Week in Review

September 9, 2019

Global Roundup

Brexit endgame: Boris Johnson loses control. During another dramatic week in British politics, Parliament—facing an imminent five-week suspension as the clock ticks towards the October 31 Brexit deadline—seized control of the agenda, introduced legislation to prevent a no-deal Brexit, and blocked early elections. It was a stunning series of defeats for Prime Minister Boris Johnson. (Brookings)

Dreams of an Asia-Pacific trade pact by year-end fading again. Hopes of finishing a monster Asia-Pacific trade pact by year’s end, and pushing back against a wave of protectionism, may be headed for disappointment again. (Business Mirror)

Turkey says it faces up to $3 billion in trade losses with Britain under no-deal Brexit. Turkey may lose trade with Britain worth up to $3 billion (£2 billion) in the event of a no-deal Brexit, Trade Minister Ruhsar Pekcan said, adding that many Turkish companies lacked information on the consequences of such a scenario. (HSN)

Learn and grow professionally through open and frank discussions with other credit professionals who will share their best practices and lessons learned during this year’s FCIB's International Credit & Risk Management Summit in Hamburg, Germany.

Prepare yourself, your department and your company for the changes that come your way. From risk management to more efficient processes to career development, the Summit will help provide the answers.

| Register Now! |

Robert Mugabe has died leaving behind a conflicted legacy. Robert Gabriel Mugabe, Zimbabwe’s first post-independence leader, has died aged 95. News of Mugabe’s death has been confirmed by his successor and current Zimbabwe president, Emmerson Mnangagwa. (Quartz)

U.S. Exim: A decade-long renewal or axe it entirely? U.S. senators have proposed a bill to reauthorize the U.S. Export-Import Bank (U.S. Exim) for 10 years over the traditional four, as the bank’s expiry date of September 30 inches closer. (Global Trade Review)

China and the U.S. will hold trade talks in Washington in October. Chinese and American officials plan to hold trade talks in Washington in early October, a new attempt to tame a trade war that is rippling through the global economy and hurting business investment and confidence. (HSN)

Italy successfully ejects far-right leader Salvini as new government is sworn in. Italy’s new government was sworn in on Sept. 5 after the pro-European Democratic Party (PD) joined the anti-establishment Five Star Movement (M5S) in an unlikely alliance that has forced the far-right out of power. (Independent)

Years of bitterness have contributed to the Seoul-Tokyo trade rift. The use of trade in retaliation to achieve political goals is something new for a nation such as Japan, which has greatly prospered in the postwar era of global free trade. (National Interest)

Lessons learned from the Argentine economy under Macri. Mauricio Macri’s election in 2015 sent shock waves around the world. A pro-market outsider candidate from Argentina’s business elites interrupted 14 consecutive years of Peronist government. (Brookings)

Britain’s constitutional time-bomb. Brexit is already a political crisis. Sooner or later it will become a constitutional crisis, too. (The Economist)

Why “zombie” companies are on the rise—and could pose a threat to the U.S. economy. In the financial world, companies on life support are called “Zombies.” Those are firms which are not even able to cover their debt-servicing costs with current earnings. They are in bad shape, and probably should have gone out of business already. (Fortune)

Why index funds are like subprime CDOs. The recent flood of money into index funds has parallels with the pre-2008 bubble in collateralized debt obligations, the complex securities that almost destroyed the global financial system. (Bloomberg)

China economy woes owe more to domestic issues than trade war. China's domestic economic issues are more problematic for policymakers in Beijing than the trade war, experts warn U.S. Congressional hearing. (South China Morning Post)

China’s new trade weapon: Shaking down foreign firms. Beijing has been targeting foreign companies with a form of geoeconomic extortion that has caught Washington flat-footed. (National Interest)

Can Oil Epicenter Shift?

Chris Kuehl, Ph.D., NACM Economist

Few sectors have seen as much volatility as the oil sector. Based on predictions made by oil analysts just a few years ago, it would seem the world was on the brink of true economic ruin. The assertion was that oil would be selling at between $120 and $150 a barrel, that the pump price would be closing in on $6 a gallon and that outright shortages would be common.

The power of OPEC would have amplified to the point that Middle Eastern politics would be altered forever. Russia would become a dominant world player again on the strength of its oil position. All of this emphasis on oil and the high costs would provoke a massive investment in all manner of alternative fuel—natural gas power, hydrogen power, ubiquitous electric vehicles, drastic expansion of mass transit.

Very little of that prediction has come to pass as the per barrel price of oil has tumbled as low as the mid-$40s and is now struggling to get to $60. The power of OPEC and Russia has been blunted, and most of the oil-producing region of the Middle East is in chaos. The urgency to develop alternatives has all but vanished, and many of these new technologies have been abandoned altogether.

The primary reason for all this change has been the development of the oil business in the U.S. The promise of oil production in the Dakotas, Wyoming and Texas was finally fulfilled, and the U.S. went from being a nation that imported more than 65% of the oil it needed to a nation that exports crude and only imports when the price is right.

This is not the only factor that has altered the oil landscape, and there are many more influencers developing. There is a distinct global slowdown underway. This has already reduced demand all over the world, and is the main reason that oil prices have not reacted to all the geopolitical turmoil that has affected oil producing states such as Iran, Libya, Iraq and Venezuela, among others.

There are more big changes on the way, and perhaps sooner than expected. The oil business in the U.S. is booming but that obscures the fragility of this sector. The fracking business is not cheap and requires per barrel oil prices to be in the neighborhood of $80—preferably at between $90 and $100. The forecast for the price per barrel is nowhere near this level, and that has many of the U.S. oil producers in a quandary. Do they continue to produce or wait for that price to increase?

The Middle East is not stable and hasn’t been for years. This has been overlooked to some degree but only out of necessity. The desire has been to replace this region as a source for the world’s oil, but thus far the alternatives have not panned out. The U.S. has altered the landscape, but most of the U.S. production has gone to the U.S., and global markets still seek an alternative to the volatility of the Middle East.

The region that could fill that need is Latin America, but this promise has gone unfulfilled for decades. Venezuela is in total shambles. Even if somehow President Nicolás Maduro could be driven out, it would take many years for the oil sector to recover.

Neither Bolivia nor Ecuador has been able to develop as expected. Colombia has made strides since the defeat of the FARC insurgency but is now contending with the massive wave of migrants streaming in from a shattered Venezuela. Brazil has thus far squandered its opportunity with endless corruption and exploitation and Argentina has been unable to get on track. None of these inhibitions are impossible to deal with, although the challenges are daunting. Should the political issues be dealt with, the oil sector in Latin America would easily supplant that of the Middle East and North Africa.

-

APRIL

24

11am ET -

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

-

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute -

APRIL

29

3pm ET

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

New Zealand: Big Business Continues Poor Record of On-Time Payments

Businesses across New Zealand are maintaining record low late payment times—all except big businesses, according to illion’s quarterly late payments report for the country.

The firm’s latest data for the June 2019 quarter show 23% of businesses in New Zealand were late in paying their invoices, with these averaging 6.7 days. This represents a 4.2% increase from the previous quarter, in line with seasonal fluctuations, but a 1% decline compared with the same time last year.

The biggest increases in late payments came from large businesses; in particular, companies with more than 500 employees reported a year-on-year jump of nearly 12% to 9.2 days, the worst on record since April 2018.

In contrast, small and medium businesses all reported a decline in late payments, although there was a small increase from micro-businesses.

“One of the things we observe globally is that the closer you are to the equator, the slower you pay your bills,” said illion CEO Simon Bligh. “Whilst the gap is closing, we still see North Island pay slower than South Island, and we see Christchurch faster than Wellington and Wellington faster than Auckland.”

The general decline in late payments across all business sectors reflected an increasing adoption of new payment technologies, according to Stephen Koukoulas, illion’s economic adviser. “The lower level of late payments over the past five years or so reflects a structural change, with businesses increasingly adopting new technologies and systems such as internet banking and direct debits, which have resulted in bills being paid faster.”

Forestry businesses were the slowest to pay their invoices, with an average of 8 days—up 41.5% compared with the same period last year. In contrast, agriculture businesses were the faster payers, averaging four days, while the fishing sector showed the biggest improvement, with late payment days decreasing by 38% year-on-year.

“With interest rates set to remain near historical lows over the medium term, low readings for late payments are likely to remain the norm for the foreseeable future,” Koukoulas said.

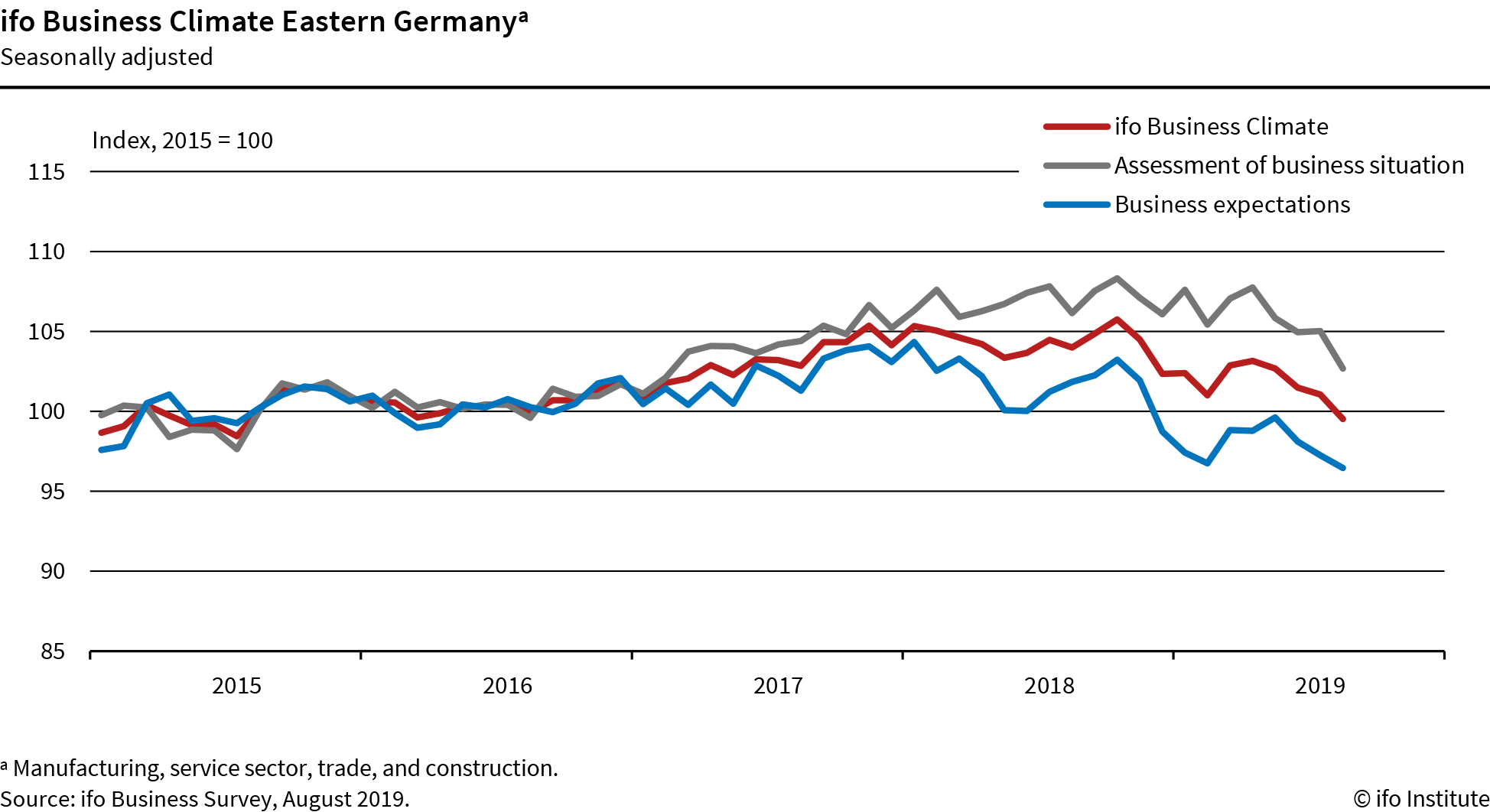

ifo Business Climate Index for Eastern Germany Falling

The mood of eastern German entrepreneurs cooled significantly in August. The ifo Business Climate Index for the region’s economy as a whole fell from 101.1 to 99.5 points, as the companies surveyed adjusted their assessments of the current situation drastically downward compared to the previous month.

Their business expectations also fell slightly. The Business Climate Index for eastern Germany thus accelerated its descent, which began in fall 2018.

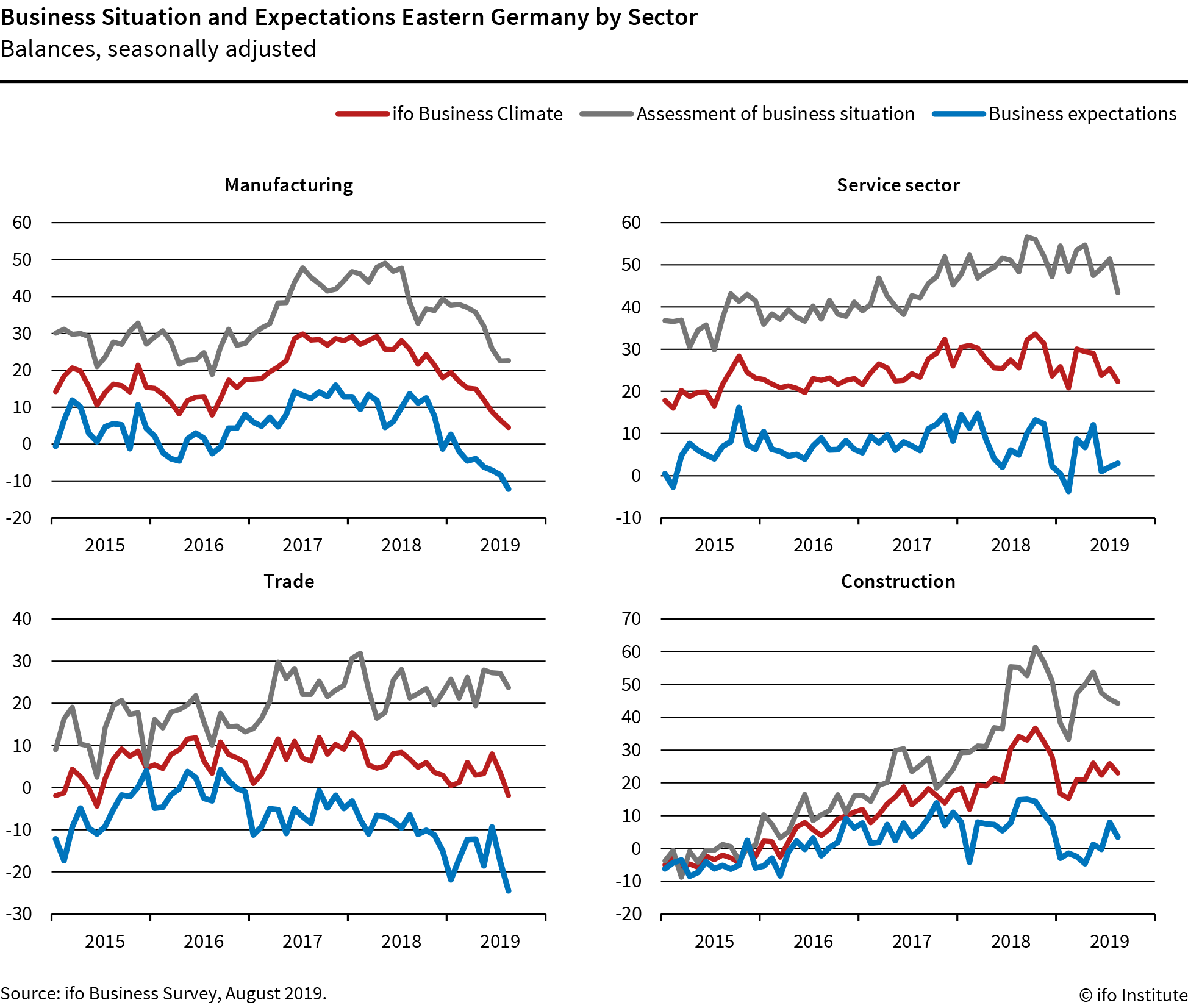

In eastern German manufacturing, sentiment was marginally gloomier. The companies surveyed raised their assessment of current business slightly, but at the same time, their outlook for the coming six months was noticeably more negative.

In eastern Germany’s service sector, the business climate became decidedly gloomier, primarily because of a strong downward revision to assessments of the current situation. At the same time, the service providers surveyed raised their business expectations slightly.

In eastern German trade, the downward trend of the previous month was clear to see throughout August as well. For the first time in a long while, the sector was pessimistic about the future. The sub-indices for both wholesale and retail trade declined.

There was a considerable drop in the ifo Business Climate Index in eastern German construction, too. The companies surveyed were somewhat less satisfied with their current business, while business expectations for the coming six months became much more pessimistic.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations