Week in Review

July 29, 2019

Global Roundup

Puerto Rico governor resigns after weeks of mass protests. Puerto Rico Governor Ricardo Rosselló on July 24 said he would resign after almost two weeks of protests calling for him to step down over a scandal involving offensive chat messages and government corruption that rocked the bankrupt island. (Reuters)

Boris Johnson chosen as new U.K. leader, now faces Brexit test. Boris Johnson, Britain’s blustering Brexit campaigner, was chosen as the U.K.’s next prime minister on July 23, with a resounding mandate from the Conservative Party but conflicting demands from a politically divided country. (AP News)

European allies spurn U.S. effort to protect ships from Iran. Soaring tensions with Iran after attacks on tankers and drones prompted the Trump administration to call for a coalition of allies to protect ships passing through the Persian Gulf. (Bloomberg)

Credit professionals have experienced enormous changes in the workplace in the past decade and more changes are on the way. Are you prepared?

Wouldn’t it be great to have a formula that will help you and your company weather those changes smoothly?

Join Raimond Honig, CT, managing director of the Credit Management Institute, and Rick Hernandez, president of Syntesis Global, for the keynote presentation, Staying Relevant in the Digital Age. Honig and Hernandez will provide strategies for creating a professional roadmap enabling you to address, adapt and respond to whatever the future brings.

This is just one of the many sessions you’ll find at this year’s FCIB's International Credit & Risk Management Summit in Hamburg, Germany, centered around the theme of credit management in transition. Visit the summit website to see the full programme and register at the early rate.

IMF sees weaker global economy but upgrades U.S. economic growth forecast. The International Monetary Fund (IMF) is downgrading its outlook for the world economy because of simmering international trade tensions. But, at the same time, the fund is boosting its forecast for the U.S. economy this year, citing expectations that the Federal Reserve will cut interest rates. (Business Mirror)

U.S.-EU trade negotiations in stalemate, Malmström says. Almost a year after the joint U.S.-EU statement, “there is a stalemate” in trade negotiations, Commissioner Cecilia Malmström conceded on July 23 speaking before the European Parliament. (EurActiv)

Brazil will give workers up to $8 billion to spur growth. President Jair Bolsonaro will give Brazilians early access this year to as much as 30 billion reais ($8 billion) in funds normally set aside for the unemployed in an effort to spur the country’s moribund economy. (WSJ)

Russia promises more support for Cuba, including “military technical” in face of U.S. pressure. Russia has vowed more support to Cuba in various fields, including defense, in order to shield the communist-led island nation against U.S. sanctions. (Newsweek)

Iran’s president warns foreign powers to keep naval ships out of the Persian Gulf. Iranian President Hassan Rouhani has told his cabinet that protecting security around the Persian Gulf is solely the responsibility of countries in the region and that other nations should stay away. (CNBC)

Scotland's leader tells U.K. PM Johnson: We want an independence referendum. Scotland’s nationalist leader warned British Prime Minister Boris Johnson that she would continue preparations for an independence referendum because his Brexit plans would hurt the Scottish economy. (Reuters)

China says it won’t rule out using force to reunify Taiwan. China said it will not renounce the use of force in efforts to reunify Taiwan with the mainland and vowed to take all necessary military measures to defeat “separatists.” (Business Mirror)

Currency problems persist in Zimbabwe. In mid-June, Cambria Africa announced that its Zimbabwe-based subsidiary had suspended its service to its bank customers in Zimbabwe, alleging that Zimbabwean banks have indicated that they are now prohibited by the central bank from paying external invoices in U.S. dollars. (International Banker)

Five charts on France’s economic outlook. France’s economic performance has been solid, and the authorities have made notable progress in recent years to introduce reforms supporting growth. But external risks have increased and some domestic structural challenges remain. (IMF)

The ABC of trade finance fintech. Do you know your trade finance fintech alphabet? Global Trade Review spells out the most important concepts. (Global Trade Review)

Why Latin Economies Are Not Emerging

Chris Kuehl, Ph.D.

The rise of the “emerging market” has been an important story for the last several years. At the start of the 2008 recession, there were those who asserted the emerging states had somehow become immune to the travails that were bringing the developed regions down.

For a while, the future of the global economy seemed to be in the hands of the BRIC nations (Brazil, Russia, India and China). That period of confidence was short-lived.

Today, all four of these countries have regressed in the face of some pretty severe economic reversals. That doesn’t mean the emerging states are not vital to the progress of the world economy, but it suggests there are many issues that need to be overcome.

The share of global growth accounted for by the emerging states was just 37% in 1980, but it is now at 60% and rising. China and India still account for the majority of that growth, but there have been gains in many other Asian and even African states.

The region that has not lived up to its promise has been Latin America. At one point, it appeared Brazil was coming into its own at last and Argentina was also climbing out of its dysfunctional past. Colombia was a bright spot and so were Peru and Chile. Of course, there were still real-basket-case nations such as Venezuela and Bolivia, but even Paraguay was making strides. Over the last few years, that progress has halted. It can be argued that many of these nations have been backsliding both from an economic and a political point of view.

It would be easy enough to point at some of the endemic issues that have long affected the states in Latin America—corruption at the top of the list, but also including commodity dependence which makes these nations subject to the vagaries of global pricing. One theory that gets a lot of attention these days holds that the main problem is a lack of anything in the middle of the economy. The majority of these states have only two classes of people—the very rich and the very poor. There is not much of a middle class in terms of either the consumer or the business community. That limits the ability of the overall economy to create more of that middle. The lack of small- to medium-sized enterprises has created a chronic issue.

The reasons for the lack of small- and medium-sized business are varied and complex. One of the issues that stands out is it is very hard for these companies to start up and survive as there are many regulatory barriers, and taxes on these companies can be very high. The big companies can get around many of these taxes and are rarely subject to the regulations imposed on these smaller concerns. This is where the corruption issue comes in—the bigger operations can use their influence to get deals. That also provides them with near monopoly power. The small companies face a daunting path and most fail.

A second issue is consumers in Latin America are highly brand conscious and will often shun the small operation as they trust and prefer the offering from the bigger operation. This is especially true of the business community which shuns not only the small business offering, but also prefers the imported good. The only place small businesses thrive is in small-scale retail and food service. The small manufacturer that is the basis of developed economies is hard to find. The same issue applies to construction and transport. The nations also still sport a lot of state-owned operations that crowd out smaller competitors.

-

APRIL

17

11am ET

-

Vendor Verification: Mitigating Risk, Maximizing Returns

Speaker: Kristen Pope, Gates Machine Tool Repair, Inc.

Duration: 60 minutes -

APRIL

18

3pm ET

-

APRIL

22

3pm ET -

Do You Know Who You Are Selling to?

Speaker: Emory Potter, Esq., Hays & Potter, LLP

Duration: 60 minutes

-

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes -

APRIL

24

11am ET

Credit Managers Navigate Asia-Pacific Payment Trends

Countries across the Asia-Pacific region are seeing a whirlwind of changes to payment terms in various industries, most of which have been attributed to the ongoing trade war between the U.S. and China, the United Kingdom-European Union Brexit debacle and diminishing economic growth in the U.S. and Europe. To better understand the implications behind these events, credit insurer Coface and the Finance, Credit and International Business Association (FCIB) delved into the region’s payment trends in separate studies over the past couple of years for a possible glimpse into the near future.

Earlier this month, Coface published its findings in the Asia Corporate Payment Survey 2019: Deteriorating Payment Trends Amid Trade War Woes, where more than 3,000 companies shared their payment history in 2017 and 2018. Participating companies spanned the Asia-Pacific region, including China, Malaysia, Singapore, Hong Kong and Japan. According to Coface data, average payment terms increased by five days in one year from 64 days in 2017 to 69 days in 2018.

“This is in line with trends observed in Asia since 2015,” the Coface report states. “Corresponding with the increase in payment terms, 63% of those companies surveyed stated they experienced payment delays in 2018 and the average payment delays also increased to 88 days in 2018, compared to 84 days in 2017.”

China, Malaysia and Singapore saw the lengthiest payment delays, the report noted, compared to those in Hong Kong and Japan, which were the lowest. FCIB’s own reports found mixed results after conducting surveys in 2017 and 2018 with credit managers who conduct business in those countries. FCIB released studies in 2016, 2017 and 2018.

For example, in China, the number of businesses offering 61- to 90-day payment terms decreased between 2017 and 2018, starting at 32% in June 2017 and leveling off at 21% by December 2018. Fewer businesses also offered 31- to 60-day terms by December 2018, while more offered 0- to 30-day terms. By 2018, 25% of respondents said payment delays were due to regulatory issues, followed by billing disputes and cash flow problems.

“Do not grant open payment terms,” one FCIB respondent said in December 2018. “Chinese payment habits are poor and they will look for every opportunity not to pay. Whatever business you do with the Chinese should be fully secured. Proceed with extreme caution.”

However, the results told a different story in Malaysia and Singapore. Between FCIB’s three Malaysian surveys in June 2016, June 2017 and September 2018, payment terms fluctuated but ended being most popular at 31- to 60-day terms by September. Although only a few respondents offered more than 91 days in 2016 and 2017, credit managers ceased doing so by 2018. Similarly, 0- to 30-day terms and 31- to 60-day terms tied at 44% for most granted in May 2018’s FCIB Singapore survey, where 0% of respondents granted more than 91 days.

FCIB’s latest survey for Asia is currently open and focuses on China, Hong Kong, India and Singapore. To complete the survey, go to https://www.surveymonkey.com/r/P5K56NR. The survey will close on Aug. 7.

—Andrew Michaels, editorial associate

Sluggish Global Growth Calls for Supportive Policies

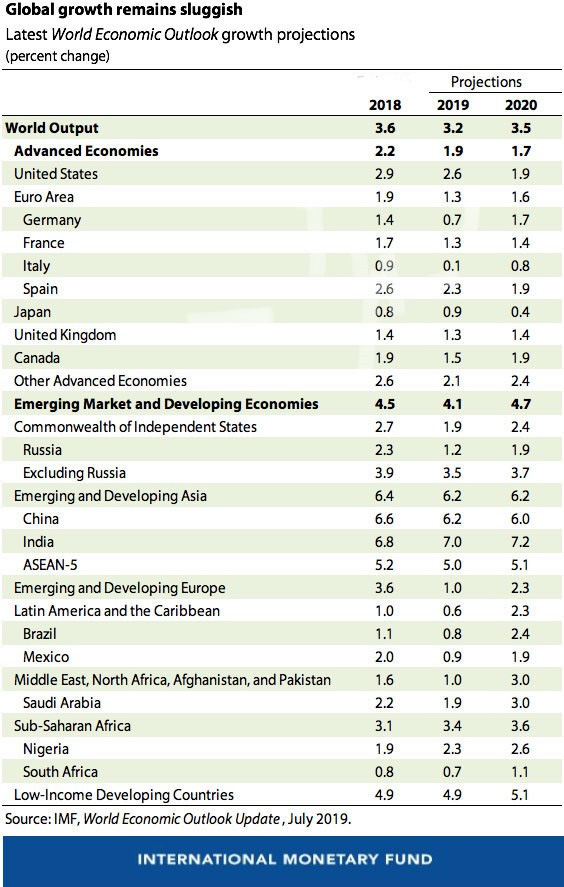

In our IMFblog July update of the World Economic Outlook, we are revising downward our projection for global growth to 3.2% in 2019 and 3.5% in 2020. While this is a modest revision of 0.1 percentage points for both years relative to our projections in April, it comes on top of previous significant downward revisions. The revision for 2019 reflects negative surprises for growth in emerging market and developing economies that offset positive surprises in some advanced economies.

Growth is projected to improve between 2019 and 2020. However, close to 70% of the increase relies on an improvement in the growth performance in stressed emerging market and developing economies and is therefore subject to high uncertainty.

Global growth is sluggish and precarious, but it does not have to be this way because some of this is self-inflicted. Dynamism in the global economy is being weighed down by prolonged policy uncertainty: Trade tensions remain heightened despite the recent U.S.-China trade truce, technology tensions have erupted threatening global technology supply chains and the prospects of a no-deal Brexit have increased.

The negative consequences of policy uncertainty are visible in the diverging trends between the manufacturing and services sector, and the significant weakness in global trade. Manufacturing purchasing manager indices continue to decline alongside worsening business sentiment as businesses hold off on investment in the face of high uncertainty. Global trade growth, which moves closely with investment, has slowed significantly to 0.5% (year-on-year) in the first quarter of 2019, which is its slowest pace since 2012. On the other hand, the services sector is holding up and consumer sentiment is strong, as unemployment rates touch record lows and wage incomes rise in several countries.

Among advanced economies, the United States, Japan, the United Kingdom and the euro area grew faster than expected in the first quarter of 2019. However, some of the factors behind this—such as stronger inventory build-ups—are transitory and the growth momentum going forward is expected to be weaker, especially for countries reliant on external demand. Owing to first quarter upward revisions, especially for the United States, we are raising our projection for advanced economies slightly, by 0.1 percentage points, to 1.9% for 2019. Going forward, growth is projected to slow to 1.7%, as the effects of fiscal stimulus taper off in the United States and weak productivity growth and aging demographics dampen long-run prospects for advanced economies.

In emerging market and developing economies, growth is being revised down by 0.3 percentage points in 2019 to 4.1% and by 0.1 percentage points for 2020 to 4.7%. The downward revisions for 2019 are almost across the board for the major economies, though for varied reasons. In China, the slight revision downwards reflects, in part, the higher tariffs imposed by the United States in May, while the more significant revisions in India and Brazil reflect weaker-than-expected domestic demand.

For commodity exporters, supply disruptions, such as in Russia and Chile, and sanctions on Iran, have led to downward revisions despite a near-term strengthening in oil prices. The projected recovery in growth between 2019 and 2020 in emerging market and developing economies relies on improved growth outcomes in stressed economies such as Argentina, Turkey, Iran and Venezuela, and therefore is subject to significant uncertainty.

Financial conditions in the United States and the euro area have further eased, as the U.S. Federal Reserve and the European Central Bank adopted a more accommodative monetary policy stance. Emerging market and developing economies have benefited from monetary easing in major economies but have also faced volatile risk sentiment tied to trade tensions. On net, financial conditions are about the same for this group as in April. Low-income developing countries that previously received mainly stable foreign direct investment flows now receive significant volatile portfolio flows, as the search for yield in a low-interest-rate environment reaches frontier markets.

Increased downside risks

A major downside risk to the outlook remains an escalation of trade and technology tensions that can significantly disrupt global supply chains. The combined effect of tariffs imposed last year and potential tariffs envisaged in May between the United States and China could reduce the level of global GDP in 2020 by 0.5%. Further, a surprise and durable worsening of financial sentiment can expose financial vulnerabilities built up over years of low interest rates, while disinflationary pressures can lead to difficulties in debt servicing for borrowers. Other significant risks include a surprise slowdown in China, the lack of a recovery in the euro area, a no-deal Brexit and escalation of geopolitical tensions.

With global growth subdued and downside risks dominating the outlook, the global economy remains at a delicate juncture. It is therefore essential that tariffs are not used to target bilateral trade balances or as a general-purpose tool to tackle international disagreements. To help resolve conflicts, the rules-based multilateral trading system should be strengthened and modernized to encompass areas such as digital services, subsidies and technology transfer.

Policies to support growth

Monetary policy should remain accommodative especially where inflation is softening below target. But it needs to be accompanied by sound trade policies that would lift the outlook and reduce downside risks. With persistently low interest rates, macroprudential tools should be deployed to ensure that financial risks do not build up.

Fiscal policy should balance growth, equity and sustainability concerns, including protecting society’s most vulnerable. Countries with fiscal space should invest in physical and social infrastructure to raise potential growth. In the event of a severe downturn, a synchronized move toward more accommodative fiscal policies should complement monetary easing, subject to country-specific circumstances.

Lastly, the need for greater global cooperation is ever urgent. In addition to resolving trade and technology tensions, countries need to work together to address major issues such as climate change, international taxation, corruption, cybersecurity and the opportunities and challenges of newly emerging digital payment technologies.

Reprinted with the permission from IMFblog.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations