demand. (Business Mirror)

U.S. manufacturing survey shows worst reading in a decade. The ISM U.S. manufacturing purchasing managers’ index came in at 47.8% in September, the lowest since June 2009. This marks the second-consecutive month of contraction. (CNBC)

Dozens killed as uprising sweeps across Iraq. Dozens of demonstrators were killed across Iraq on Oct. 3 and Oct. 4 as violent protests against government corruption swelled into a mass spontaneous uprising sweeping much of the country, the worst unrest since the defeat of Islamic State. (Reuters)

Germany's outsized export dependence a growth risk. Germany's heavy dependence on exports means that the slump in world trade and manufacturing has taken a much heavier toll on growth than in other G7 economies. (Fitch)

Has move to impeach President Trump pushed aside the USMCA? The momentum to impeach in Washington, DC, is not only hurtling Congress and President Donald Trump toward a potential constitutional crisis, but the prospect of reaching a solution to the ongoing trade standoffs has dimmed considerably. (Global Trade Magazine)

Global Manufacturing Takes a Hit

Chris Kuehl, Ph.D., NACM Economist

Nothing in the latest set of readings from various purchasing managers’ indices (PMIs) should come as a shock. If anything is shocking about this latest data, it is how long it has taken for the trade wars to have this kind of influence.

In country after country, the PMI has been declining. In many cases, the decline has been precipitous. Even before the latest numbers, it had been noted that of the 15-largest export markets for the U.S. all but three had been sporting readings under the 50 line that separates expansion from contraction.

In every case, the slowdown in manufacturing has been attributed to trade issues. This is not just the tariff war between the U.S. and China, although that has arguably been the most significant contributor. The Brexit mess has been affecting Europe and the ongoing battle between Japan and South Korea has profoundly affected Asian trade. There are other rifts between other nations as well: Latin American states, the Middle East, South Asia and Africa. In general, there has been a global move against further globalization and toward nationalism and various degrees of isolationism.

PMI numbers for the U.S. declined for the second straight month. The combined reading now sits at 47.8 after being at 49.1 in August. The U.S. is anything but alone in this new misery. Most of the nations in the EU have seen numbers slip deeper into contraction territory with both Germany and France looking at numbers as bad as they have been in several years.

China saw decline and so did Japan along with South Korea and India. No major nation escaped the decline. Data from the CPB Netherlands Bureau for Economic Policy Research show that global trade flows fell by 0.8% in the second quarter and are down by 0.3% for the year. The forecasts for global growth have been reduced twice already this year by the International Monetary Fund, World Bank, Organization for Economic Cooperation and Development and others. The message is about as loud and clear as it gets. The global economy is in distress and trade is on the decline.

Many simplistic suggestions have been made as to what has been causing this and even more simplistic and ineffective solutions. President Donald Trump has asserted it is all due to the Fed policy of holding interest rates at too high a level. A Federal Funds rate of 2% is not high in any sense, and no evidence suggests companies are unable to get access to capital should they need it.

Trump claims the dollar is too strong because of these rates. The reason for the dollar’s strength is that the U.S. economy remains healthier than those in Asia and Europe and that is stimulating investors. The interest rate is no factor at all in this market demand. Furthermore, the lack of exports from the U.S. has had little to do with the value of the dollar as evidenced by the fact that no nation has been watching its exports grow. If currency value was the key, the U.K. would be surging in the export market, but it isn’t. Exports are down because nations are feeling the economic pinch from the trade wars, and nobody is in a position to do much buying.

The U.S. has been imposing tariffs on China, and it has been experiencing slower growth—down to around 6%. That means China is buying less from the many nations relying on that activity to bolster their own economic growth. These nations, in turn, are buying less from the U.S. The global trade system is just that—a system. If one aspect of it is altered or disturbed, there is a ripple effect on the rest of the world.

The fight between the U.S. and China has been one very large ripple. As mentioned, the issue between the U.S. and China is not the only one. Brexit has been more of an issue in Europe, and there have been other trade disputes.

There is a political undercurrent that is making global business very, very tough. In nation after nation, there has been a shift away from free trade and globalization despite the ample benefits the trade patterns have brought consumers around the world. The problem is these benefits are diffuse.

Consumers are dimly aware that their products come from around the world and that this distribution of production means they will be cheaper. The people who have lost their jobs to foreign competition are immediately and profoundly affected and make their case more effectively than the consumer who notes that being denied foreign goods will cost a few dollars more. The fact is that losing access to foreign production will cost the average consumer in the U.S. around $8,000 a year. One would have to ask how upset people would be with an extra tax of $8,000 annually.

-

APRIL

24

11am ET -

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

-

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute -

APRIL

29

3pm ET

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

WTO Lowers Trade Forecast as Tensions Unsettle Global Economy

Escalating trade tensions and a slowing global economy have led World Trade Organization (WTO) economists to sharply downgrade their forecasts for trade growth in 2019 and 2020. World merchandise trade volumes are now expected to rise by only 1.2% in 2019, substantially slower than the 2.6% growth forecast in April. The projected increase in 2020 is now 2.7%, down from 3% previously. The economists caution that downside risks remain high and that the 2020 projection depends on a return to more normal trade relations.

“The darkening outlook for trade is discouraging but not unexpected,” said WTO Director-General Roberto Azevêdo. “Beyond their direct effects, trade conflicts heighten uncertainty, which is leading some businesses to delay the productivity-enhancing investments that are essential to raising living standards. Job creation may also be hampered as firms employ fewer workers to produce goods and services for export."

The updated trade forecast is based on consensus estimates of world GDP growth of 2.3% at market exchange rates for both 2019 and 2020, down from 2.6% previously. Slowing economic growth is partly due to rising trade tensions but also reflects country-specific cyclical and structural factors, including the shifting monetary policy stance in developed economies and Brexit-related uncertainty in the European Union. Macroeconomic risks are firmly tilted to the downside.

Due to the high degree of uncertainty associated with trade forecasts under current conditions, the estimated growth rate for world trade in 2019 is placed within a range of 0.5% to 1.6%. Trade growth could fall below this range if trade tensions continue to build, or outperform it if they start to recede. The range of likely values is wider for 2020, ranging from 1.7% to 3.7%, with better outcomes depending on an easing of trade tensions.

Risks to the forecast are heavily weighted to the downside and dominated by trade policy. Further rounds of tariffs and retaliation could produce a destructive cycle of recrimination. Shifting monetary and fiscal policies could destabilize volatile financial markets. A sharper slowing of the global economy could produce an even bigger downturn in trade. Finally, a disorderly Brexit could have a significant regional impact, mostly confined to Europe.

All geographical regions recorded positive year-on-year export growth in the first half of 2019 despite a substantial weakening of global demand. North America had the fastest export growth of any region at 1.4%, followed by South America at 1.3%, Europe at 0.7%, Asia at 0.7%, and other regions (comprising Africa, the Middle East and the Commonwealth of Independent States, including associate and former member States) at 0.1%.

North America recorded the fastest import growth of any single region at 1.8%, followed by Europe at 0.2%. Two regions registered declines (South America at -0.7% and Asia at -0.4%). Collectively, the imports of other regions grew faster than those of North America, at 2.4%. Import demand has been particularly weak in Asia, weighing heavily on exporters of manufactured goods (e.g., Japan, Korea and Germany). Exporters of natural resources have also seen demand for their products weaken, as evidenced by the 12% year-on-year decline in commodity prices in August.

There are no comprehensive statistics on services trade in volume terms due to the general unavailability of price data, but an approximate measure of services trade volume can be derived by adjusting nominal commercial services trade statistics to account for exchange rates and inflation. Like merchandise trade, commercial services trade has plateaued recently.

Monthly economic indicators provide some worrying clues about the current and future trajectory of world trade. An index of new export orders derived from purchasing managers' indices has fallen from 54 in January 2018 to 47.5 in August 2019, the weakest reading since October 2012.

A separate indicator based on the frequency of phrases in press reports captures aspects of monetary, fiscal and trade policy uncertainty. In 2019, the index has risen from 289 in January to 348 in August, its highest level ever. To the extent that economic uncertainty deters investment, it can have a disproportionately negative effect on trade since capital goods that make up investments tend to have high import content.

If current GDP estimates are realized, the volume of world merchandise trade should increase by 1.2% in 2019, but this would require a degree of recovery in the second half of the year. Monetary easing in developed countries has not had a major impact to date, but is likely to be felt toward the end of 2019 and into 2020. Other measures, including fiscal policies for surplus countries, are being undertaken to stem the current slowdown. These measures could provide some upside potential to the forecast, especially if outstanding trade disputes are resolved. However, the balance of risk remains on the downside, with trade disputes, financial volatility and geopolitical tensions providing potential triggers for a steeper downturn.

Cyberattacks and Fiscal Crises Top List of Business Risks in 2019

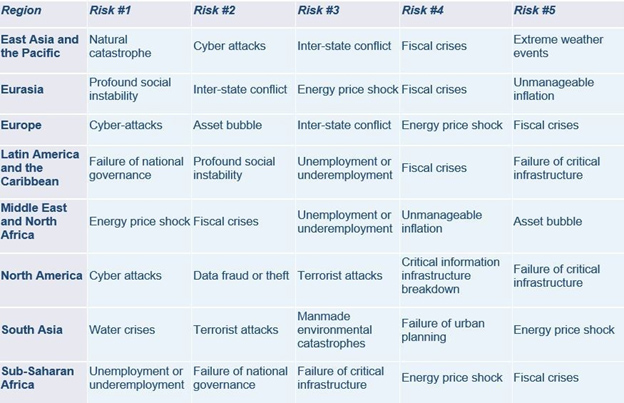

Economic issues dominate concerns for business executives around the world, according to the World Economic Forum’s Regional Risks for Doing Business 2019 report. In a survey of nearly 13,000 business leaders in more than 130 countries, respondents ranked “fiscal crises” as the leading risk to doing business at a global scale.

Globally, three of the top-five risks are economic-related with “unemployment or underemployment” coming in third and “energy price shock” ranking fourth. These risks have strong links to social disruption and contribute to “failure of national governance” ranking fifth and “profound social instability” ranking sixth. “Cyberattacks” are the second-biggest challenge for executives, and the most important one for European and North American businesses for the second year in a row, highlighting the increased sophistication and proliferation of this type of attack.

Environmental-related risks are the top concerns in South Asia and in East Asia and the Pacific, with both regions having suffered devastating natural disasters and extreme weather events. Social challenges rank high in Eurasia, affected by economic slowdown, and Latin America and in the Caribbean, where governments are still aiming to deliver critical social services.

In the Middle East and North Africa “energy price shock” leads due to ongoing price and production volatility, and in sub-Saharan Africa, where youth unemployment is above 13%, executives are worried by their economies’ inability to create jobs. While global cooperation is still the most effective tool to address these varying risks, the report’s mapping highlights the areas in which regions can act.

“At a time when global economic growth appears fragile, business leaders are deeply concerned by their governments’ fiscal resilience,” said Emilio Granados-Franco, head of Global Risks and Geopolitical Agenda at the World Economic Forum. “Meanwhile, cyberthreats remain a major risk due to their rapid evolution and increasingly disruptive potential. But in examining risk at the regional level, we also see various, interconnected drivers shaping diverse risks landscapes. Only by addressing economic risks and societal, technological and environmental risks in an integrated manner, can stakeholders truly build resiliency.”

Business leaders in advanced economies noted that cybersecurity remains the most concerning, said John Drzik, president of Global Risk and Digital at Marsh. “Growing technology dependence for many businesses will only amplify this. Combined with fractious geopolitical developments and growing economic concerns, executives face a very challenging portfolio of potential threats.”

Eugenie Molyneux, chief risk officer of commercial insurance at Zurich Insurance Group identified three risks that he felt require action. “Executives are concerned that governments have too much debt to be able to afford measures that could help avoid a recession, and see cyberattacks as the No. 1 risk in 16 economies representing over 40% of the world’s GDP. At the same time, businesses are not even factoring in the impact of climate change over the next decade.”

The Regional Risks for Doing Business 2019 report is published in partnership with Marsh & McLennan Companies and Zurich Insurance Group and is part of the Forum’s Global Risks Initiative, a workstream that analyzes critical global risks and communicates these risks to stakeholders and the wider public through digital and media assets. Respondents were asked to select “the five global risks that you believe to be of most concern for doing business in your country within the next 10 years.” The latest edition of the survey was carried out from January to April 2019. Business leaders were asked to choose up to five risks from a list of 30, including terrorist attacks, extreme weather events and state collapse or crisis.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations