Strategic Global Intelligence Brief for September 4, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Climate Change and the 2020 Elections

Despite what already seems like an endless campaign, the various candidates are still casting about to find the issues that will most motivate the voters by next November. There has been lots of attention paid to health care, income inequality, immigration, gun control and the many forms of bias and prejudice. Now it seems to be the time for climate change. In the days prior to the next round of debates between the Democratic candidates, there have been plans launched to deal with the issue. There are differences but all have some things in common—getting the U.S. back into the Paris accords, spending heavily to develop renewable energy and severe restrictions on fossil fuels. At the moment, these ambitious plans would never make it through Congress, but should the balance of power shift, some elements might emerge.

Changes in Interview Process

There have been many not-so-subtle changes taking place as a result of the attention brought to sexual harassment and discrimination. It was once fairly common for interviews to be conducted in social environments—hotel rooms, bars, restaurants and the like. Several organizations and businesses have now forbidden these settings and demand that all interviews be conducted in a public office during normal business hours. There are now more restrictions regarding how people travel to meetings with some policies demanding that men and women stay in different hotels so as to minimize the appearance of impropriety.

Infrastructure Plan Stalls

It is a very common occurrence in politics. There is near universal agreement that money needs to be spent on the repair and expansion of the nation's infrastructure. After all, the survey from the civil engineers gives the U.S. system a grade of D-. The problem is everybody wants a piece of that action and there is not enough money to go around. The fight is over what should be addressed first—whose highway, mass transit or new roads, seaport facilities or airports, broadband access for rural areas or more free access in urban areas. The squabbling reaches a fever pitch and, in the end, there is no money allocated for any of the projects.

Short Items of Interest—Global Economy

The End of the Tories?

It has not come to that yet, but the Conservative Party in the U.K. has never been this fractured. The fight over Brexit has morphed into an existential threat to the party. It has now become deeply divided between the traditional members who placed business and economic issues as priorities and the right-wing British nationalists motivated by social issues and antagonism towards immigrants. Yesterday, key members of the Tory party defected and Prime Minister Boris Johnson no longer has a working majority in Parliament—a development that could result in a snap election.

Hong Kong Concessions

Carrie Lam, the embattled leader of Hong Kong, has made a major concession to the protest movement, but it may be too little, too late. At the start of the confrontation the demand was that Lam withdraw the controversial extradition provision permanently. This was a rule that would have allowed Beijing to arrest people in Hong Kong and punish them. She has now agreed to do this, but the protestors now want more—starting with her resignation. They are also demanding much more democratic opportunity and a reduction in Chinese influence.

Dorian May Be Only the Beginning

While all eyes have been on Hurricane Dorian, the next threats are already manifesting. There are two other hurricanes in the area—one headed for just south of Brownsville, Texas, and one on Mexico's Pacific side. There are also two tropical depressions forming in the Atlantic and several more disturbances off the African coast that could strengthen. It was predicted this would be a very busy year for these storms. It looks like that prediction is coming to pass.

CMI Provides a Ray of Sunshine

Hey Kids! Do you know what time it is? For those of a certain age you know what comes next, but I am not referring to that this time. I am referencing the fact it is time for the latest Credit Managers' Index (CMI). Each month we have the honor and duty of interpreting the data collected by the National Association of Credit Management. The CMI is modeled on the Purchasing Managers' Index (PMI) and has the same virtues—very accurate and unbiased data that provides a snapshot of the economy every month. It has often proved to be an accurate predictor of future economic trends. What follows is the executive summary for the whole index as well as the breakout summaries for the manufacturing and service sectors. Go to the NACM website to see the entire report.

Analysis: Just when it seemed safe to settle into a good funk, the Credit Managers' Index tracked in a very positive direction. The CMI was not the only indicator that experienced a reversal of fortune, but while that trend seemed to be on the upswing for some, there were those readings that showed further decline. The economy appears to be in a transition phase again. It is not entirely clear, however, what it is transitioning from or what it might be transitioning to. The latest durable goods data shows an improvement, but most of that is due to the changes in the more volatile aerospace sector. The data from Markit's PMI was showing numbers that are in the contraction zone (a reading below 50). There has been better news as far as capital spending but bad news as far as capacity utilization. In short, there is a little something for both the glass-half-full and the glass-half-empty crowds.

The combined score for the CMI this month was a very solid 55.2. That puts the index right back where it was in June when it was at an even 55. It is not quite at the level reached in May when it hit 55.7, but it is far better than last month's 53.4. The combined score for the favorable factors jumped back into the 60s with a reading of 61.8 compared to the 58.6 notched in July. Again, the readings are not as robust as in May when they hit 63.8, but the trend is pointing in a more positive direction. The combined score for the unfavorable factors also improved, but by the narrowest of margins. It was 50 the month prior when it appeared likely to fall into contraction territory, but this month the pattern reversed and it climbed up slightly to 50.9.

As usual, the details are the most informative. There was a nice recovery in the sales data from 58.4 in July to 64.4 this month. This is not the highest point reached this year, but it is in the top five. In May, it was standing at 65.9, the second-highest level reached in the last 12 months. The new credit applications number remained very close to what it had been the month prior, moving from 60.8 to 60.9. This is still a bit lower than the reading in the last several months and seems to indicate a little more caution manifesting. The dollar collections numbers improved quite a bit; always good news. Last month, the reading was 56.6—down from 60.3 in June, but this month the numbers are back to 60. The amount of credit extended also returned to the 60s with a reading of 61.7, just shy of the 62.5 number from June. All in all, it appears July was something of an aberration, or simply a traditionally slower month.

The specifics of the unfavorable categories are informative as well. The data on rejections of credit applications remained very close to what it was in July at 52.6, but it dropped slightly to 52.1 this month. These are decent numbers, which is important given there was a decline in the new applications data. It suggests that those asking for credit are getting it and this is taking place even as credit managers are trying to get a little tighter with their decisions. The accounts placed for collection remain in the contraction zone, but not as deep as before. The reading last month was 46.2, and now it stands at 48.6. This is not exactly good news, but the trend is more acceptable. Disputes, however, slid out of expansion territory into contraction by going from 50.5 to 49.4. The dollar amount beyond terms improved quite a lot, a nice trend as the holiday spending season gets underway. It was at 46.1 and buried pretty deeply in contraction, but it has reentered the expansion category with a reading of 53.6. The amount of customer deductions slipped from 51.2 to an even 50, but at least it has not fallen into contraction. The filings for bankruptcies have become a bit of a concern, however. The reading this month is 51.6, the lowest it has been in well over three years. There have been companies hanging on by a thread, and it now appears some can't handle the economic reversals that have emerged in the last few years.

Manufacturing Sector

As concerns about the economy begin to mount, the focus of most of the concern has been manufacturing. There have been distinct indications that factors such as the on-again, off-again trade war has been having an impact as well as more long-term threats, such as labor shortages and declining demand in such key areas as agriculture and aerospace. Even with these challenges, there were some decent numbers in important sectors.

The combined index reading of 55.7 was back to the levels seen in May of this year (55.4) after being at 53.2 in July. The index of favorable factors jumped back into the 60s with a reading of 61.6 from 56.7 the month before. This category has been above 60 in all but four of the last 12 months. The unfavorable index extended further into expansion territory with a reading of 51.7 compared to last month's 50.8. All in all, it showed a better set of indicators than some of the other manufacturing indices.

The sales category surged to a level not seen in many months. It is sitting at 65.3, the highest point since September of last year. This has been despite the travails of Boeing and the sharp drop in demand for farm equipment. Even the dip in exports did not seem to affect the sector this month. It seems there has been a solid demand for vehicles and machinery—especially in the energy sector and in the general category of robotics. The new credit applications remained almost exactly where they were last month (60.1 as compared to 60). The dollar collections data also improved significantly as it moved from 54.7 to 59.6. The amount of credit extended broke back into the 60s with a reading of 61.4 from 54.7 in July. The good news may have been flowing only from select sectors, but these have been strong enough to carry the whole sector.

The rejections of credit applications remained very close to what had been seen earlier—53 compared to 53.4 in July. This is good given the activity in new applications. It is not uncommon for companies to desperately seek credit when times are tough. That is why rejections move up. The accounts placed for collection jumped out of the contraction zone with a reading of 50.6 compared to 46.7 in July; that is very encouraging. The disputes category sank slightly (51 to 50.3), but it still remained in expansion territory. The dollar amount beyond terms moved into expansion territory with a reading of 55.9 compared to the 48 registered in July. The dollar amount of customer deductions slipped, however, as it went from 52.7 in July to contraction territory in August with a reading of 49.3. There are some early warning signs showing up in filings for bankruptcies with the drop from 53 to 51.4, the lowest reading seen in over three years. There have been some manufacturing sectors that have taken real hits thus far this spring, and some are not going to survive.

Service Sector

As for the service sector, it is both immensely important and almost impossible to accurately assess. It is by far the dominant sector in the U.S., both in terms of its impact on GDP (it accounts for approximately 80% of the total) and employment (again, over 80%). Nearly all of the hiring in the last 12 months has been in the service sector (close to 95%). The challenge is the sector is vast—everything from health care to retail to construction and transportation. Tracking the changes requires some attempt at isolating what is being measured. The bulk of the CMI service sector is retail, but there are also significant contributions from transportation, construction and finance.

This is the time of year that retail comes into sharp contrast. For the next several months, all eyes will be on the consumer and their behavior during the holiday period. Thus far, it seems to be off to a decent start, but the retailers are still approaching the season with an "inventory light" attitude.

The combined score for the service index recovered some lost ground from July, but is still off from the month previous. The current reading is 54.8, better than July's 53.7, but not as robust as the 55.1 in June or the 55.9 in May. The combined score for the favorable factors remained in the 60s and was a little stronger than July's 60.5 with a reading of 61.9. The index of unfavorable factors returned to expansion territory but by the narrowest of margins (49.1 to an even 50).

The sales numbers will be very closely watched from this point. Right now, the reading stands at 63.4. It was previously at 59.3. It is expected these numbers will steadily improve as the holiday season gets into full swing. The new credit applications data stayed almost the same as the prior month, but these are very good numbers—61.6 in July and 61.7 in August. The dollar collections readings improved and returned to the 60s with a reading of 60.4 compared to 58.4 in July. The amount of credit extended stayed nearly static with a reading of 62.1 after 62.6 last month.

The rejections of credit applications were also nearly stationary, dropping from 51.9 to 51.2. These are encouraging numbers as they suggest most of those seeking credit are receiving it. The accounts placed for collection remain stuck in contraction territory, but there has been a slight upward trend with a reading of 46.7 from 45.7 in July. The disputes category went down, however, and is now in contraction territory with a reading of 48.5 compared to last month's 50. The dollar amount beyond terms jumped quite a lot and escaped the doldrums of contraction dramatically. In July, the reading was 44.2 and this month it is at 51.2—comfortably in expansion territory. The dollar amount of customer deductions also escaped the contraction zone with a reading of 50.6 from 49.7. As with manufacturing, there is growing concern over the rate of bankruptcies. The filings from the bankruptcies index went from 53.4 to 51.9, the lowest mark set in over three years. This is especially worrying for retail since traditionally the biggest threat of bankruptcy activity is after the holiday season when some companies find they have badly missed their revenue and profit targets.

August 2019 versus August 2018

It looks more and more like July was an outlier in terms of the CMI data. Most of the August numbers have returned to the trends started in May and carried through June. The next question is whether September reverses course or matches August and June.

Speaking of Indices

The latest edition of the Purchasing Managers' Index did not deliver such good news. For the first time in several years, the PMI has fallen into contraction territory with a reading of 49.1. This was not unexpected, however, given the reading from the Markit version of the PMI earlier this month.

Analysis: Manufacturing has been hit hard by the slowdown in the global economy and this trend is likely to continue for a while.

Patient—Doctor Relationships

I have developed a rather odd system for measuring my health status. It started with my previous primary care physician and has extended to my current primary care doctor as well as my cardiologist and radiologist. That little bout with throat cancer last year has resulted in my having a plethora of doctors in my life at varying times. Each visit is accompanied by all the requisite tests and evaluations necessary to assess me, but we all know that medical commentary can be a bit confusing. I have a system that is much easier to interpret.

When one of my doctors and I would meet and spend the bulk of the session discussing Pakistani politics rather than my health, I knew I was in pretty good shape. When he moved to Dallas, he suggested a replacement. She and I end up talking about economics rather than any of that icky doctor stuff. Then, there's my cardiologist from India. We talk about Narendra Modi and the good old days under Manmohan Singh. Even my radiologist has taken to discussing the vagaries of Brexit as he has relatives in the U.K. I now know that when I emerge from my appointments, having spent my time in rapt discussion of everything but my health, that I am getting some very good news.

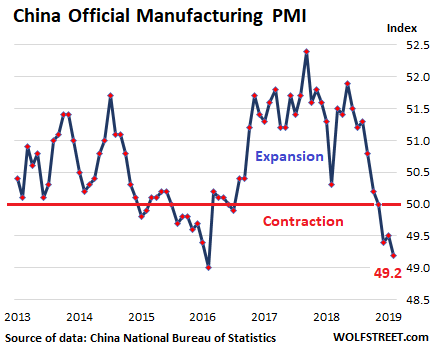

China Manufacturing PMI

The decline of the PMI in the U.S. has not been an isolated development. Of the top-15 trading partners for the U.S. only two still have PMI numbers above 50 in the expansion zone. China has seen one of the more precipitous declines. Not that there was a huge difference between 52 and 49, but sliding this deep into contraction is a definite worry for a nation that is as dependent on manufacturing as is China. The trade war has been damaging to China—as it has for the world as a whole. With the new round of tariffs, the situation will get worse.