Week in Review

Week in Review

What We're Reading:

November 2, 2020

The real winners of the US-China trade dispute. With tariffs on Chinese products high, U.S. importers are turning to other countries. A DW analysis shows where Americans are now buying their cell phones, computers, furniture and clothing from instead. (DW)

Brexit decision entirely separate from US election outcome says PM Johnson. Britain’s decision on whether to agree a Brexit deal with the European Union is entirely separate to the outcome of the U.S. election next month, Prime Minister Boris Johnson said last week. (HSN)

US economy posts record growth in third-quarter; COVID-19 scarring to last. The U.S. economy grew at a historic pace in the third quarter as the government injected more than $3 trillion worth of pandemic relief which fueled consumer spending, but the deep scars from the COVID-19 recession could take a year or more to heal. (Reuters)

Coronavirus: France and Germany have announced second national lockdowns. Emmanuel Macron said his country and its European neighbours were being "submerged" by the rapid pace of COVID-19. (Sky News)

South Korea’s top court upholds 17-year jail term on ex-leader. South Korea’s top court upheld a 17-year sentence imposed on former President Lee Myung-bak for a range of corruption crimes in a final ruling on Oct. 29 that will send him back to prison. (Business Mirror)

The Trump Administration is about to change the H-1B visa program forever. Replacing the computerized draw of lots to decide on the successful H-1B applicants, the DHS said it is expected to help counter the downward pressure on the wages of American workers that is created by an annual influx of relatively lower-paid, new cap-subject H-1B workers. (Economic Times)

The Three Seas Initiative: A European answer to China’s Belt and Road? A quest to modernize dilapidated infrastructure in Central Europe has quickly transformed into a geopolitical contest. (Interpreter)

US rejection throws WTO leadership race into confusion. The World Trade Organization’s bid to select a new leader was plunged into uncertainty on Oct. 28 after the United States rejected the Nigerian woman proposed as the global trade watchdog’s next director-general. (HSN)

WTO members greenlight EU sanctions against US over Boeing aid. World Trade Organization members gave the green light for Brussels to slap tariffs on $4.0 billion in U.S. imports annually in retaliation for illegal American aid to plane maker Boeing. (EurActiv)

Seven things to know about fiscal challenges in the Middle East and Central Asia. The COVID-19 pandemic and the ensuing economic crisis have required emergency fiscal measures as revenues have dried up. Many countries in the Middle East and Central Asia, which were already vulnerable before the pandemic, are now in a precarious fiscal position. (IMF)

Chinese fintech could shatter records with $35-billion share offer. The world’s largest fintech company, China’s Ant Group, will try to raise nearly $35 billion in a massive public offering of stock that would shatter records. (Business Mirror)

Bulgaria: Can civil unrest lead to actual change? It is important to discuss the recent rise in popularity of the movement Democratic Bulgaria and if it could deliver viable political results. Given the political momentum it has gathered, this newcomer has a chance of breaking through the ranks of the old political elite. (Global Risk Insights)

A world of trade uncertainty. The U.S.-China trade war and Brexit have generated quantifiable uncertainty in the marketplace, but the impact of those events is being eclipsed by the uncertainty generated by the global pandemic. (Global Trade Magazine)

It All Comes Down to Shopping

Chris Kuehl, Ph.D.

The analysts and experts spend a great deal of time assessing factors that could impact and influence the progress of economic growth. They watch the price of commodities and the actions of the central banks. They inspect the patterns and strategies of the political leaders, the impact of natural disasters and a whole slew of other indicators.

At the core of all of this is the actions of the consumer. Nothing matters as much as the daily decisions made by hundreds of millions of people—none of whom check any sort of economic indicator before they decide to spend or not spend on any given item or activity.

The analysis of the consumer focuses on two factors. The first is their ability to spend on anything at all. This is why there is so much emphasis on employment, inflation, taxation and all the other influences on income. If people have a significant income and loads of discretionary power over that income, they have the ability to spend. If they have no job or a poorly paying job, they will be a less active consumer. If they pay high taxes, they will have less discretion in how they spend their income. It really does come down to this. The second key factor is their desire and willingness; this is far more complex. There are many basic demands that must be met. But within the categories of food and shelter, there is a great deal of variety. The discretionary income is infinitely more diverse.

Prior to the lockdown recession, the majority of spending in the U.S. was directed at services, a category that has grown exponentially in importance over the years. People spent upwards of 60% of their income on services, everything from going out to eat, attending performances, getting their hair done, their yards mowed or their homes cleaned. This shift towards services has been even more profound for the higher income consumers because they tend to focus on time rather than acquisition. They do not want to be bothered with routine tasks when they have the ability to hire someone to perform them. They are then free to travel or engage in entertainments. The upper 25% of income earners traveled at least eight to 10 weeks out of the year, while the bottom 25% almost never travel more than 100 miles from home.

The lockdown shattered the service economy, a fact we have all become aware of. The service sector is still far from recovered even in those regions where there have been attempts to reopen. Travel is still far below normal levels. Hotel occupancy is low. Entertainment parks, resorts, casinos, performance venues remain closed. Restaurants are only partially open, and so on. This has affected the very lowest income earners, and it has affected the very highest income earners. The vast majority of those who lost their jobs were in the low paid service sector. At first, these job losses were thought to be furloughs; it was assumed that everything would be back to normal by the end of May. That obviously was not the case. Now these are seen as permanent job losses. The upper income consumer was affected because they have been cut off from the service sector and are subsequently spending far less money than before.

To see the economy rebound, two things will have to happen and they are closely connected. The consumer will have to get engaged and stay engaged. This means spending on goods as well as services. Thus far, there has been willingness to get back into the “thing buying” mode, although the shift from brick and mortar to online has created crisis for some and opportunity for others. The return to services has not occurred as of yet, although there appears to be willingness on the part of the consumer if these opportunities present themselves. At the same time that consumers show a willingness to resume their old spending habits, they will have to have the income available to do so. This means a resumption of employment for the tens of millions who lost their job, but it also means having the level of disposable income steady and rising. There will soon be a desire on the part of every level of government to address the massive revenue shortfalls created by the recession and that means turning towards taxes. The more people are taxed, the less money they have to spend so it becomes a delicate trade off. Without revenue, the governments will have to reduce their services and in many cases the burden will fall on the general population and that will cost consumers money as well. At the heart of all of this will be consumer confidence, without it the economy will stall.

-

APRIL

17

11am ET

-

Vendor Verification: Mitigating Risk, Maximizing Returns

Speaker: Kristen Pope, Gates Machine Tool Repair, Inc.

Duration: 60 minutes -

APRIL

18

3pm ET

-

APRIL

22

3pm ET -

Do You Know Who You Are Selling to?

Speaker: Emory Potter, Esq., Hays & Potter, LLP

Duration: 60 minutes

-

Where the Buck Stops: Establishing KYC &

Export Compliance Best Practices

Speaker: Paul J. DiVecchio, principal of DiVecchio & Associates

Duration: 60 minutes -

APRIL

24

11am ET

7 Tactics to Lead Through a Crisis

Ron Price, Price Associates

After 50 years of serving in a wide variety of leadership roles, I’m convinced that every leader will face multiple crises as a normal part of the leadership journey. In my own experience, I have found myself in the middle of crises brought on by leadership failures, destructive fires, economic downturns, supply chain breakdowns, regulatory battles, business fraud, work violence, and now in 2020, a global pandemic. For much of my career, I viewed these crises as interruptions and distractions, seeking to put them behind as quickly as possible so we could get back to our organizational plans.

What if crises are an important and useful part of the life cycle for leaders and the organizations they serve? What if we could use crises to increase the trajectory for future success? What if the following quote from personal growth expert, Napoleon Hill, became a pivotal belief in our mindset as leaders?

“Every problem, every adversity, and every heartache has contained within it the seeds of equivalent or greater benefit.”

If we really believed this quote, we would immediately view each crisis as new opportunity. We would face crisis with an optimistic belief that something good was waiting to be discovered. And with the belief that “luck comes to us when preparation meets opportunity,” we would spring into action with enthusiasm and a positive expectation for the future.

Starting with the right mindset about crisis, we can then take practical steps to lead others through the turmoil to a brighter future. How? I believe the following steps will help those we lead join us in exercising hope for the future after a crisis:

- Set the example by how you care for yourself. To navigate a crisis successfully, we need to summon deeper levels of strength. By setting the example of self-care, we can inspire others to do the same.

- Be honest about the crisis. Followers need to know that their leaders see things as they are in a crisis before they can fully embrace an optimistic view of future possibilities.

- Don’t make promises you can’t fulfill. It can be tempting to reassure others through confident assertions about the future. However, it is always better to under-promise and then over-deliver as you work your way through the crisis.

- Realign commitments and resources as soon as possible. Every crisis requires adjustments to plans, budgets, resources, and commitments. Thinking these adjustments through early, then communicating them clearly, will help followers have confidence and support the necessary changes.

- Think differently about the future. Crisis is an opportune time for creativity and innovation. Innovation includes creating new value for customers through new products or services, more efficient processes, rethinking market positioning, and sometimes, complete paradigm changes in the nature of your business.

- Communicate well and often. Crisis often brings a loss of predictability. Followers need to hear from their leaders regularly. They need to hear clear, consistent messages that evolve as clarity around the new circumstances grows.

- Communicate gratitude instead of victimization. Leaders well equipped for crisis are resilient and flexible. Though they can’t control everything happening, they are intentional in finding things to be genuinely grateful for and they don’t succumb to temptations to complain, blame, or express discouragement.

When we realize that crises will come throughout our careers and that these moments of abrupt change present real opportunities for growth, we will prepare and then respond better. Instead of being slowed down by crisis, we will be propelled to greater success and deeper fulfillment, both for ourselves and those we lead.

NACM and FCIB is hosting an Author Chat 11-12:30pm ET, on Nov. 19 for members. Read, Growing Influence, and join the discussion with author Ron Price by registering for the free event.

Sub-Saharan Africa’s Difficult Road to Recovery

Abebe Aemro Selassie, Director, IMF’s African Department

The Covid-19 pandemic represents an unprecedented health and economic crisis for sub-Saharan Africa. Within months, the spread of the virus has jeopardized years of development and decades-long gains against poverty in the region while threatening the lives and livelihoods of millions of people.

In our latest Regional Economic Outlook, we project -3% growth in sub-Saharan Africa’s GDP in 2020, representing the worst outcome on record for the region. The drop will be even larger for economies dependent on tourism and commodity exports. Growth in the region should rebound modestly in 2021 to 3.1%, but for many countries, a return to 2019 levels won’t occur until 2022–24.

Countries in the region acted swiftly to protect their people from the worst of the crisis, but lockdown measures came with high economic and social costs. Policymakers in sub-Saharan Africa now face the added challenge of rekindling their economies with fewer resources and more difficult choices.

As the region looks toward the future, uncertainty over the path of the pandemic continues to loom over an enduring recovery.

Confronting Policy Constraints and Hard Choices

The top policy priority should be saving lives and protecting livelihoods through health spending and income and liquidity support for households and businesses. Even with limited funds, policymakers acted swiftly with what they had.

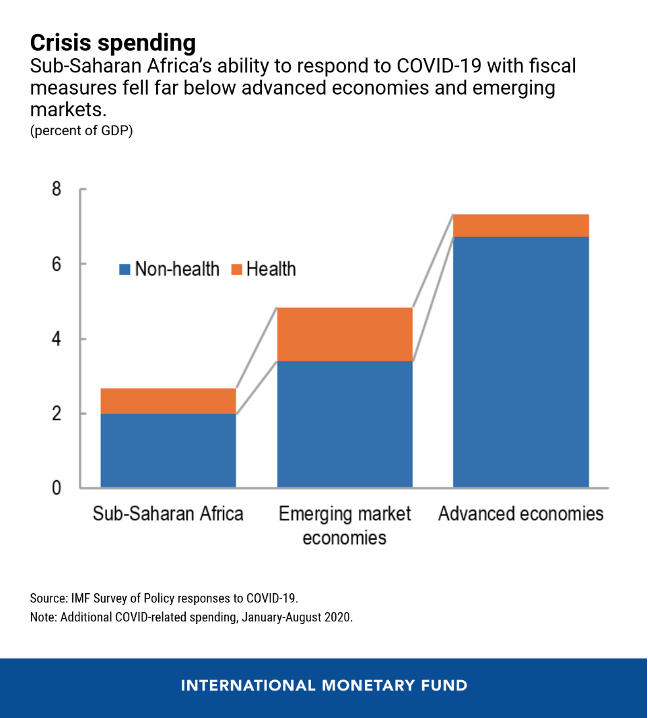

However, countries in the region entered the crisis with significantly less fiscal space than they had prior to the global financial crisis of 2008–09. COVID-19 related fiscal support in sub-Saharan Africa has averaged 3% of GDP—markedly less than what has been spent in other regions of the world.

Advanced economies have had the space to do “whatever it takes.” In sub-Saharan Africa, no such luxury exists, as countries struggle to do “whatever is possible” with their scarce resources. Limited resources will ultimately force difficult choices.

Fiscal policies needed to boost the economy will have to be balanced against debt sustainability—already a daunting challenge for many countries in the region. The need to support growth through monetary policy will need to be matched against maintaining external stability and longer-term credibility. Financial regulation and supervision measures are needed to address crisis-affected banks and firms but should not compromise longer-term growth.

All the while, efforts to stabilize and grow economies must be weighed against the need to maintain social stability while preparing for sustained and inclusive growth over the long term.

Calling on the Global Community for Support

Without significant additional financial assistance, many sub-Saharan African countries will struggle to simply maintain macroeconomic stability while meeting the basic needs of their populations.

The IMF has taken swift action to cover a significant portion of the region’s needs by providing about $16 billion financing this year alone to 33 countries and immediate debt service relief to 22 of the poorest, most vulnerable sub-Saharan African countries. We are working with countries to put in place governance mechanisms to help ensure that the funds benefit their people as intended.

We have also worked with the G20 to suspend debt service payments to official bilateral creditors and welcome the extension of the Debt Service Suspension Initiative.

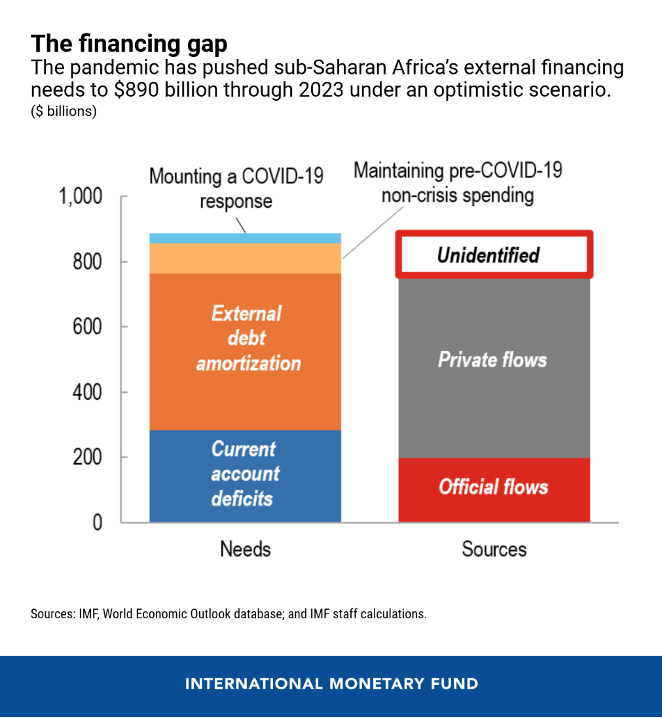

But more help is needed. Sub-Saharan Africa faces additional financing needs of $890 billion through 2023. Private financial flows are expected to fill less than half of that need, while current commitments from international financial institutions and bilateral donors will cover only one-quarter of the need. Under that scenario, the region still faces a projected financing gap of $290 billion through 2023.

No country should have to choose between paying their debt or providing food and medicine for their people. To prevent the loss of decades-worth of development gains, the region will need access to more grants, concessional credit, and debt relief.

Looking Toward a Brighter Future

Despite an uncertain outlook, the potential of sub-Saharan Africa and the resourcefulness of its people remain clear. Now is the time for lasting transformational reforms.

Sub-Saharan Africa will find its way back to a path of green, sustainable and inclusive development. The pandemic has presented a historic opportunity to build a better future and the international community has an important role to play.

Fostering better transparency and governance to improve trust in rule of law, strengthen business conditions and encourage external support will be a key element for developing a better future. Transformative domestic reforms to improve revenue mobilization, digitalization, trade integration, competition, social safety nets, and climate-change mitigation will be critical for the region’s resilience, growth and job creation.

Nelson Mandela once said, “may your choices reflect your hopes, not your fears.” The long climb out of this crisis won’t come easy, but the actions and choices of today will be vital for a prosperous and resilient future for sub-Saharan Africa.

Reprinted with permission from IMF Blog.

Week in Review Editorial Team:

Diana Mota, Associate Editor and David Anderson, Member Relations