Week in Review

September 23, 2019

Global Roundup

Global economy seen sliding toward weakest growth in decade. Intensifying trade conflicts have sent global growth momentum tumbling toward lows last seen during the financial crisis, and governments are not doing enough to prevent long-term damage, the OECD said in its latest outlook. (Bloomberg)

A divided Fed reduces rates, may not cut again this year. A sharply divided Federal Reserve cut its benchmark interest rate on Sept. 18 for a second time this year but declined to signal that further rate cuts are likely this year. (Business Mirror)

China is pitting the yuan against the dollar. So far, it’s not going to plan. The yuan is languishing in currency-trading rankings, highlighting international skepticism about Beijing’s tight control over the renminbi. (WSJ)

Learn and grow professionally through open and frank discussions with other credit professionals who will share their best practices and lessons learned during this year’s FCIB's International Credit & Risk Management Summit in Hamburg, Germany.

Prepare yourself, your department and your company for the changes that come your way. From risk management to more efficient processes to career development, the Summit will help provide the answers.

| Register Now! |

The repo market: What it is, and why everyone is talking about it again. After repo rates spiked, analysts are asking why a crucial part of the financial system came under pressure last week. (WSJ)

Trade dispute worries U.S. companies in China. As the Trump administration wages an economic battle with China in the form of reciprocating tariffs and other economic measures, it may not be a great time to be an American company operating in China. (Risk Management Monitor)

Europe launches last-ditch effort to avoid U.S. tariffs. The European Commission has dangled the prospect of limiting its public subsidies to the U.S. administration in an attempt to avoid further tariffs from Washington that could come as early as next month in the context of the Airbus-Boeing dispute. (EurActiv)

Israel’s election results show Netanyahu is in serious trouble. No one outright won. But Netanyahu did worse than he hoped and may lose office because of it. (Vox)

IMO 2020: Understanding the impact of cutting sulphur oxide emissions. As global shippers prepare for the busy season approaching, the International Maritime Organization (IMO) has a new international regulation scheduled to begin the first of January. (Global Trade Magazine)

What Iran’s hardliners stand to gain from the Abqaiq attack. If Tehran gave the green light to a strike in Saudi Arabia, why now, just as a Trump-Rouhani meeting seemed possible? (Interpreter)

China pushing ahead with controversial corporate social credit rating system for 33 million firms. China is rapidly moving forward its plans for a controversial social credit rating system that will include 33 million companies, raising fears of reprisals among foreign firms as Beijing seeks to extend its control over the business environment in the country. (SCMP)

A Latin American Brexit? Analyzing Brazil’s threat on Mercosur. It may not be as politically toxic as the United Kingdom’s efforts to leave the European Union, but President Jair Bolsonaro’s threat to leave Mercosur could prove almost as complicated and costly. (Bloomberg)

Austria deals first blow to EU-Mercosur trade pact. Austrian lawmakers have rejected an EU-Mercosur trade deal, putting the fate of the project in doubt. Several European states have raised concerns about the South American trade agreement and the environment. (DW)

Export basics: Seven tips for new exporters. Before launching an export initiative, it is essential to plan and prepare. Selling a product or service overseas means doing business in a new environment where language requirements, export documents and payment options all may be different. To deal with these challenges, here are seven tips for success. (Shipping Solutions)

A New Cold War?

Chris Kuehl, Ph.D., NACM Economist

The relationship between the U.S. and China has never been simple. During World War II, the Communists in China under Mao were allies of the U.S. in the war against Japan. There were many who assumed some kind of alliance would be sustained once the war came to an end.

That hope was dashed when the U.S. stood behind its other Chinese allies—the nationalists under Chiang Kai-shek. For decades, the U.S. has stood behind the Taiwanese and opposed any suggestion they go the route of Hong Kong. The Chinese were clear enemies during the Korean War and through the conflict in Vietnam.

The Cold War was a simple construct with communists on one side and the free world on the other. The Chinese were lumped in with the Soviets, Cubans, North Vietnamese and others. In the 1980s and 1990s, there was a political shift as communism seemed to be fading away. The collapse of the USSR and the end of the Warsaw Pact seemed to be a vindication for the U.S. and the system of democracy coupled with capitalism.

When China began to embrace the global economic system under Deng Xiaoping, the U.S. was convinced that becoming democratic and part of the world order was imminent. Suddenly, China was the new frontier and no longer the pariah. It would take far more space than is available in this piece to detail all the assumptions that have proven to be inaccurate. Suffice it to say that China developed far differently than expected and is today in a very unique position as not quite arch enemy, but far from friend and ally.

The trade war between the U.S. and China is ostensibly over economic issues, but the conflict runs far deeper than this for President Donald Trump and his supporters. The deficit the U.S. runs with China is a legitimate issue of concern, but the U.S. runs deficits with many nations. This is what happens when one has the most affluent consumers in the world who demand a great deal of product and at a very low price. There is nothing inherently wrong with importing more than one exports as long as the economy thrives anyway.

The U.S. does very well as a consumer-driven society. Millions of people have jobs that are tied directly to all that importing. At the same time, the U.S. has lost jobs and business to China and other nations able to produce more cheaply than the U.S. can. That angers those who lost those jobs and businesses. It should be remembered that China (and the other nations) did not force companies to move operations to their countries nor did they force people to buy product made outside the U.S. These were free choices made by American consumers and American companies.

Today, the U.S. and China are intimately intertwined as China sees the U.S. as its major consumer and the U.S. sees China as its major supplier. Despite this connection, the two nations remain at odds over a host of issues—the status of Taiwan, status of Hong Kong, the disposition in the South China Sea, relations with nations the U.S. opposes and so on. China is no closer to being a democracy than it was in the 1960s and 70s and continues to look at the U.S. as an adversary in a variety of ways. The U.S. has alternated between hostility and attempts to cajole China towards an American view of things. Today, Trump has chosen hostility and seems committed to policies that isolate China and sharply reduce contact.

It is not easy to figure out Trump’s motivation as his stance as president is far different from his stance prior to holding office. Most of the Trump-branded merchandise was made in China and he invested heavily in project development in China—just like almost every other businessperson. Now China is the enemy. One suspects this is a move to mollify his U.S. political base. Many of those who voted for Trump have been hurt by Chinese competition as they lost jobs when their companies decided to source from China or when cheaper Chinese goods chased the American-made version out of the market. Whatever the motivation, the enmity between Trump and China is real enough and has led to pressure on U.S. allies to take the same position.

-

APRIL

24

11am ET -

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

-

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute -

APRIL

29

3pm ET

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

British Insolvencies Creeping up in the Face of Brexit Uncertainty

Dana Bodnar

Insolvencies are on the rise globally, but the United Kingdom is predicted to see among the highest increases in 2019 and 2020 compared to other advanced markets, according to a recent insolvency report by trade credit insurer Atradius. This trend first appeared in 2018.

In the first half of this year, U.K. business failures were up nearly 9% year-on-year. The main culprits: slowing economic growth and uncertainty in the face of the still-unspooling Brexit saga.

Growth in the U.K. economy is down. In 2018, the economy grew 1.4%, but will likely only reach 1.3% in 2019. Brexit-related uncertainty is certainly a major cause. U.K. businesses—particularly large international firms—are delaying investment decisions, wreaking havoc on smaller companies further down the supply chain. Business investment saw a 0.4% contraction in 2018 and will likely contract a further 1.4% this year.

Brexit, of course, looms over it all. With the second extension of Article 50, the U.K.’s departure from the EU now won’t take place until October 31. This delay is keeping inflation high, holding back the recovery of sterling, and prolonging the sluggish business investment activity. The likelihood that a third extension is needed is increasingly high, extending this uncertainty. Thus, Atradius economists predict U.K. insolvencies could rise another 5% in 2020. If the U.K. departs the EU without a deal in October—still a very real possibility—insolvencies could rise another 15% under the initial shock.

The construction and retail sectors have been hit the hardest. Last year brought multiple bankruptcies and liquidations of large U.K. construction firms, including c, the second-largest in the country. Labor shortages exacerbate the problem due to the increasing costs of attracting workers and loss of skilled labor from EU nationals working in the U.K. Retail, as everywhere else, is being crushed by ecommerce, particularly giants such as Amazon. Retailers also face increasing challenges in passing higher import costs onto consumers, already facing contracting real wage growth.

The impacts of Brexit uncertainty are rippling outward to other European countries, as well. Businesses in the Netherlands, Belgium, Ireland and Denmark have close relationships to U.K. sectors—while insolvencies are already predicted to increase in each country in 2019, a no-deal Brexit could worsen the outlook. Ireland is at particularly high risk, given that the U.K. is a major importer of Irish goods and services.

Dana Bodnar is an economist at Atradius, where she is responsible for macroeconomic and country risk analysis specializing in Central and Eastern Europe.

OECD Sees Rising Trade Tensions and Policy Uncertainty Further Weakening Global Growth

The global economy has become increasingly fragile and uncertain, with growth slowing and downside risks continuing to mount, according to the Organization for Economic Cooperation and Development’s (OECD’s) latest Interim Economic Outlook.

Economic prospects are weakening for both advanced and emerging economies, and global growth could get stuck at persistently low levels without firm policy action from governments, according to the Outlook.

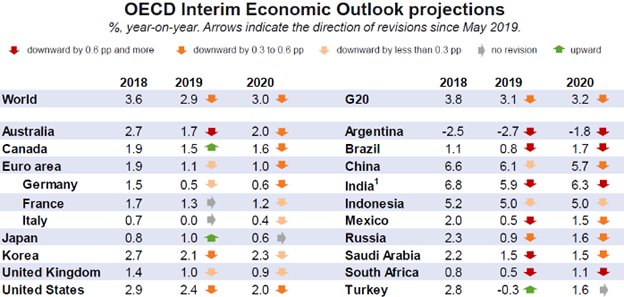

Escalating trade conflicts are taking an increasing toll on confidence and investment, adding to policy uncertainty, aggravating risks in financial markets and endangering already weak growth prospects worldwide. The OECD projects that the global economy will grow by 2.9% in 2019 and 3% in 2020—the weakest annual growth rates since the financial crisis, with downside risks continuing to mount.

The Outlook covers all G20 economies, and includes downward revisions to projections from the previous Economic Outlook in May 2019 for almost all countries, particularly those most exposed to the decline in global trade and investment that has set in this year.

The Outlook identifies trade conflicts as the principal factor undermining confidence, growth and job creation across the world economy, and underlines that continuation of trade restrictions and political uncertainty could bring additional adverse effects. While solid consumer demand has supported service sector output to date, persistent weakness in manufacturing sectors and continuing trade tensions could weaken employment growth, household income and spending.

Substantial uncertainty persists about the timing and nature of the withdrawal of the United Kingdom from the European Union, particularly as concerns a possible no-deal exit which could push the U.K. into recession in 2020 and lead to sectoral disruptions in Europe. Other risks—including the overall slowdown in the Chinese economy and significant financial market vulnerabilities from the tension between slowing growth, high debt and deteriorating credit quality—are also weighing on future growth.

“The global economy is facing increasingly serious headwinds, and slow growth is becoming worryingly entrenched,” said OECD Chief Economist Laurence Boone. “The uncertainty provoked by the continuing trade tensions has been long-lasting, reducing activity worldwide and jeopardizing our economic future. Governments need to seize the opportunity afforded by today’s low interest rates to renew investment in infrastructure and promote the economy of the future.”

The outlook calls on central banks to remain accommodative in the advanced economies, but stresses that the effectiveness of monetary policy could be enhanced in many advanced economies if accompanied by stronger fiscal and structural policy support. It says fiscal policy should play a larger role in supporting the economy, by taking advantage of exceptionally low long-term interest rates for wider public investment to support near-term demand and future prosperity. Greater structural reform ambition is required in all economies to help offset the impact of the negative supply shocks from rising restrictions on trade and cross-border investment and enhance medium-term living standards and opportunities.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations