Week in Review

March 11, 2019

Global Roundup

China's GDP growth pace was inflated for nine years, study finds. China over-reported its economic growth between 2008 and 2016 by an average of 1.7 percentage points, according to a recent study by researchers at the Chinese University of Hong Kong and the University of Chicago. (Bloomberg)

U.K. finance firms prepare for “catastrophic” no-deal Brexit scenario. As Britain is set to leave the European Union (EU) on Mar. 29, U.K. finance firms have been preparing for a “no-deal” scenario that they believe would be “catastrophic” for the nation’s economy. (HSN)

U.S. threat looms over foreign firms trading with Cuba. U.S. President Donald Trump’s administration is brandishing the threat of sanctions against foreign companies “trafficking” with Cuba, a move hitherto mothballed by Washington so as not to offend allies. (EurActiv)

As China growth slows, U.S. companies see falling profits. China is officially slowing. U.S. companies based there say they are expecting lower profits this year as a result of changing economic dynamics in the world’s No. 2 economy. (HSN)

China sets robust growth target to shore up cooling economy. China’s government announced a robust annual economic growth target and a 7.5% rise in military spending on Mar. 5 at a legislative session overshadowed by a tariff war with Washington. (Business Mirror)

ECB signals sharp policy U-turn with fresh stimulus plans. The European Central Bank signaled a major policy reversal on Mar. 7, flagging plans for fresh measures to stimulate the eurozone’s faltering economy less than three months after phasing out a 2.6 trillion-euro ($2.9 trillion) bond-buying program, making it the first major central bank to ease policy in response to a global slowdown. (HSN)

Economic slowdown and China’s green future. China has adopted a high-profile role as a champion for climate action and renewable energy. Yet, as the country faces new economic constraints, its climate endeavor might be in danger. (Global Risk Insights)

Italy to join China’s New Silk Road infrastructure plan. Italy is set to become the first member of the “Group of Seven” most powerful nations to join China’s infrastructure plan “One Belt, One Road” (OBOR), despite the heightened scrutiny of Beijing’s investment in Europe. (EurActiv)

Trump still hopes for North Korea nuclear deal after ominous report. Satellite photos showing new activity at a North Korean rocket launch site raised fresh doubts on Mar. 6 that Kim Jong Un will ever give up his drive for nuclear weapons, yet talks continue and President Donald J. Trump said he was still hoping for the agreement that eluded the leaders at February’s summit. (Business Mirror)

America and Europe: Growing differences over Iran. The United States’ and Poland’s co-hosted conference in Europe is a controversial event. It has united some American allies around President Donald Trump’s aggressive anti-Iran posturing while alienating some others. (Global Risk Insights)

Why some banks still back BPO. Amidst all the blockchain hype, you might be forgiven for thinking that the bank payment obligation (BPO)—a previous attempt to digitize trade—was dead and buried. But far from abandoning the solution, a small but determined number of banks want the rest of the industry to ramp up adoption efforts. (Global Trade Review)

-

APRIL

24

11am ET -

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

-

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute -

APRIL

29

3pm ET

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

Macron Launches Attack on Populism

Chris Kuehl, Ph.D.

Emmanuel Macron became the president of France because of who he was running against. That reality was acknowledged by Macron at the time and has been reinforced by many of his actions since. He was the alternative to the far-right National Front candidate Marine Le Pen. Many millions in France voted against her as much as they voted for the unknown Macron. His position was that Le Pen was a reactionary; one who did not really represent the French.

Since his victory, he has struggled to maintain that support base as the voters have now had more time to evaluate the man they elected. He has been accused of being elitist and unsympathetic to the travails of the average French citizen with the imposition of a gas tax designed to help push France further toward a “green” transportation and power production stance. The people paying that tax are not opposed to the green future, but reject the notion they should be the ones to pay for it. He has been on the back foot since the start of his term as he has been attacked by both the left and the right as they seek to put their own people in place in the future. Now he seems to be taking the initiative with a proposal that looks similar to the ones he used in the campaign against Le Pen.

The European elections are coming up, and it appears the populists have focused a lot of energy on expanding their influence here. The Euro-Parliament is an odd body; often the place for those who enjoy making long speeches more than actually governing. It is actually quite powerless in a direct sense as it is not allowed to compromise the sovereignty of any of the EU members. It is a platform for politics and for fringe politicians to address their issues. Many nations do not really take the institution all that seriously. It is still a good place to make a point, however, and Macron has a point to make.

His platform calls for aggressive European unity in the face of all the populist ferment in the region. He has called attention to the mess that Brexit has caused in the U.K. He cites this as an example of what happens when the populists get the public to turn on the accomplishments of the EU. His positions include fighting the cyberattacks that have been undermining the legitimacy of the election process, developing an industrial policy to counter the influence of China and the U.S., and the development of a comprehensive set of policies to address climate change and other environmental issues. This is all activity that has been done by the whole of the EU and demands a return to faith in its institutions.

This not a popular position—at least not at first blush. The point he has been making is that many of those populist movements and governments that have appeared in Europe of late have created far more problems than they have solved.

OECD Sees Global Growth Slowing, as Europe Weakens and Risks Persist

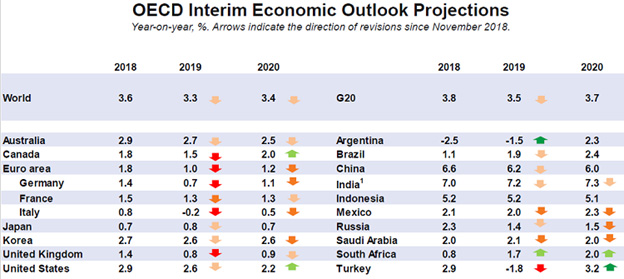

Economic prospects are now weaker in nearly all G20 countries than previously anticipated, according to the latest Interim Economic Outlook of the Organization for Economic Cooperation and Development (OECD). Vulnerabilities stemming from China and the weakening European economy, combined with a slowdown in trade and global manufacturing, high policy uncertainty and risks in financial markets, could undermine strong and sustainable medium-term growth worldwide.

The OECD projects that the global economy will grow by 3.3% in 2019 and 3.4% in 2020. The outlook and projections cover all G20 economies. Downward revisions from the previous economic outlook in November 2018 are particularly significant for the euro area, notably Germany and Italy, as well as for the United Kingdom, Canada and Turkey.

The Outlook identifies the Chinese and European slowdown, as well as the weakening of global trade growth, as the principal factors weighing on the world economy. It underlines that further trade restrictions and policy uncertainty could bring additional adverse effects on global growth. While policy stimulus is expected to help offset weak trade developments in China, risks remain of a sharper slowdown that would hit global growth and trade prospects.

“The global economy is facing increasingly serious headwinds,” said OECD Chief Economist Laurence Boone. “A sharper slowdown in any of the major regions could derail activity worldwide, especially if it spills over to financial markets. Governments should intensify multilateral dialogue to limit risks and coordinate policy actions to avoid a further downturn.”

The Outlook calls on central banks to remain supportive, but stresses that monetary policy alone cannot resolve the downturn in Europe or improve the modest medium-term growth prospects. A new coordinated fiscal stimulus in low-debt European countries, together with renewed structural reforms in all euro area countries would add momentum to a growth rebound, boost productivity and spur wage growth over the medium term.

This pace of growth has not been seen since the depths of the recession, said NACM Economist Chris Kuehl, Ph.D. “It seems unlikely that the nations of the eurozone will be able to do much about it. The downgrade applies to all the member states, but some experienced more pessimistic interpretations than others. The most disturbing part of the report holds that Germany will see growth of around 0.7%—very weak. Given that Germany is the engine for the rest of Europe, this does not bode well.”

The eurozone’s reliance on exports has contributed to the projected decline in economic growth, Kuehl noted. “This is a region that depends heavily on exports—Germany is over 50% reliant on those exports. Nearly everything that can go wrong with global trade has: Brexit means that Germany loses a key trade partner in the U.K.; the Chinese economic slowdown has hammered German companies that had invested heavily in that market; and the U.S. has been hostile to the Europeans in general and toward the Germans in particular.”

Other factors including opportunities to trade with fellow eurozone members have been constrained due to struggling economies and cautious German consumers, he added.

Turkish Economy: Domestic Demand Still Waning, Exports Fueled by the Lira’s Depreciation

Coface

Turkey is experiencing a severe economic slowdown coupled with a jump in inflation as a result of the sharp depreciation of the lira during 2018, which hit the country’s production and consumption dynamics. Last June, Coface downgraded Turkey’s country risk assessment to high (C) and the third quarter was marked by a wave of sector downgrades.

Government measures have helped to counter any further rise in inflation and temporarily support some sectors, although a full recovery will take time.

On the industrial production side, the pace of growth fell to 1.6% in 2018 from around 9% in 2017 and businesses continue to suffer from slower domestic demand. In September 2018, the annual increase in producer prices rose by a record 46%, while consumer prices jumped 24%. Domestic demand-driven sectors, such as construction, retail and information and communication technologies (ICT), are among the most-affected. But in 2019, inflation is expected to decelerate thanks to the base effect and slower pass-through from the weaker lira.

The worsening of the economic circumstances fostered exports, which have become an important source of revenue for the Turkish economy. In 2018, exports rose by 7% year-over-year (YY) to USD 168 billion, with key performances in chemicals (17%), motor vehicles (12%) and paper (11%), followed by textile and clothing (5%) and food (4%).

The automotive sector represented the biggest export product in 2018, accounting for 17% of total exports. It particularly benefited from the economic growth in European countries (final destination of 50.3% of exports) and from several government incentives.

Turkey enjoys a high degree of comparative advantage in textile, clothing, metals and plastics. This excellence helped the country to reach a threshold in sector specialization and possibly record additional sophistication and market share in the future. This is in line with the government’s new 2019-2020 economic program based on rebalancing the economy with higher exports. Pharmaceuticals, chemicals, petrochemicals, energy, machinery and software sectors are considered a priority in terms of investment.

Technology continues to be a less favorable sector due to its limited capabilities.

A low level of technology and limited competitiveness are restraining factors for further expansion of Turkish exports. Turkey is highly integrated in the global value chains with a close relationship with industrial production in Europe, particularly in Germany (Turkey’s biggest export market). Export revenues will therefore depend on the resilience of European growth, especially in automotive and textile and clothing.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations