Week in Review

Week in Review

|

What We're Reading:

July 26, 2021

French minister rejects UK Brexit renegotiation request. France's Europe minister Clement Beaune rejected on Thursday Britain's request to renegotiate the Brexit deal governing trade with Northern Ireland, dismissing British accusations of European dogmatism as a "tall tale". (Reuters)

Finance chiefs are still trying to replace Excel with new tools. Many companies would like to reduce their reliance on the spreadsheet application, but employees remain reluctant to give it up. (WSJ)

‘There is no food, money or work’: how shortages fueled Cuba protests. Pandemic devastated tourism industry and cut state’s ability to finance food imports, leading to higher prices. (Financial Times)

The global implications of Germany’s September elections. Germany's September elections not only mark the end of the Merkel era but could also mark a structural change in Germany’s fiscal stance. (ING)

U.S., Mexico fail to resolve dispute on trade rules for cars. The U.S. and Mexico failed to resolve a dispute over trade rules for cars during a meeting this week, threatening the goal of boosting regional manufacturing under their new trade pact. (Bloomberg)

Lebanon's water system on brink of total collapse, says UN. Lebanon's water supply system is on the verge of total collapse, according to the United Nations Children's Fund (UNICEF), in what would mark the latest development in the eastern Mediterranean country's slide into chaos. (CNN)

EU launches WTO dispute against Russia over procurement. The European Union has launched a legal challenge at the World Trade Organization against Russian measures it says restrict or prevent EU companies from selling goods to Russian state-owned enterprises. (EurActiv)

Shipping industry slams EU’s proposed new emissions charge as ‘extraterritorial tax on trade.’ Industry bodies have decried the European Commission’s plan to levy a charge on greenhouse gas emissions generated by shipping companies, calling it a “tax on trade” and a “pure money grab,” amid warnings the move could see firms seek to evade major ports on the continent. (Global Trade Review)

British supermarkets warn of 'pingdemic' threat to food supplies. Staff shortages and delivery problems caused by a COVID-19 app mean that some of Britain's favorite products are off the shelf for now. The government has moved to downplay the reported supply disruption. (DW)

Venezuela ignores US sanctions in quest to increase oil output. Venezuela’s state-owned oil company imported a key component needed to achieve its goal of almost tripling crude production, defying U.S. efforts to isolate the Maduro regime’s grip on power. (World Oil)

As the West winds down its 'war on terror,' jihadists are filling the vacuum, UN warns. As the 20th anniversary of 9/11 approaches, the United Nations is warning that the threat from terror groups such as ISIS and al Qaeda is not only resilient, but in many places expanding. (CNN)

Russia’s national security strategy: same book, new cover. The subtext of the country’s new security strategy

reveals a regime beset by suspicion and insecurity. (Interpreter)

Screening International Distributors: Separating Pretenders from Contenders. Choosing international distributors without a thorough selection process is less than ideal and to be avoided at all costs: selecting the wrong distributor is a tremendous setback for the exporter and the distributor alike. (Shipping Solutiions)

Using plastic waste to help solve sand shortages. Does the world have a shortage of sand? At first, that might sound like a peculiar question. (BBC)

Belarus shuts more civil society groups in wide crackdown. Belarusian authorities on Friday announced the closure of 15 nongovernmental organizations, part of a sweeping crackdown on independent media and civil society activists that includes shutting dozens of NGOs.

New Survey Finds Half of All Credit Sales Are Overdue in Asia

During Pandemic Recession

Silvia Ungaro, corporate communications manager, Atradius

The next few months present a critical time for business and industries across all major countries and regions worldwide. For Asia, there are positive signs for the months ahead, particularly with China’s strong economy, placing the region in the driver’s seat of a global rebound. Vulnerabilities remain, however, with the slow vaccination rate in Asia and resurgence of cases in many parts of Southeast Asia, posing a threat to short-term economy recovery.

In the 2021 edition of the payment practices barometer survey from trade credit insurer, Atradius, businesses across Asia were polled in China, Hong Kong, Indonesia, Singapore, Taiwan and the United Arab Emirates to see how they and their industries are coping with challenging times.

One year into the pandemic, businesses surveyed in the Asia region told Atradius that they experienced serious setbacks to growth and needed to take several measures to face the changing economic and trade circumstances.

Late payments and DSO increase on last year

Customer payment practices deteriorated for 40% of businesses surveyed in Asia over the past year. Late payments affected an average of 50% of the total value of all B2B credit sales. Businesses in the United Arab Emirates were hit the hardest, with 60% of the total value of all credit sales overdue, followed by Hong Kong and Singapore both at 52%.

Late payments can lead to operational difficulties for businesses with a reduction in cash flow, making it difficult to pay creditors and invest in the materials or services needed to complete new orders.

Supply chain challenges cause businesses to favor domestic customer credit

An average of 56% of all domestic B2B sales in Asia was made on credit over the last 12 months. This contrasts with the regional average of just 44% to foreign customers. There are several contributing factors for this discrepancy.

The first factor could be that most businesses find it easier to access local information for credit assessments, and most businesses in Asia told us that they used their customers’ financial statements as their primary source of credit information.

A second factor could be linked to the business’s perception of credit risk; survey results indicate that the risks associated with selling on credit have intensified since the onset of the pandemic.

Based on survey findings, most businesses in Asia anticipate seeing growth in their domestic economies before global trade picks up, and therefore may associate credit risk through trading with foreign customers.

Trade credit used as key sales tool

To encourage repeat business with established customers and attract new business, most businesses in Asia use trade credit. Favorable trade credit terms can make the difference between winning a new contract or retaining a new customer and losing the trade to a competitor.

Before agreeing to offer credit, a business should make sure it has enough liquidity to support the period of credit, and ideally, longer.

Confidence for the coming months

The coming months still represent a time of high uncertainty, therefore predicting future developments in the business and trade environments in the region’s major economies is still quite challenging. As governments continue the vaccination roll-out differently per country and withdraw fiscal stimulus and support packages, there is likely to be a spike in the rate of insolvencies during the second half of 2021. In order to protect accounts receivable from the impact of late payments and bad debts, businesses should monitor the health of the supply chain for signs of insolvency that could lead to other bankruptcies.

Despite concerns over the pandemic and vaccination roll-out, ongoing supply chain disruptions, containment of credit management costs and liquidity issues, business confidence across the region is mostly upbeat. There are some positive signs that help us understand that the coming months may be brighter. The survey results indicate that despite the heightened credit risk environment, pressure to sell led many businesses to increase their appetite for credit sales, indicating its importance as a sales and loyalty tool for businesses in Asia.

More than half of all respondents surveyed across Asia are confident their business will grow next year, with the majority expecting improvements in profitability to come from a rebound in their domestic economies. Businesses who were able to offer flexible payment terms and adapt to the changing trading scenarios were the most effective at managing trade risk, while others suffered. Overall, businesses’ credit management processes will be put to the test, and those companies that adopt a flexible credit management approach will be best positioned to navigate through this uncertain period.

gement processes will be put to the test, and those companies that adopt a flexible credit management approach will be best positioned to navigate through this uncertain period.

-

APRIL

24

11am ET -

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes

-

Just a Little off the Top: Strategies for Reducing the Growing Cost of B2B Credit Card Acceptance

Speakers: Lowenstein Sandler Partner Andrew Behlmann and

Colleen Restel, Esq.

Duration: 60 minute -

APRIL

29

3pm ET

-

MAY

7

11am ET -

Collections 101

Speaker: JoAnn Malz, CCE, ICCE, Director of Credit, Collections, and

Billing with The Imagine Group

Duration: 60 minutes

-

Author Chat: How to Lead When You’re Not in Charge

Author: Clay Scroggins

Duration: 90 minutes | Complimentary -

MAY

8

11am ET

Seizing the Opportunity for a Pro-Growth, Post-Pandemic World

Geoffrey Okamoto, First Deputy Managing Director, IMF

Since March 2020, governments have spent $16 trillion providing fiscal support amid the pandemic, and global central banks have increased their balance sheets by a combined $7.5 trillion. Deficits are the highest they have been since World War II and central banks have provided more liquidity in the past year than in the past 10 years combined. This was absolutely necessary: IMF research indicates that if policymakers had not acted, last year’s recession, which was the worst peacetime recession since the Great Depression, would have been three times worse.

That’s where we’ve come from, but where are we headed? In the year ahead, as more vaccines roll off the production line, more people get jabbed and more economies gradually reopen, policymakers need to engineer a fundamental shift from saving their economies from collapse to strengthening their economies for the future with growth-oriented reforms.

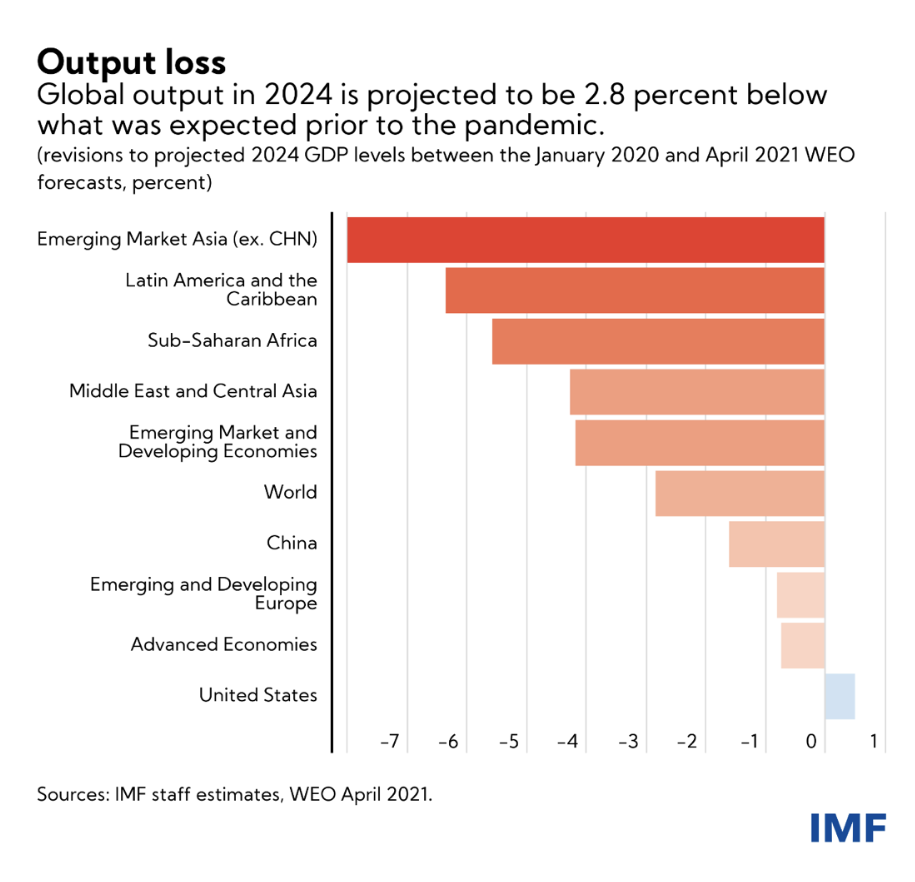

We know that some pro-growth reforms were deferred, if not reversed, and some economic scarring has occurred. The world lost $15 trillion in output as a result of COVID-19, relative to what the IMF expected in January 2020. The same energy that is being put into vaccination and plans for recovery spending also needs to be put into growth measures to make up for this lost output.

Enhanced debt restructuring mechanisms should help resolve unviable firmsexpeditiously and channel investment to new ideas and companies. Stronger active labor market policies, including job-search monitoring and support, and retraining should help workers shift to more promising jobs in dynamic parts of the economy. Improved competition policy frameworks—actively debated right now in Europe and the United States—and reductions in barriers to entry in sclerotic sectors should ensure that we don’t have moats around the firms that captured the policymakers of yesteryear.

Toward a brighter future

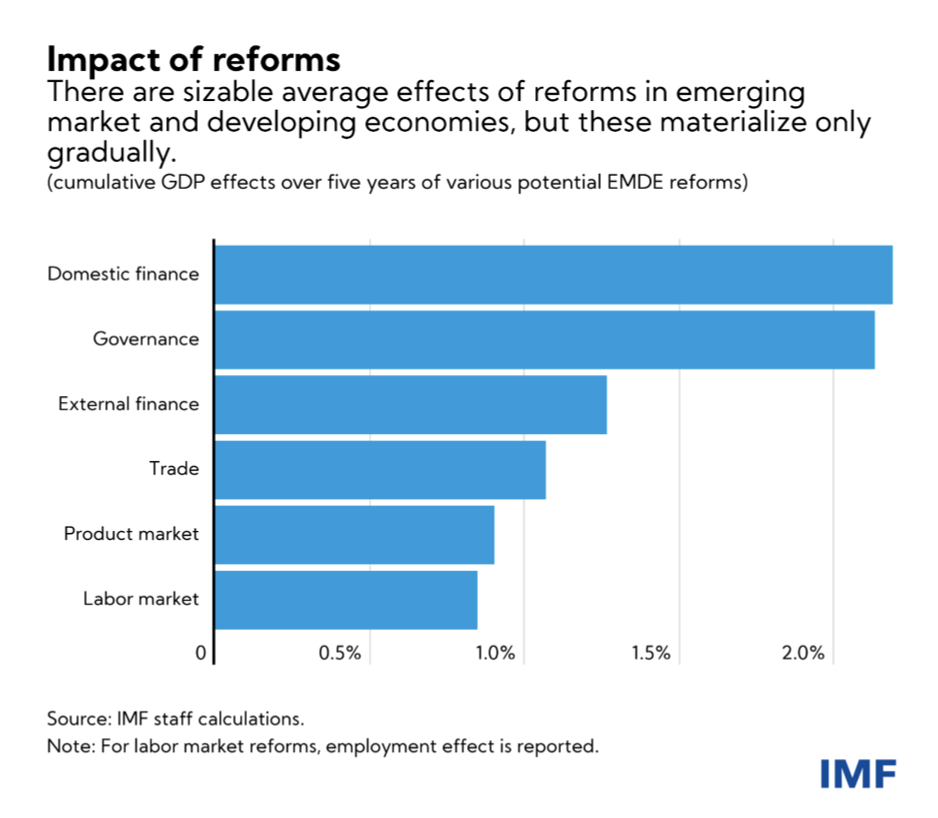

Using this moment for some of these difficult reforms means that the monetary and fiscal stimulus still flowing will serve as a springboard to a brighter and more sustainable future rather than a crutch to a weaker version of the pre-COVID-19 economy. Seizing the opportunity could deliver years of solid post-COVID-19 growth and progress in living standards. The IMF estimates that comprehensive growth-enhancing reforms cutting across product, labor and financial markets could raise annual growth in GDP per capita by over one percentage point in emerging market and developing economies in the next decade. These countries would be able to double their speed of convergence to advanced economies’ living standards relative to the pre-pandemic years.

For advanced economies, a growth-reform tailwind would help repay the debts incurred to provide unprecedented support, increasing the space for critical investment and reducing the need to raise taxes. With inflation running higher than forecasted and the lack of certainty about when its drivers will abate, growth reforms that target the supply-side provide insurance against any persistent inflationary risks from demand-side pressures in the United States and elsewhere.

For emerging market countries that have been able to maintain access to global capital markets, reforms can strengthen fundamentals and bolster investor confidence even as financial conditions tighten, especially if inflation persists in advanced economies. For low-income countries who have depleted their policy space, the returns on growth-oriented reforms can be high enough to avoid harsh fiscal austerity, allowing them to protect social and health spending in the short-run while boosting their capacity to invest in their people in the long-run.

It doesn’t all have to be done at once. Recovery from this crisis will take years for most countries. Inspiring the next generation to rebuild a brighter future is the primary challenge for this generation of policymakers. They should seize this challenge, daring to be bold as the current crisis reaches a crossroads. Pairing growth reforms with recovery spending will deliver the prosperity that we have promised our citizens, making our own fate in a post-COVID-19 world.

Reprinted with permission by IMFBlog.

United Kingdom: Johnson Riding a Wave

The PRS Group

Prime Minister Boris Johnson’s Conservative Party confirmed its dominance across the U.K. in local and regional elections held in early May, making clear that the Labour Party still has much work to do if it hopes to regain the credibility lost under the leadership of Jeremy Corbyn. The elections made for a rough coming-out party for Labour’s current leader, Keir Starmer, and confirmed the broad satisfaction of the Tory faithful with the ever-eccentric Johnson.

The strong showing of the pro-independence SNP in elections for Scotland’s devolved assembly ensures that First Minister Nicola Sturgeon will persist in her campaign to hold another status referendum, but there seems little chance that she might obtain the required authorization from Johnson if his hold on the top job remains secure. That said, the possibility that Sturgeon might attempt to organize a plebiscite without the blessing of the national government, resulting in a constitutional crisis, cannot be ruled out.

There are of course factional pressures within the governing party that the prime minister must manage, but the absence of a major shake-up after the recent elections suggests that these are at least temporarily in abeyance. As such, near-term political risks stem mainly from the danger that either COVID-19 or Brexit (or both) might inflict further damage on an economy that is poised to grow by more than 5% in real terms in 2021.

In the case of Brexit, the risks include the social fallout from the creation of customs checks on goods trade between Northern Ireland and other parts of the U.K., a necessary compromise to maintain an open border between Northern Ireland and Ireland. Fears among loyalists that Northern Ireland’s isolation within the U.K. will lead inexorably to its absorption by Ireland have already triggered episodes of sectarian conflict in an entity where national allegiances overlap significantly with religious affiliation.

The March budget included an increase in the corporate tax rate to help pay for the pandemic-related fiscal stimulus, although the hike will not take effect until 2023 and businesses will in the meantime be eligible for a super-deduction for investments in plant and machinery. There is a strong likelihood that other taxes may have to rise to finance programs to protect the environment and shrink a public sector debt estimated at around 145% of GDP. Borrowing conditions remain favorable, but officials will need to move quickly to restore fiscal discipline or risk leaving the economy vulnerable to an abrupt change of course for monetary policy in response to a spike in inflation (which could set the stage for a housing crash) or fresh external shocks that send the economy back into recession.

The analysis above is taken from the June 2021 Political Risk Letter (PRL). The best-in-class monthly newsletter, written by the PRS Group, provides concise, easy-to-digest briefs on up to 10 countries, with additional recaps updating prior month’s reports. Each month’s Political and Economic Forecasts Table covers 100 countries, with 18-month and five-year forecasts for KPIs such as turmoil, financial transfer and export market risk. It also includes country rating changes, providing an excellent method of tracking ratings and risk for the countries where credit professionals do business. FCIB and NACM members receive a 10% discount on PRS Country Reports and the PRL by subscribing through FCIB.

Week in Review Editorial Team:

Diana Mota, Editor in Chief and David Anderson, Member Relations