By Chris Kuehl, Ph.D., NACM Economist

Short Items of Interest—U.S. Economy

Have Trump's Attacks on Fed Worked?

The relationship between the Fed and Trump has been odd from the very beginning. Upon taking office, Trump had the opportunity to pack the Fed as there was only one holdover from the Yellen Fed—Lael Brainard. Trump's choices were quite mainstream (Fed Chief Jerome Powell, Richard Clarida, Randal Quarles and Michelle Bowman) until this past year. He is not the first president to push the Fed to see things his way, but his style has been especially personal and aggressive. The Fed has reacted as expected and refused to consider this political pressure, but there is an assertion that the markets have reacted to the Trump position. This has applied pressure on the Fed sufficient to promote rate cuts that might not have been considered were there less bombast from the White House.

Fed Still Using Repo Market Heavily

The New York Fed has dumped another $110.1 billion into the money markets through the repo market. These are short-term loans in which borrowers offer lenders collateral such as Treasury bonds for loans that may be as short as overnight. The effort is to back up their positions in the market and the Fed wants to ensure this market liquidity remains sufficient. The reason for all this short-term demand is an increase in perceived instability among financial institutions.

Trade Deficit Still Getting Worse

The gap between what the U.S. exports and imports is still widening. The trade deficit continues to get worse, but at least the pace has slowed a little and the deficit is more diverse. The U.S. is importing a little less from China due to the tariffs and trade wars, but is now importing more from other nations chewing into Chinese market share. The real worry is that exports are down due to the strength of the dollar and the trade threats the U.S. continues to brandish at allies. The gap is now at $72.8 billion, up by $400 million since last month. Exports were up to $137.8 billion (an increase of $200 million), but imports were up to $210.6 billion (a $500 million increase over the previous month).

Short Items of Interest—Global Economy

France Plans Tax Cuts

The plan by President Macron would cut taxes by around 10 billion euro as a means by which to boost the economy, but the watchdog agency that oversees budgetary matters has attacked the plan as wholly ineffective. The assertion is that only massive public sector investment will dig Europe and France out of the hole they are in. Tax cuts may be popular and might push retail activity a little, but the reality is that most business will save this windfall and so will most consumers. It will do little to stimulate on any kind of a long-term basis—essentially the same issue that faced the U.S. with the tax cuts at the start of 2018. It helps a little in the short term but not in the long term.

Deep Split Within ECB Ranks

Four of the most prominent members of the European Central Bank (ECB) Board are on record as deeply opposed to the stimulus measures the ECB has undertaken of late. This could present a major challenge for the incoming head of the group—Cristine Lagarde. The bankers from Germany, France, the Netherlands and Austria have been angry at the policy they believe will do little to boost growth, but will risk more inflation as well as do damage to small savers. The debate will only intensify as the next year progresses. That will be Lagarde's problem to deal with.

Room to Maneuver

A recent study from a private Swiss investment fund asserts that all of the major emerging market nations have the capacity to expand their economies through both fiscal and monetary means. Essentially, they have the room to increase spending and cut taxes at the same time. The fact is that these nations have much lower deficits and their interest rates are not at rock bottom. The developed nations are in a bind as they have no wiggle room left, but that is not the case with the majority of nations that are still classified as emerging.

This Month the CMI Dipped a Little—How Concerned Should We Be?

Once again, it is time to review the Credit Managers' Index (CMI). For the last several years, we have been asked to interpret the data collected by the National Association of Credit Management. It is a system modeled on the Purchasing Managers' Index (PMI) and uses the same diffusion index where anything above 50 indicates expansion and numbers below 50 suggest contraction. Like the PMI, the data is fundamentally unbiased. It has the added advantage of being predictive given the fact credit managers are far more interested in what happens in 90, 120, 180 days. What follows is the executive summary of the report. For the full version with historical charts and graphs, go to the NACM website.

Analysis: It was fun while it lasted! Last month featured a nice little rebound in the Credit Managers' Index —especially on the manufacturing side. That gain was short-lived as this month there was a bit of a decline. The data is still pretty firmly in the expansion zone (above 50) but not as robustly as was the case earlier. The indicators for the economy in general have been following that same pattern—some good indicators coinciding with some not so good. Industrial production numbers were far better than they were in the previous month and there was an improvement in the industrial capacity numbers as well. On the other hand, the Purchasing Managers' Index sank into contraction territory for the first time in years with a reading of 49.1. The problems with the CMI were in the favorable categories, but the drop was not calamitous.

The combined index score fell from 55.2 to 54.1, but still higher than the numbers seen in July (53.4). Readings in the mid-50s, however, certainly beat the high 40s that are showing up in the Purchasing Managers' Index. The combined score for the favorable factors fell from 61.8 to 59.1, but again, this is better than the 58.6 notched in July. There is certainly no reason to panic about numbers in the high 50s, but there is concern that a downward trend might extend. The combined score for the nonfavorable factors stayed almost the same as last month—going from 50.9 to 50.7. This category has been teetering on the edge of contraction for months and even years, but has been able to keep out of the contraction zone thus far.

The biggest drop in the favorable categories was in sales, which could be a potential problem. Last month, the sales data was at a high point—64.4. This was close to the level reached in May. The reading this month fell to 58.7, about where it was in July. A reading in the upper 50s is certainly no cause for alarm, but the trend is not good and signals there may be more caution in the economy—an observation that has been made by many looking at other data points. The other readings in this category were not as concerning. The new credit applications data slipped from 60.9 to 59.7, a pretty minor reduction. The dollar collections numbers went from 60 to 58.5. This is a bit more worrisome as it shows some creditors may be struggling a little. The amount of credit extended also fell out of the 60s with a reading of 59.7 as compared to last month's 61.7. The numbers are not as good as they were in August, but they have hardly fallen off the map.

The data from the nonfavorable factors didn't vary much from the month before, but this is somewhat cold comfort as the readings are not all that high. The rejections of credit applications slipped a bit from 52.1 to 51.4. This category is tied to the applications for credit—if there are fewer applications and there are more rejections, it essentially means there are fewer good applicants. There was very little change in terms of accounts out for collection. The reading this month was 48.4; it was 48.6 the month before. The more salient point is this category remains in contraction territory. The disputes numbers actually improved with a reading of 50 after an August reading of 49.4. It is always good to see a reading break out of contraction—even if only by a little. The reading for dollar amount beyond terms fell quite a bit, but has still managed to stay out of contraction (down from 53.6 to 50.2). This is worrying in that slow pays are the first sign of future problems. The dollar amount of customer deductions improved a little, which was somewhat unexpected. It has gone from 50 to 52.1. There was also an improvement in filings for bankruptcies from 51.6 to 52.1. The bankruptcy numbers had been a bright spot for years, but had been slipping over the last few months, so it was reassuring to see an upward trend.

As for the manufacturing sector, Kuehl said that it has been experiencing the greatest levels of volatility thus far this year. The start was pretty impressive, but there were developing concerns as the trade and tariff war began to take shape. By mid-year, the slowing global economy was taking a toll on the U.S. industrial sector. Much of what the U.S. exports is machinery and other higher tech goods, and the market has been suffering a little. These issues are expected to worsen.

The combined score for manufacturing is at 54.3—less impressive than the month before (55.7). It is still higher than it was in July, however. The favorable numbers fell from the 60s, but remained firmly in expansion territory with a reading of 58.8. The nonfavorable factors came in very close to what they had been—51.2 as compared to 51.7. The sales data took a significant hit as it went from 65.3 to 57.9, a development that was not unexpected given all the challenges that have been facing the manufacturing sector of late. This can be attributed to the global slowdown, as most of the major trading partners for the U.S. have been struggling. Of the top-15 U.S. trade partners, all but three now have Purchasing Managers' Index readings below 50 and the three that are still in expansion territory are only at 51 or 52. The new credit application numbers slipped from 60.1 to 59.5. The dollar collections numbers also declined, but not by that much as they went from 59.6 to 58.7, certainly still respectable. The amount of credit extended numbers fell out of the 60s, going from 61.4 to 59.2. The favorable numbers are clearly still favorable as readings in the 50s are solid. The worry is that sales data tends to drive everything else.

There was less volatility in the nonfavorable categories, but the readings have been weak for several months and in some cases years. The rejections of credit applications data slipped, but stayed out of contraction territory with a reading of 51.9 compared to 53 last month. The accounts placed for collection did slip back into contraction with a reading of 49.7 from 50.6 the month prior. This takes the reading back to levels seen in July (46.7) and far lower than the June reading of 53.5. The disputes numbers remained almost as they were the month before with a reading of 50.6 after being at 50.3 in August. The dollar amount beyond terms slipped quite a bit from 55.9 to 52.1, but the good news is that the data is still in expansion territory. The slow pay is often the first sign of trouble and thus far there are few major alarms sounding. The dollar amount of customer deductions improved as the reading rose from 49.3 to expansion territory at 51.1. The filings for bankruptcy reading recovered a little bit of ground as it went from 51.4 to 52.

As far as manufacturing is concerned, there are conflicting assessments. There have been more than a few positive signs and there have been negative indicators as well. The sense is that trends will be more negative as the trade war grinds on and more tariffs come into play.

Service Sector

As the holiday season gets firmly underway, it is likely there will be additional movement in the index as there is both good news and bad. The retail sales numbers will climb, but the question will be by how much and for how long. If the season is not quite what had been expected, the nonfavorable factors will likely show the strain—perhaps even experiencing a hike in bankruptcies in the retail community. The other service category that shows strong influence over the CMI is construction. This area may decline simply due to seasonal factors.

The combined score is 53.9, which takes the readings back to nearly what they were in July at 53.7. The favorable factors slipped out of the 60s with a reading of 59.4 compared to the 61.9 in August. The nonfavorable combined score went from 50 to 50.1, as close to no change as one can get. The majority of the activity in the survey was in the favorable categories.

Sales slipped out of the 60s with a reading of 59.6, but these are obviously very legitimate readings and still a little higher than was the case in July (59.3). The new credit applications also dropped from the 60s with a reading of 59.8 after 61.7 in August. Again, this is not a bad number overall. The dollar collections number was the third to leave the 60 range with a new reading of 58.2. Only amount of credit extended was able to stay in that 60 zone with a reading of 60.2 compared to the 62.1 registered the month before.

The rejection of credit applications fell a bit from 51.2 to 50.9, but the important note is the reading stayed out of the contraction zone. The accounts placed for collection improved from a reading of 46.7 to one of 47.1, but this is still in contraction territory. The fear is that there will be more struggles in the sector as the year progresses. It will all come down to the impact of the tariffs. The imposition of new tariffs on goods from China is expected to cost the consumer an additional $1,000 a year, but that is only if the big retailers raise their prices, although operations such as Wal-Mart, Target and others have no intention of doing so. They will push their suppliers to eat the cost of the tariffs. The disputes category improved a bit from 48.5 to 49.4—not quite out of the contraction hole but getting closer. The dollar amount beyond terms fell fairly hard from 51.2 to 48.3. That is worrying, given the fact that slow pays usually precede bigger issues. The dollar amount of customer deductions improved from 50.6 to 53.1 and may signal some stability down the road. There was an improvement in the filings for bankruptcies readings with 52.1 as compared to 51.9 last month. "The success of the retail season will determine whether there will be more bankruptcies toward the beginning of next year.

September 2019 versus September 2018

The data this month was slightly less impressive than last month, but the declines were not steep. The exception was that sales numbers tanked, and that worries analysts down the road.

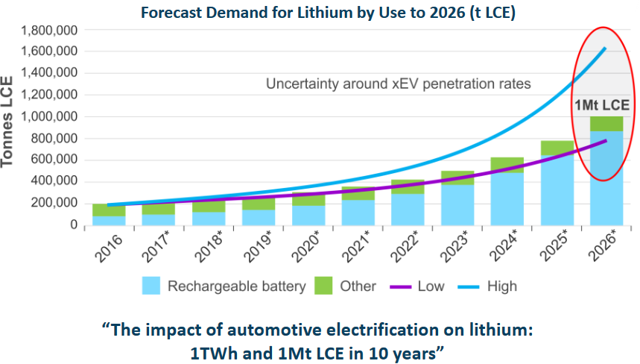

Battle for Rare Earth Minerals

There has been a significant increase in demand for a collection of minerals and materials collectively referred to as the "rare earths." These are elements such as lithium, cobalt and others that have proven key to the development of green technologies such as batteries and other aspects of power generation. For the last several years, the Chinese have had a dominant position in the development of rare earths. The U.S. is now trying to organize other nations that have these resources to break that stranglehold.

Analysis: Obtaining these materials is costly and usually involves massive mining operations that can be devastating to the local environment. Nations want compensation for that damage and assurance the market will be sustained once they do this investing.

Recognizing Absurdity

It was an innocent enough request. I simply ordered room service as I was pretty worn out from a week of travel. My food arrived in the new style that seems to be the latest thing in hotel "convenience." A paper bag filled with my order in plastic take-out containers. The part that struck me was a heartfelt note pointing out that they had not provided a straw as they were doing their part to be eco-friendly. Really? My hamburger came in a plastic box with a plastic lid. My water in a plastic cup. The utensils were plastic, the condiments in little plastic containers, napkin was paper and so was the bag. All of it trash and destined for the landfill. No real plates, no actual silverware or glass. Nothing that can be washed and used again. But there was no straw.

Does anybody ever stop to look at what they are doing? The old system offered a civilized meal with plates, silverware and cloth napkins. One had the sense of dining as opposed to having snatched a happy meal at the drive through. The absurd part is the effort to pass the missing straw off as ecologically sound. My big pile of discarded food containers tells a very different story. And even more absurd was the fact this was supposed to be a high-end hotel—at least one that charges high-end prices.

Forecast Demand for Lithium

The demand for lithium is just one of the rare earth examples. The expansion of the electric car has driven the market and there has been a race to supply the proposed need. The largest deposits outside China are in Bolivia. That means working with the controversial and prickly leader of that nation—Evo Morales. The U.S. faces this dilemma in many states that have the rare earths—leaders that are far from sympathetic with the U.S. and remain far closer to China.